Pairs In Focus - Sunday, March 2

Image Source: Unsplash

USD/JPY

(Click on image to enlarge)

The US dollar rallied during the course of the week as it turned around to break above the JPY150 level. The USD/JPY currency pair recently formed a bit of a double bottom on the chart. That being said, the 50-week EMA above has been offering significant resistance, so a break above there could send the pair toward the JPY155 level. On the other hand, a break below the JPY148.50 level could spark a further drop down to the JPY145 mark.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 fell during the course of the week, as the index declined into the 20,500 region. However, the question now is whether or not the index can stay within the consolidation area that it's recently been hovering in, or if it will start to break down.

If the index can break down below the bottom of the candlestick for the week, then such a move could cause the Nasdaq 100 to drop toward the 20,000 level. The 20,000 level is a large, round, psychologically significant figure that is also backed up by the 50-week EMA. A break above the 21,000 level could cause buyers to return to this market.

EUR/USD

(Click on image to enlarge)

The euro initially tried to rally during the course of the trading week, but it seemingly found the 1.05 level to be too much to overcome, and it has since fallen toward the 1.04 level. At this point, the market is likely to see a lot of noise in the area between the 1.02 mark and the 1.05 level above. All things being equal, this is a market that will likely remain range-bound from what I can see.

Gold

(Click on image to enlarge)

The gold market initially tried to rally during the week, but it has since given back those gains as it formed a nasty candlestick. The market is likely to continue to see a little bit of turbulence, but it still appears to be in an uptrend, and I would not bet against that.

There are still a lot of concerns when it comes to tariffs, and, of course, global trade in general. With that being said, I anticipate that the gold markets will remain bullish over the longer-term. However, there might be a lot of issues to contend with in the short-term.

USD/CHF

(Click on image to enlarge)

The US dollar initially fell during the course of the week, but it has gained strength since then. At this point in time, the market is likely to continue to see a lot of importance placed on the interest rate differential, as well as the potential of American tariffs being placed on the European Union. These factors will likely influence the Swiss economy. Remember, the interest rate differential most certainly favors the American economy.

Silver

(Click on image to enlarge)

Silver markets plunged during the course of the trading week, as the gray metal tested the crucial $31 level. This is a level that has previously been significant, so a return to that area in the short-term could spark a bit of hope.

However, due to the unappealing shape of the candlestick, I would be very cautious at this point. In fact, I’m assuming that silver is going to end up dropping from here a bit further, perhaps into the range that it was previously stuck in.

GBP/JPY

(Click on image to enlarge)

The British pound rallied a little bit during the trading week, as it reached toward the JPY190 level. However, it was unable to break above that point.

That being said, if the pair could rally and break above that level, then I think the 50-week EMA could come into the picture, as well as the JPY195 level above. On the other hand, traders would have to pay close attention to the JPY187 level if a break below the weekly candlestick was to occur.

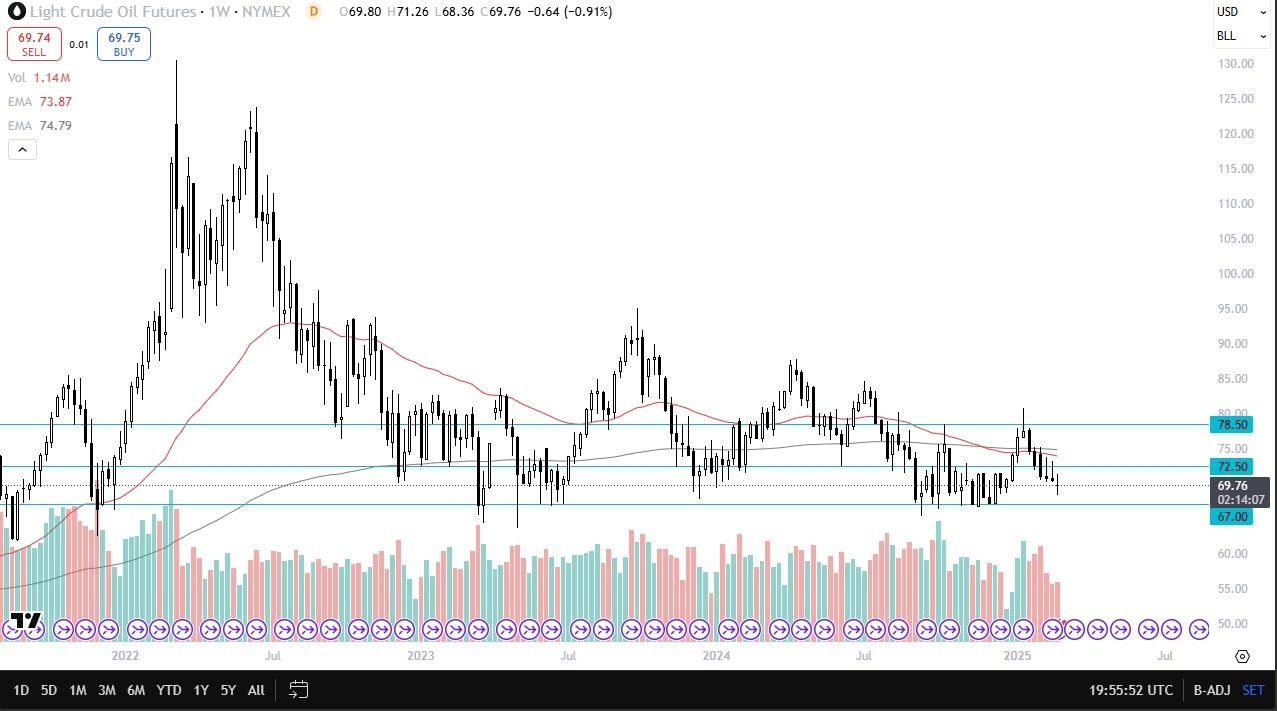

Crude Oil

(Click on image to enlarge)

Crude oil fluctuated quite a bit during the course of the trading week. The market has been range-bound for the past few years, so I suspect this back-and-forth movement will continue. The $67 level should offer support, and I think it could essentially serve as the bottom at the moment. A break above the $72.50 level could cause crude oil to reach toward the $78.50 level.

More By This Author:

ETH/USD Forecast: Looking For A BottomBTC/USD Forecast: Drops Sharply, Testing Key Support Levels

AUD/USD Forecast:Aussie Dollar Continues To See Noisy Trading

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more