Plunge Bath

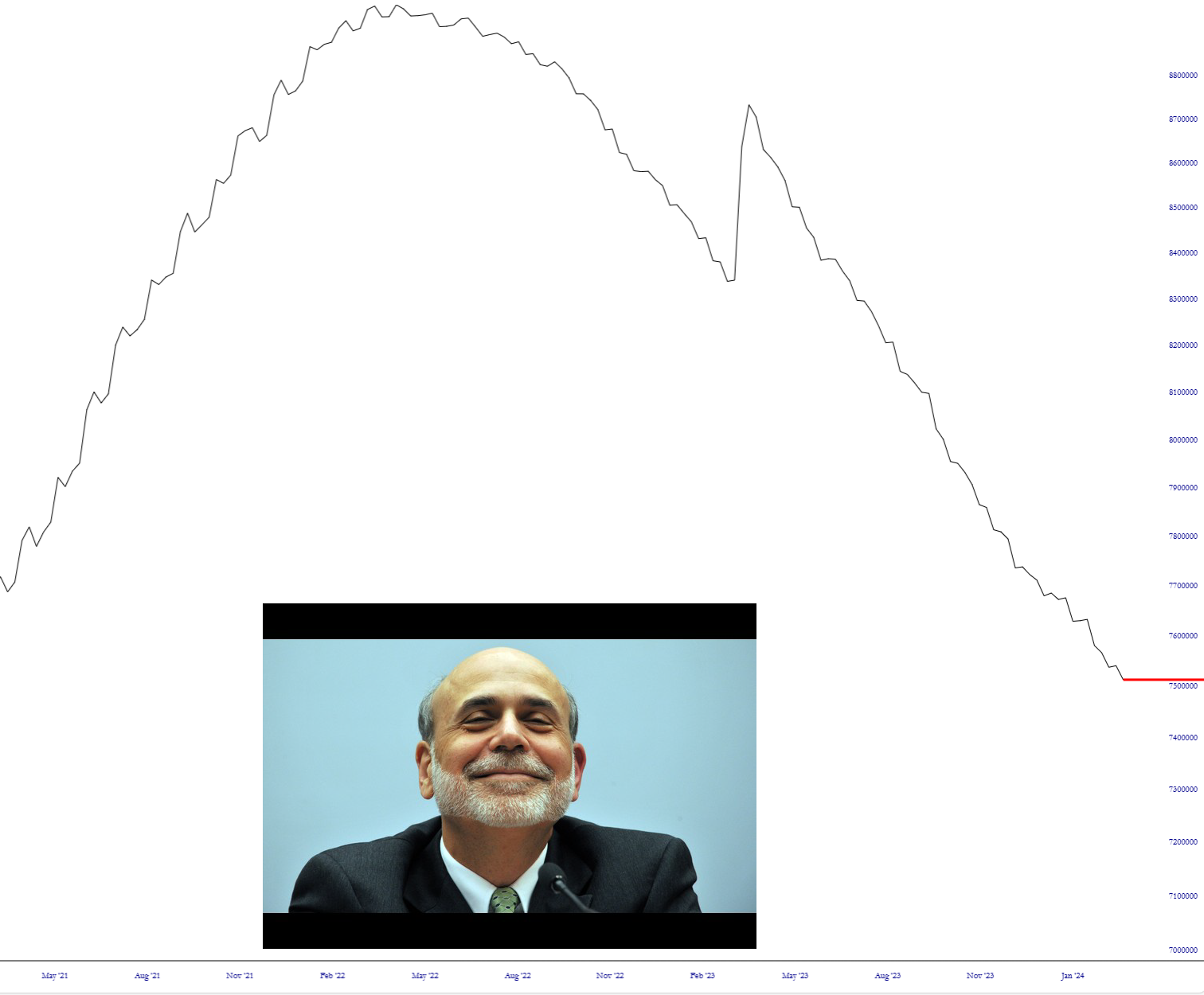

The data from the Fed is getting mildly interesting again. The Quantitative Tightening is still trucking right along. There are still trillions left, but the bump a year ago notwithstanding, the Fed has actually kept their word on burning off these assets.

(Click on image to enlarge)

The Reverse Repo is in an absolutely free-fall. I’ve read about the effects of this in countless articles, but honestly, I still don’t get it. Fed “plumbing” has become incredibly complex and, evidently, matters way more to stocks than some quaint notions as revenues and profits.

(Click on image to enlarge)

As for BTFP, Yellen’s scheme that started over a year ago and has shuttered on schedule, it is falling for the first time in its history. I suppose the reason is that the healthier banks are starting to pay the funds back.

(Click on image to enlarge)

More By This Author:

MSTR Island ReversalRevisiting Utilities

Home Depot: Soaring To New Heights

I tilt to the bearish side. Slope of Hope is not, and has never been, a provider of investment advice. So I take absolutely no responsibility for the losses – – or any credit ...

more