"Powell Throws In The Towel": Gold, Global Stocks Soar, S&P At All Time High As Yields Tumble

Risk assets, safe havens? It doesn't matter: just buy it all as central banks enter the last stretch of the race to the (credibility) bottom.

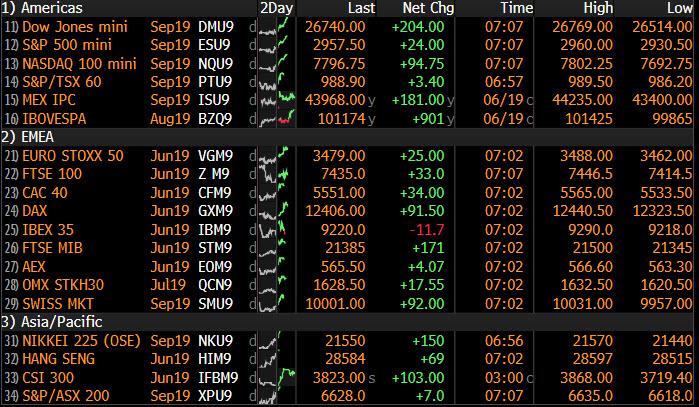

The global dovish tsunami - still in its jawboning phase - which was started by Mario Draghi on Tuesday and escalated on Wednesday when Fed chair Powell finally threw in the towel and effectively said he would cut rates in July, has resulted in a global scramble for both risk assets and safe havens, with global equity markets a sea of green...

... and S&P500 futures at all time high, indicating a record S&P print when the cash market opens...

Medley Global Advisors’s Emons on Fed Policy, Bond Yields, Gold

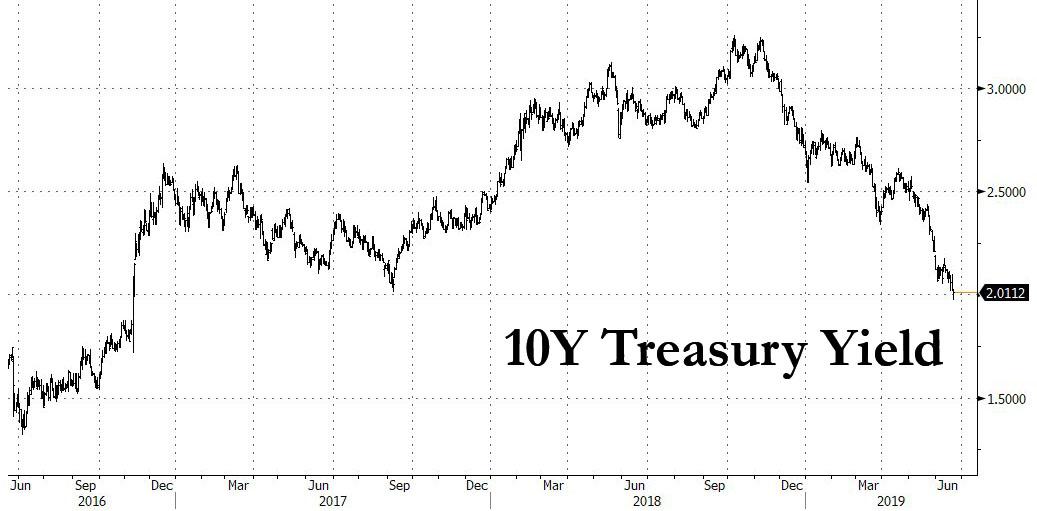

... even as the 10Y Treasury yield plunged overnight, dropping below 2% for the first time since November 2016 and reaching as low as 1.97% before rebounding.

Finally, the ultimate safe asset, gold, has surged 1.5% overnight and has finally broken out above multi-year support as we noted last night.

The rest of the world joined the party, with Europe's Stoxx 600 Index boosted by gains in technology shares and carmakers. Just like in the US, European stocks and bonds rally simultaneously in the aftermath of the Fed’s dovish tilt yesterday. Euro Stoxx 50 +0.9% to highest since May 6, led by technology, autos, and industrials. In rates, Euro-area yields were steady to 4bps lower across the 2-yr through 10-yr tenors, with 10-yr BTPs outperforming bunds by 6bps.

