Ramp, Camp, And Stamp

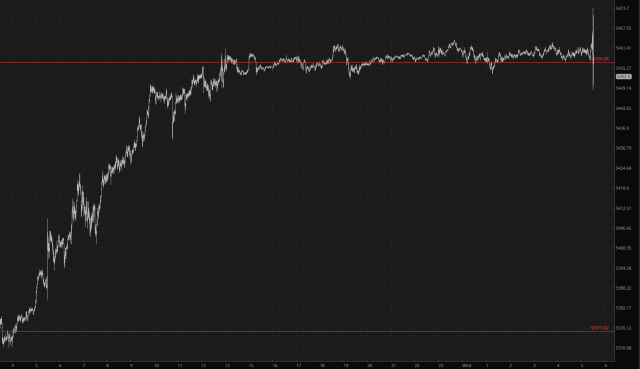

The past twenty-four hours were a comic example of the “Ramp & Camp” markets which are so annoying.

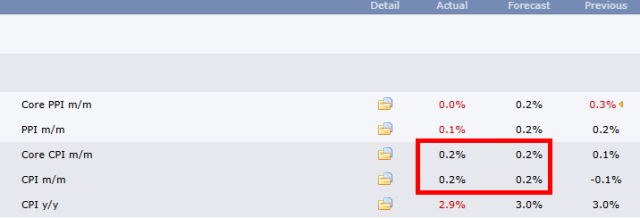

We shot up quickly yesterday and then spent about 17 hours just sitting in a ridiculously tiny range, waiting for the all-important CPI report. Well, it’s finally here, and in contrast to yesterday’s PPI, today’s numbers were aligned perfectly with the anticipated target.

In the chart of the /ES below, you can see the “camping” taking place for hours and hours on end, finally terminating in a quick jolt, first up double digits, then down double digits, and then, as I’m typing this, just a little bit red.

The overall picture is still a steady series of lower highs, and the Fibs from the April low to the July lifetime high seem to be doing a pretty good job highlighting importance areas of support and resistance.

I am VERY lightly positioned (50% cash) right now but am absolutely thrilled this stupid PPI/CPI nonsense is out of the way again.

It must be said, the notion that a prospective 25 basis points cut by the Fed at some point is going to cure all our ills is the most empty-headed, hare-brained nonsense I can imagine. Eventually it’ll be proved as such.

More By This Author:

Breadth Strength UpdateCrocs: A Durable Brand, But A Chart On The Brink

Missed Opportunity: Huntsman’s Plunge And The Puts I Sold Too Soon

I tilt to the bearish side. Slope of Hope is not, and has never been, a provider of investment advice. So I take absolutely no responsibility for the losses – – or any credit ...

more