People Are What Matters, Actually

Yes, Everything is Falling Apart, Mostly

It seems more and more that everything is a balancing act, existing in the tail end of extremes, and the slightest touch can tip the whole scale. There is a lot going on! People will often describe markets as dominoes - one thing falls, and everything else goes down with it. Like, this guy is the economy!

the economy

So, what exactly is going on with (i am gesturing broadly at literally everything) all of this?

There are many different frameworks to examine the economy through but for this article, I want to examine it through the context of People which is sort of the core driver behind policy decisions.

-

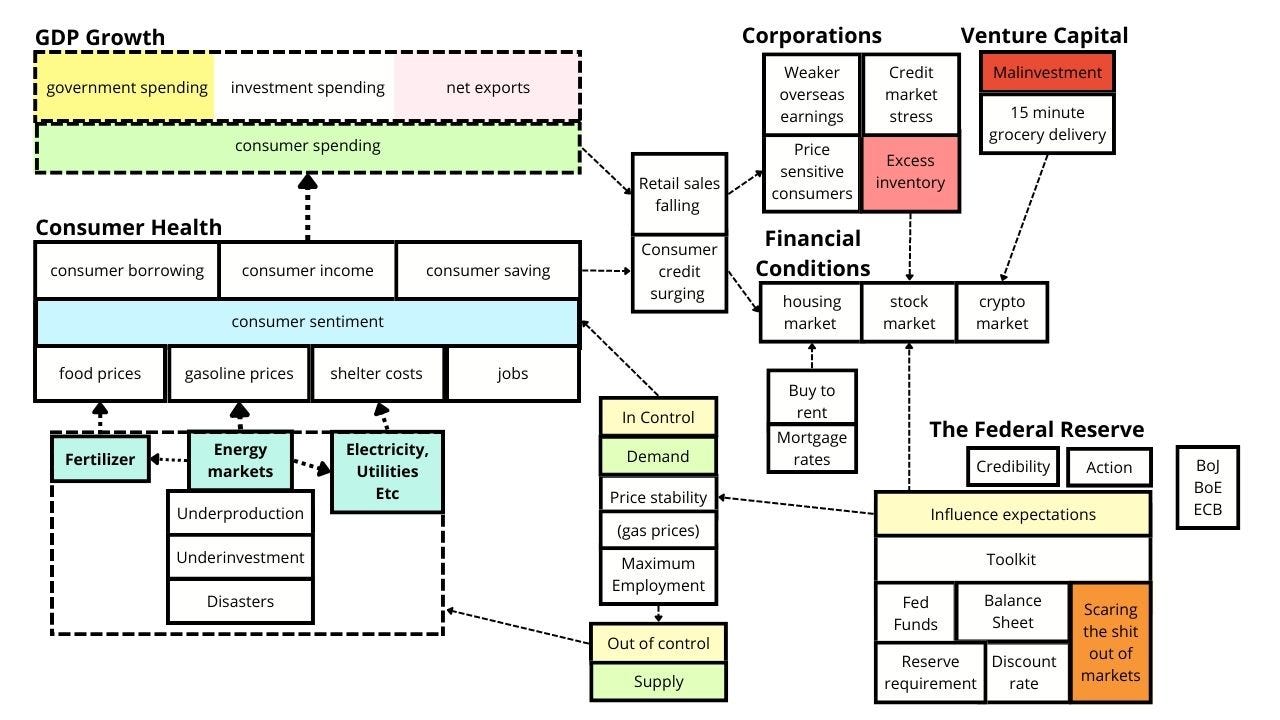

People fuel the following matrix - GDP growth, consumer health, corporations, financial conditions, and the Federal Reserve.

GDP Growth

Basically, the economy looks isn’t doing super hot. Elements are cooling (which is what the Fed wants) but it’s kinda like the balancing scale - some things are okay, but other things are very not okay. Consumer spending is wobbling, which is a big driver of the growth.

-

GDP Contraction: Many people seem to think that a recession is looming, with the GDPNow forecast coming in at 0% (which would imply a technical recession, considering we did get a negative GDP print last quarter). '

-

The Fed sort of hinted at a Recession coming (or at least implied it in their forecasts) so it seems like this is really an increasing probability.

-

-

Most importantly, people are not feeling good. Consumer sentiment is low. There are a lot of worries about what is Next. Recessions are scary.

