Palladium On Path To Bearish Correction? Silver Outlook Bullish

PALLADIUM ON EDGE OF BEARISH CORRECTION?

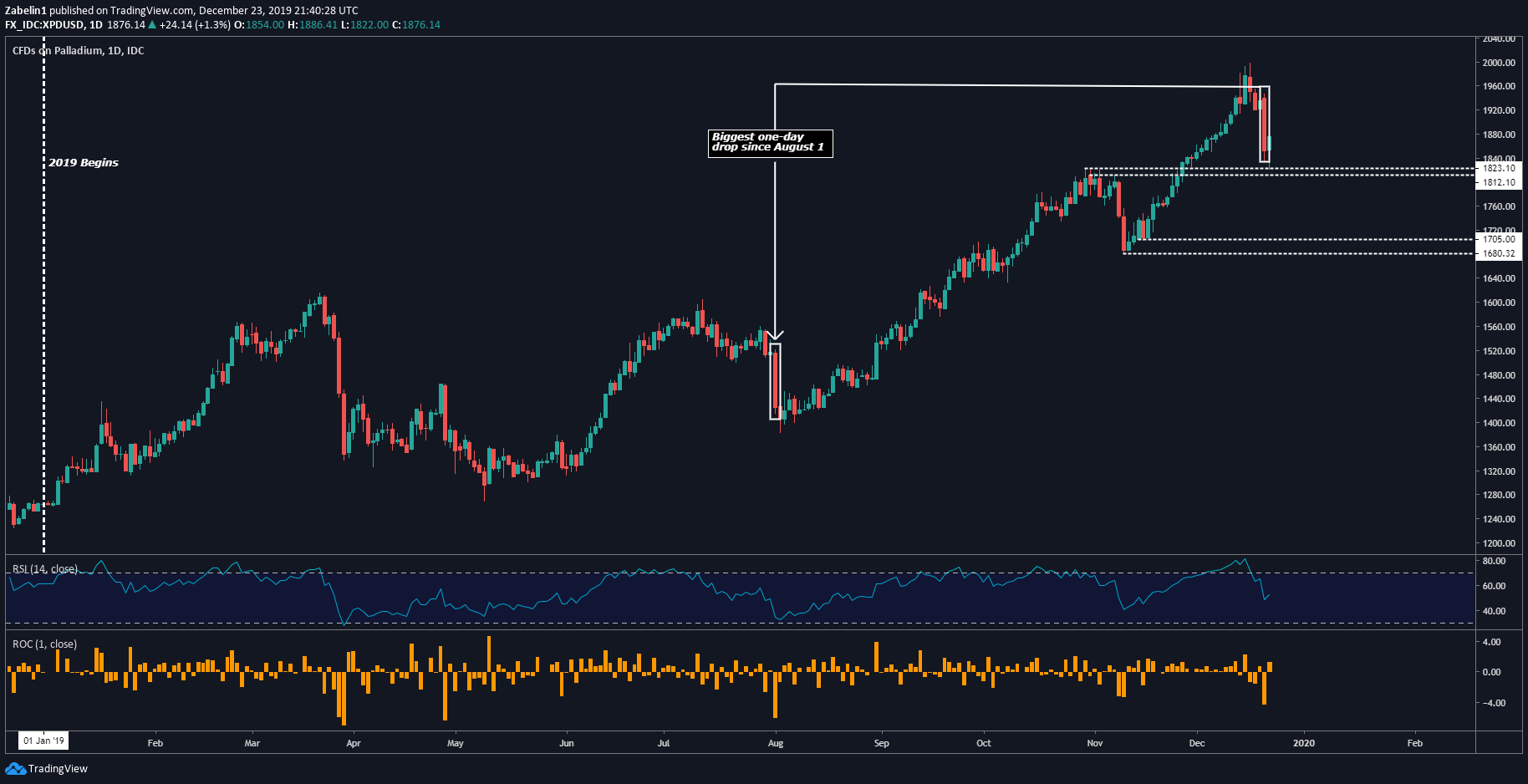

Year-to-date, Palladium has rallied over 46 percent and briefly topped $2,000/oz, the highest on record for XPD/USD. Shortly after reaching the milestone, Palladium fell over seven percent and experienced its biggest one-day drop since August 1. XPD/USD is now testing a familiar resistance-now-turned support between 1823.10 and 1812.10.

XPD/USD – Daily Chart

(Click on image to enlarge)

XPD/USD chart created using TradingView

A break below that range with follow-through could catalyze a selloff until the precious metal hits a multi-layered support area between 1680.32-1705.00. Heading in Q1, XPD/USD may attempt to re-test the $2,000/oz landmark if favorable fundamental factors continue to support upside momentum.

