Producer Price Index Rises 0.3 Percent Led By A 0.5% Jump In Services

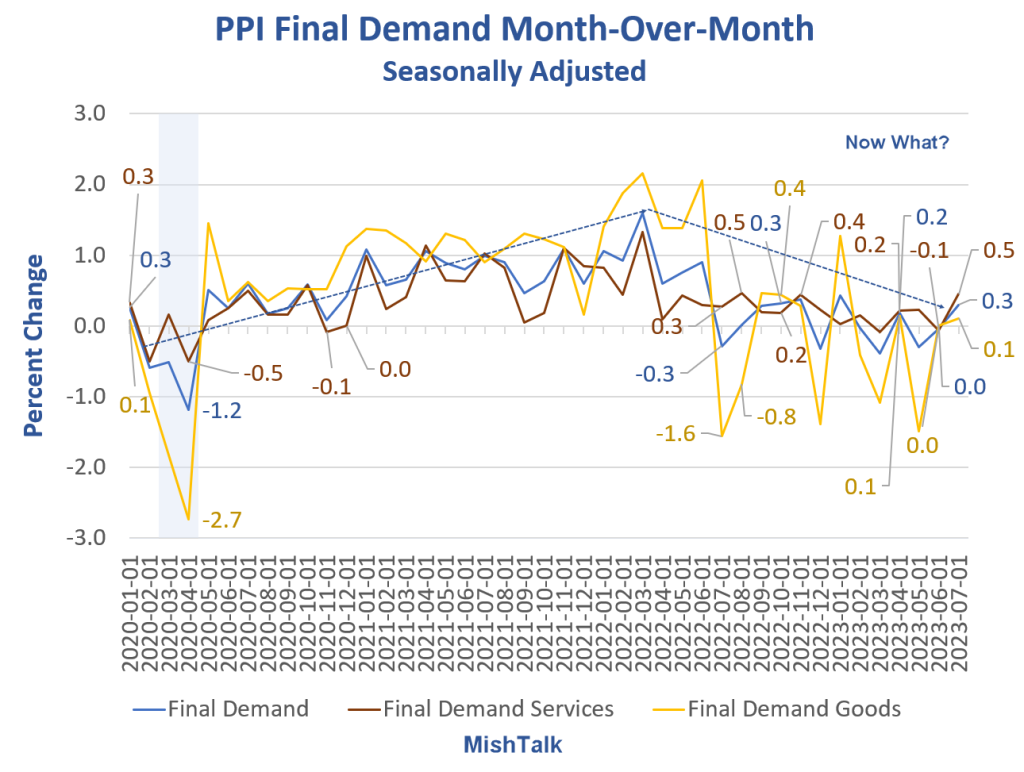

Producer Price Index (PPI) data from the BLS, chart by Mish

Producer prices for final demand have largely stabilized with services stronger than goods. Falling energy prices account for much of it.

Final Demand Services

- The index for final demand services increased 0.5 percent in July, the largest rise since moving up 0.5 percent in August 2022.

- Leading the broad-based advance in July, prices for final demand services less trade, transportation, and warehousing climbed 0.3 percent.

- Margins for final demand trade services rose 0.7 percent, and the index for final demand transportation and warehousing services moved up 0.5 percent.

- Forty percent of the July advance in the index for final demand services can be traced to a 7.6-percent rise in prices for portfolio management.

- Margins for food and alcohol retailing declined 2.5 percent. The indexes for application software publishing and for long-distance motor carrying also fell.

Final Demand Goods

- Prices for final demand goods edged up 0.1 percent in July after no change in June.

- Prices for final demand goods less foods and energy and for final demand energy were both unchanged.

- Within the index for final demand goods in July, prices for meats rose 5.0 percent. The indexes for gas fuels; hay, hayseeds, and oilseeds; utility natural gas; and motor vehicles also moved higher.

- Prices for diesel fuel dropped 7.1 percent. The indexes for gasoline, fresh fruits and melons, and plastic resins and materials also decreased.

Intermediate Demand

Producer Price Index (PPI) and CPI data from the BLS, chart by Mish

Processed Goods for Intermediate Demand

- The index for processed goods for intermediate demand fell 0.6 percent in July, the sixth consecutive decline. Leading the decrease in July, prices for processed materials less foods and energy moved down 0.7 percent.