Earlier in the session, Asian stocks also climbed, heading for their best week since January. The MSCI Asia Pacific Index rose for a third day, with communications and finance among the best-performing sectors. Most markets in the region were up, as China and Hong Kong led gains. Chinese stocks rallied the most in Asia with a surge in large caps as risk appetite picked up around the world. Investors adjusted positions before FTSE Russell is set to add A shares to its global indexes for the first time. The Shanghai Composite Index closed 2.4% higher, with Kweichow Moutai and large financial firms offering the biggest boosts, after Chinese President Xi Jinping began a state visit to North Korea. A rally pushed the price of gold surged to the highest level in more than five years, sending shares of gold miners across Asia higher. The Topix gauge advanced 0.3%, driven by SoftBank and Nintendo.

In the latest central bank news:

- Norges Bank, busy building a reputation as one of the world’s most hawkish central banks, unanimously delivered on the promised 25bps June hike, with the Key Rate now at 1.25%, as expected.” Governor Olsen highlighted that the “assessment of the outlook and balance of risks suggests that the policy rate will most likely be increased further in the course of 2019”, with policy forecasts signaling faster rate rises in the coming years. In-fitting with some of the calls, the rate path was left unchanged from the March release.

- The Bank of Japan kept monetary policy unchanged Thursday,

- Indonesia’s central bank signaled it’s ready to cut interest rates.

- The Philippines central bank kept its key rate unchanged.

- RBA Governor Lowe said the possibility of lower rates remain on the table and that it is not unrealistic to expect a further reduction in the Cash Rate. RBA Governor Lowe also commented that recent data suggests we are not making any inroads into the economy's spare capacity and it is unrealistic to think one 25bps cut can alter the growth path, while he also suggested that it is important to recognize monetary policy is not the only option and that he is very hopeful we will not need to cut as far as some central banks in Europe. (Newswires)

- The Bank of England kept rates unchanged but warned that the risk of a no-deal Brexit is rising, sending cable sliding.

In FX, the Bloomberg USD index tumbled -0.5%, its biggest drop since March 20, as a fresh round of leveraged and real money selling after the London open kept the greenback under pressure. Norway’s krone rallied as Norges Bank signaled its rate hike Thursday may be followed by a similar move later this year, while sterling rose above $1.27 before the Bank of England policy decision.

In the biggest geopolitical news of the day, the Iranian Revolutionary Guard shot down a US drone according to reports citing the state news agency, although the US military later stated that no US aircraft had operated in Iranian airspace. Iran's Revolutionary Guard Corp Top Commander Salami says the downing of the US drone sent a clear message to Washington, according to State TV.

In commodities, both Brent ($63.26) and WTI ($55.21) rally as Mideast tensions ratchet up, with gold jumping to the highest level in more than 5 years.

Market Snapshot

- S&P 500 futures up 0.8% to 2,957.50

- STOXX Europe 600 up 0.7% to 387.36

- MXAP up 1.2% to 159.89

- MXAPJ up 1.3% to 525.59

- Nikkei up 0.6% to 21,462.86

- Topix up 0.3% to 1,559.90

- Hang Seng Index up 1.2% to 28,550.43

- Shanghai Composite up 2.4% to 2,987.12

- Sensex up 0.7% to 39,388.97

- Australia S&P/ASX 200 up 0.6% to 6,687.41

- Kospi up 0.3% to 2,131.29

- German 10Y yield fell 1.8 bps to -0.306%

- Euro up 0.6% to $1.1290

- Italian 10Y yield fell 0.6 bps to 1.747%

- Spanish 10Y yield fell 2.9 bps to 0.374%

- Brent futures up 2.6% to $63.46/bbl

- Gold spot up 1.5% to $1,380.15

- U.S. Dollar Index down 0.4% to 96.73

Top Overnight news

- Fed Chairman Jerome Powell made clear that uncertainty -- primarily about the president’s trade battles -- was a major factor behind the central bank’s policy shift, along with weak inflation

- President Trump told confidants he believes he has the authority to replace Jerome Powell as Fed chairman, according to people familiar with the matter. Powell said he intends to serve his full four-year term

- Bank of Japan kept monetary policy unchanged, just hours after the Fed became the latest central bank to signal a willingness to cut interest rates in the face of rising threats to economic growth

