Reflections, Predictions, Chaos

When I was five years old, my father taught me five things.

-

How to play Gin Rummy

-

How to read the McCormick (MKC) stock quote in the Baltimore Sun

-

How to keep the score at a baseball game

-

How to read and calculate averages in a box score in the Baltimore Sun

-

How to pour a proper Vodka Soda for him and his friends (Smirnoff preferred.

All these elements required mathematics and a deeper appreciation for division and multiplication. I walked into first grade a little too proud and nearly got tossed from Warren Elementary because everyone else was working on: 2 + 4 = sandwich.

Today is my father’s birthday, and it’s great to be back in Maryland to spend more time with my parents. Thanks for everything, Dad… but you already know that…

Why I Stand for the Flag…

I didn’t say anything about the 80th Anniversary of D-Day because I wanted to tell this story properly.

When I was 18, I went to an Orioles game with my father and his friend Mo McGarity.

Before the game started, the National Anthem played. And I was distracted by something. I didn’t stand up fast enough, and Mo got really mad at me.

“You stand for the national anthem,” he sniped.

I asked him why this was so important, and he said he’d tell me later. So, we went to my father’s restaurant, and we sat down.

Mo explained that when he was about 16-17 years old, he signed up for the military to join the U.S. effort in World War II. He then explained what it was like to be that age, storming Normandy Beach during the initial waves…

That was a very humble moment.

But then, the story took a turn.

My father’s other friend, Eddie Keelan, walked into the restaurant. He approached both of us, said Hello, and asked why we were there.

Both of these guys were notoriously fun. Eddie would always throw a Jimmy Buffett-themed backyard pool party that got out of hand… and Moe would wear a full tuxedo on Halloween, only to find that there were complete cutout holes on his butt under the coattails…

Well, I explained to Eddie that Moe was telling me about his time in World War II.

And with that… Eddie said that he was also at Normandy at a similar age.

They’d known each other for years… and never once discussed it.

If my memory serves me, one was at Omaha and the other at Utah.

And that was it. Just a nod to one another, and they went on to talk about something else. It was one of those moments where you realize these guys were the Greatest Generation.

So… yes, I stand for the Anthem… promptly.

The Dollar War Hits A New Phase

I’ve mentioned that I’ll discuss in more depth how the United States and Japan are weaponizing the Yen to fight the Chinese Yuan.

This currency war is happening in real time.

As we know, there’s the BRICS, which is looking to create a gold-backed currency for the purposes of trade (remember, though, this could be a problem for them, as it effectively acts as a glorified Gold ETF that can be manipulated by rampant production and flooding of the gold market… a nuclear option…) Then there’s the United States and Europe… trying to hold their fiat systems in place.