Source: PiQ

-

And that impacts how people spend: Consumer sentiment is the core driver of GDP growth - because sentiment is the core driver of consumer spending.

-

Consumer spending is a function of (1) borrowing (and indeed consumers are borrowing as shown by credit card data), (2) income (which has increased, but not at the pace of inflation), and (3) savings (a strong stockpile generated during COVID that is rapidly depleting).

-

As BofA writes in their Consumer Checkpoint:

Total credit and debit card spending remains well above 2019 levels, though has been easing lower very recently

-

That has shown up in retail sales (which are still above trend, but rapidly weakening) - spending is rotating more into things like food, gasoline, rent and away from items like automobiles.

-

There are a lot of forces at work here - a rotation to services spending, frustration with shortages, and avoiding things that have become too expensive.

But it’s a flashing red bell for how people are feeling. Consumer sentiment is LOW (semi-relatedly, market sentiment literally could not get any worse) - that drives spending. When the consumer spending domino topples, LOTS of things topple.

Consumer Health

Consumer spending is ~70% of all GDP growth, so policy is largely incentivized to keep people spending. Consumer sentiment is formed from a lot of different things, but the core formations in this current market seem to be:

-

Food prices

-

Gasoline prices

-

Shelter costs (home prices, rent, utilities)

-

Jobs

Right now, 3 of those 4 things are really wobbly. Food costs are really high (because of supply chain woes, fertilizer prices, etc), gasoline prices are really high (because oil prices are high, refining capacity is restricted for a myriad of reasons), and electricity and utility costs are high too. So people are struggling right now.

-

Food is expensive.

-

Gas is expensive (and U.S. is a car culture!).

-

And rent is skyrocketing.

So of course consumer sentiment is going to be low - things seem not very good! The only bright spot is the labor market - unemployment is low, jobs are being added, but it’s beginning to look bumpy. There have been a series of layoffs in the tech and crypto world, and of course, monetary policy is going to influence this even more.

Key point: Fed policy gets all of its traction over employment and inflation *through* financial conditions.

— Skanda Amarnath ( Neoliberal Sellout ) (@IrvingSwisher) June 9, 2022

And gets most of its relatively reliable traction over consumer price inflation *through* the labor market (hard to affect household demand for consumption otherwise) https://t.co/2FGeRFRQ92

-

The Fed has two levers - the labor market and financial conditions.

-

Forcing people out of work (which tightening financial conditions will do) *will* reduce inflation

-

So as the Fed tries to reduce inflation there is going to be some pain in employment metrics - making 4 out of those 4 things driving consumer sentiment wobbly.

-

But people are feeling bad - and that enough could drive us into a Recession. Expectations are everything. And the Fed knows that.

Gasoline Prices

Gas prices are really high, which makes people feel bad because all the sudden, a lot more money goes towards keeping their car on the road. Gas prices are clearly part of the Fed’s dual mandate at this point - but they have very little control over it.

Part of the driver behind gas prices -

-

Lack of supply: Part of the problem here is U.S. refineries shutting down (Laura has a great thread here) - sometimes because they don’t have a buyer, from natural disasters, conversion to biofuel production and not crude, etc.

-

Lack of money: Investors are “practicing capital discipline” - as Eric Mandelblatt described, an element of it is policy uncertainty (what are carbon taxes going to do? ESG?) and there is an incentive for shareholders to not want fossil fuel supply to grow (even though we really need it).

something that i'm increasingly realizing people aren't thinking is:

— Alex Williams (veb) (@vebaccount) June 17, 2022

everyone is mad abt gas prices bc they feel poorer ->

Fed plans to "align supply and demand" ->

in order to make people feel better about feeling poorer, we're going to make them poorer ("reduce demand")

We have an energy crisis.

-

And energy goes into everything - food, shelter, electricity, etc.

-

This is a fiscal policy decision - as many have pointed out, the Fed can’t raise rates and make more oil come out of the ground.

-

They can only try to normalize supply and demand. Make people buy less gasoline, but that breaks down the whole economy because it ruins consumer sentiment.

-

The Biden administration needs to do more. Accusing the industry of price gouging isn’t going to make more oil come out of the ground. Taxing them more isn’t going to expand refining capacity.

EVERY time I hear interviews with people about inflation they mention food and gas. the Admin and especially Congress are the ONLY policymakers who could address that problem. Jay can't print oil or wheat. I wish he could but he can't.

