Pairs In Focus - Sunday, June 8

Image Source: Unsplash

Gold

(Click on image to enlarge)

Gold markets initially rallied during the week, but the yellow metal has since given back quite a bit of those gains. There appears to be a large amount of choppiness in the gold space at the moment. It seems that the overall uptrend may not continue in the short-term unless a catalyst comes into play.

Crude Oil

(Click on image to enlarge)

Crude oil experienced a very strong week, as it broke toward the crucial $65 level. Such a move s a very positive sign, so I will be watching the space this week. A break above that point could open the door for a move to the $68 level, or possibly even the $72.50 level.

Underneath, there is a massive amount of support to be found near the $60 level. As long as crude oil can stay above that level, I think there will still be plenty of buyers entering the space, especially as the US economy looks to be stronger than the market had been pricing in previously.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 rallied for the week, as it broke above the 21,800 level and threatened overall highs near the 42,100 mark. That being said, the market does appear to be a little bit extended. I think the index may experience some choppiness as it attempts to push through the major swing high that it melted down from. Short-term pullbacks at this point in time should be expected, but those pullbacks could end up being buying opportunities if given enough time.

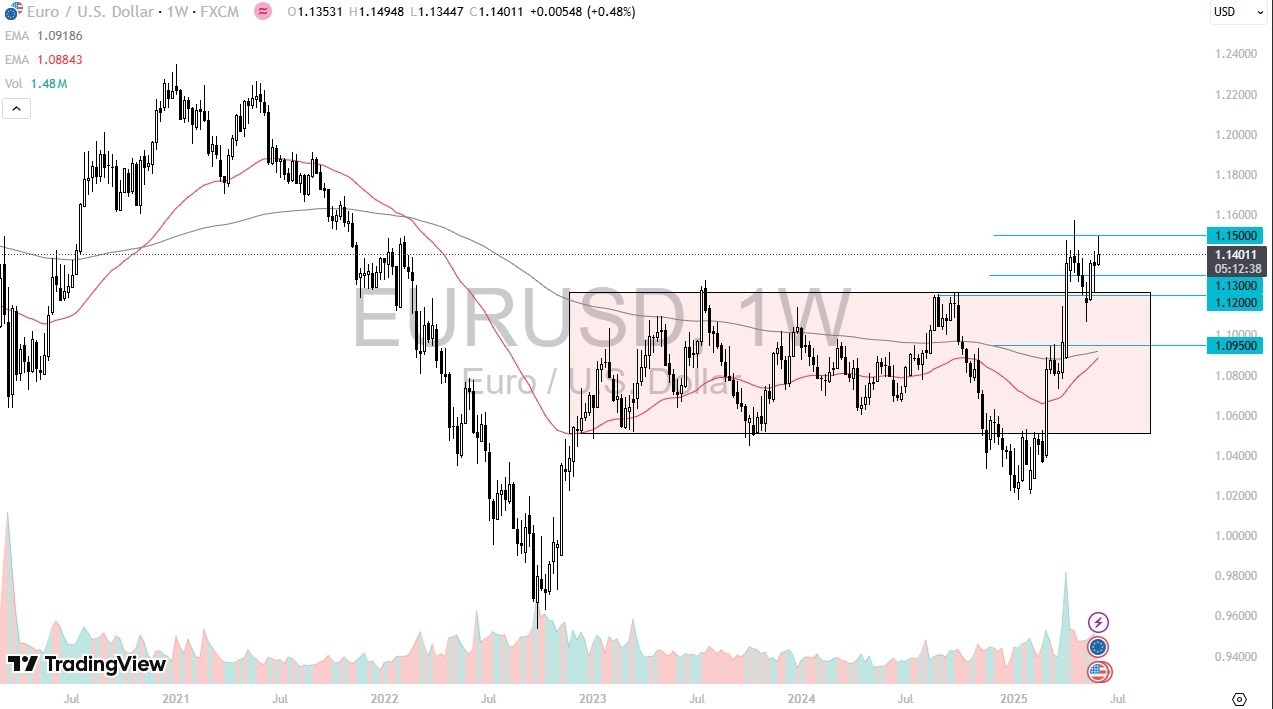

EUR/USD

(Click on image to enlarge)

The euro initially rallied during the course of the trading week, yet it continued to see a large amount of resistance near the 1.15 level. This is an area that I think will continue to see significant resistance, and given enough time, it could very well end up being the “ceiling in the market.”