- Australia’s central bank chief Philip Lowe reiterated it was “not unrealistic” to expect a further rate cut

- New Zealand’s economic growth held at a five- year low, leaving the door open for the central bank to cut rates again. GDP rose 2.5% from a year earlier, matching the revised pace for the fourth quarter of 2018

- Norway’s central bank is set to raise rates again as a boom in oil wealth spending and investments put the economy at odds with a global economic cooling

- U.K. Conservative members of Parliament will choose the final shortlist of two candidates to succeed Theresa May as prime minister Thursday, a day after the favorite Boris Johnson stretched his lead to 89 votes; U.K. Chancellor Philip Hammond will urge the Tory leadership contenders to consider holding a general election or second referendum in order to break the Brexit impasse, rather than an economically damaging no-deal exit

- Norges Bank is busy building a reputation as one of the world’s most hawkish central banks as it delivers its third interest- rate hike since September and signals there’s more to come

- U.K. Conservative members of Parliament will choose the final shortlist of two candidates to succeed Theresa May as prime minister, a day after the favorite, Boris Johnson, stretched his lead to 89 votes. Tory MPs are due to vote twice Thursday, each time eliminating one candidate

- The Bank of England must decide whether to temper warnings of future interest-rate hikes as investors and other major central banks prepare for more policy easing. While the Monetary Policy Committee is expected to keep the key rate unchanged on Thursday, Citigroup predicts some votes for an immediate increase

- Iran said it shot down a U.S. spy drone in its airspace, escalating already fierce tensions in the Persian Gulf. The reported drone downing followed a missile strike by Yemeni rebels overnight on Saudi Arabia

Asian equity markets traded mostly positive as the region digested the dovish FOMC. ASX 200 (+0.6%) was led higher by gold names after the precious metal surged to its highest since 2013 but with upside in the broader market capped by weakness in other miners including Rio Tinto after it lowered its iron ore production outlook and with Caltex heavily pressured on disappointing guidance. Nikkei 225 (+0.6%) was also supported in the aftermath of the FOMC although a firmer currency and unsurprising BoJ announcement limited the advances, while Hang Seng (+1.2%) and Shanghai Comp. (+2.4%) outperformed on optimism ahead of the US-China trade talks and as financials surged after continued liquidity efforts by the PBoC. Finally, 10yr JGBs were higher as they tracked the upside in T-notes amid a decline in global yields with the US 10yr yield below 2.00% for the first time since November 2016 and with the 30yr yield also at similar multi-year lows.

Top Asian News

- Japan Bond Futures Climb to Record as Kuroda Signals Flexibility

- Philippine Central Bank Holds Key Rate After Inflation Quickens

- Bank Indonesia Cuts Reserve Ratio for Lenders to Boost Liquidity

- Malaysia Leader Says ‘No Proof’ Russia to Blame for MH17 Downing

European equities are higher across the board [Eurostoxx 50 +0.8%] as the region carries the FOMC-spark gains from Wall Street and Asia overnight. UK’s FTSE 100 (+0.5%) marginally lags its peers as the index is pressured by a firmer Sterling ahead of the BoE Monetary Policy Meeting. Sectors are also broadly in green, albeit financial names lag amid the post-FOMC yield decline. In terms of individual movers, Dixons Carphone (-13%) sunk to the bottom of the Stoxx 600 after the Co. cut guidance. Meanwhile, Fresenius Medical Care (+2.1%) is supported by a positive Barclays broker move. Finally, more bad news for Deutsche Bank (-1.1%) after NYT reported of a criminal probe over alleged money laundering.

Top European News

- BOJ Stands Pat as Fed and ECB Signal Possible Rate Cuts Ahead

- Polish Judges’ Retirement-Age Cut Is Illegal, EU Court Aide Says

- Guindos Says ECB Is Prepared to Act If Situation Deteriorates

- Norges Bank Stuns Markets With ‘Sole Hawk in Town’ Performance

In FX, the Dollar is down across the board as the FOMC matched market expectations by shifting further towards a rate cut, while Fed chair Powell delivered an extra dovish snippet in the press conference by revealing that even those not plotting ease are more prone towards loosening monetary policy if needed. The has now index lost grip of the 97.000 handle and extended losses towards 96.500, with chart support just below (ie the 96.459 post-NFP low) under threat ahead of weekly claims, Philly Fed and the LEI.

