Pairs In Focus This Week – USD/CHF, Gold, NASDAQ 100, FTSE 100, USD/CAD, USD/JPY, Dow Jones 30, GBP/USD

USD/CHF

The US dollar has rallied rather significantly against the Swiss franc during the course of the week, as it looks like we are starting to find the bottom of this market. Ultimately, we can break a little bit higher, clearing the last week candlestick, then I think the market could go looking to the 0.90 level. Keep in mind that this is the end of the year, and liquidity could come into the picture, but at the end of the day this is a pair that certainly looks like it is well oversold.

(Click on image to enlarge)

Gold

Gold markets have had a wild week, kicking off Monday with an explosion outside. That being said, we still haven’t understood exactly what’s happened, but it looks like we ran a bunch of stops and may have had a “blow off top. I think the next couple of weeks could be very crucial for this market, as we will have a lot of liquidity taken out of the market, so we will have to see whether or not gold can keep it up. This weekly candlestick is absolutely ugly, and we may continue to see people sell gold, or perhaps more importantly - close long positions and collect profit.

(Click on image to enlarge)

NASDAQ 100

The NASDAQ 100 initially fell during the week but has turned around to show signs of life again. At this point, it looks like the NASDAQ 100 is going to continue to rally, which is not out of the realm of normalcy because the “articles rally” does come into the picture. That being said, we also have to worry about a lack of liquidity, but with the turnaround that we have seen during this week, I think we do have more of a “buy the dips” attitude in general.

(Click on image to enlarge)

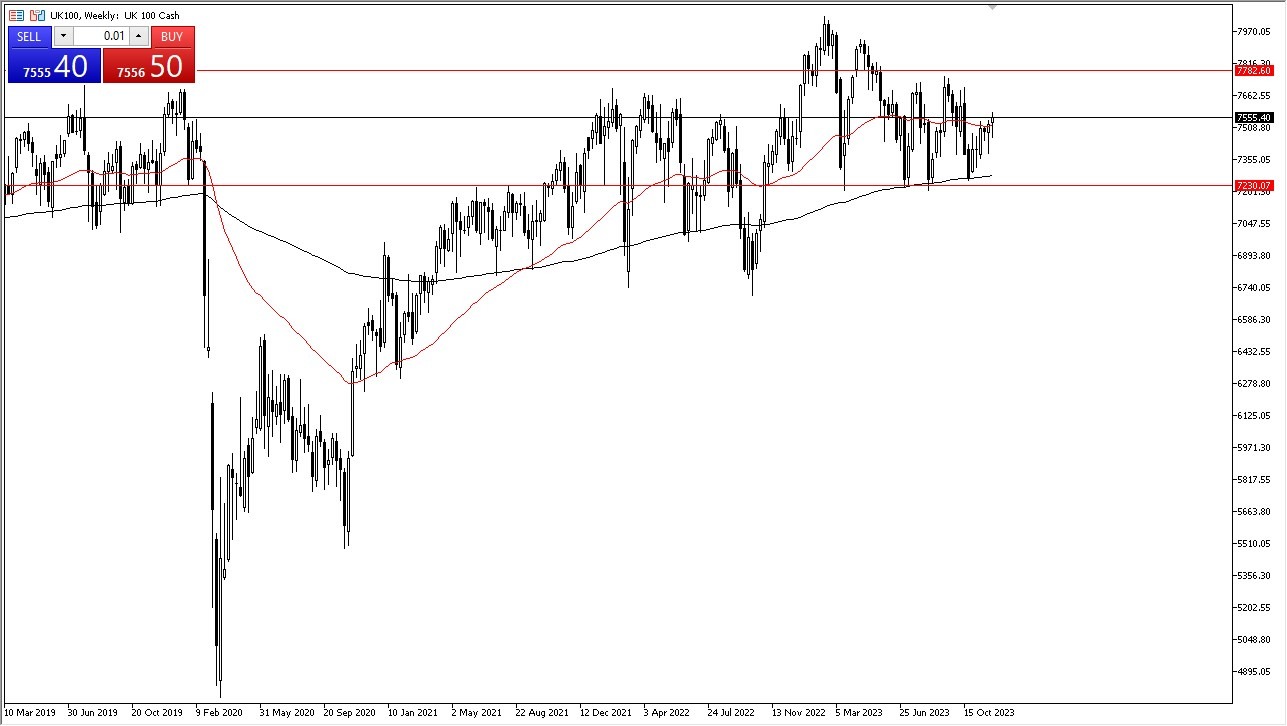

FTSE 100

The FTSE 100 initially pulled back during the week, but much like the previous week, we have seen buyers come back in to pick this market up. Because of this, think the FTSE 100 is likely to continue to grind higher, perhaps trying to reach the 7750 level. That is the top of the recent range that we have been in, and therefore I think it’s likely that we continue to see more or less a grind to the upside, and not much more than that. Pullbacks should offer value all the way down to about 7230.

