Rate-Cut Hopes Resurrected As 'Hard' Data Slides: Stocks, Gold, Oil, & Crypto Dumped

Image Source: Unsplash

A weird week of weak 'hard data, strong 'soft' data (macro), weak micro (ugly hints for software and consumer from earnings), and dovish-and-hawkish FedSpeak...

Source: Bloomberg

Which prompted a resurgence in rate-cut hopes...

Source: Bloomberg

But today's Chicago PMI puke dominates any in-line PCE print and dragged stocks lower on the week, led by weakness in Nasdaq as Small Caps were the least ugly horse in the glue factory. The typical late Friday meltup painted some lipstick on the week's pig...

For the CTA followers: The S&P tested below its short-term threshold at 5203 and found support (the Medium-term threshold for CTA sellers is consideriably lower at 5002)...

On the month, all the majors were green with Nasdaq leading and The Dow lagging...

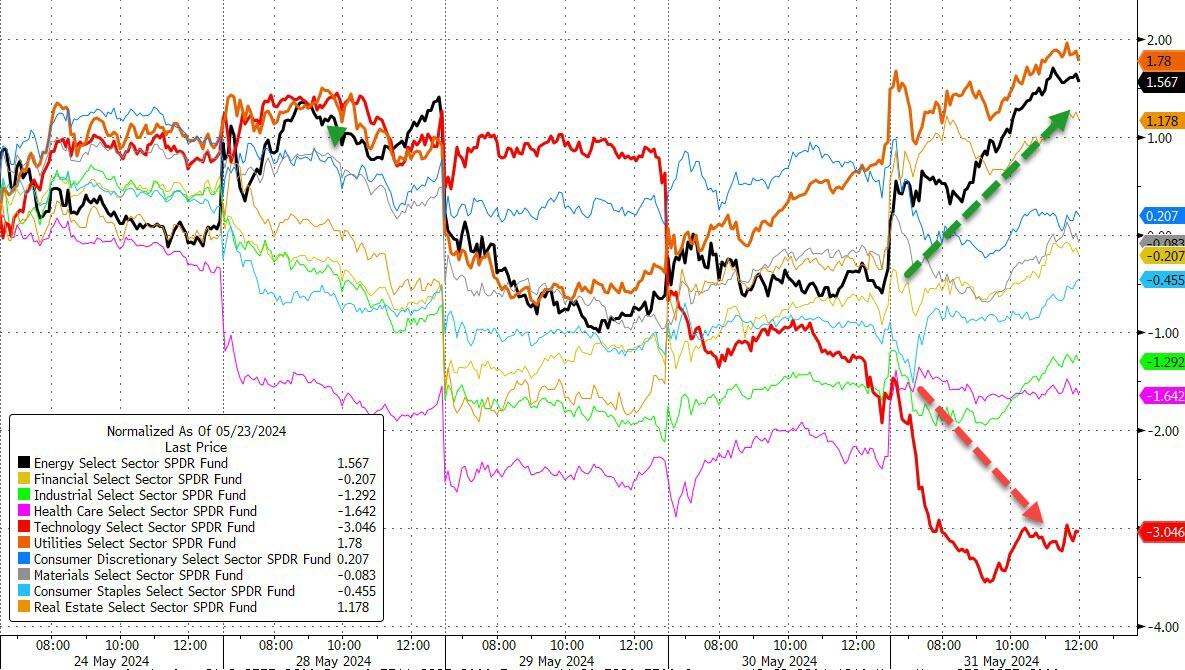

Energy and Utilities outperformed while Tech stocks saw a notable 3% on the week...

Source: Bloomberg

MAG7 stocks ended the week lower overall...