- NOK/NZD/CHF - The G10 outperformers, with the Norwegian Crown benefiting from a hawkish Norges Bank hike on top of the aforementioned Greenback weakness, and also further divergence vs the ECB as the revised rate path pencils in 2 more 25 bp tightening moves (next in September 2019 and 3rd before Summer next year). Usd/Nok and Eur/Nok down to circa 8.5500 and 9.6630 respectively in response. Meanwhile, the Kiwi and Franc drew additional impetus from data in the form of NZ Q1 y/y GDP and Swiss trade, as Nzd/Usd rebounds firmly towards 0.6600 and Usd/Chf retreats sharply through 0.9900, with 0.9850 in sight.

- EUR/AUD/CAD/GBP - The next best majors in terms of gains relative to the Buck, as the single currency tests 1.1300 and unwinds more post-Draghi declines, while the Aussie pivots 0.6900 even though RBA Governor Lowe underscores room for further OCR cuts and the CBA believes back-to-back easing is in the offing with another ¼ point reduction in July. Elsewhere, the Loonie has built on Wednesday’s strong headline Canadian CPI platform to probe 1.3200 offers and psychological resistance and the Pound has reclaimed 1.2700+ status ahead of the BoE amidst market expectations or perceptions that the outturn might be hawkish on balance – see the headline feed or Research Suite for a more detailed preview. Note, not much reaction in Cable to UK retail sales that were weak and came with back data downgrades as the ONS flagged bad weather impacting clothes and footwear in mitigation.

- EM - Broad rallies or rebounds at the Dollar’s expense, but the Lira also gleaning impetus to breach 5.7500 via an improvement in Turkish consumer sentiment, while the Rand is testing 14.2000 in anticipation of SA President Ramaphosa’s SOTU address and the Ruble is getting an oil-related boost and rallied to 63.2400 at one stage.

In commodities, WTI and Brent futures extended on gains in early European trade as the upside seen amid the dovish FOMC was exacerbated by reports that Iran shot down a US spy drone over the Strait of Hormuz, as tensions in the region escalates. WTI futures rose to levels just shy of USD 56.00/bbl whilst its Brent counterpart ran out of steam ahead of USD 64/bbl. Both benchmarks have since come off highs but hold onto a bulk of its gains, amid light news flow in the complex. Elsewhere, gold remains closer to the 1400/oz after having experienced a post-FOMC flash spike, with some attributing the move to a breakout from a five-year range. Meanwhile, copper is back above the USD 2.70/lb amid a weaker Dollar and upbeat risk sentiment around the market. Finally, Dalian iron ore hit fresh record highs after Rio Tinto yesterday lowered its Pilbara shipment guidance, suggesting that supply could remain tight despite Vale resuming operations at its Brucutu Mine.

US Event Calendar

- 8:30am: Current Account Balance, est. $124.3b deficit, prior $134.4b deficit

- 8:30am: Initial Jobless Claims, est. 220,000, prior 222,000, Continuing Claims, est. 1.68m, prior 1.7m

- 8:30am: Philadelphia Fed Business Outlook, est. 10.4, prior 16.6

- 9:45am: Bloomberg Consumer Comfort, prior 61.6

- 10am: Leading Index, est. 0.1%, prior 0.2%

DB's Jim Reid concludes the overnight wrap

By the time you read this, I’ll have just taken off on the last flight out of NY back home. The biggest thing waiting for me on my arrival will be knowing whether my 3.75yr old daughter Maisie managed to be persuaded to sleep without her dummy for the first time ever last night. The dentist last week insisted it went ASAP. As such the reason we bought the dolls house furniture earlier in the week was a bribe. When she’s ready to give the dummy to the dummy fairy, said fairy will give her the furniture. Every night this week my wife has asked her if she’s ready to leave her dummy out for the fairy and every night she’s sobbed that she’s not ready. However last night she reluctantly agreed after seeing some of the furniture. My wife said it had to last through the night for the fairy to do the swap. I’ll wait to see what happens.

