Permafrost And Inflation

Long-time readers know how fond I am of metaphors and analogies. I have one to offer today, and it has to do with permafrost.

According to the articles I’ve read, there is far more carbon stored in the permafrost of Earth than what is already in the atmosphere. In other words, if the permafrost begins to melt, a staggering amount of carbon gets released in the atmosphere, which speeds up the process of global warming. Thus, trillions of tons of carbon exist, but they are safely stowed away in the permafrost -- unless it melts.

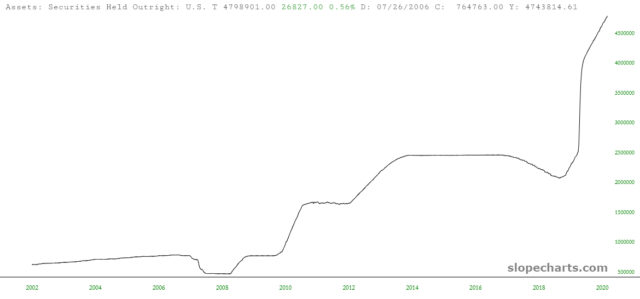

I think it’s exactly the same way with inflation. Because the Fed isn’t hiding the fact it has released trillions and trillions of dollars of new money into the economic system.

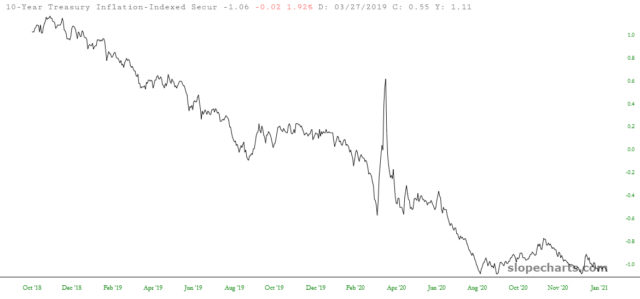

Yet the inflation index not only isn’t budging, but it has also been withering away for years.

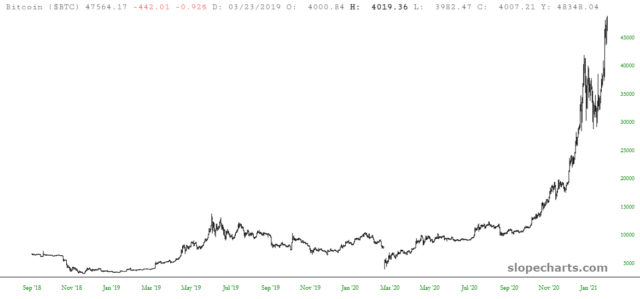

So where’s the inflation? Why isn’t the general public facing a yearly inflation rate of 15%? You already know the answer: assets. They are the metaphorical permafrost housing all of those trillions. There’s inflation, all right. In places like Bitcoin (BITCOMP).

And, of course, the hyper-inflated equity markets:

So what happens when:

- For whatever reason, crypto owners start selling their coins for dollars;

- Stock holders start selling the shares for dollars;

- Or parents start leaving their millions to their children via inheritance?

My view is that all those dollars – trillions of them – are going to go into the real economy, inflation will start to take hold, and rising prices will simply spur on the buying. And that melting metaphorical permafrost – and the trillions of dollars that are released – is going to cause an inflation that the Fed will never, ever wish it had solicited.

Disclaimer: Please read the disclaimer here.

Deflation is taking place faster than inflation. Did you read Jeff Booth's book "The Price of Tomorrow" yet? Check it out.