— Claudia Sahm (@Claudia_Sahm) June 16, 2022

ExxonMobil wrote a pretty powerful statement to President Biden asking for clear policy, infrastructure support, and waivers of things like Jones Act provisions so they can produce more oil.

Corporations

Consumers (people?) influence corporations too - through a lot of different avenues, including… spending. Retail sales have contracted, as people decide that the new car is indeed not worth it right now, and as mentioned earlier, consumer credit is surging. Corporations are sort of hurting right now too!

-

The U.S. Dollar: The dollar has gotten stronger because it’s a safe haven asset during times of uncertainty (ahem, right now)

-

So if a company has operations overseas (a lot of them during this time of globalization) they are going to suffer from the exchange rate conversion - a stronger dollar hurts exports.

-

-

Price sensitivity: Consumers are becoming more sensitive, so companies aren’t able to pass costs off as easily hurting their margins.

-

Credit Markets: There is credit market stress for a lot of companies - meaning people are like ‘well, hm, maybe they won’t be able to pay back this debt actually” which results in widening spreads and general worry. Junk-bond spreads are over 500 bps - which is NOT good.

-

As a note, corporate credit stress could deter the Fed’s path forward. If the bond market is blowing out, they sort of have to step in and fix that.

-

-

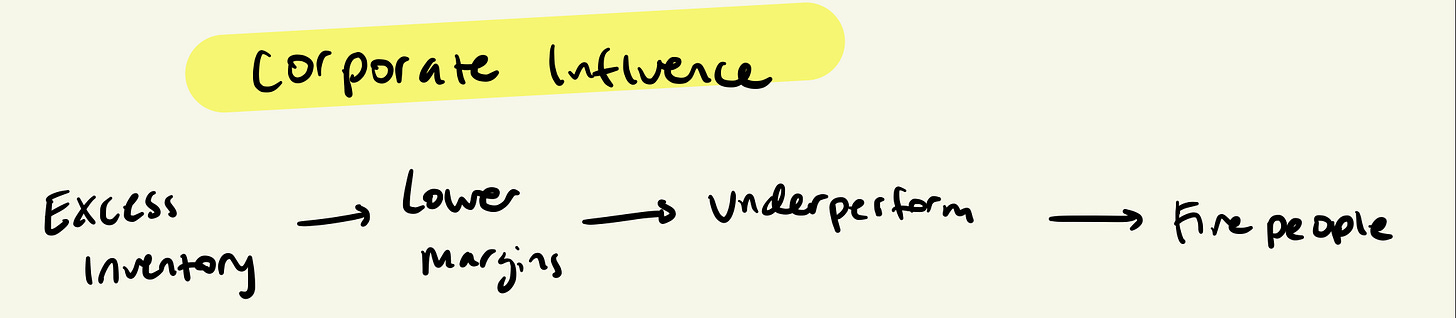

Deflation with too much stuff: Companies also have excess inventory! Which is largely deflationary, but bites into profits, etc. And you might say, “wonderful! i wish all corporations a slow, burning death” but corporations employ people! So if all the sudden their profits contract, so do the jobs they have.

-

This circles back to consumer sentiment - jobs. So everything is intertwined and if one domino tips, the whole line topples down.

-

Financial Conditions

Financial conditions are the main dominoes that the Fed ends up influencing (not oil production) - assets and markets and other things - and the focus is really:

-

Stock market (people feeling less spendy because their gains have disappeared)

-

Housing market (mortgage rates making it hard to buy a house)

-

Crypto market (with 3AC and Celsius becoming insolvent, there is a lot of pain there as dominoes tip).

The Housing Market

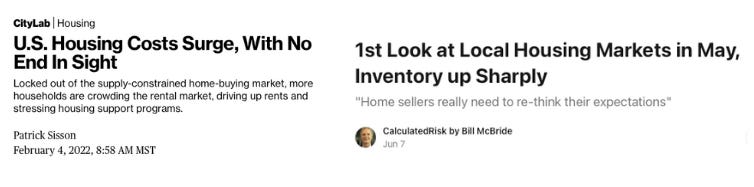

As I wrote about in my Recession piece, a lot of younger people think that we need a total market reset so they can get access to a home - and Powell himself even said a recalibration was necessary! There are few things that are going on with the housing market - and it of course boils down to supply and demand.