In markets, the rate cut fairy arrived overnight after the market figuratively spat out its dummy over recent weeks. The Fed was certainly more dovish than prior expectations with the main manifestation being the -12.8bps drop in two-year yields (-1.6bps more in Asia), taking them to a fresh 20-month low. I would say the main success story was that 10-year yields (-3.6bps) didn’t follow the move in full indicating that the market believes that the Fed can sustain the expansion with rate cuts. Had the 10y moved in tandem then it would have implied more doubts over the growth and inflation outlook even as they cut. So 2s10s steepened by +9.1bps to 28.2bps, its sharpest move up since November 9, 2016, the day after the US presidential election. Regular readers will know that I think 2s10s is the most important curve variable and if it can steepen then that’s a positive all other things being equal. It has flattened back a little to 25.9bps in Asia as 10 year yields have caught up a little (-3.9bps) and have traded below 2% for the first time since November 2016. More market reaction later.

In more details on the Fed, the language of the statement and the dot plot moved more than expected in signaling imminent rate cuts, though both stopped short of a truly explicit signal. Eight FOMC members moved their dots lower to endorse cuts this year, with 7 of those now calling for 50bps and 1 penciling in 25bps. That leaves 8 members predicting no change to policy and just 1 one member assuming a rate hike. That leaves things finely balanced, and indeed if just one more member had moved toward cuts, the median dot would have fallen. For 2020, the median dot did fall by 50bps, to 2.125%, while the long-run forecast fell 25bps to 2.50%, a new record low. On the growth front, the median projection for 2019 stayed steady at 2.1%, while 2020 was revised up by 0.1pp to 2.0%. That likely reflects the assumed impact of rate cuts on the economy from those members who expect cuts.

The policy statement mirrored these new forecasts, highlighting “soft” business fixed investment and noting that “market-based measures of inflation compensation have declined.” They also removed the word “patient” with regards to the committee’s policy stance, and added the recent buzz-phrase that they will “act as appropriate to sustain the expansion.” They also noted that “uncertainties about this outlook have increased.” St. Louis Fed President Bullard dissented in favor of a cut, the first dissent of the Powell era, in line with his prior comments.

In the press conference, Chair Powell mostly avoided saying anything too substantive, though he did reveal that "a number of those that expected flat rates agree that the case for more accommodation has strengthened.” That suggests that even among those who did move their rate forecasts, the case for a rate cut is strengthening. On the hawkish side, he did reiterate that “the baseline outlook has been a good one” and cited the strong labor market, rising wages, and steady consumption growth as key supports for the economy. However, he also said that “the limited evidence available at this time suggests that growth in business fixed income has slowed in the second quarter,” and noted that trade uncertainty is a key factor driving this trend. When asked about planned balance sheet policy, Powell seemed to tacitly indicate that the Fed could end its runoff program at the July meeting alongside a rate cut.

Our economists published their recap of the meeting last night (available here ), where they conclude that the meeting opened the door to rate cuts as early as July, as they expected. They did note that Powell said, “there was not much support” for a cut at yesterday’s meeting (excluding Bullard’s dissent), which likely means that they will need to see further deterioration in the data and/or worsening trade conflict to feel fully comfortable cutting in July. Even apart from those conditions, our econ team thinks that Powell’s comments on the ongoing Fed review, plus the persistence of inflation undershooting, potentially signal a willingness to allow for an “opportunistic reflation,” as Governor Brainard has described it. That would argue for a rate cut even if the data and trade talks do not deteriorate. Overall, our econ team expects conditions to evolve sufficiently to warrant a cut in July and view a 25bps move as more likely than 50bps, and they continue to anticipate a total of three rate cuts this year.

As mentioned, the biggest market reaction came in rates, where short-end treasuries rallied sharply and money markets moved to price in even greater odds of Fed easing. There are now 32bps of cuts priced in for the July Fed meeting; implying a near-certainty of a 25bps cut and some additional chance of a 50bps cut. Beyond that, there are now a full 75bps priced in through end-2019 and 100bps over the next 12 months. Ten-year treasury yields fell -3.6bps even as inflation breakevens rose +4.4bps. The dollar slid -0.54%, with its losses spread evenly across high-yielding EMs (ZAR +1.38%, TRY +0.64%) and developed market havens (CHF +0.63%, EUR +0.29%). US equities had been trading flat into the Fed meeting but rallied after the statement and dot plot was released and continued to build on their gains during Powell’s press conference. The S&P 500 ended +0.30% higher, while the NASDAQ and DOW gained +0.42% and +0.15%. Despite the positive headline numbers, there was a defensive tinge to the sectoral moves, with materials, energy, and industrials all lagging. Banks also performed poorly, dropping -0.86% on the lower rates outlook. Despite all the excitement, volatility continued its recent slide, with the VIX down -0.8pts to 14.3.

