Pairs In Focus - Sunday, May 4

Image Source: Unsplash

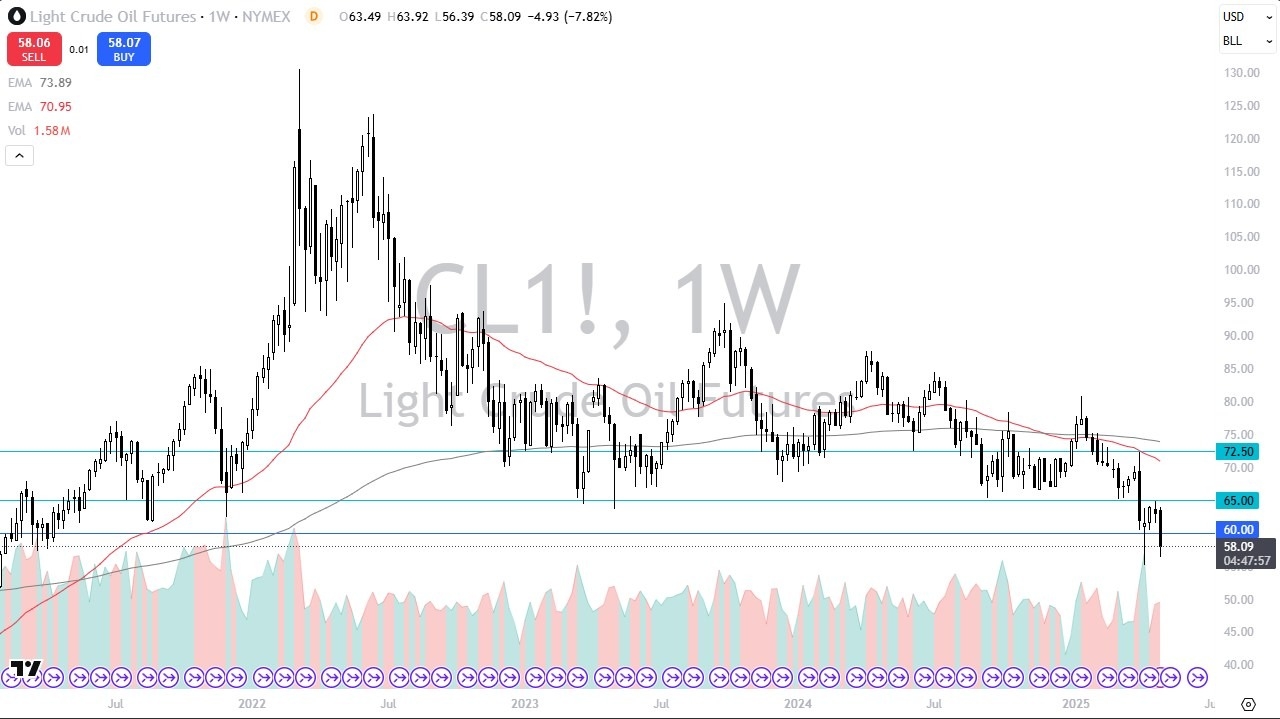

Crude Oil

(Click on image to enlarge)

The crude oil market fell pretty significantly during the trading week, as it aimed to close below the $60 level. This is an area that will likely gather some attention, mainly due to the bounce that was previously staged from that level. Some level of caution would likely be beneficial at this point in time, as this is a market that I believe will only continue to experience volatility due to demand. Overall, market movement has been rather sideways, with a slight tilt to the downside.