-

Supply: there isn’t enough of it!

-

Investors (private equity) buying up a significant amount of real estate

-

Different zoning policies or obstructions to construction making it more difficult to build homes

-

Or, homes sitting idly by waiting to be finished

-

-

-

Demand: there was too much of it (not anymore!)

-

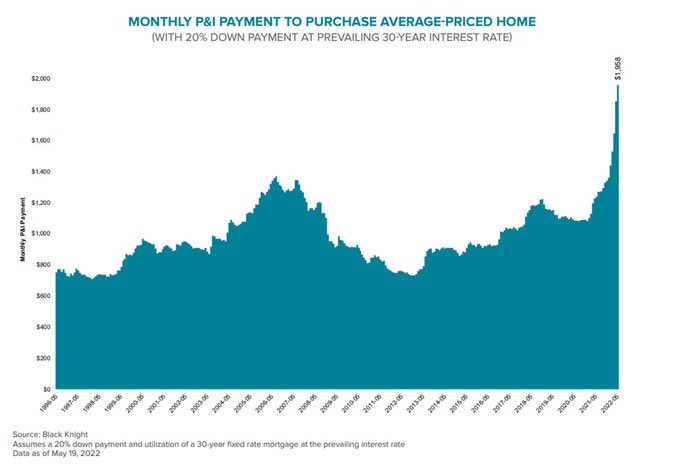

Mortgage rates pricing new home buyers our of the market (while previously allowing them in) and the aging of Millennials has them ready to Own

-

Louis Barnes from Cherry Creek Mortgage wrote:

The same physics govern housing collisions with mortgages. At the new year mortgages were still ~3%. In February, 4%. At the end of March, 5%. May, 5.5%... Now it’s time for Wile E. Coyote in his Acme sneakers, running off into thin air and all okay until he looks down.

It really is Wile E. Coyote time. We have been running so fast for so long, on so many things - the housing market, the stock market, the crypto market, etc - that the ground has essentially disappeared from beneath us. Just look at the headlines over the past few months.

-

Borrowing costs: The main lever that has changed is mortgage rates - it’s become way more expensive to own a home. As Redfin writes “a 30-year fixed-rate mortgage is looking at a monthly payment of $2,514, up from $1,692 a year ago” That is a big yikes!

Source: Nick Timiraos

So we are starting to see those supply and demand mechanics ‘normalize’.

-

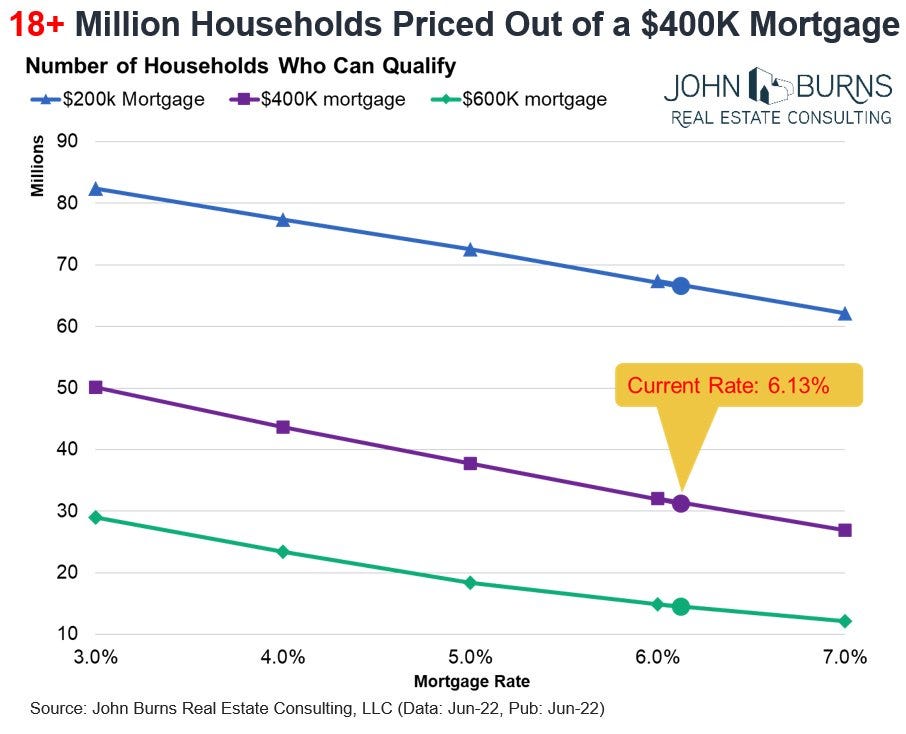

With rates north of 6%, that prices over 18 million people out of the housing market (demand destruction, hello) and this was *before* the 75 bps hike.

