Pairs In Focus This Week - Sunday, Feb. 4

Image Source: Unsplash

The EUR/USD currency pair showed support near the 1.08 mark, while the AUD/USD duo tested support at the 0.65 level. Natural gas stabilized at around $2.00. The S&P 500 aimed for the 5000 figure. The USD/JPY and EUR/JPY currency pairs rose, while gold fluctuated between $2000 and $2075.

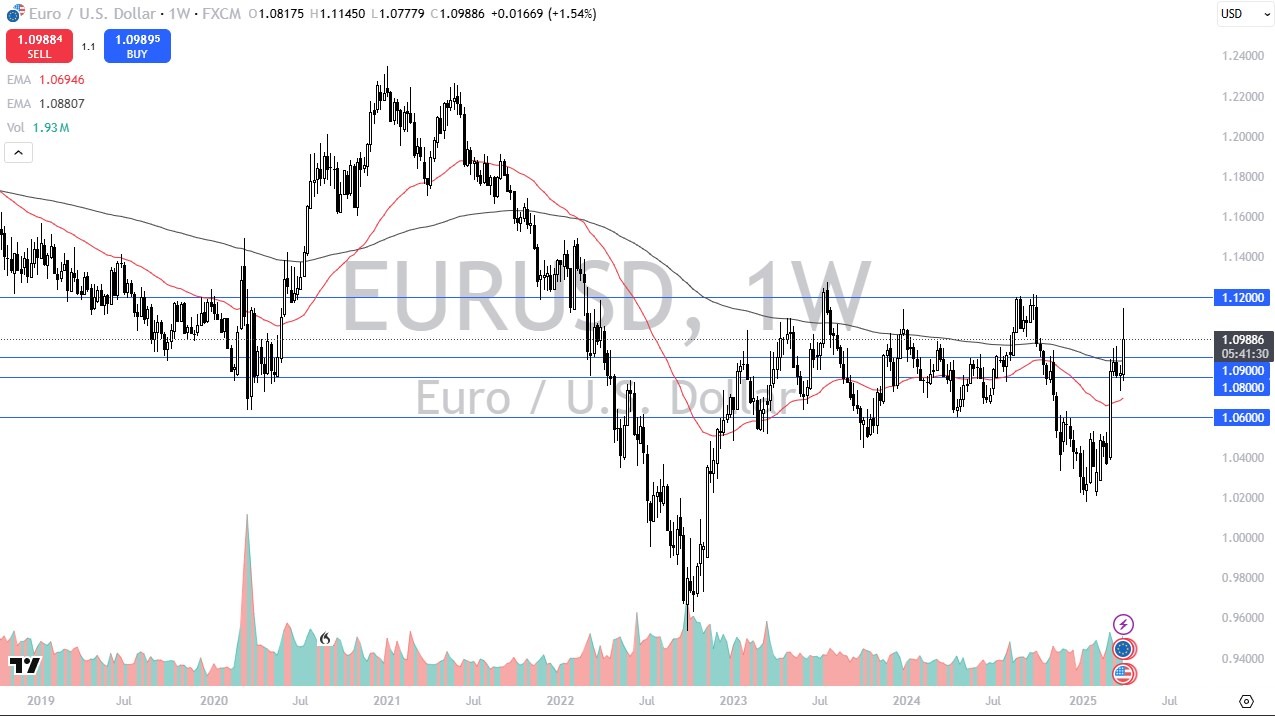

EUR/USD

(Click on image to enlarge)

The euro looked to be a little bit threatened over the past week, but there was a lot of support located just below recent trading areas. The 1.08 level is an area where we will likely see a lot of noise.

However, even if the euro could break down below there, I believe that the 1.0750 level would come into the picture as potential support. Any rallies at this point could extend all the way to the 1.10 level, but I think it would take a pretty significant shift in attitude to get all the way to that invisible barrier.

AUD/USD

(Click on image to enlarge)

The Australian dollar initially tried to rally during the week, but it received a hard blow on Friday as the Jobs numbers in the United States came in. Because of this, the Aussie appeared to be threatening to break through to the 0.65 level. This is an area that I think demonstrates significant support, so it’ll be interesting to see if the Australian dollar can hang onto it.

If it can't, then the Australian dollar would almost certainly fall down to the 0.6350 level. On the upside, I think the 0.66 level could serve as resistance, followed closely by the 0.67 level.

Natural Gas

(Click on image to enlarge)

Natural gas markets appeared to be negative again this week, but the momentum slowed down, and as natural gas was seen hanging around the crucial $2.00 level, I do think that there may be some value hunters out there willing to get involved. Ultimately, this is a market that I think will try to carve out a range for the year, perhaps with the $2.00 level offering support, and the $3.00 level above offering significant resistance.

S&P 500

(Click on image to enlarge)

The S&P 500 initially fell a bit during the course of the trading week, only to turn around and rally again to new highs. At this point, I don’t think there’s any doubt that the index is going to go looking toward the 5000 level above. That level has a lot of psychology attached to it, and I think there could be a lot of profit-taking in that area. At any time between now and then, I think a short-term pullback would offer a buying opportunity.

USD/JPY

(Click on image to enlarge)

The US dollar initially fell during the course of the week, but it shot straight up in the air against the Japanese yen as the Jobs number came out hotter than anticipated on Friday. It looks like the Federal Reserve may be cutting rates in the next month or two. Additionally, one should be aware that the market will probably be paying attention to the Bank of Japan not being able to tighten monetary policy at the same time.

EUR/JPY

(Click on image to enlarge)

The euro initially fell during the week against the Japanese yen, but it found enough support near the JPY159 level to turn things around and form a bit of a hammer. At this point, I think the euro will continue to gain against the Japanese yen, not necessarily due to its own strength, but because of the yen's weakness.

Ultimately, I believe this is a situation where it may be beneficial to buy dips when they occur, as the Japanese yen is not a currency people want to own at the moment. Furthermore, the 50-week EMA broke above the JPY155 level, which could add even more support.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 initially fell during the week, but it continued to plow higher. It appears that the Nasdaq 100 has been trying to do everything it can to get to the 18,000 level, and the fact that Meta reported earnings on Friday likely helped the idea of the index going higher, as it is not equal-weighted. Every time there is a pullback in this index, it may be beneficial to be a buyer, as there is so much momentum at the moment.

USD/CHF

(Click on image to enlarge)

The US dollar initially fell against the Swiss franc during the course of the week, but it turned around to show signs of life. This was aided by the Non-Farm Payroll numbers coming out much hotter than anticipated, as previously mentioned. It looks like the Federal Reserve will be waiting to cut rates, and the US dollar has recovered against most things, with the Swiss franc being no exception.

The currency pair has recently been at extreme lows, but if it can break above the 0.8750 level, then I think momentum could carry the US dollar to the 0.8860 region. However, a break down below the 0.85 level would be very negative for the dollar.

Gold

(Click on image to enlarge)

Gold markets rallied early in the week, but they then turned around to show signs of weakness. Ultimately, this is a market that I think will likely move higher, but it may have a bit of a fight ahead of it. Gold has recently been trading between the $2000 level on the bottom and the $2075 level on the top.

More By This Author:

Gold Forecast: Gold In A RangeNatural Gas Forecast: Natural Gas Likely Stuck In A Longer-Term Range

NASDAQ 100 Forecast: NASDAQ 100 Sees Buyers No Matter What

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more