If it can break above that point, such a move would be a very bullish sign. However, I don't think such a move is likely. On the other hand, a break down below the 1.12 level could see the market plunge further. As things stand right now, based on the last two weekly candlestick formations, I think it is essentially stuck in its recent range.

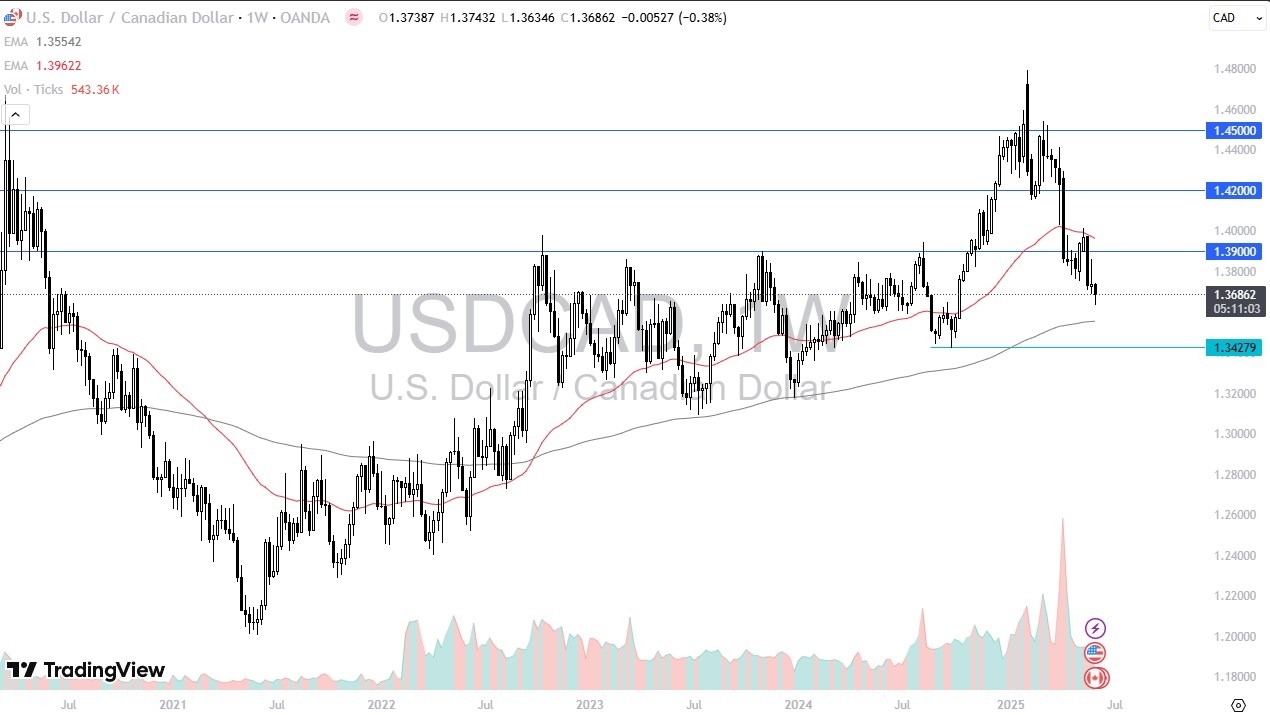

USD/CAD

(Click on image to enlarge)

The US dollar fell against the Canadian dollar at the start of the week, yet traders recently pushed back against this, especially after the jobs number on Friday came out stronger than anticipated.

At this point in time, there is still a lot of downward pressure to be seen. However, the space could see buyers return if given enough time, especially as the market approaches the 200-week EMA. Additionally, it appears that the market may have pulled back into a major demand area. I will be watching this pair very closely this week.

