Pairs In Focus This Week - Sunday, Sept. 11

Image Source: Unsplash

The difference between success and failure in Forex trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments are affected by macro fundamentals, technical factors, and market sentiment.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on Sept. 4 that the best trades for the week were likely to be:

- Short of the EUR/USD currency pair, which rose by 0.92%.

- Short of the GBP/USD currency pair, which rose by 0.68%.

- Long of the USD/JPY currency pair, which rose by 1.77%.

This produced a small average win of 0.06%.

The news has been dominated by last week’s risk-on rally, which saw a selloff in the US dollar, and a strong rise in the stock market towards the end of the week, differing greatly from the largely risk-off tone with which markets had begun the week. The key S&P 500 Index ended the week 3.47% higher while almost all other major global indices also rose. The US Dollar Index ended the week lower.

The risk-on rally has not been affected by the increasingly hawkish expectations from the US Federal Reserve and the European Central Bank, not to mention the strong rate hikes from the Bank of Canada and the Reserve Bank of Australia.

The Fed is now strongly expected to implement a further 0.75% rate hike at its next policy meeting later this month, while the ECB made its largest rate hike in years last Thursday, raising rates by 0.75%. The ECB also raised its inflation forecast, expecting an average rate of 8.1% over 2022, and stating that “inflation remains far too high and is likely to stay above target for an extended period."

Regarding market movements, the most dramatic impact beyond the stock market was seen in the Japanese yen, which saw a further strong decline. The initial moves earlier in the week were met with insouciance from Japanese policymakers, but some (such as deputy chief cabinet secretary) are now beginning to signal unhappiness with the idea of any further strong declines.

The details of the important economic data releases last week can be summarized as follows:

- ECB Main Refinancing Rate and Monetary Policy Statement.

- BoC Overnight Rate and Rate Statement (CAD) – 0.75% hike, the Canadian dollar now the major global currency with the highest rate of interest, at 3.25%.

- RBA Cash Rate and Rate Statement (AUD) – 0.50% hike.

- Australian GDP data – quarterly increase of 0.9%, as had been widely expected.

- Announcement of new UK Prime Minister – Liz Truss was appointed, as had been overwhelmingly expected.

- UK Monetary Report Hearings (GBP) – nothing very interesting happened here.

- US ISM Services PMI data – showed stronger-than-expected numbers in the US services sector.

- CAD Employment Change & Unemployment Rate – Canada saw a strong increase in its unemployment rate, from 4.9% to 5.4%, when an increase to only 5.0% had been expected.

The Forex market saw relative strength in the Swiss franc last week. The weakest currency was the Japanese yen, by a long way.

Rates of coronavirus infection globally dropped last week for the eighth consecutive week. The only significant growths in new confirmed coronavirus cases overall right now are happening in Russia and Taiwan.

The Week Ahead: Sept. 12-16, 2022

The coming week in the markets is likely to see a similar level of volatility than last week, with some key inflation data scheduled. Releases due are, in order of likely importance:

- US CPI.

- UK CPI.

- UK GDP.

- US PPI.

- US Retail Sales.

- New Zealand GDP.

- Australian Unemployment.

- US Empire State Manufacturing Index.

- US Preliminary UoM Consumer Sentiment data.

It is a public holiday this Monday, Sept. 12, in China.

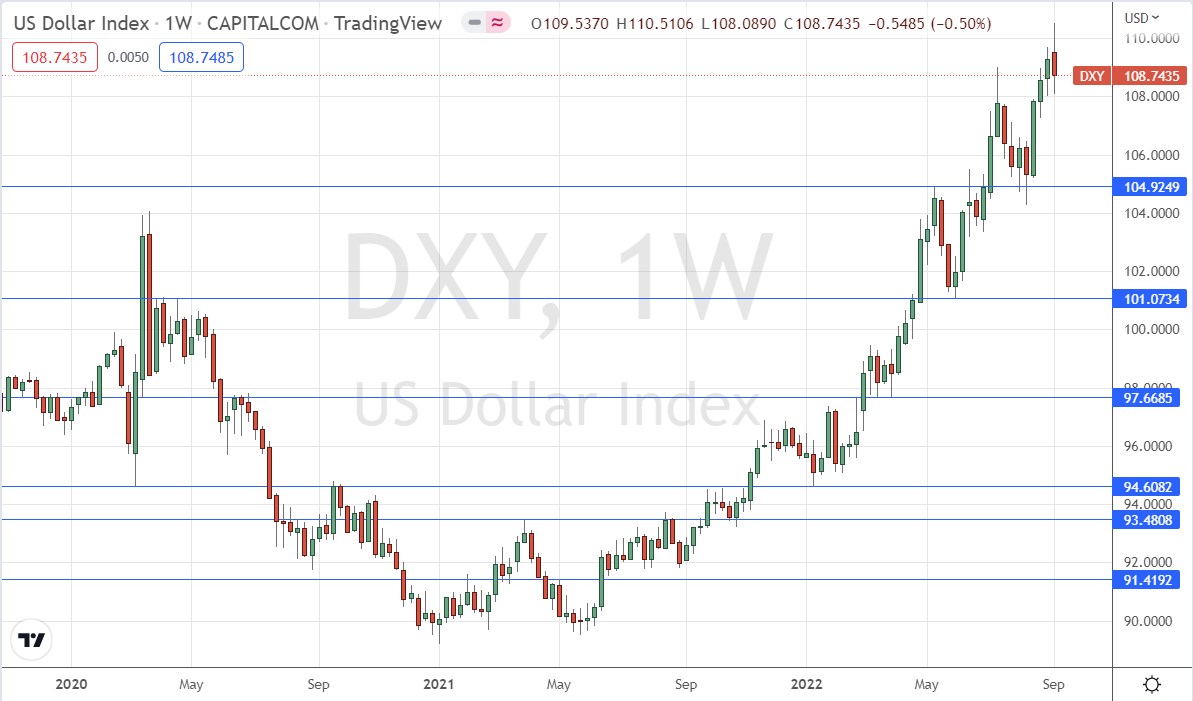

Technical Analysis - US Dollar Index

The weekly price chart below shows the US Dollar Index printed a bearish candlestick which closed down against the long-term trend, which is bullish.

