Photo by American Public Power Association on Unsplash

In The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, author Greg Zuckerman explains how today’s traders spend most of their time doing research. At Renaissance, the hedge fund Zuckerman chronicles, and other quantitative funds, traders spend much of their time looking for market anomalies that are likely to repeat and aren’t just the accidental result of noise. The trading that takes place is done by algorithms executing trades for a given strategy. The trader monitors the activity and looks for new opportunities.

This is very different than the trading I did over thirty years ago. Fast reactions and rapid mental numeracy were what separated the great traders from the average. We often hired MBAs. Some years ago, I visited the trading floor for Jane Street, a big market maker in ETFs, and learned that their hires are typically computer science majors.

(Click on image to enlarge)

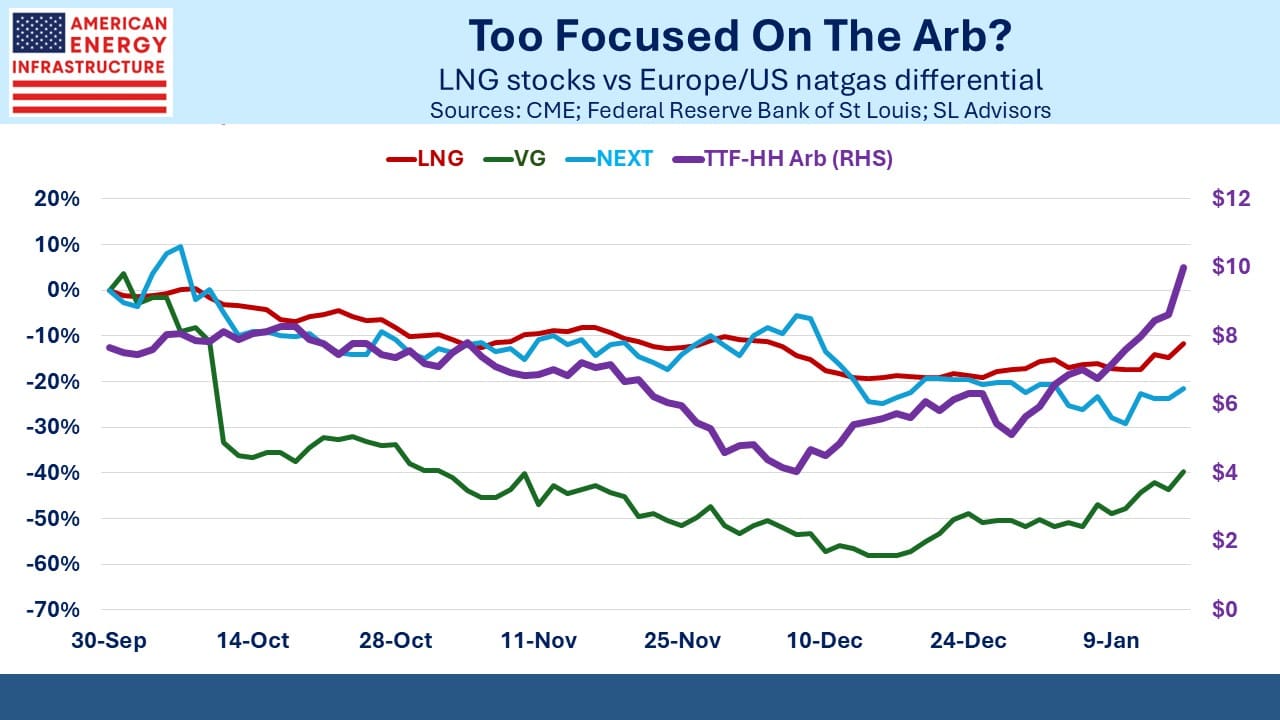

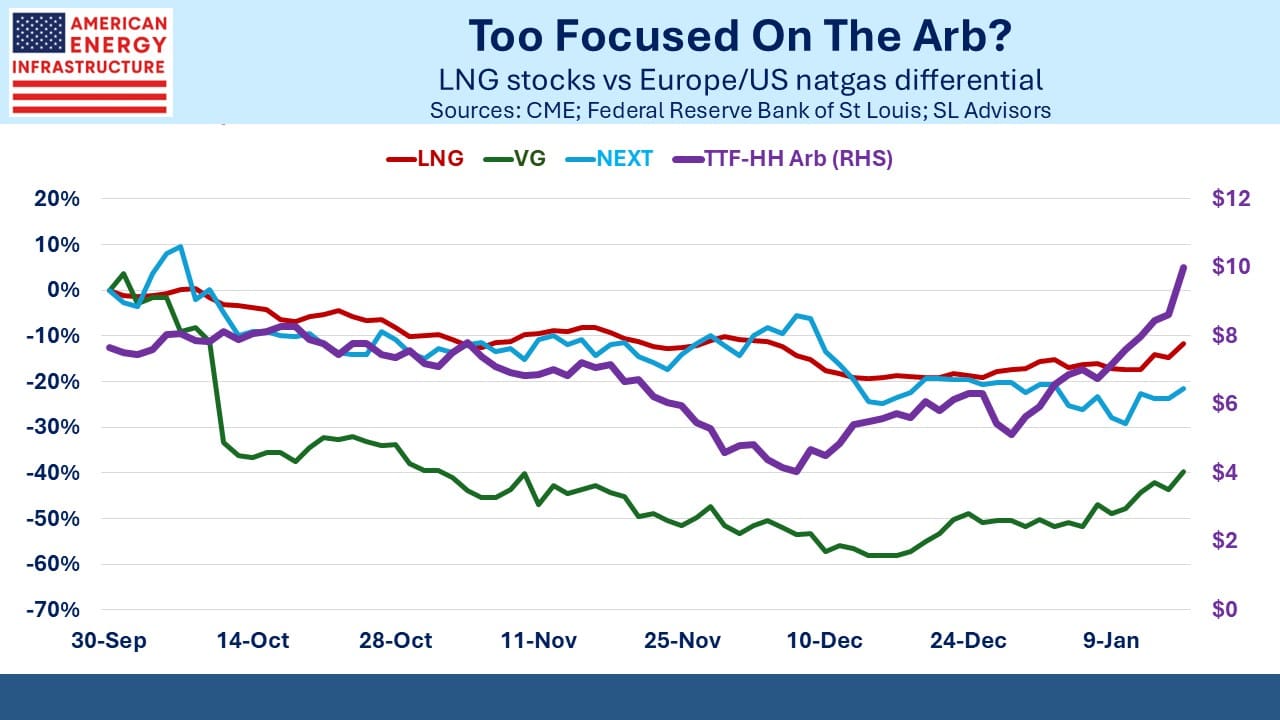

Over the past couple of months, we’ve noticed a relationship between the Europe/US natural gas spread and the prices of LNG stocks. I don’t know if quant hedge funds are trading this. We’re not, but their prices seem to be connected.

Specifically, we looked at the differences between the TTF Dutch benchmark for natural gas and the US Henry Hub, converted to US$ per Million BTUs (MMBTUs). It costs around $2-$4 per MMBTUs to liquefy US gas and ship it to Europe, whereas the TTF/HH spread is usually more than that. The wider the spread, the bigger the profit opportunity.

Generally, LNG is liquefied under long-term Sale Purchase Agreements (SPAs). Cheniere (LNG) has locked in 90% of its estimated cashflows through 2035 with SPAs. Venture Global (VG) famously exploited a sharp widening of this spread following Russia’s invasion of Ukraine in 2022. They netted billions of dollars and wound up being taken to arbitration by aggrieved counterparties claiming breach of contract. They won against Shell in August but then lost to BP in October, which led to a repricing of their stock that reflected on the shares worse than losing all of the remaining cases.

LNG terminals retain some uncontracted liquefaction capacity to allow for maintenance or other downtime. A wider TTF/HH arb is directionally good for them, but these are facilities with a useful life measured in decades, so changes in the arb shouldn’t have much effect on, say, thirty years of discounted cashflows.