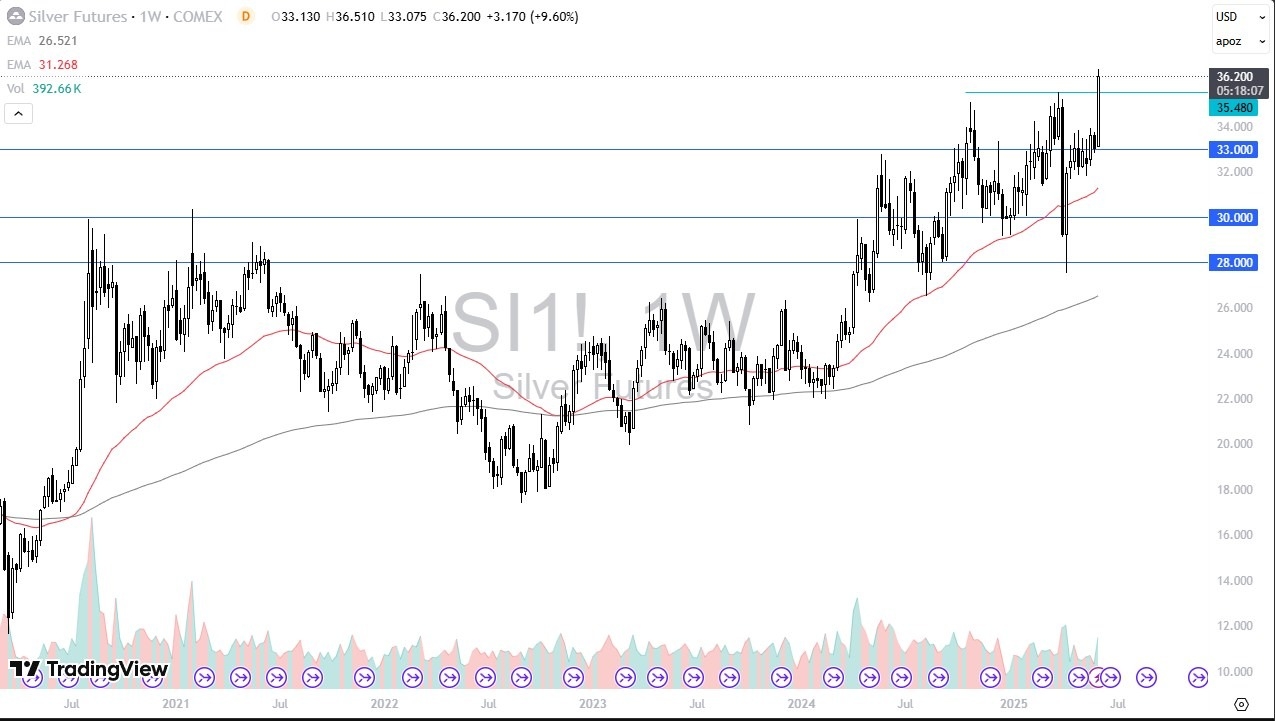

Silver

(Click on image to enlarge)

Silver exploded this week, as it broke above the recent double top that had previously proved troublesome. With that being the case, the market could now go looking toward the $40 level, but such a trajectory would take some time to reach.

Pullbacks at this point in time would likely serve as buying opportunities. The silver market got a little bit of a boost on Friday as well, as the jobs number came out hotter than anticipated in the United States, signaling that there might be a bit of industrial demand coming from the US.

USD/JPY

(Click on image to enlarge)

The US dollar initially fell against the Japanese yen during the trading week, but it has since turned around to show signs of strength. The jobs number on Friday saw people buying the greenback, and it now seems to be threatening the crucial JPY145 level. This level is a large, round, psychologically significant figure.

The JPY142 level underneath looks like massive support. The pair seems to be consolidating, but it may break to the upside if given enough time. The interest rate differential will likely continue to favor the greenback.

USD/MXN

(Click on image to enlarge)

The US dollar initially tried to rally against the Mexican peso during the trading week, but it fell pretty hard against the 200-week EMA. The Mexican peso continues to look reasonably strong, and I think traders may take advantaged of the interest rate differential favoring the peso.

With the MXN19 level underneath offering a significant amount of support, it will be interesting to see if the greenback can break below that level. Such a move would be rather negative for the pair.

More By This Author:

EUR/JPY Forecast: Looking At ResistanceNasdaq Forecast: Gains Again

Natural Gas Forecast: Gas Stalls Again

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more