Rare Oversold Readings

EXTREMELY OVERSOLD IN VERY SHORT PERIOD OF TIME

A wide range of stock market breadth charts have reached oversold readings; some of the readings have reached “never seen before” levels, which is remarkable considering the S&P 500 made a new all-time high just seven trading sessions ago. Expressions like “never seen before” typically mean some big moves and wild swings may occur in the stock market in the coming days, weeks, and months. It is prudent to keep in mind that wild swings (up and down) are typically associated with a market that has not yet completed a bottoming process.

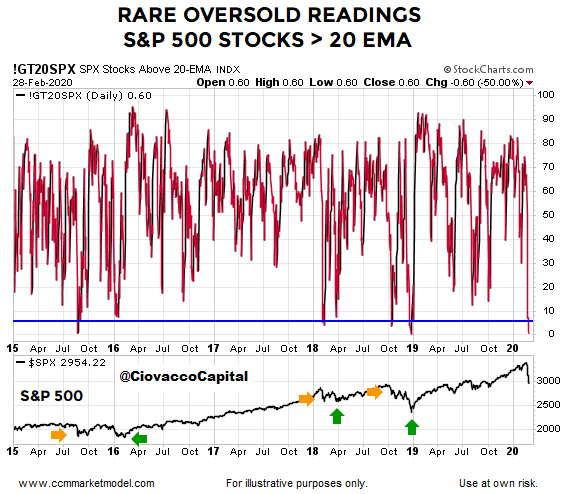

BREADTH CHARTS HAVE SOME UNREAL LOOKS

The chart below shows the percentage of S&P 500 stocks above their 20-day exponential moving average. As of last Friday’s close, only 0.60% of S&P 500 stocks were able to hold above their 20-day EMA. This rare oversold reading tells us to be open to a bottoming process. Notice in the 2015 and early 2018 cases, the S&P 500 rallied, but then came back weeks or months later and retested the low. The Q4 2018 case tells us not to assume a low is in place or even forming since stocks took another significant leg down before finding a bottom. For us, rare oversold means “be ready to buy”. Based on how things unfold, we may begin to redeploy some of our capital in the coming days.

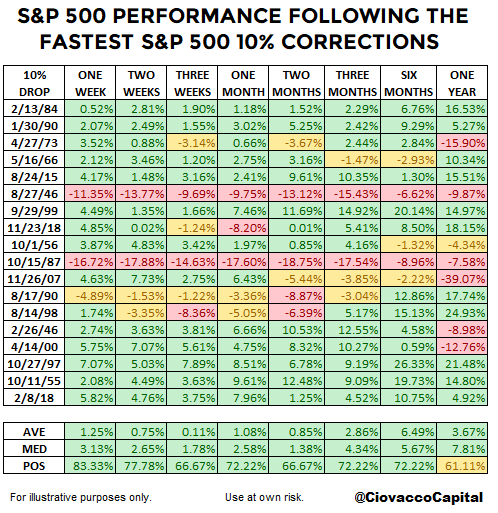

FASTEST 10% CORRECTIONS AND STOCK PERFORMANCE

Since we just experienced the fastest 10% correction in stock market history, it might be helpful to understand how stocks performed after other cases from the list of fastest 10% corrections. The table below helps us keep an open mind about a wide-range of outcomes. This study fully supports a “trade the chart in front of you” approach. The market will guide us if we are willing to listen without bias. The tepid average returns looking out three weeks to two months speak to the fact that bottoms tend to be a series of rallies and pullbacks (a process rather than an event).

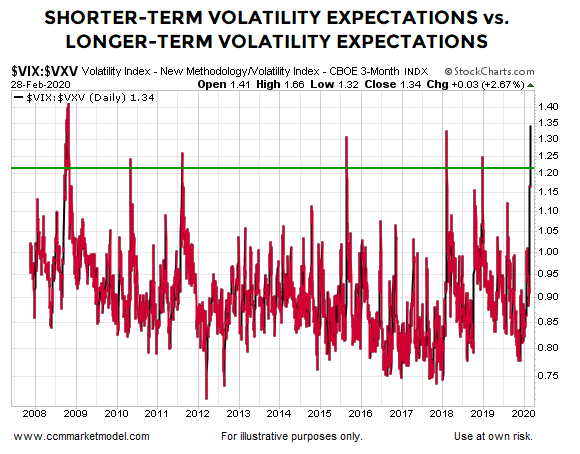

BIG SPIKES IN SHORT-TERM VOLATILITY EXPECTATIONS

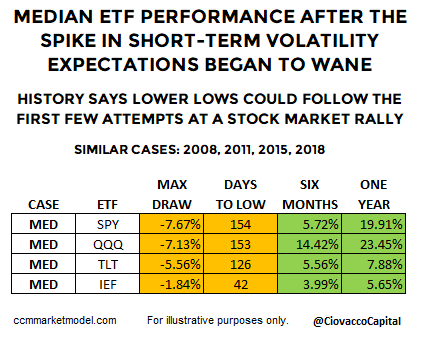

Big spikes in shorter-term volatility expectations are often seen near market lows or at the early stages of a bottoming process. The chart below shows a spike similar to what took place last week has only occurred a handful of times since 2008.

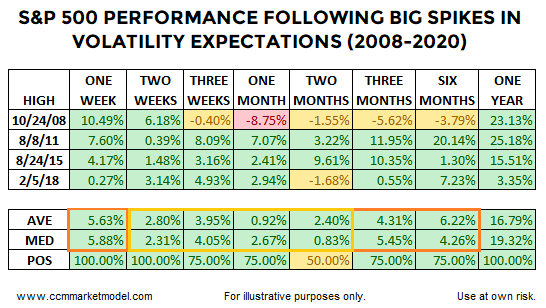

The table below shows stock performance after the volatility spike ended, something that may or may not be in place yet in 2020. The table shows a lot of green, but notice how the returns are typically muted between the week following the spike and three-to-six months later. Also notice how stocks tended to give back the first week’s gains over the next two months. The table aligns with how bottoms are typically formed; some big spikes higher in stocks followed by a retest of the prior low. The bottoming process can take weeks or months in some cases. We should not be surprised to see some wild swings in stock prices over the coming days. We are making no assumptions about how it plays out; the table is simply a reference point.

BULLISH CASE TAKES A DIRECT HIT

This week’s video assesses the damage from last week’s historic selloff and looks at both bullish and bearish scenarios walking forward.

DAY BY DAY BASED ON HOW THE DATA EVOLVES

We looked at each of the four similar “volatility expectations spike” cases above walking forward from the peak in short-term fear. In all four cases, even after short-term volatility expectations began to wane, the S&P 500 traded lower before making a final low. The good news is the median returns for both stocks and bonds looking out six months and one year were favorable, telling us to keep an open mind about a bottoming process in the weeks and months ahead. The median number of calendar days to the final low was 154 for the S&P 500 ETF (SPY), which equates to 5.12 months.

Tuesday's drop in the market seemed to correspond with current wisdom that rally's like Monday's are false and we should act on them at our peril and maintain Bear strategies. If so, why are Dow futures up this morning?