Profit Taking Stalls Wall Street's Santa Claus Rally

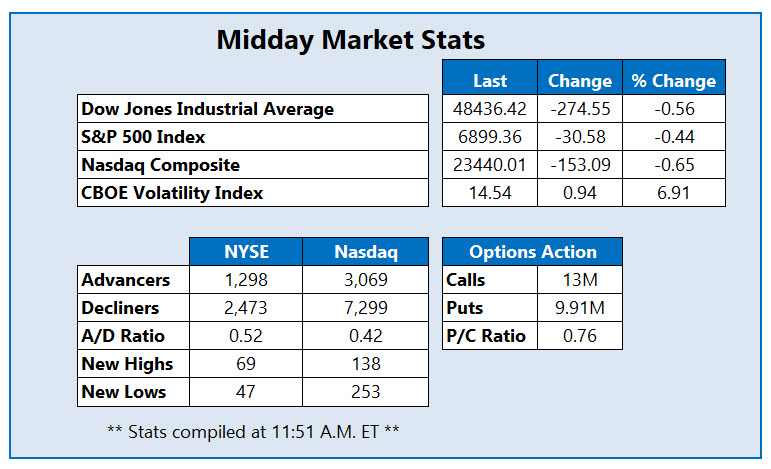

The Santa Claus rally has faded to start the last week of 2025, as profit taking grips Wall Street. The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are off triple digits at last look, while the S&P 500 Index (SPX) is modestly lower. Gold and silver prices are selling off alongside tech stocks today, all while the Cboe Volatility Index (VIX) heads for its biggest one-day pop since Dec. 8.

EV giant Nio Inc (NYSE: NIO) stock is getting attention in the options pits today. At last check, 66,000 calls have changed hands, volume that's 1.3 times the average intraday amount and four times the number of puts traded. Most popular is the weekly 1/2 5.50-strike call, where new positions are being bought to open. NIO is up 3.2% to trade at $5.26, heading for its third-straight daily win after China EV exports surged last month. Year to date, the stock is up 20% and breaking out of a consolidation pattern around $5.

(Click on image to enlarge)

Verisk Analytics Inc. (Nasdaq: VRSK) is one of the better stocks on the Nasdaq today, last seen 1.8% higher to trade at $224.24. The IT data firm officially ended efforts to acquire AccuLynx after the Federal Trade Commission (FTC) missed its Dec. 26 review deadline. VRSK has traded in a tight range since a late-October bear gap, and is 18% lower on the year.

Metals name Freeport-McMoRan Inc (NYSE: FCX) is near the bottom of the New York Stock Exchange (NYSE) today, with copper prices succumbing to late-year profit taking as well. The copper miner is 3% lower to trade at $51.41, retreating from its Dec. 26 annual high of $53.76. Despite the pullback, FCX is still up 37.3% in 2025.

More By This Author:

S&P 500 Logs Record High Amid Outperforming WeekS&P 500 Secures Fresh Record Close Before Christmas

S&P 500 Logs Record Close; VIX Hits 1-Year Low