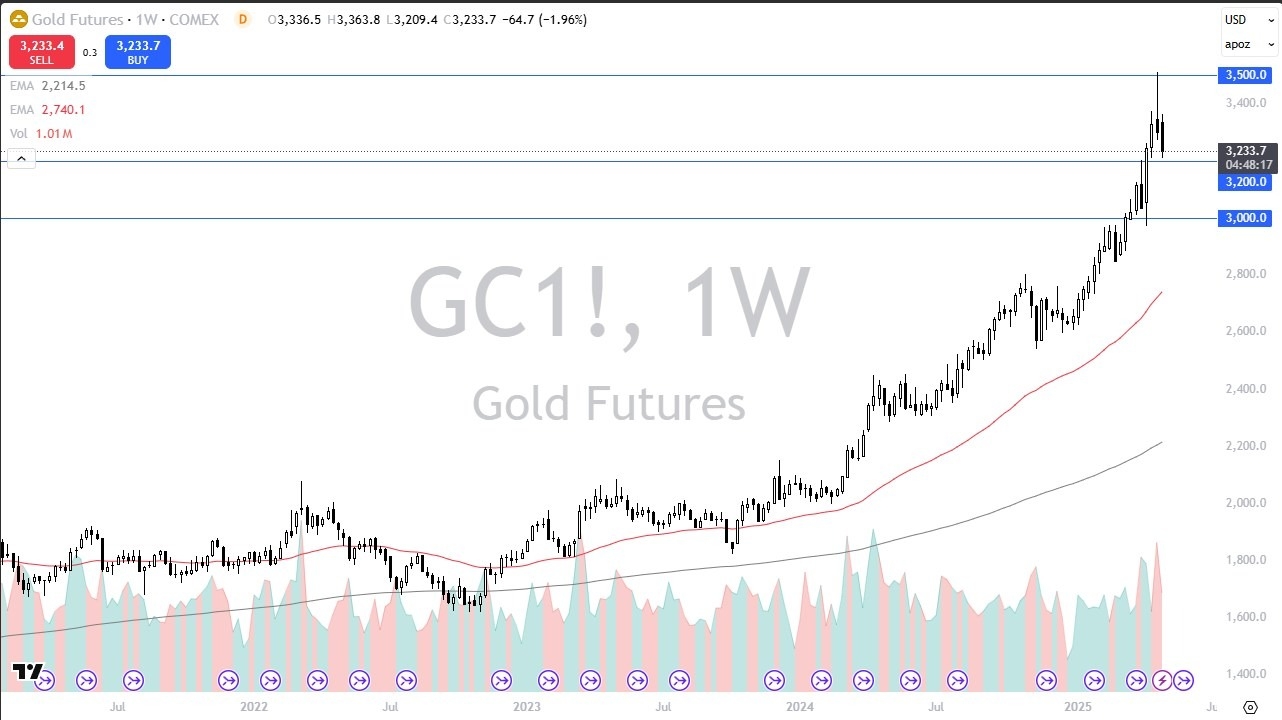

Gold

(Click on image to enlarge)

The gold market initially tried to rally during the trading week, but it fell rather hard. It’s interesting to see that the gold market has been falling while the stock market has been rallying. We have seen a major negative correlation between gold and stocks as of late, so I will be paying close attention to the $3200 level. I will also be watching the $3000 level for some type of bounce in which I can start buying again.

AUD/USD

(Click on image to enlarge)

The Australian dollar experienced a positive trading week, as it recently broke above the 50-week EMA. By doing so, it looks as though it could continue to push higher, perhaps even to the 200-week EMA near the 0.67 level.

This space will probably see some positive price action due to the potential of a trade deal between China and the United States. Such an event would have a major influence on the Australian economy as Australia is a major supplier of raw materials for China.

EUR/USD

(Click on image to enlarge)

The euro moved all over the place during the trading week, as it seemed to be lacking in direction. It should be noted that the market has experienced primarily sideways movement for around three weeks after its initial shot higher.

What I find most interesting is that the previous week ended up forming a massive shooting star at the crucial 1.15 level, which is an area that has been important previously. It’s a large, round, psychologically significant figure as well, so that is also something to keep in mind. A break below the 1.12 level could see the market continue to fall even further.

GBP/USD

(Click on image to enlarge)

The British pound initially tried to rally during the course of the trading week, before it gave back its gains and formed a shooting star structure. The formation was preceded by another shooting star on the weekly timeframe, and the 1.34 level may continue to be a major barrier.

The formation of these shooting star patterns has been a rather ugly turn for the British pound, so traders will likely be watching the space closely for any further falls. A drop below the 1.32 level would likely lead to even more downward momentum.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 initially fell a bit during the course of the trading week, but the index eventually found enough support near the 19,100 mark to turn things around. It broke above the 50-week EMA during a very bullish week.

