Pairs In Focus - Sunday, May 25

Image Source: Unsplash

USD/CAD

(Click on image to enlarge)

The US dollar plummeted against the Canadian dollar during the trading week as it started to test the crucial 1.3750 mark. This level is an important area that will likely continue to see a lot of volatility and potential support.

At this point in time, I would need to see the US dollar recapture the 1.39 level before I would even begin to consider buying against the Canadian dollar. Traders should keep in mind that there is still a lack of a trade agreement between the two economies.

Crude Oil

(Click on image to enlarge)

Crude oil moved all over the place during the trading week, as it tested the $65 level before it turned around to show signs of hesitation. The $60 level seems to be offering support at the moment. If crude oil can stay above that level, then I think there could be a real buying opportunity in the short-term.

I think that’s probably the most likely turn of events, but Donald Trump announced 50% tariffs being recommended against the European Union starting June 1, and that could be negative for oil. Only time will tell, though. If crude oil can recapture the $65 level on a daily close, then I think it could rally quite nicely from there.

USD/JPY

(Click on image to enlarge)

The US dollar fell rather significantly against the Japanese yen throughout the trading week. Now that even more chaos involving tariffs has been introduced, the Japanese yen could continue to strengthen. This would fly in the face of the recent interest rate situation, and I am fairly neutral about this pair at this point in time.

There looks to be a good amount of support around the JPY140 level, so I will be on the lookout for a stable turnaround before I start buying. Meanwhile, a break down below the JPY140 level would be extraordinarily negative.

EUR/USD

(Click on image to enlarge)

This might be one of the more interesting pairs to monitor this week, as the United States and the European Union are about to ratchet up tensions as far as tariffs are concerned. It’s interesting to see that there is a lot of resistance right around the 1.14 level, extending to the 1.15 level. If traders can take out the 1.15 level on a daily close, then I believe the euro would really start to take off.

In the meantime, though, it’s hard not to notice that the struggle the pair has endured in the area of stubborn resistance. I favor the downside, at least for the moment, but this is a very fluid space. Ultimately, traders will likely pay more attention to the US dollar than anything else.

DAX

(Click on image to enlarge)

The German index moved all over the place during the week, and Friday's announcement about US tariffs on the European Union caused even more chaos. That being said, it looks to be a bullish market at the moment. The index will likely encounter a lot of noise in the coming week, and perhaps even some "buying on the dip" price action.

I have no interest in shorting this market. I believe the index will eventually go breaking to the upside, perhaps even to the EUR25,000 level, although such a move would take some time.

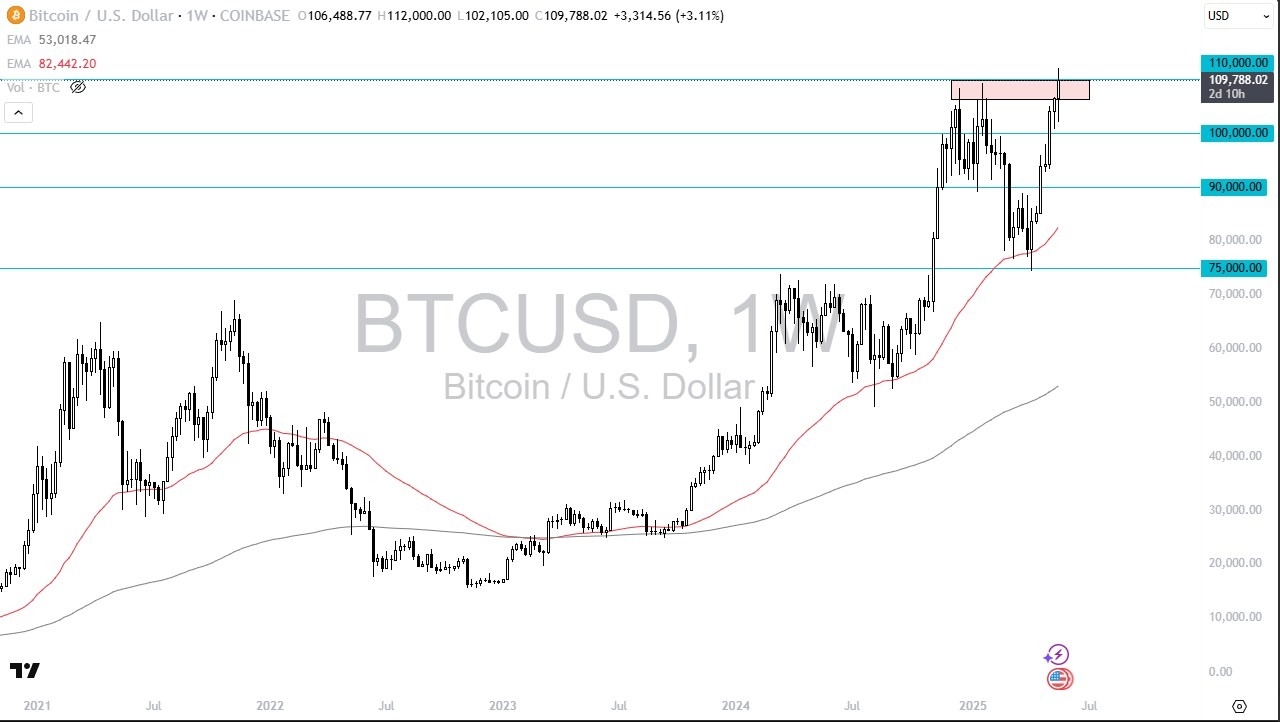

Bitcoin

(Click on image to enlarge)

Bitcoin was extraordinarily bullish during the course of the week, as it has been trying to break out. I think Bitcoin should continue to go higher from here. However, it’s also worth noting that it has been drifting a little bit below the $110,000 level as we approach the end of the week, so there is a very real possibility it could pull back from here. I would anticipate seeing buyers enter the space if such a scenario occurs.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 fell a bit during the trading week. This is market that has been extraordinarily bullish. It seems that the market needed a reason to pull back a bit, and with the recent updates about tariffs, it has supposedly received that reason. With that being the case, I do think that the recent dip will more likely than not open up the possibility of buying again.

GBP/USD

(Click on image to enlarge)

The British pound broke higher during the course of the week after it formed 3 shooting stars and a rather neutral candlestick on the chart. These patterns seemed to suggest that resistance was going to hold.

As of the time of writing, the British pound appears ready to threaten the 1.35 level. I think out of all of the currencies that I follow right now, the British pound might be one of the big winners, as the United Kingdom seems to have a reasonable hold on the tariff situation. Short-term pullbacks in the space could serve as potential buying opportunities.

More By This Author:

Natural Gas Forecast - Continues To RecoverBTC/USD Forecast: Bitcoin Drops Only To Find Buyers

GBP/USD Forecast: British Pound Continues To Struggle Against The Dollar

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more