Q2 Earnings Loom: A Look Ahead

Image Source: Unsplash

Here are the key points:

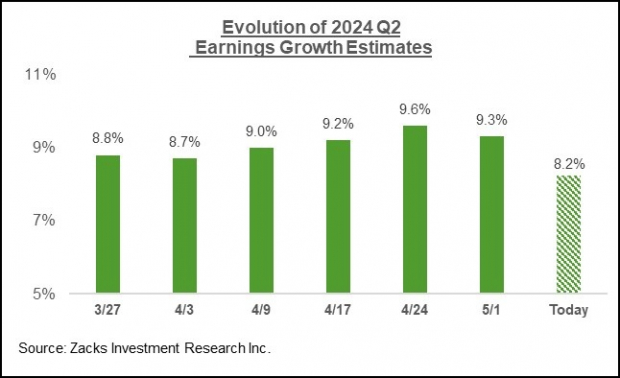

- The setup for the Q2 earnings season, whose early reports have started trickling in, is one of continued resilience coupled with a steadily improving outlook. Given the favorable revisions trend ahead of this reporting cycle, we will be looking for further improvement in the earnings outlook.

- For 2024 Q2, S&P 500 earnings are expected to be up +8.2% from the same period last year on +4.6% higher revenues. This will be the highest earnings growth rate since the +9.9% growth rate in the first quarter of 2022.

- Earnings growth for the Energy sector is on track to turn positive in Q2 after remaining in negative territory over the preceding four quarters.

- Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +25.5% from the same period last year on +13.1% higher revenues. Excluding the ‘Mag 7’, Q2 earnings growth for the rest of the index drops to +4.6% (from +8.2%).

- Q2 earnings growth for the index drops to +5.6% from +8.2% if the Tech sector’s +15.5% growth is excluded.

Regular readers of our earnings commentary are familiar with our favorable take on the overall earnings picture. A big part of our positive view reflects developments on the revisions front, both for the current period (2024 Q2) as well as the remainder of the year.

As noted earlier, the current +8.2% earnings growth expected for the S&P 500 index is barely down from where the growth rate stood at the start of the period, as shown in the chart below.

Image Source: Zacks Investment Research

In addition to the Energy sector, Q2 estimates have increased for the Tech, Utilities, Transportation, and Autos sectors, helping partly offset negative cuts for the other sectors.

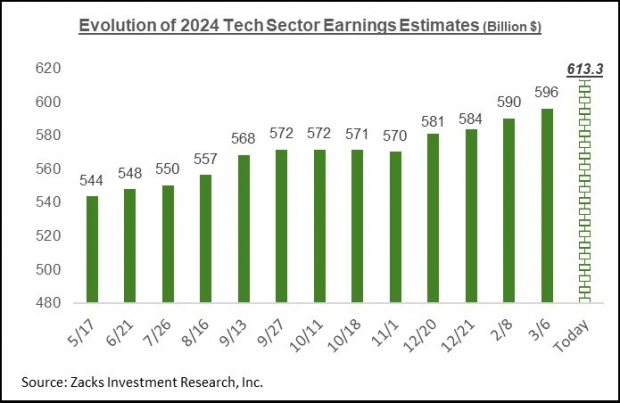

The revisions trend for the Tech sector has been positive for a while now, which is important since the sector alone is on track to bring in almost 30% of all S&P 500 earnings over the coming four-quarter period.

The 2024 Q2 quarter will be the fourth consecutive quarter of robust Tech sector earnings growth, with total earnings for the sector expected to be up +15.5% from the same period last year.

For full-year 2024, Tech sector earnings are expected to be up +17.3%, followed by another strong showing expected next year.

The chart below shows how the aggregate earnings total for the Tech sector has evolved over the past year.

Image Source: Zacks Investment Research

Some of the major Tech stocks that have led the market’s gains this year are also experiencing positive estimate revisions.

Take, for example, Meta Platforms (META - Free Report) and Nvidia Corp. (NVDA - Free Report). The current $20.16 per share earnings estimate for META for this year is up from $17.64 at the start of the year and $14.92 on June 30th, 2023. The magnitude of positive revisions to NVDA’s estimates is in a league of its own.

We will be closely watching how the revisions trend for the space unfolds as the Q2 reporting cycle really gets going, but the early results from the likes of Oracle (ORCL - Free Report) and Adobe (ADBE - Free Report) suggest that we can expect continued favorable momentum here.

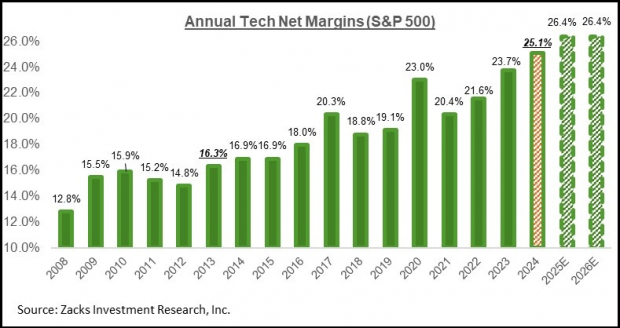

A big contributing factor to the Tech sector’s positive earnings outlook is the sector’s margins outlook, as the chart below shows.

Image Source: Zacks Investment Research

We are already in record territory with Tech sector margins, with 2024 margins expected to exceed last year’s record level. The expectation is for some more gains next year and the year after, with the ever-growing share of higher-margin software and services in the overall Tech earnings pie explaining the favorable trend. Part of this likely also reflects optimism about the impact of AI on the sector’s productivity.

The Earnings Big Picture

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

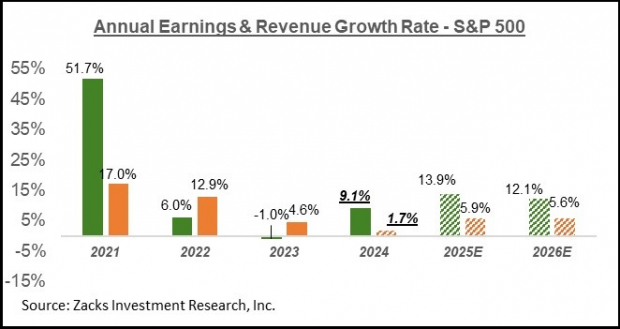

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

Please note that this year’s +9.1% earnings growth on only +1.7% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace remains unchanged, but the revenue growth rate improves to +3.9%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.

On the margins front, 12 of the 16 Zacks sectors are expected to have higher margins in 2024 relative to last year, with Tech, Basic Materials, Medical, and Consumer Discretionary as the big gainers.

More By This Author:

The Q2 Earnings Season Gets Underway

Taking Stock Of The Retail Sector After The Q1 Earnings Season

Previewing The 2024 Q2 Earnings Season