-

The force of the move in mortgage rates is enough to knock anyone of the market - if you spend time *thinking* about buying, you might not be able to afford to buy by the time you’ve made a choice!

Source: Eric Finnigan

-

Pressure on the rental market: Of course, the flip side of 18 million people not being able to own a home is that they have to go rent, which tips the balancing scale of the rental market, pushing those prices up.

-

And in the housing market, that 18-million person gap results in available inventory of homes ticking up 5% in a week.

-

-

Fast and Furious Fed: This is going to get worse because the Fed is not planning on pulling back on raising rates anytime soon (which nudges mortgage rates up). This is the ‘tightening of financial conditions’.

-

No bid on MBS: Also, the market does not want to touch mortgage backed securities - it’s just not attractive to the market, so that is going to have to push mortgage rates up *even more* to get buyers in there.

i have never since 2005 seen a worse setup for new-issue MBS thats guaranteed (so no credit risk, just the risk of prepayment). dealers so full of inventory, carry on it impaired and dwindling, end-users with 24wk of consecutive outflows so not buyers, AML not interested at all.

— NRI Inc (@NewRiverInvest) June 15, 2022

But the supply and demand issues that I outlined earlier still exist. As Conor wrote - “While higher mortgage rates and less panic buying might help relieve imbalances in the short term, it’s doing nothing to address the longer-term need for more homes”

Ryan in Buffalo wrote a really good thread on his apartment - stating that

It would be illegal to build this in 99% of urbanized land in the US today, including my own neighborhood. Setbacks, parking mins, floor-area-ratios, height limits, single-family zoning, and “incompatible use” restrictions have made buildings like this a 19th century relic

One thing that we seem to continuously do is tunnelhole ourselves into a policy mess. You see it with energy, housing, everything - by trying to fix things, we only make it worse.

We banned the houses that fight inflation pic.twitter.com/cuM8VawydA

— Phil Ritz NYC (@philritz1) June 15, 2022

And policy never covers what it should - like, should Blackstone be buying up homes and turning them into rental properties? No! Probably not. But that’s what they are doing, and that’s their special way to hedge against inflation. Good for them I guess.

Energy and housing are the same. We need more of it. Sustainably. Stemming demand in the short term is not a solution to a systemic long-term issue of 1) not enough available housing and 2) not enough energy production.

The Federal Reserve

And the Fed can’t do anything about this.

They exist to influence expectations. That is the most important thing to know about them. That’s why they came out swinging with 75bps - because they were losing control of the narrative.

Source: Skanda

They have their toolkit that helps them do this but the goal is really to scare the shit out of markets. They do this through a few ways -

#Fed has three key policy tools: forward guidance, rates and balance sheet.

— Gregory Daco (@GregDaco) June 14, 2022

Initially, it relied on forward guidance, now is aggressively raising rate, and will start shrinking its balance sheet. The combo of these tools is more powerful than any one alone ⤵️ https://t.co/iOFq6psXb4

-

Fed Funds rate: This is what people are talking abaout when they say the fed “raises rates” - the Fed nudges around the fed funds, which influences all the other rates in the economy including mortgages, auto loans, etc.

-

When rates go up that means everyone is like “it’s going to be sO expensive for you to get a loan” which works to make the economy slow down.

-

-

Balance sheet: They are now engaging in QUANTITATIVE TIGHTENING which provides less support to the market because they are engaging the fed vacuum versus the fed money printer

-

Reserve requirement and discount rate: They also have other things that basically encourage banks to not lend out and that also causes the economy to slow down because less money is sloshing around

The most important thing - they have to have a balance between credibility and action. Right now, the market believes them. They’ve been managing expectations really well and haven’t done a whole lot of actually contractionary policy - they’ve just been saying stuff. But now, their credibility is at risk because everyone is like “Fed, you’re kind of behind here…” which explains the 75 bps move (which ironically might hurt their credibility down the line).

-

They have a hard job.