SILVER PRICE OUTLOOK

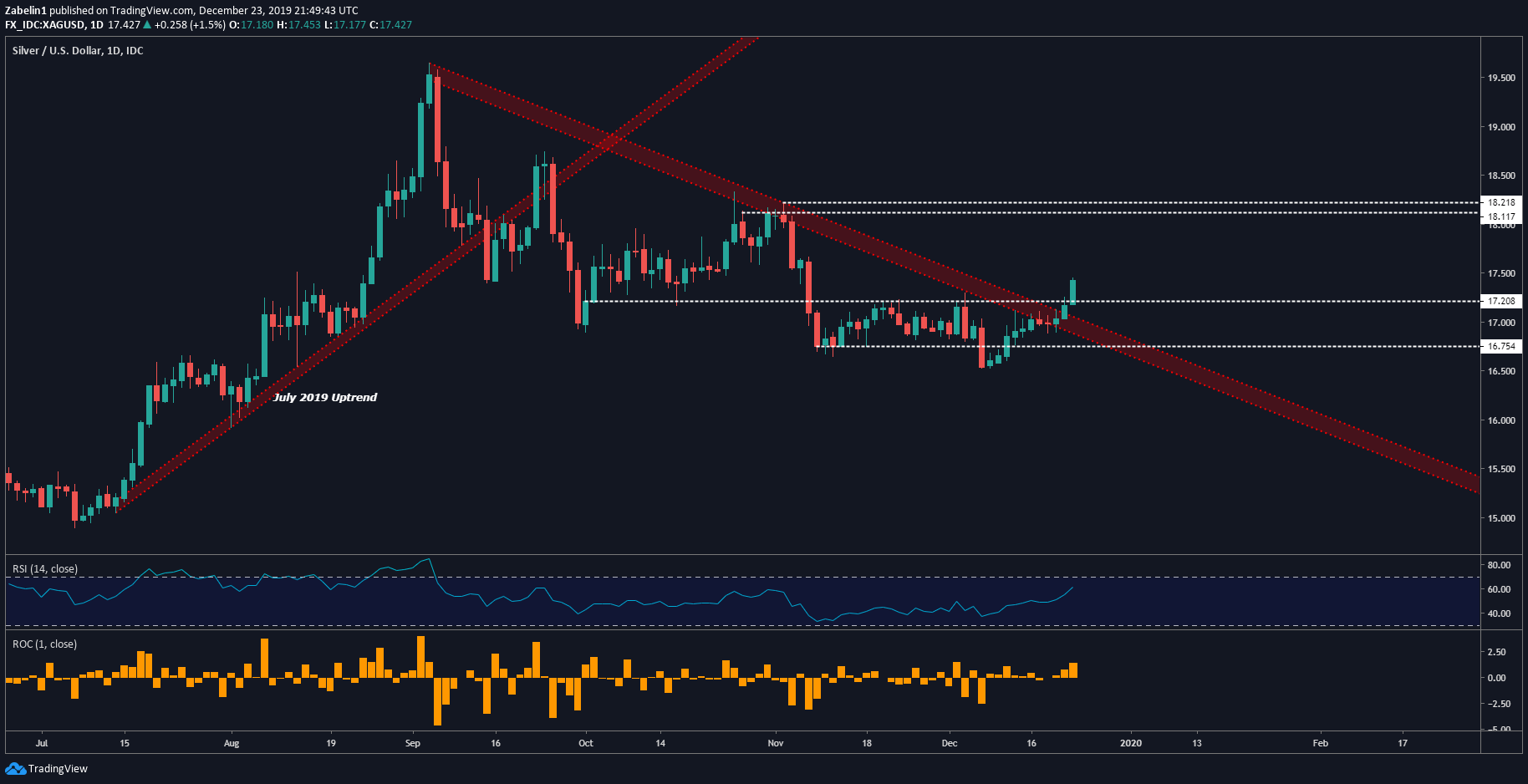

Silver prices have broken above the September descending resistance channel and the upper lip of the 16.754-17.208 congestive range with confirmation, signaling a bullish surge may be in the cards. I highlighted the importance of this cross-section in my previous piece outlining my bullish outlook for silver prices. Looking ahead, XAG/USD may rise with confidence until it hits resistance between 18.117 and 18.218.

XAG/USD – Daily Chart

(Click on image to enlarge)

XAG/USD chart created using TradingView

FUNDAMENTAL FACTORS AFFECTING SILVER PRICES, PALLADIUM

The US-China trade war will likely be the biggest factor impacting these precious metals. For palladium, weaker car exports out of a China could weigh on demand for XPD, a key input used in the production of catalytic converters. For XAG, an escalation in trade tensions could boost Fed rate cut bets and boost demand for anti-fiat hedges like silver higher.

Comments

No Thumbs up yet!

No Thumbs up yet!