Positioning Yourself For An Oil And Natural Gas Rebound With Chesapeake

Introduction

The current oil and natural gas slump has decimated energy securities, some more than others, and have finally brought Chesapeake Energy (NYSE:CHK) down to a price where I am comfortable going long. I've said in the past that I will not be a buyer until CHK hits $4/share and now that they are trading around ~$4.60 (12/4/15), I feel it's time to place my bet. This article will explain my strategy for initiating a full position in CHK, rather than a detailed analysis of the company's fundamentals and outlook. However, below are the links to 4 of my favorite CHK articles If you would like to read the recent news regarding their financial health, performance, and outlook. These articles, along with my own conviction, are the reasons behind my long position. In addition to my strategy, I will also detail a second high risk/return trade that I am entering into with ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO). The articles are as follows:

- Chesapeake Energy Joined The Second Lien Club

- Chesapeake Energy's Double Leverage

- Chesapeake Energy Haunted By A Bad Deal, Bankruptcy Looms

- Chesapeake's Debt Exchange Offer Is A Brilliant Move For Equity Holders, Courtesy Of Carl

General Outlook for CHK

CHK is priced for failure, due to a potential liquidity crisis in 2016 and uncertainty around their debt restructuring, which provides us with a cheap entry point. I have no doubt that CHK has some tough times ahead and are rightfully considered as a high risk security, as they fight to gain control of their balance sheet. Therefore, I believe in order for me to realize an enticing risk adjusted return on a long position, 2 things will need to happen for CHK by the end of 2016.

- A modest sustained rebound of oil ($50-$60) and natural gas ($2.50-$3.00) starting sometime next year.

- A realized benefit from their relationship with Carl Icahn and from Carl's relationship with Cheniere (NYSEMKT:LNG).

CHK ranks as the 2nd largest natural gas producer in the L48 with a total production mix of roughly 71% NG, 16% Oil, and 13% NGLs across their acreage in the Utica, Marcellus, Haynesville, Anadarko Basin, Barnett, Eagle Ford, and the Powder River basin. In addition to their production and sizable acreage position, Carl Icahn holds a stake in both CHK and Cheniere so it's plausible that CHK will directly benefit from Cheniere's export terminals as a supplier of natural gas moving forward. Since global LNG/NG demand is expected to grow in the future, making a bet on a rebound with CHK provides enticing returns. If the two conditions above are satisfied within my time frame, then I have no doubt that CHK will outperform. However, I have no idea if my 2 requirements will come to fruition so I will need to add a level of protection to my investment.

My Strategy to Go Long

There are 3 levels of protection that I will need for CHK:

- Protection against today's price fluctuation.

- Protection against the next downturn price drop.

- Loss of investment in the case of a bankruptcy.

The first level of protection is primarily obtained by being patient. Oil and Natural Gas companies will typically see 3 hits to their share price which vary in magnitude:

- Initial shock to share price

- End of summer/travel seasons

- Write downs and impairments

Once these hits occur, I start putting in my limit orders, expecting them to be filled after Q3 results. Since Q3 results allow most analysts and investors to forecast end of year performance and Q1 results for the following year with reasonable accuracy, the market will likely price in the negatives and positives.

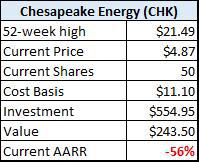

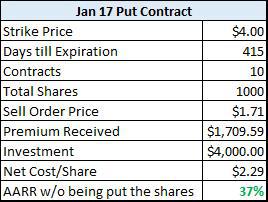

The second level of protection is going to be obtained by selling cash covered puts. My previous limit orders allow me to test the market with small positions, while the cash covered puts will serve as my method of acquiring a full position at a further discount to the market. A while ago I had a $11 limit order for 50 shares, since then CHK has continued to fall leading to my price target of $4. Now that CHK is trading at ~$4.60, I'm comfortable with tying up my money for 415 days (January 2017 $4 puts). I was not comfortable with tying up money at $11 but I also wasn't sure how much lower CHK could fall. Now that I know CHK has the potential to fall to $4 a share, I have to assume that CHK could fall again to $4 a share when we have another downturn in the future.

The last level of protection comes from capital management and hedging. CHK's leverage is roughly 2x and depends on commodity prices for revenue which equates to being a high risk security. If you are going to invest in high risk securities, then you would be wise not to allocate a large position of your portfolio's funds to that security. Given the price of CHK's shares, I can allocate $4,000 to acquire 1,000 shares and if they go bankrupt then, it's only $4,000 not $40,000 or $400,000. Upon being putted the shares, if the outlook of CHK has worsen and/or commodity prices show no sign of a modest rebound, we can hedge our position with a protective put or collar hedge. The selection of the hedging strategy will depend on the cost of each when we get putted the shares; I'll provide an update in the future if I decide to hedge.

My Actual CHK Order

By taking into consideration the risk with CHK, cost of an initial investment, and the length of time that my cash will need to be tied up, I am comfortable entering the trade as follows.

