Pre-November US Crop/S&D Ideas

Market Analysis

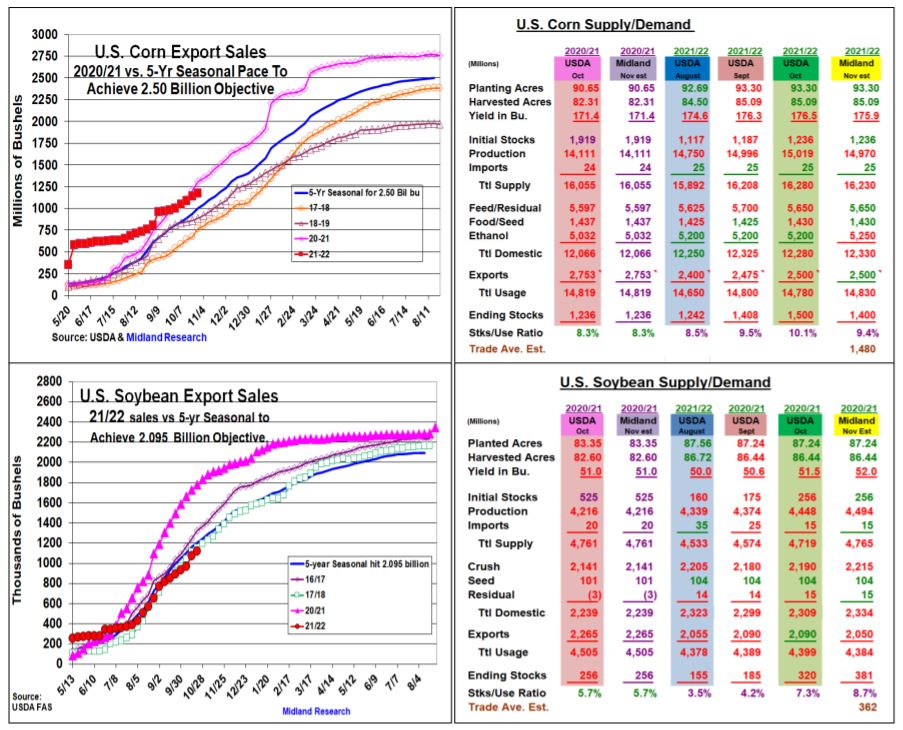

The trade is anticipating limited changes in the US corn and soybean output on the upcoming November 9 USDA crop report. Late season rainfall in the WCB prompting some better-than-expected yields have been countered by reduced output from disease issues and a bout of heavy rains during harvest in the ECB.

USDA adjustments in their overseas and domestic demand outlooks will likely have an impact on both corn (CORN) and soybeans (SOYB) 2021/22 balance sheets and their latest ending stocks forecast.

This year’s timely spring plantings and dryness/drought in the W Midwest for much of summer has keep corn’s harvest ahead of its 5-year pace at 74%. The trade is expecting 0.4 bu rise in the US yield to 176.9 bu which would increase 2021’s output by 31 million bu to 15.05 billion. We favor the low side of the trade’s yield range at 175.9 bu, but this month’s demand changes will be important. China’s corn purchases have kept 2021/22’s corn sales 135 million ahead of its seasonal pace to hit the USDA’s 2.5 billion forecast so change is expected. Strong gasoline prices & this fall’s surge in US ethanol output to near record levels suggest a 50 million bu jump is likely. This suggests a possible 100 million drop in corn’s ending stocks to 1.4 billion.

In soybeans, stronger-than-expected western US yields has the trade expecting 0.4 higher US average this month to 51.9 bu. This could up this year’s output by 36 million bu to 4.484 billion crop. Low Chinese hog prices and Brazil’s good start to their 2022 bean crop has slipped US exports behind its seasonal pace to hit the USDA’s 2.09 billion forecast. Even with a strong bean oil outlook from expanding renewable diesel upping the US crush, this month’s US ending stocks could rise to 360-380 million bu. this month.

Seasonally strong world demand, a smaller world crop & dryness in parts the US Plains and the Black Sea has firm wheat prices to their highest prices since 2012. However, the USDA isn’t expected to change its US current 580 million bu ending stocks with the current high US Dollar curtailing foreign demand.

What’s Ahead:

The combination of wet weather slowing the US harvest, building concerns of higher energy prices reducing 2022 crop plantings because of higher inputs prices and a surge in wheat (WEAT) export activity rallied corn & wheat prices to our sell points.

This advanced our 2021/22 grain sales to 35-40% early this week. Utilize January bean strength in the $12.48-60 range to increase current sales to 40-45%.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more