Price Action Is King, But Volume Is Queen

In the short to an intermediate-term trading system we run in our nightly report The Wagner Daily, price action is king but volume is very important. Moving averages can help with entries and exits, as well as defining the trend, but that’s about it. Anything added to that tends to make the decision process more difficult.

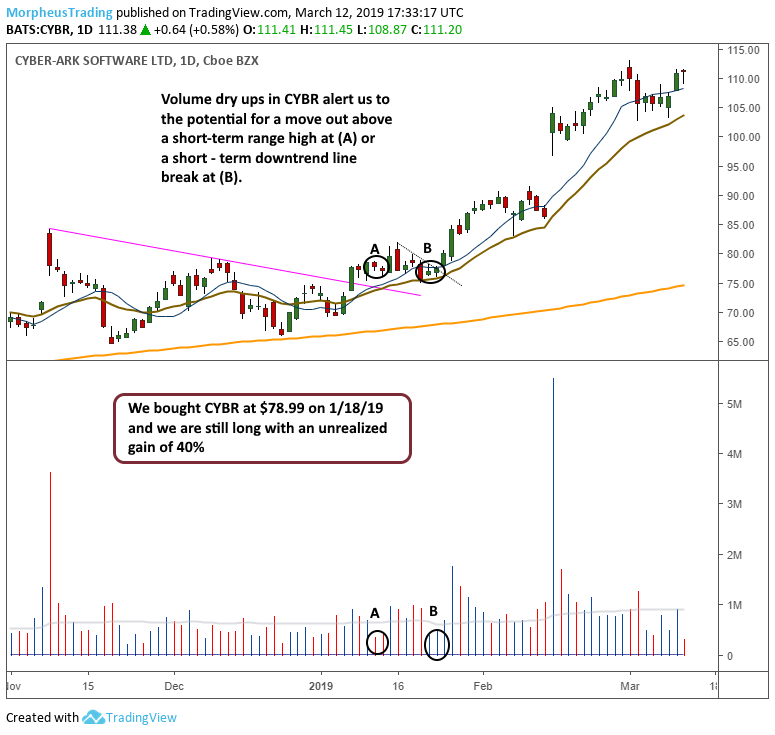

In the spirit of keeping it simple, we are going to discuss one of the ways we use volume to alert us of a potential low-risk entry point in a stock we are monitoring.

Generally speaking, when monitoring a stock for an entry, we first want to see a considerable drop off in volume. If looking to quantify the dry up, then a 10-day low in volume is fine, but there is no rule other than there should be a noticeable dry up from earlier trading.

We especially take notice when the dry up in volume coincides with a contraction in price over one or a few days. When price and volume contract, the next move may not always be in the direction we want, but if the market is healthy and we are in the right industry groups, more often than not the stock will move in our favor.

Let’s run through a few examples below:

$YETI – Note the dry up in volume at (A), (B) and (C). At (A), there is a dry up in volume and a pullback in price to the 10-day MA, but no move out as the price action just chops around for a few days. At (B) there is a narrow ranged day of trading (a few of them) along with another dry up in volume at the 20-day EMA. Any move off this area that clears the 10-day MA is buyable or as we often say “in play”. At (C), the volume once again dries up, with the price chopping around in a tight range, making a move through the highs of the tight range buyable.

$GH – At (A), GH was just starting to pullback from a recent surge up but failed to do much of anything. At (B), the volume dried up once again and price tightened, which puts any move through the highs circled at B buyable. The volume dried up at (C), making any move above resistance in play as well.

Keep in mind that every dry up in volume won’t lead to a breakout within a few days, but staying on top of volume should provide an edge over those who focus only on price patterns.

$CYBR – The volume dropped off considerably at (A), which coincided with tight action following a downtrend line break on a pick up in volume. A move through the swing high at (A) was a potential entry point. At (B), the volume dried up over two sessions, offering yet another entry point over the short-term downtrend line. We are still long $CYBR in our report with a +40% gain.

$CRON – Volume dried up to its lowest levels in several weeks prior to a strong move out on March 5. Once again light volume and a tight price range leads to a decent entry point.

As mentioned above, price action is king, but volume is very important. When monitoring a stock for an entry point don’t just look at the price pattern, keep an eye on volume as well for clues.

Disclaimer: Past results are not necessarily indicative of future results. There is a high degree of risk for substantial losses in trading securities. All data and material on this website and/or ...

more