The returns are annualized and are calculated using 415 days for the case where we are not putted the shares and a full year for the case where we are putted the shares. Lastly, the full position annualized return is calculated assuming a rebound in oil and natural gas prices equates to a rebound in CHK's shares to $15/share. If the position works in my favor, I'll be able to secure a 283% annualized return. If I'm not putted the shares then I will still realize a 37% annualized return but if everything goes south then I will realize a -62% annualized return. Given the potential return on a relatively small upfront investment, the risk of a loss is bearable.

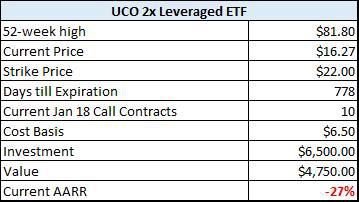

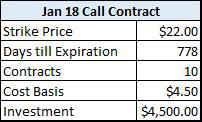

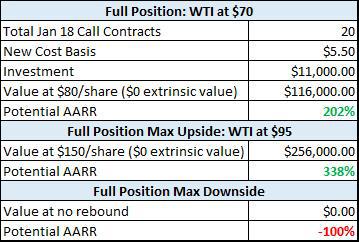

ProShares 2x ETF Trade

I was going to publish a second article over this trade but I just figured I'd include it with the article and save myself the extra work. A few weeks back, I begin researching a trade with ProShares 2x Leveraged ETF UCO while discussing the trade outcomes with another SA contributor, Michael Filloon, since we both plan on executing the trade. UCO seeks to double the daily performance of WTI, if WTI rises by 3%, then UCO rises by 6% and vice versa. Purchasing actual shares and holding leveraged ETF's for the long haul is great way to lose all your money, quick, if you bet the wrong way. However, UCO has options so we can still gain exposure without purchasing shares, rather we purchase call contracts. Since we don't know when oil is going to rebound, purchasing long dated calls is going to be our strategy, specifically 2018 calls. Regardless which side of the oil argument you are on, most people bet we will see +$70 oil before 2018 or at least BY 2018. That scenario would equate to about a 3-year bear market for oil. When WTI was trading at its high of ~$95 in 2014, UCO was trading at ~$195 while ProShares UltraShort Bloomberg Crude Oil -2x ETF (NYSEARCA:SCO) was trading around ~$25. Now that oil has plummeted to ~$40, UCO has fallen to ~$17 and SCO has surged to ~$107. We could opt to short SCO but 2018 put contracts are trading at ~$30/contract, which is just too much money to risk. On the other hand, 2018 call contracts on UCO are trading around ~$5, which allows us to take on this high risk bet with little upfront capital. To summarize, the reason we are looking at 2018 contracts and not 2016 or 2017 is because we have no idea when oil will rebound and I rather increase my time horizon, sacrificing the extrinsic value of the option, in order to increase the probability of benefiting from a rise in oil prices. If this trade works in our favor, the bulk of our gains are going to be intrinsic anyways. Second, we want to target a strike price as close as possible to today's current UCO price so we have the option of selling and benefiting from short term spikes in WTI and we are able to maximize our returns on a rebound. Lastly, buying calls on UCO is far cheaper than buying puts on SCO, which allows us to risk less capital and improve our risk/reward ratio. I was distracted when I bought my first 10 contracts of UCO and accidentally clicked "market order" rather than "limit order" so my first 10 contracts have a high cost basis but are still manageable. I plan on purchasing a total of 20 contracts on UCO by implementing the below strategy.

On a side note, you don't have to purchase calls with a $22 strike price. You could opt for the $19, $20, $21 or a mix of strike prices, I chose to keep it simple but there are other options available. Some of you may be wondering, why I selected the 2017 date for CHK and the 2018 date for UCO since both are bets on oil rebounding. The reasoning is because they have two different purposes, CHK is a company that I want to own shares in for cheap, while UCO are oil future contracts that I'm looking to trade; both tie up capital for different reasons. If I need to recoup a CHK loss, then I have an additional year to do so with my UCO contracts. On the contrary, if CHK rebounds before 2017 and I'm not putted the shares, then I want to still have the option of buying the shares before a significant run up which I wouldn't have if my money was tied up until 2018.

Conclusion

These are high risk/return bets on a rebound in oil and natural gas prices and the market can remain irrational longer than you can remain solvent. Therefore, do not enter these trades if you are not in the position to realize a complete loss of your capital or you can't handle the day to day swings because the volatility will be large. However, if you can stomach the risks and are wanting to place a bet on a rebound in oil and natural gas prices, then these two trades will position you to do so. Once I am putted the CHK shares, I have no intentions of selling CHK for a short term profit, unless there is a good reason to. Feel free to ask me any questions and I'll do my best to answer them. I am always open to learn from others so if you have a better strategy or a suggestion that improves upon my strategy, then please post your ideas; I look forward to your comments.

Disclosure: I am/we are long CHK, UCO.