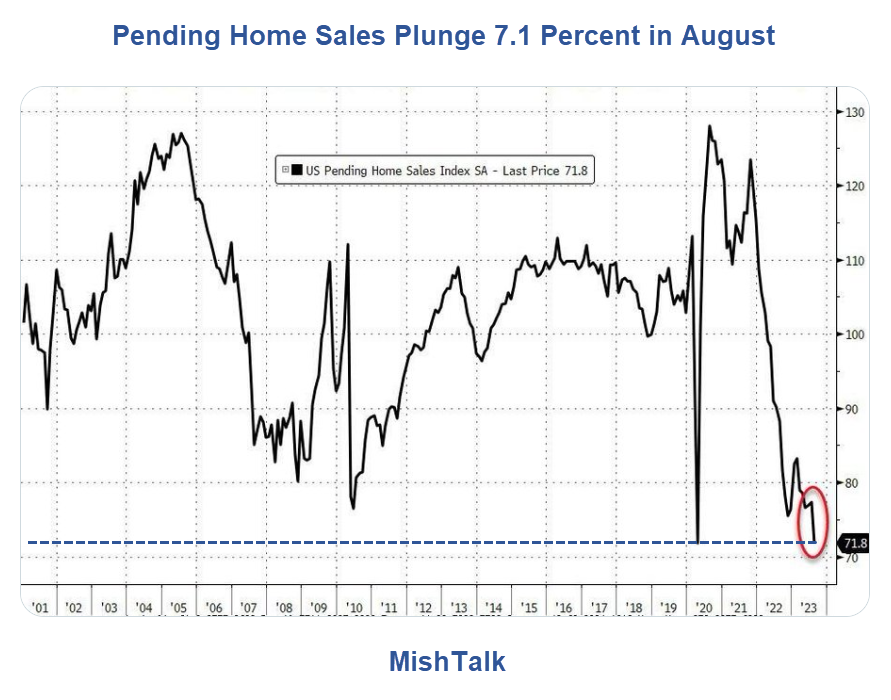

Pending Home Sales Plunge 7.1 Percent Tying The Covid Record Low

The NAR is in panic mode as pending home sales dip to a record low dating to 2000.

(Click on image to enlarge)

Pending Home Sales Image via Tweet listed below,

Pending home sales represent contracts signed but not yet closed. It’s an estimate of future existing homes sales reports.

Pending home sales slid 7.1% in August.

— National Association of REALTORS® (@nardotrealtor) September 28, 2023

“Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers,” Lawrence Yun, NAR chief economist. https://t.co/n6ln5kjnHo

Record Low

Pending home sales fell by 7.1% in August, significantly higher than expectations of 1.0%.

— The Kobeissi Letter (@KobeissiLetter) September 28, 2023

This was the biggest monthly decline since September 2022.

Now, pending home sales are down 18.8% over the last year all while existing home sales are at their lowest since 2010.

The… pic.twitter.com/TyYAy6Z6GP

Pending home sales fell by 7.1% in August, significantly higher than expectations of 1.0%. This was the biggest monthly decline since September 2022. Now, pending home sales are down 18.8% over the last year all while existing home sales are at their lowest since 2010.

The Pending Home Sales Index is now at its lowest level on record, exactly equal to the pandemic lows. We now have new, existing, and pending home sales in free fall. There simply is no supply.

NAR in Panic Mode

Mortgage News Daily reports NAR Calls for End to Rate Hikes as Pending Sales Drops Again

NAR Chief Economist Lawrence Yun: “The Federal Reserve must consider the sharply decelerating rent growth in its consideration of future monetary policy. There is no need to raise interest rates. Moreover, the government shutdown will disrupt some home sales in the short run due to the lack of flood insurance or delays in government-backed mortgage issuance.”

On Track for 8 Percent Mortgages

Pending home sales fell by 7.1% in August, significantly higher than expectations of 1.0%.

— The Kobeissi Letter (@KobeissiLetter) September 28, 2023

This was the biggest monthly decline since September 2022.

Now, pending home sales are down 18.8% over the last year all while existing home sales are at their lowest since 2010.

The… pic.twitter.com/TyYAy6Z6GP

New Home Sales Sink 8.7 Percent

(Click on image to enlarge)

New home sales from census department, chart by Mish

New home sales are about where they were in 1963.

For discussion, please see New Home Sales Sink 8.7 Percent in August.

Existing-Home Sales Decline 17 of Last 19 Months

(Click on image to enlarge)

Existing-home sales slipped again in August as rising mortgage rates make housing prices the least affordable ever. Despite denials in many corners, a crash is underway.

Yes, This is a Crash

- Existing-home sales are down 35.8 percent in 2.5 years.

- Existing home sales are back to a level seen in the mid 1970s.

- If there is a decline next month, an that is highly likely, existing-home sales will drop to a 12-year low.

Real estate tooters keep telling me there is no crash.

What the heck are the above stats? Chopped liver? An egg salad sandwich?

Prices have not crashed but transactions have. Crashes are rare, but we are in one now, from a transaction perspective.

For discussion, please see Existing-Home Sales Decline 17 of Last 19 Months – Yes, This is a Crash

Bidenomics Explained

Bidenomics In a Nutshell

— Mike "Mish" Shedlock (@MishGEA) September 28, 2023

1: Hand out free money via unwarranted subsidies to ease the pain of stupid regulations

2: Stoke massive inflation in the process

3: Brag that it is working.https://t.co/Fn5hxUlUln https://t.co/TsmuNV6HBQ

“New data released this morning provide more evidence that Bidenomics is working.“

Yeah right. Tell me about it.

1: Hand out free money via unwarranted subsidies to ease the pain of stupid regulations 2: Stoke massive inflation in the process 3: Brag that it is working.

More By This Author:

GDPplus Big Positive Revisions Decrease Likelihood A Recession HappenedBEA Revises Spending Lower, Income Higher, With GDP Unchanged For 2023 Q2

Oil Price Tops Highest Level Since Summer Of 2022, What About The SPR?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more