I think at this point in time, any short-term pullbacks that occur could serve as buying opportunities in the index. That is, of course, unless some decidedly negative headlines were to be released. On the other hand, a break above the 20,350 level could send the Nasdaq 100 flying even higher.

USD/JPY

(Click on image to enlarge)

The US dollar initially fell against the Japanese yen, but it eventually was able to turn around to show signs of life. It made an attempt to break above the JPY145 level during the week, which is a large, round, psychologically significant figure.

It recently formed a massive “triple bottom” structure on the weekly chart, so it’ll be interesting to see how far it can bounce from here. However, it looks as though the "risk-off" behavior in the markets has started to cool.

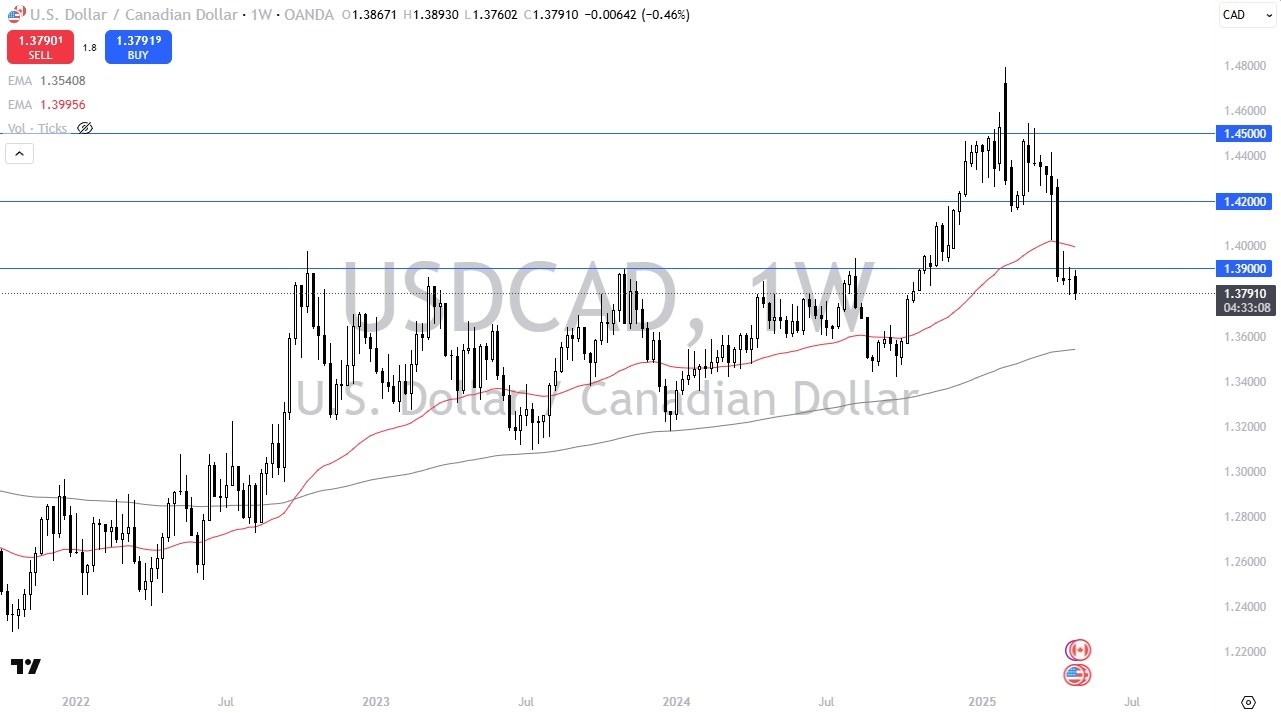

USD/CAD

(Click on image to enlarge)

The US dollar dropped against the Canadian dollar during the week amidst its overall plummet in the currency space. That being said, the area that it seems to be approaching looks to be rather noisy. Therefore, even if we do continue to see it drop from here, I would not necessarily look to get short in this market. However, a weekly close above the 1.39 level could possibly tempt me to start buying.

More By This Author:

USD/JPY Forecast: Surges Against YenGold Forecast: Continues To Consolidate

ETH/USD Forecast: Threatens 50 Day EMA

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more