Pre-March US/World S&D Reports

Market Analysis

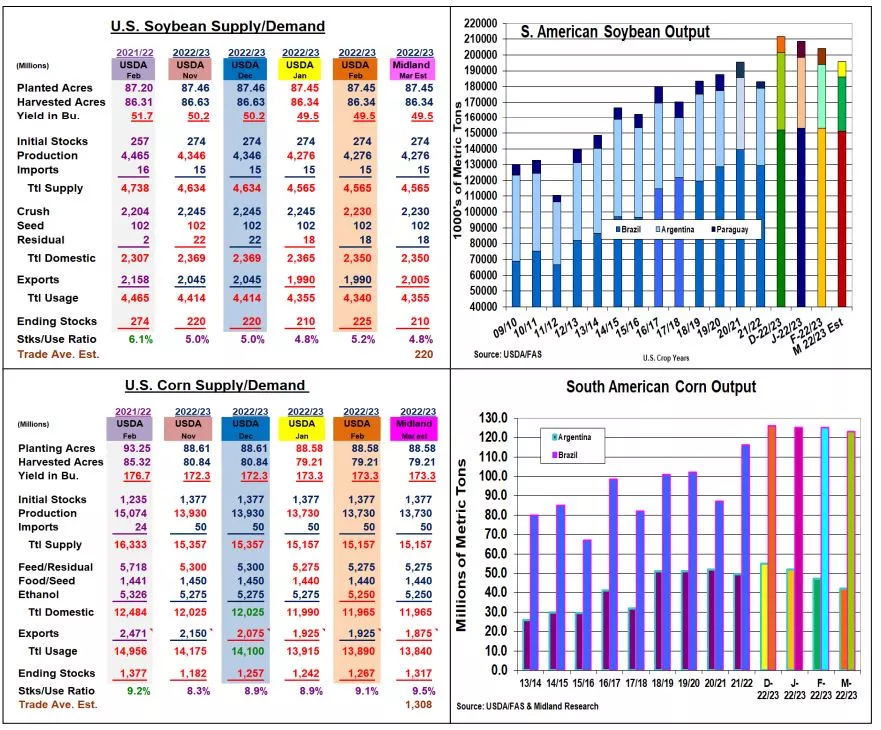

The USDA’s next US & World supply/demand & S. American crop updates will be on March 8. Traditionally, the World Board makes minimal changes in their US & World estimates. They prefer to see important US quarterly stocks and processing reports later this month before making big domestic adjustments. However, 2023’s extreme Argentina and S Brazil drought suggests further cuts in S America’s crops are likely. With the current Black Sea grain deal expiring on March 18, concerns are swirling that this important world trade agreement might not be extended. Ukraine wants the arrangement extended for one year, more Russian inspection teams to speed up the 140-boat backlog in Turkey and 1 or 2 additional Ukrainian ports added to the shipping deal. The trade isn’t optimistic about these changes, particularly with Russia demanding the current financial & insurance sanctions on their exports being dropped before they will come to the bargaining table. This would be catastrophic to world trade if Moscow would follow-thru on this demand.

Because of continued heat & dryness in Argentina & S Brazil, the USDA could decrease S AM’s soybean output another 6-8 mmt. Much of this drop is in Argentina with S America’s output at 196 mmt. This would be like 2020/21’s output & S American overall yield in 17/18 of 3.11 mt/ht. This suggests a 15-20 million rise in US exports is possible with just 196 million bu to sell in the last half of the crop year. With no change in the US crush, this suggests 210 million US ending stocks.

South America’s corn output has also been hurt by weather with a 5-7 mmt drop. Argentina has been the hardest hit with a 5 mmt cut to 42 mmt likely. No change in either feed or ethanol demand are likely after Feb’s 25 million cut in biofuel demand, However, with current sales 13% behind the US 5 yr average pace, corn’s exports could be trimmed 50-75 million bu. Sales might pick-up with Brazil’s safrina corn exports not until July, but China’s absence has been tough to overcome. March US ending stocks are projected at 1.317 billion bu.

No change in US what ending stocks are expected, The Black Sea trade deal determine if US exports hit their goal .

What’s Ahead:

The market’s focus will be on Black Sea grain corridor talks, S. America’s weather and yield reports and the upcoming USDA’s March US & world production and Supply/Demand reports. The US Planting Intensions and Quarterly Stocks reports on March 31 remain important.

Continue to have your old-crop sales at 80% for both corn and soybeans and new-crop sales at 10% at this time.

More By This Author:

In Grains South America’s Weather Is The FocusPre-February US/World S&D Reports And S. American crop

Lower US Corn & Soybean Crops, But WW Plantings Jump Big

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more