Predicting Market Prices Is Simply Trying To Predict Market Phycology

“Davidson” submits:

Market predictions! Everyone has one. So many predictions that the media will always find someone to tout at any point in time they can label as ‘correct’. For investors seeking guidance, the question should be how good were their previous predictions, but the media(neither does anyone else) does not provide a review of prior predictions. When one does have a record to review, it can be seen that no one ever has predicted market prices with any level of precision. The ‘hype’ to stimulate viewership and thus advertising revenue is everyday fare. The phrase, “If it bleeds, it leads!” is the mantra of the press.

The media produces a story just to move on to the next story of the moment. Understanding markets and making predictions is far more complex than many perceive. Precise predictions which many investors demand and in turn are demanded by the media are truly without much value if one steps back far enough and takes into consideration enough market history to compare literally thousands of prior predictions with outcomes. The best we can do is to identify those periods when market psychology differs markedly from economic and individual corporate financials and invest as best we can to take advantage of future changes in market psychology as the economic/financial facts are eventually revealed in news headlines. This is an investment process in which we recognize that economics/financials develop first and only later become recognized by markets as having the potential for shifting prices. Once this recognition occurs, we have price shifts which occur after the fact. Market prices are connected to underlying returns by market psychology, not by mathematical models. There is tremendous imprecision in this translation. Two illustrations help to explain how markets operate and why they seem so confusing.

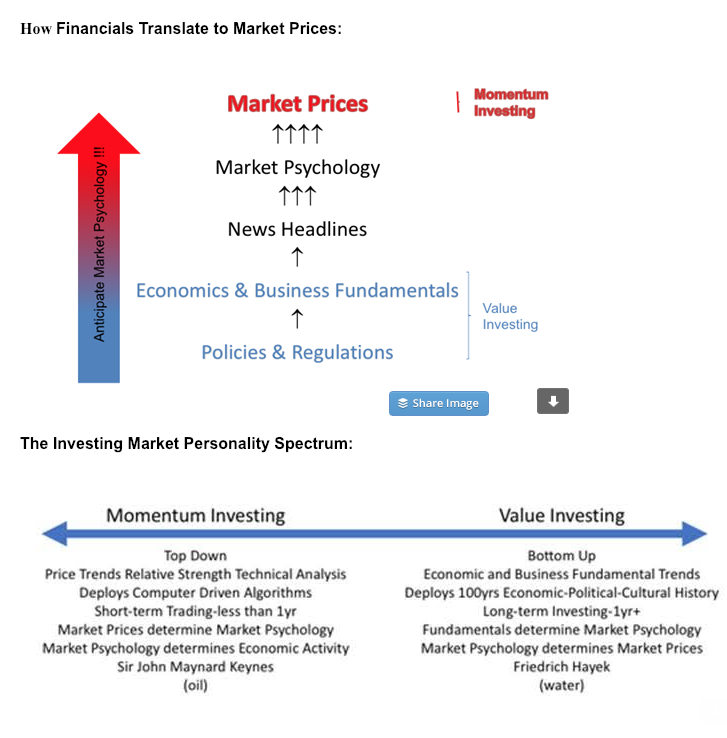

How Financials Translate to Market Prices illustrates the pathways of various investor styles of thinking that we speak of today. The Investing Market Personality Spectrum illustrates the fact that every investor is unique but generally falls along a spectrum spanning Momentum Investors at one end and Value Investors at the other. Not only does market psychology’s perception of future prices dominate everyday pricing with a complex mix of inputs, but market psychology itself also varies according to the complex nature of the investor spectrum. Investors mostly desire to focus on the simple theme precisely measured such as how many iPhones Apple can sell. From this information, investors make predictions on broad economic activity and specific market prices and in the process ignore the complexity of human activity occurring everywhere else. One would think today that the only companies which are important investment concepts are summed in the acronym F.A.N.G identifying Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOG). Add two others, Apple (AAPL) and Tesla (TSLA), and one has the bulk of the media attention which has held investor attention in the current cycle. Every cycle has had a similar media and investor focus with this cycle being no different. This occurs because investors and the media find it is simpler to deal with only a few themes at a time and develop a type of myopia. Investing is far more complex with more than 6,000 public companies comprising the investor spectrum in the US markets alone. Every one of these companies offers its piece to solving the overall puzzle of understanding the investment marketplace. Markets are understandable and investible, but they are not predictable as we speak of them today. Once we know this, we come to the realization that we can generally guess the next change in market psychology and a future shift in prices to our advantage even though we cannot predict anything with precision. Developing one’s judgment regarding market expectations less mathematics and more about reading history, psychology, politics, philosophy, and a dozen seemingly unrelated subjects. These are all factors in learning how we view the world.