The downwards movement is nothing dramatic nor out of the ordinary, so I see no reason to treat it as anything other than a normal bearish retracement within a bullish trend. This is given weight by the sizable lower wick of the candlestick, and by the fact that the US dollar was not one of the biggest movers in the Forex market last week.

We may have seen a new support level formed at last week’s low near or at 108.00, which would add to the bullish case. It may be a good idea to look for long trades in the US dollar over the coming week. There is a very powerful, long-term bullish trend in the most important currency in the Forex market, although market sentiment is currently against it.

EUR/USD

Last week saw the EUR/USD currency pair print a bullish outside bar after initially breaking down to a new 19-year low. Although this is a bullish sign, it is telling that the price was unable to hold up above the resistance level at $1.0100, so we are not really seeing a strong sign of a bullish reversal.

Even though the ECB hiked rates last week by 0.75% and signaled further hikes are forthcoming, the euro did not end the week with strong gains. The residual strength of the US dollar, plus fundamental headwinds against the euro, suggest a short trend trade opportunity remains in this currency pair. However, it may be helpful to use relatively wide trailing stop losses for this pair, as using ATR 3 has produced better results than ATR 1 over the years.

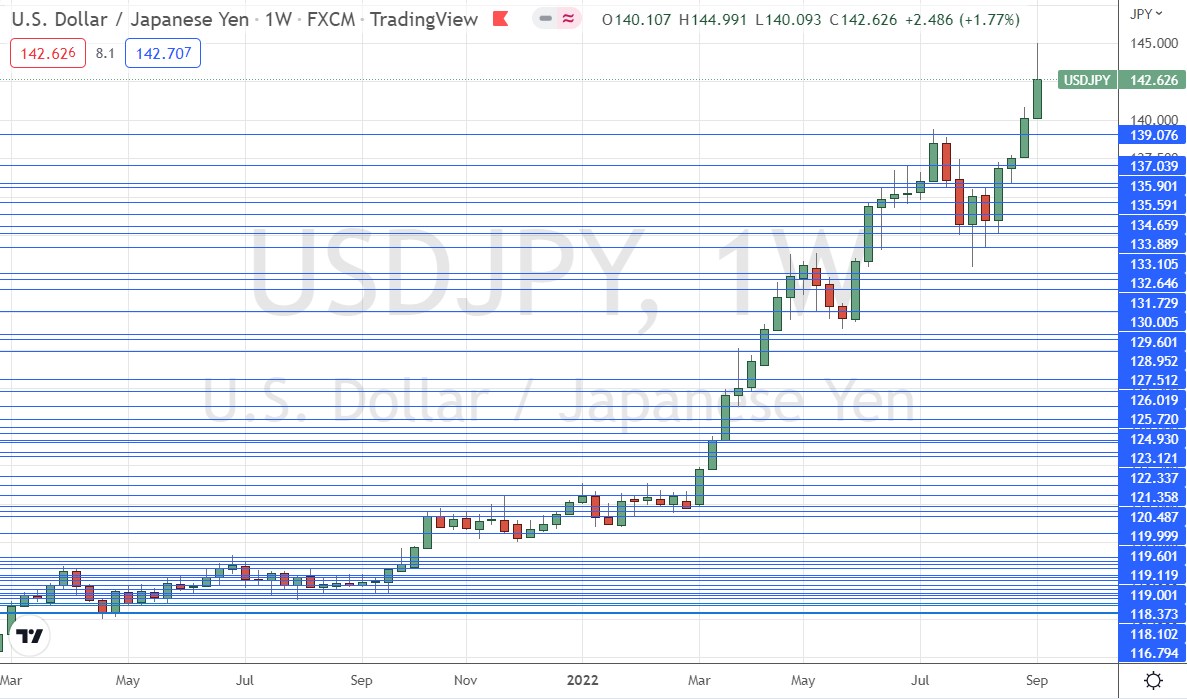

USD/JPY

The USD/JPY currency pair was once again a huge gainer last week, reaching as high as the JPY145 level, which had been mentioned as a possible long-term high by a Japanese policymaker, before giving up much of its gains – but still closing significantly higher over the week, and making its highest weekly closing price seen in the last 24 years.

This strong movement was driven mostly by the Japanese yen, which retains weakness as Japanese policymakers are still trying to inflate their economy, with Japanese inflation remaining well below its 2% target. This puts the Bank of Japan on a very divergent course to every other major central bank.

We see a large upper wick in last week’s candle, and it may be that the price will now struggle to reach the JPY145 level again. However, I see no strong reason why the bullish trend here should be seen to have ended. Trend traders will mostly be looking to stay long of this currency pair until its price declines by a significant further amount.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of the EUR/USD currency pair, and long of the USD/JPY currency pair. However, I would be cautious about entries and only look to trade from reversals from key support or resistance levels in line with the long-term trends.

More By This Author:

Ethereum Merge ExplainedDow Jones Technical Analysis: Deepens Its Losses

Forex Today: US Dollar Roars To New Highs As Risk-Off Strengthens

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more