(Click on image to enlarge)

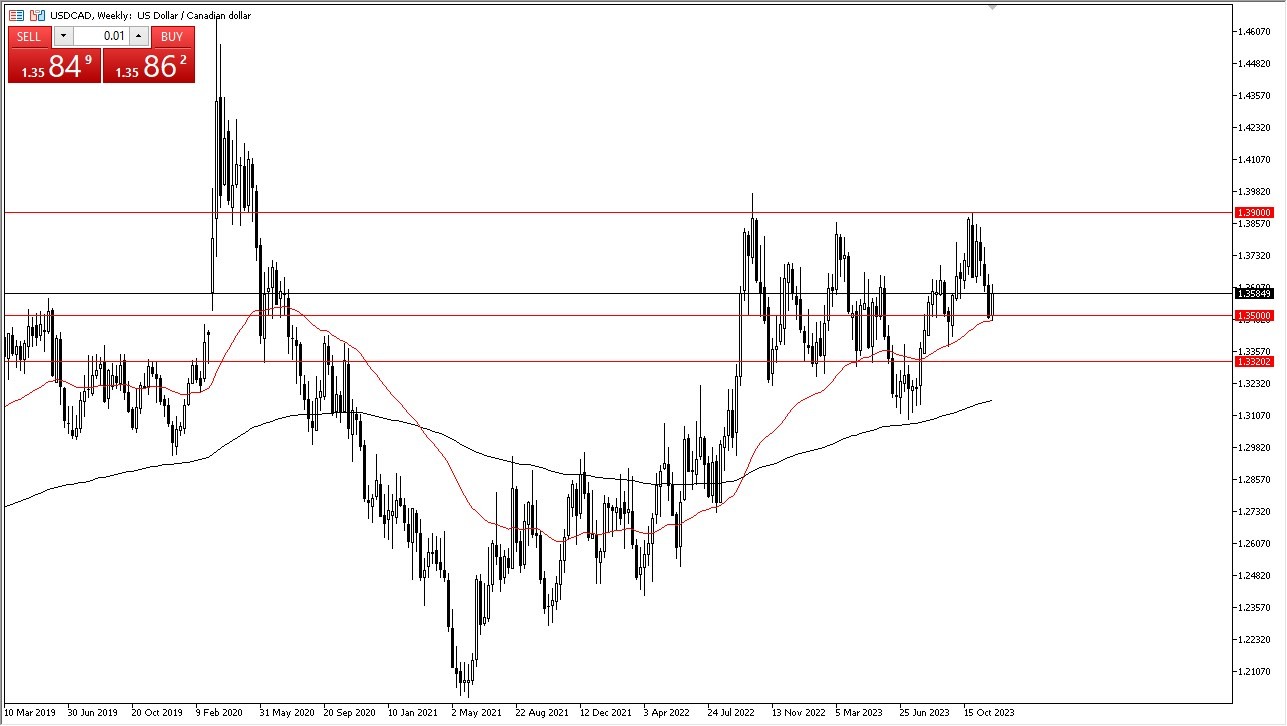

USD/CAD

The US dollar has recovered quite nicely against the Canadian dollar, bouncing from the crucial 1.30 level. That’s also where the 50-Week EMA was, so does make a certain amount of sense that we would see buyers trying to push the market higher. Beyond that, we also have the jobs number showing higher than anticipated numbers on Friday in the United States, so that has sent the greenback higher against quite a few currencies. The Canadian dollar is unfortunately tethered to the oil market, which has been absolutely crushed.

(Click on image to enlarge)

USD/JPY

The US dollar has fallen rather significantly during the week as murmurs of the Bank of Japan possibly trying to normalize interest rates has overtaken the market yet again. That being said, we have bounced quite hard from the 50-week EMA to form a bit of a hammer, and we are closing out the week near the ¥145 level. That suggests that we are potentially going to try to recover, but it’s worth noting that on the 19th the Bank of Japan has an interest rate decision and statement that will drive where this pair goes for the long term.

(Click on image to enlarge)

Dow Jones 30

The Dow Jones Industrial Average initially fell a bit during the week, dropping down to the 3600 level. That being said, it looks like the “Santa Claus rally” is about to kick into high gear, and the fact that this short-term pullback that we got during the week was bought into right away suggests that we are going to continue to go higher. Yes, we are a bit stretched at this point, but at the end of the day, traders are trying to pad their performance numbers by the end of the year.

(Click on image to enlarge)

GBP/USD

The British pound has fallen significantly during the week but is currently grinding back and forth between the 50-Week EMA, and the 200-Week EMA above. With this being the case, the market is trying to squeeze and try to make a bigger decision, but at this point it’s probably worth noting that the end of the year means that fewer people will be trading and we may go sideways more than anything else.

(Click on image to enlarge)

More By This Author:

AUD/USD Forecast: Attempts To Turn Around

S&P 500 Forecast: Bounces From Bottom Of Range

EUR/USD Forecast: Looking For Buyers Waiting For NFP

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more