Source: Bloomberg

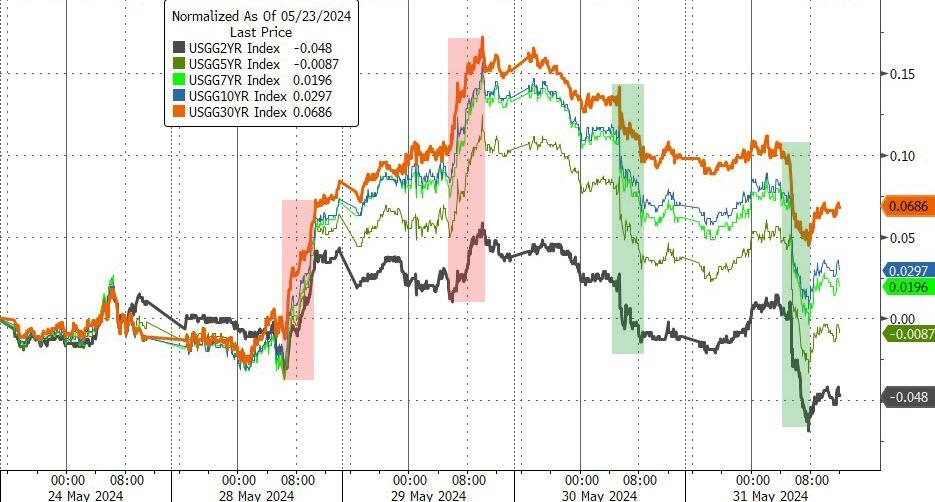

Treasury yields were mixed on the week with 2Y and 5Y ending lower and the longer-end lagging...

Source: Bloomberg

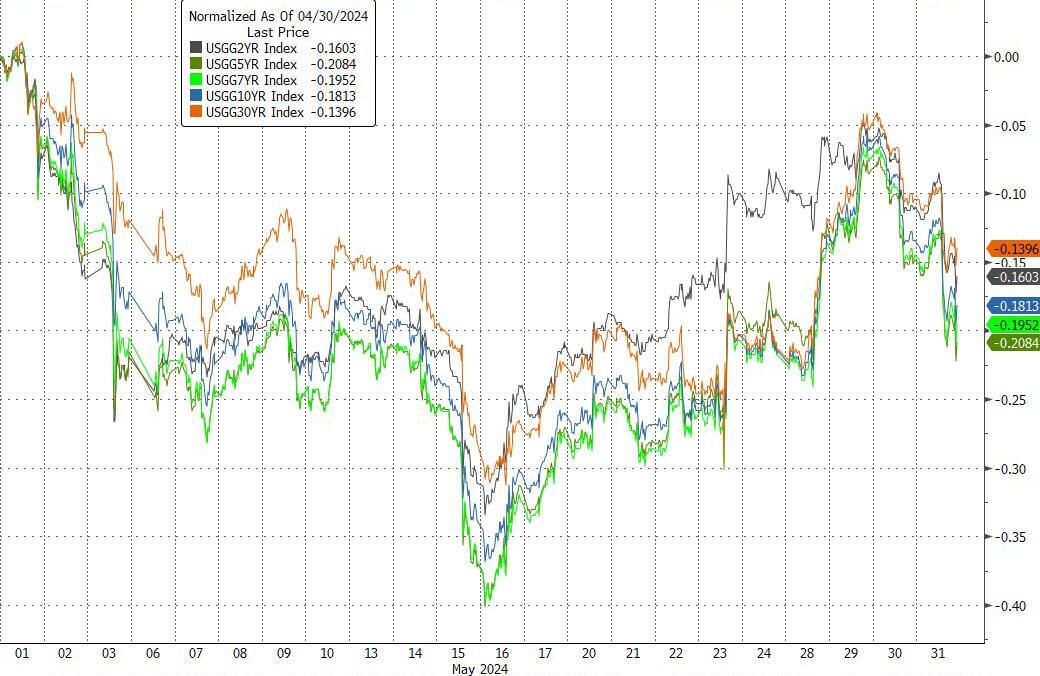

Treasury yields were lower across the whole curve for the month with the belly outperforming...

Source: Bloomberg

The dollar managed gains on the week, having bounced off the week's punch line today...

Source: Bloomberg

Gold ended lower on the week thanks to a post-PCE puke today...