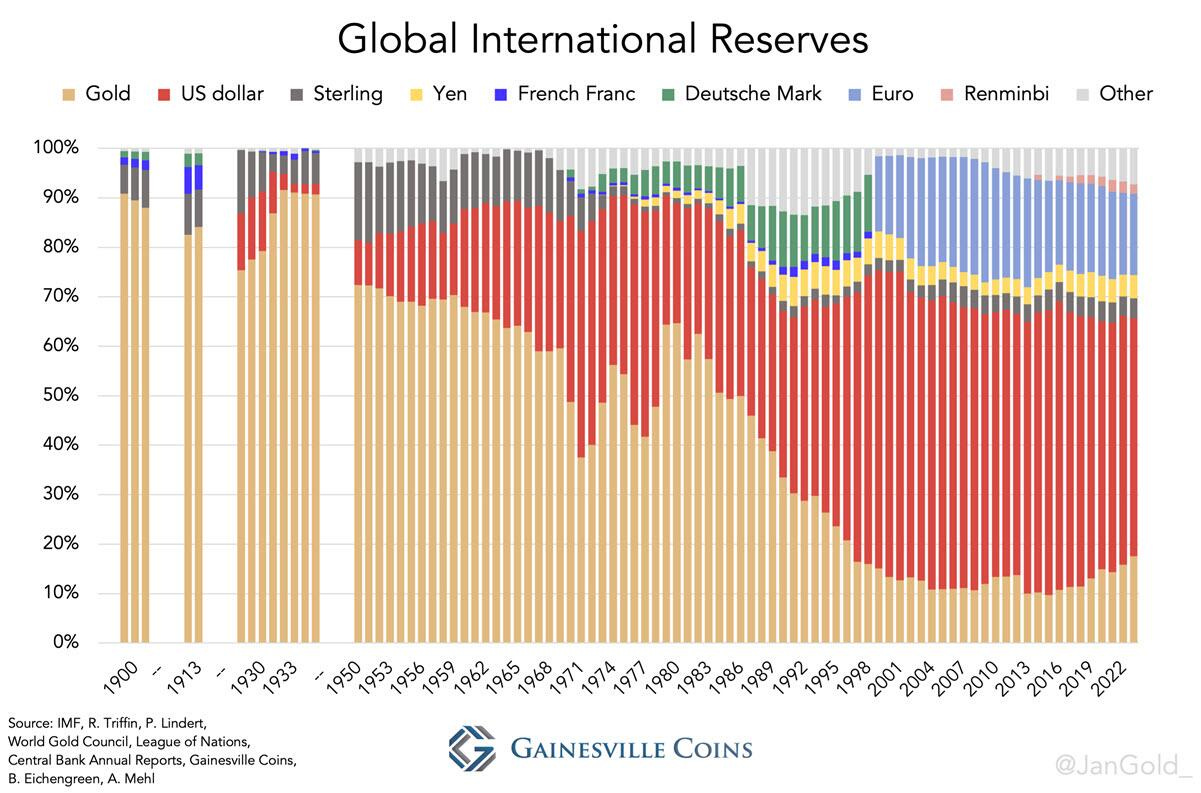

There’s a problem for Europe. Gold has now surpassed the Euro on the international reserve markets. As a share of global reserves, the blue area is stagnating, and the gold lines are rising. Gainesville Coins highlights the changes in dollar dominance.

I don’t know how else to explain this… but gold has 5,000 years of historical value…

The dollar is down 99% since its inception in 1913.

This battle will rage on, with global populations increasingly skeptical of dollar-denominated debt. I’m not predicting a dollar collapse tomorrow, but be very wary of how the U.S. defends the currency in trade.

China likely won’t win, and the currency will likely be devalued at some point. But this will be a race to hell, full of monetary inflation and roaring gold demand as a hedge.

Finally… A Market Update

The good news was bad news today… but the pressure

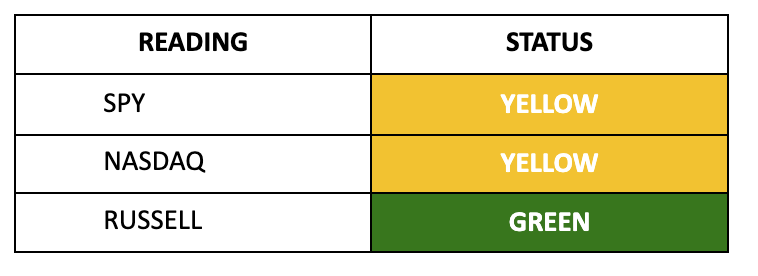

But this economy certainly has weaknesses, and housing remains under deep pressure. Nvidia (NVDA) is propping up the Nasdaq, while industrials and cyclicals represent the true weakening underbelly of this market and economy. I have four sectors in negative territory: materials, consumer, industrial, and tech. But Tech is being propped up by NVDA. We’re yellow and green and green and yellow… bouncing back and forth… But this is frothy as usual… an odd redux of 2021’s trading calendar.

The question is: “How are we Yellow?” Well, look at the low volume in the market. Look at the fact that 46% of stocks have peeled under their 50-day moving average. Look at the fact that as of 10:15 this morning…

2,444 stocks were advancing… but 6,110 were declining. On the S&P 500, the number of stocks down on the week (while down for the month) and up on the week (and up on the month) - a poor man’s clue on momentum - is 298 to 154. That’s a 2-to-1 ratio. The number of S&P 500 stocks down 5% (and down on the month) compared to up 5% (and up on the month) sits at 23-19 in favor of negative. That’s a sign of outflows.

And again… what’s propelling the S&P 500?

One stock.

Stay positive.

More By This Author:

The Week Ahead: What's Next

The June Watch List

Postcards: Five Things To Think About

Disclosure: None.