(Click on image to enlarge)

Anticipate changes in Market Psychology by Monitoring Fundamentals

By closely monitoring fundamentals, one can anticipate the financial direction of headlines, which in turn changes market psychology. which in turn drives market prices. Two basic types of investors operate in the market place, Momentum Investors who invest with headlines and Value Investors who invest using fundamentals. The differences between the perception of these investment styles can be simply described as the same as the differences between ‘oil’ vs. ‘water’. Value Investors are the “Bottom Fishers’ who ramp up their buying activity during recessions forming the major market lows with their long-term multi-cycle economic and market cycle perspective. It is Value Investor market psychology which creates major cycle lows. This is the basis behind the SP500 Value Investor Index. Value Investors make comparisons between economic/corporate financials and market prices to make investment decisions. Low prices are seen as favorable investment opportunities. Their research encompasses historical business fundamentals, economic trends, government policies, and geopolitical perceptions. They anticipate how prices are likely to change with anticipated economic shifts domestically and globally once trends they monitor become media headlines. Their perspective is typically longer term, 3yr-5yr not being unusual. Momentum Investors are selling while Value Investors are buying. One comes to understand these behaviors by reading their views published in the media. Momentum Investors do not turn positive till price trends begun by Value Investors have developed sufficiently into up-trends. This is how investment cycles begin. As headlines confirm an economic recovery, the media goes back and forth between Value vs. Momentum Investors questioning which is correct with many ebbs and flows of Momentum Investor commentary as prices ebb and flow. Value Investors remain steady till they believe prices are too high. At this point, Momentum Investors, not being concerned with fundamentals, promote investing with price-trends and drive prices much higher. This where companies with a string of net income losses such as NFLX and TSLA find strong Momentum Investor support if the headlines are deemed ‘good’. There is no fundamental analysis in Momentum Investing. It is Momentum Investor market psychology which drives markets to excess and creates major market tops. This is where the ‘oil’ vs ‘water’ perception becomes most obvious. One needs to recognize these factors if one is to invest across the full investment cycle. Value Investors do not and often exit equities well before a market top occurs.

My approach is to recognize the inputs from both Value Investors and Momentum Investors and how each contributes to market pricing over time. One wants to invest early, but not overstay the market cycle. To this end, I use one series of indicators near market lows based on valuation parameters and another series for market tops indicating momentum behavior. As a cycle progresses one also must be alert to policy changes which may impact the cycle or separate sectors within the cycle. These can range to the impact of geopolitics on the value of the US$(US Dollar) as global capital ebbs and flows in response to risks/rewards perceived globally or changes in Domestic tax law, regulations or government initiatives that can have a direct impact on specific business sectors. Let's also add to this mix the unexpected innovation occurring every cycle that can have a dramatic long-term impact. This cycle saw an impact from Apple’s iPhone which while introduced in 2007 was responsible for the ‘Arab Spring’ in 2010, the conquering of Aids(HIV) virus (not the issue devastating health cost expected), a cure for Hepatitis C which came from HIV research and soon to arrive 5G wireless communications. Each of these provided an unexpected standard of living and economic benefits that were unanticipated. Every cycle has unique unpredictable advances which require monitoring to assess the importance to investments in the cycle. History shows we have never exited a cycle worse off than when we began prior to the last. Human society is relentlessly moving forward.