Source: Bloomberg

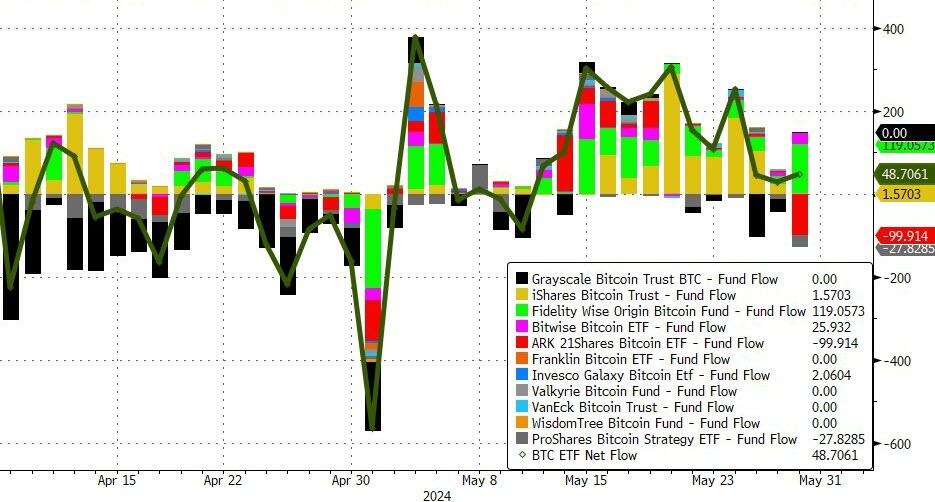

For the 13th straight day, Bitcoin ETFs saw net inflows...

Source: Bloomberg

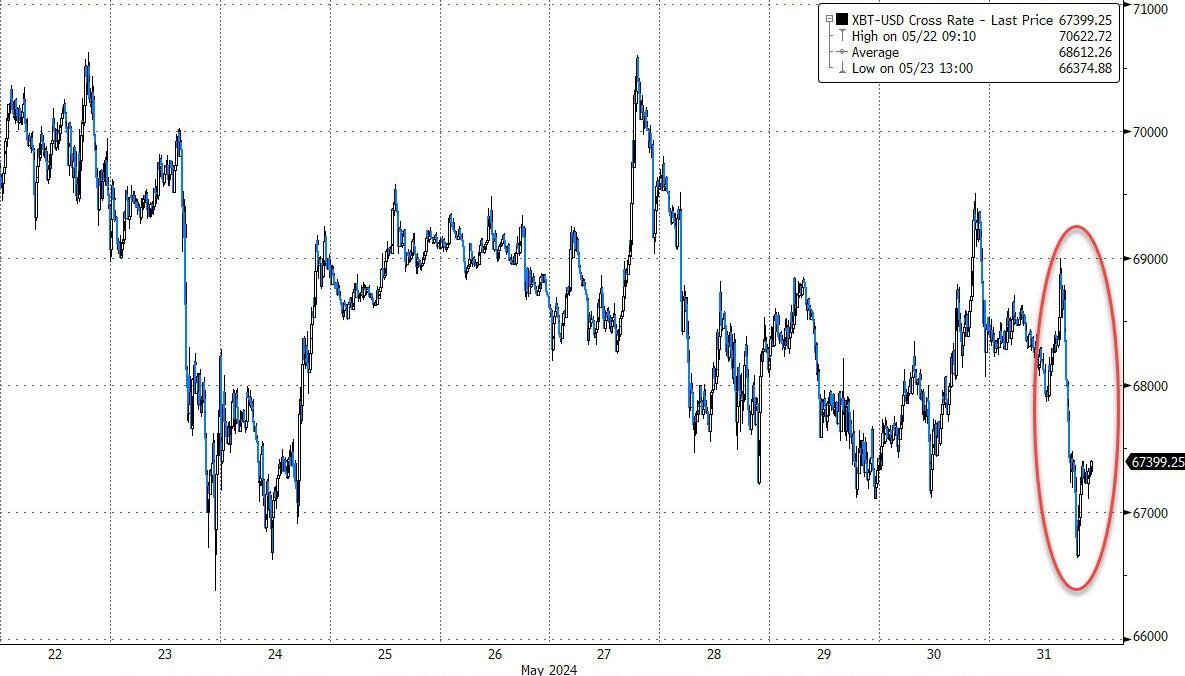

But the bitcoin price fell on the week, thanks to a big puke today, finding some support at $6,000...

Source: Bloomberg

Crude prices slipped lower again today, back into the red on the week...

Source: Bloomberg

Finally, one can't help but feel that Gold's recent resurgence - while real yields languish continues to drive lower...

Source: Bloomberg

More By This Author:

As Copper Soars, Telecoms Sitting On $7 Billion Mother Lode Of Old CableCore PCE Grows At Slowest Pace In Three Years After Lowest Monthly Increase Of 2024, Spending Drops

PCE Preview: A 3 Year Low?

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more