The central bank baton passed to the BoJ this morning however it’s been much less of a spectacle with no policy announcement nor any change to forward guidance. The statement did include a reference to rising global risks however that was about the only change. Governor Kuroda is yet to speak (07:30 am London time) so it’s worth keeping an eye on his comments. As for markets, the yen is up +0.46% - although that more reflects the post-Fed move - while yields on 10yr JGBs are down -1.6bps to -0.160% and the Nikkei is up +0.68%. Markets in the rest of Asia are also trading up with Chinese bourses leading the way – the CSI (+3.29%), Shanghai Comp (+2.58%) and Shenzhen Comp (+2.15%) are all up over 2% while the Hang Seng is also up +1.01% although it’s not entirely clear what is driving the big China outperformance this morning.

As for Europe yesterday prior to the Fed, the rally for rates ran out of steam with yields backing up slightly. Indeed 10y Bunds rose +3.2bps but they still remain -5.2bps down from the pre-ECB levels. OATs rose +3.9bps while BTPs closed flat. The ECB’s Rehn was fairly coy in his comments yesterday in Sintra, only reiterating that the ECB will “consider and discuss and – as appropriate – take decisions on this in our forthcoming meetings”. In equities the STOXX 600 finished flat after an intraday range of just 0.39% which is the 7th lowest this year. The DAX ended -0.19% and CAC +0.16%. HY credit spreads in Europe ended -8bps.

So, just in case you hadn’t had enough of central banks for one week, we’ve still got the BoE meeting today. No change in policy is expected, with the market similarly priced for no change. Our UK economists changed their BoE call a few weeks ago away from a hike this year with rising risks that the Bank Rate has reached its terminal point. They pointed to the deterioration in the global outlook, a demand slowdown from surveys, a longer pass through from wages into inflation and the rising risks of a no deal Brexit. More can be found in their note here.

Staying with the UK, last night’s leadership contest ended with further gains for frontrunner Boris Johnson. He amassed 143 votes in the latest round of voting, as dark horse Rory Stewart was eliminated. That leaves Jeremy Hunt, Michael Gove, and Sajid Javid as the final contenders. The list will be whittled down to the final two candidates in two more votes today. Sterling was up around +0.61% prior to the Fed before ending +0.69% stronger. It’s worth noting that the Telegraph has reported overnight that Chancellor Hammond will use his annual Mansion House speech today to warn Tory leadership contenders to "be honest with the public" and admit that Parliament is likely to reject both the Withdrawal Agreement and no deal. The report went on to add that he is likely to say that a second referendum could be a possible way to break the impasse in the parliament while adding that a general election "could put Jeremy Corbyn in Downing Street”.

It was the May inflation report in the UK yesterday which was the only real data of substance. However, there were no great surprises with the +0.3% mom headline reading matching expectations, putting the annual rate at +2.0% YoY, while the core dipped one-tenth to +1.7% YoY, albeit one-tenth above consensus. That data didn’t really move the dial for the BoE today. The other data was the June CBI survey in the UK which showed total orders of -15 compared to estimates for -11.

Looking at the day ahead, this morning we’ll get the May retail sales report prior to the BoE meeting at midday before the US data includes jobless claims, the June Philly Fed business outlook, and May’s leading index. The June consumer confidence reading for the Euro Area is also out this afternoon. Meanwhile, the ECB’s Rehn and Guindos are due to speak, while we’ve got another Conservative Party leadership ballot to look forward to, while EU heads of state gather for the start of a two-day meeting to discuss the leadership race for the commission and ECB.

Fingers crossed that’s the last of the dummy. Only the twins to deal with at some point in the future.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Powell is holding the towel. He has not actually thrown it into the ring yet.