Nonetheless, Cheniere, Venture Global, and NextDecade (NEXT) all dropped by 20% or more as the spread narrowed during Q4 25. The Henry Hub benchmark traded up from $3 to $5 per MMBTUs on colder US weather. Meanwhile the TTF benchmark slumped from EUR31 to EUR27 per Megawatt Hour ($11.25 to $9.25 per MMBTUs) on ample supplies and mild weather.

This slashed the TTF/HH arb in half, from over $8 to $4. Venture Global probably has more exposure than Cheniere and has moved more. But it still seems excessive. And they need never lose money on the arb. If it drops to an unprofitable level, they would simply stop doing any new spot transactions.

Even more bizarre was the reaction of NextDecade, since they’re at least a year away from shipping any LNG at all. They’re not generating any cash, so the spot arb is irrelevant. But perhaps the computer scientists at quant funds are trading a basket of LNG stocks, and since there aren’t many to choose from, NextDecade is added for diversification.

In any event, the arb has been widening in recent days, which seems to have acted as a catalyst on these stocks. On Friday morning, it spiked to $10, which should benefit Venture Global and to a lesser extent Cheniere via increased profit on spot market transactions. It’s also worth noting that Qatar, from which the US recently removed some air base personnel, is the world’s second biggest exporter of LNG.

Elsewhere in energy, the oil glut is not a secret, and Jeff Currie (formerly head of Commodities Research at Goldman Sachs but now at Carlyle) argues that the geopolitical risks have risen markedly following the capture of Venezuela’s Maduro. China may start seizing oil tankers in the South China Sea. We don’t make oil bets, but Currie’s views are worth considering.

We have two have funds that seek to profit from the current energy environment:

- Pacer American Energy Independence ETF (USAI)

- Catalyst Energy Infrastructure Fund (MLXAX)

(Click on image to enlarge)

Last week was the CFA Naples Annual Forecast Dinner. SL Advisors was a sponsor, and I was happy to bring Bradley Golden and Thomas Vulgaris, both from Pacer Advisors, along with long-time friends and investors David Pasi and Michael Shinnick. David Rubenstein, co-founder of Carlyle, was the speaker and his star power drew record attendance.

More By This Author:

Venezuela: Mostly Questions, Few AnswersFew Laughs In Gas Last YearWhat A Difference A Year Makes

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

less

How did you like this article? Let us know so we can better customize your reading experience.