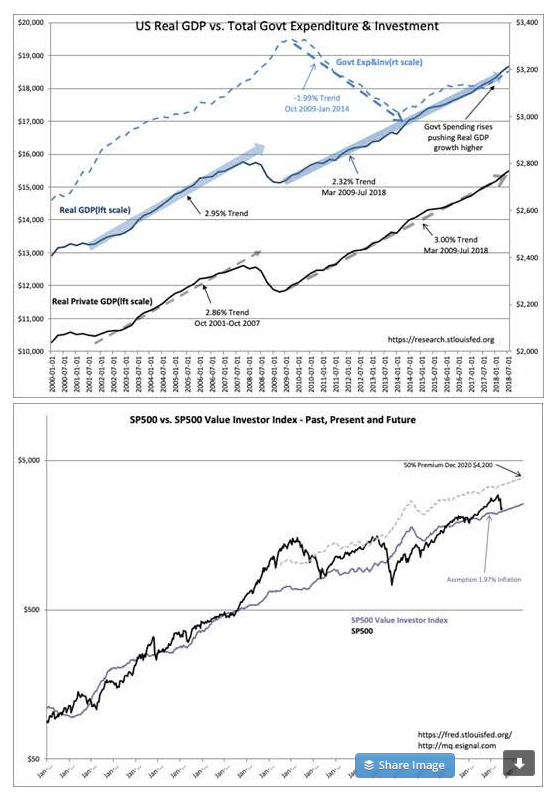

Unfortunately, we usually believe we can forecast future markets by understanding the past. Our understanding is often not as insightful as we like to believe. The Present always has its own characteristics which differ from the Past. None has been more obvious than the 2008-2016 period of perceived ultra-low GDP growth in the US. Real GDP growth 2008-2016 hovered close to 2% vs historical expectations for 3%+. For most of this period, it was confusing seeing strong Retail Sales, Personal Income and other strong economic indicators that were typical of past recoveries accompanied counter to very weak GDP growth. Weak US Productivity concerns were expressed with every GDP report. Something was wrong here as weakness was not present in the other indicators!

Further analysis revealed the simple fact that GDP measures include Government Expenditure&Investment(GEI) with the rest of economic activity. GEI is spending for the military, government agencies, farm support, roads, bridges, and other direct-control spending programs, not Social Security, Medicare/Medicaid or transfer payment programs. The 1960’s Man on the Moon, Great Society were part of this spending as was the 1950’s national highway system, WWII, the Korean War, and Vietnam War. Take this spending out of GDP and one gets the Private GDP. The Private GDP is the output of the population which supports government spending programs and a better measure in my opinion of the actual output of any national economy. Once the Private GDP is analyzed it becomes clear that economic activity 2008-2016 was similar to previous recoveries. No one it seems was sensitive to the impact of “Sequestration”, the cutback in government spending, had on reported GDP. The series shown in US Real GDP vs. Total Govt Expenditure & Investment are adjusted for inflation. GEI began to rise April 2014, then stalled and has since begun to rise with the new administration’s policy of rebuilding the military after a long period of cost-cutting. Suddenly, the media and pundits are raving about an economy growing over 4% Real GDP. The interpretation is that this is due to the tax cut and that Real GDP will fall to 1.5% growth this year, 2019. Just as most analysts have misperceived GDP as the worst recovery in a century this cycle, they are forecasting dire growth to resume in the years ahead. In my opinion, they will be greatly surprised!

(Click on image to enlarge)

In all likelihood, GEI is going to rise to continue to rebuild a strong military even though it may not be deployed. The current administration is using economic tools to diminish global threats to Democracy but requires a ‘Big Stick’ in a strong military. In this day and age, it has become apparent that military deployment has a history of ineffectiveness long-term. Economic sanctions and banking restrictions are being shown as very cost effective. However, economic sanctions are only effective if one also projects the appearance of a strong military. It is this rise in GEI which is mostly responsible for the rise in Real GDP, not the tax cut. It can be seen that the Real Private GDP remains ~3% while it is Real GDP which is impacted by the rise in GEI. Yet, pundits attribute the rise in Real GDP to the tax cut which they expect to wane 2019 and economic activity to slump.