- The index for processed energy goods fell 0.9 percent.

- Prices for processed foods and feeds advanced 1.4 percent.

- For the 12 months ended in July, the index for processed goods for intermediate demand dropped 7.8 percent.

- Over 60 percent of the July decline in prices for processed goods for intermediate demand can be traced to a 7.6-percent decrease in the index for steel mill products.

- Prices for diesel fuel; industrial chemicals; plastic resins and materials; electric power; and natural, processed, and imitation cheese also fell.

- The index for meats rose 5.0 percent. Prices for liquefied petroleum gas and for softwood lumber also advanced.

Unprocessed Goods for Intermediate Demand

- Prices for unprocessed goods for intermediate demand moved up 1.7 percent in July, the largest advance since jumping 4.8 percent in August 2022.

- The July increase can be traced to the index for unprocessed energy materials, which rose 8.0 percent.

- Prices for unprocessed nonfood materials less energy and for unprocessed foodstuffs and feedstuffs declined 3.1 percent and 0.9 percent, respectively.

- For the 12 months ended in July, the index for unprocessed goods for intermediate demand dropped 24.9 percent.

- Leading the advance in prices for unprocessed goods for intermediate demand, the index for crude petroleum rose 8.4 percent. Prices for natural gas; hay, hayseeds, and oilseeds; slaughter hogs; slaughter cattle; and carbon steel scrap also moved higher.

- The index for nonferrous metal ores fell 4.5 percent. Prices for corn and for slaughter poultry also decreased.

Services for Intermediate Demand

- The index for services for intermediate demand increased 0.5 percent in July after no change in June.

- Half of the broad-based rise can be traced to margins for trade services for intermediate demand, which moved up 1.3 percent.

- The indexes for services less trade, transportation, and warehousing for intermediate demand and for transportation and warehousing services for intermediate demand also advanced, climbing 0.3 percent and 0.4 percent, respectively.

- For the 12 months ended in July, prices for services for intermediate demand rose 4.6 percent, the largest 12-month increase since moving up 6.2 percent in February.

- Within the index for services for intermediate demand in July, margins for chemicals and allied products wholesaling advanced 2.4 percent. The indexes for portfolio management; securities brokerage, dealing, investment advice, and related services; courier, messenger, and U.S. postal services; accounting services (partial); and hardware, building material, and supplies retailing also moved higher.

- Prices for business loans (partial) decreased 1.5 percent. The indexes for fuels and lubricants retailing and for arrangement of freight and cargo transportation also fell.

PPI Final Demand Year-Over-Year Four Ways

Year-Over-Year PPI

- Final Demand: +0.8 percent, up from +0.1 percent

- Final Demand Services: 2.5 percent, up from +2.3 percent

- Final Demand Goods: -2.5 percent, up from -4.4 percent

- Final Demand Energy: -16.8 percent, up from -23.9 percent

Spotlight Energy

- The index for unprocessed energy materials rose 8.0 percent in July.

- The index for crude petroleum rose 8.4 percent in July.

- Prices for diesel fuel dropped 7.1 percent.

- Year-over-year final demand for energy was -16.8 percent, up from -23.9 percent.

With energy prices heading back up, this may be as good as it gets for a while.

But note the huge divergence between diesel and crude. Demand for shipping and trucking is plunging.

CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase

CPI data from BLS, chart by Mish

For the 18th straight month the price of shelter has risen at least 0.4 percent. For a year, analysts have predicted not just a slowing pace of increases, but falling prices.

For a look at the consumer side of things, please see CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase

With crude and gasoline prices rising, there will be a jump in the CPI in August unless the price of shelter declines.

China Exports and Imports Collapse, Harbinger of the Global Economy?

Also see China Exports and Imports Collapse, Harbinger of the Global Economy?

China’s exports are down 14.5 percent year-over-year, imports down 12.4 percent.

More By This Author:

Fed Rate Hike Odds Show Little Change Following CPI Inflation DataBonds Of China’s Largest Property Developer Crash To 25 Percent Of Notional Value

CPI Rises 0.2 Percent, Shelter Again Accounts For Most Of The Increase

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more