-

And they have enabled some elements of excess, like the malinvestment that we see from vc firms. Investing in 15 minute grocery delivery as the world faces a food shortage is… not great.

But that’s how this market seems to operate. Everything is bifurcated, everything is one tail end or the other, and the knowledge that there is polarization is the only common ground there seems to be.

The Vibeset Shift

The Fed manages expectations, but I do think expectations are going to have to shift.

The OECD came out with their Economic Outlook paper for 2022, banging a trash can lid, and said ‘hey everyone, the world economy is probably going to collapse’. Their three main points were

-

The war is slowing the recovery

-

Inflationary pressures have intensified

-

The cost of living crisis will cause hardship and risk famine

Quite the haircuts to global GDP growth estimates this year (economists' consensus estimates) … world in blue; U.S. in orange; Eurozone in white; China in purple pic.twitter.com/Vvs6D8aAPt

— Liz Ann Sonders (@LizAnnSonders) June 17, 2022

So yes. All of this is true. Energy markets are mess from Russia, from lack of refining capacity, from the desire of Europe to transition to green before they are really ready to do so - so it’s a lot of factors that are putting pressure on what the Fed does.

-

Soft landing? The Fed has some pretty wild expectations for what they can achieve in this tightening cycle. Their forecast for unemployment and GDP hint that they expect some sort of slowdown to come, but not a Recession. However, it will be really difficult to do what they seem to want to do without causing an element of economic hardship.

-

Fed narrative: The Fed can only nudge nudge things. They are having to politicize an element of what they do because inflation is really, really painful. That isn’t the best thing for them to do because the market might stop believing the Fed has any power at all, ruining their credibility + expectations tool.

Jerome Powell even said in the meeting that they don’t want people to lose jobs, but like it’s kind of par for the course. The NY Fed is predicting a 10% chance of a soft landing and 80% chance of a hard landing - an element of pain is going to have to happen. Other central banks are sort of joining the party too -

-

(not them) The BoJ is remaining on their loose monetary policy path which like ? who knows what is going to happen to the Yen and also the U.S. Treasury market

-

But really the ECB! They’ve had years of easy monetary policy, and hinted that they would be tightening in July. Almost immediately, Italian bonds blew out (this is very bad). Europe has a significant amount of inflation - but the market is demanding more easing - which is a big challenge.

And finally, everyone is just kind of guessing. That’s what monetary policy is. Vibes. As Neel Kashkari, president of the Minneapolis Fed wrote -

I know of no theoretical framework that can tell us how much we will need to tighten long real rates to get inflation back to target in a reasonable time frame.

A lot of people mistake bull runs for brilliance - when it’s really just “the credit cycle at their back” as Jim Chanos describes on Odd Lots. Also, we’ve gotten really used to Good things. Our expectations are pretty high! Which is good, but I mean, even the mere concept of 15 minute grocery delivery is a luxury. As Sarah O’Connor wrote -

Unprofitable “on-demand” services like someone bringing a coke to your door gave people a sense of affluence in a decade of stagnant wage growth. But they were subsidised by investors, and now the money is drying up

Americans are used to the economy working a certain way — excess capacity, easy to get more labor or send production abroad, high-value activity concentrates in a small number of places — and a lot of our uncertainties and frustrations stem from that not being the case now.

— Conor Sen (@conorsen) June 5, 2022

We have expectations. And those might have to shift.

But we can build to align our expectations to reality. But we aren’t doing that right now. Like the high speed Roomba train. What even is that? So many of our solutions are simple in nature, but we don’t want these more simple frameworks as Alan Cole wrote 1) because our infrastructure building process is bloated with regulation and 2) action is often lost in the bureaucratic sinkhole that is our government.

-

We need broader policy action. The Fed cannot fix this. Skanda and EmployAmerica are carrying policy on their back and have a lot of really practical solutions that the administration can implement.

-

Also good legislation has been passed this year - so it is possible!!

I think we often forget that the economy is really a bunch of people peopling around and trying to make sense of this world. So it’s going to be silly and dumb because people are silly and dumb.

I don’t know. I think it’s frustrating and it’s also okay to *be* frustrated. That’s part of where action comes from. And just like the Fed, we have to take action to maintain our credibility (something I need to work on more). The bifurcation of society shows that we care at least - but how do we harness these emotions into something productive for our collective future? That’s the eternal question.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more