In my opinion, some additional GEI spending will continue to drive Real GDP. This will surprise most investors who now expect a slump and likely to swing market psychology from the current pessimist bent to something much more optimistic. Should we get continued GEI spending, we could see Real GDP into the mid-4% range vs. current expectations of ~1.5%-2% range which could result in investors charging into equities as in past cycles. Momentum Investor price-trend investing would reinforce any strong investor theme. Such a shift could see the SP500 rise with market optimism to a 50% premium (as witnessed in past cycles) to the Value Investor Index or ~$4,000 by Dec 2021. This is not a specific prediction, but more a guess that based on previous periods in which investors were positively surprised and priced the SP500 50%+ higher than the Value Investor Index. This is another market feature which requires monitoring.

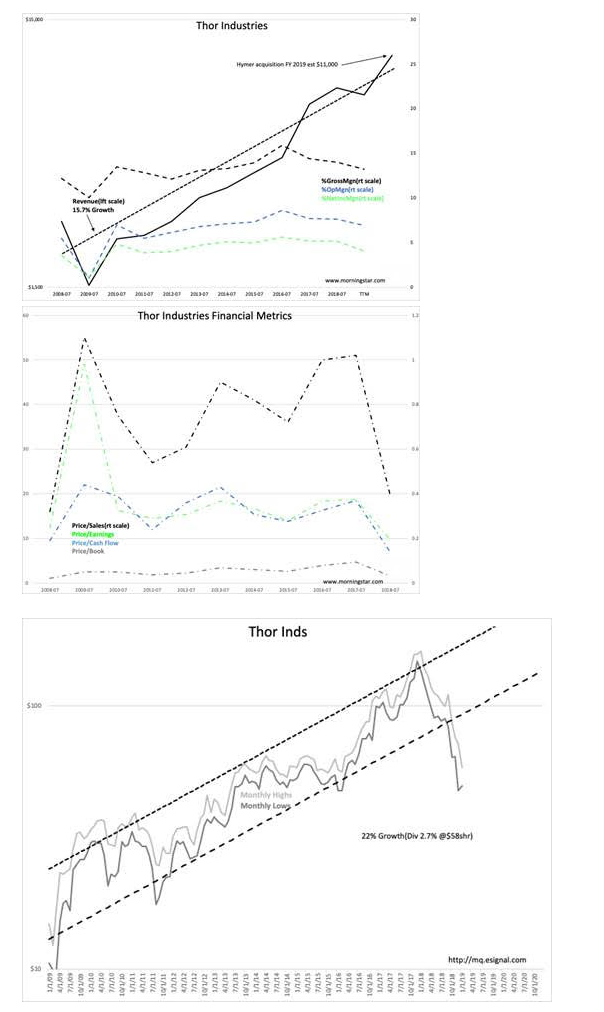

Thor Inds (THO) as an example of where the next rise in prices could emanate

Thor Inds (THO) a good example of a conservatively managed growth company priced at a price level which attracts Value Investors. Any surprises from the current level of pessimism could result in investors repricing THO back to its recent price trends. THO is a manufacturer of recreational vehicles(RV). THO recently bought Euro-centered Hymer to add $2.9Bil of revenue thus extending its more than 15% Revenue growth history. Current pricing metrics are at or very near 10yr lows. Should THO become repriced as shown in the price history, its current $60shr could rise above $150shr by Dec 2021. It is in the swings from pessimism to optimism in individual issues that we get surges in the SP500 to 50% premium of the Value Investor Index.

Note that THO insiders have been buying shares. Always a good sign when the management has this skill level. The ultimate Value Investor is an insider, especially with exceptional business judgment.

(Click on image to enlarge)

Summary

Predicting markets and markets is a guessing game, but one based on experience with how investors respond to unexpected news. There is no precision to any of this, no mathematical relationship to fundamentals, but if the financials surprise on the upside then prices rise and vice versa. The role of the investors and advisors is to judge when markets are reflecting market psychology that differs from fundamentals. The wider the differential the greater the investment opportunity if all else holds true. The current level of pessimism severely under-estimates the economic positives. There are multiple indicators which attest to the current misreading including valuations, insider activity, economic and business trends which are likely exaggerated by the misperceptions of expected GDP growth.

Markets are offering a strong opportunity for equity investors at this time. I urge additional commitments to portfolios.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more