Pairs In Focus - Sunday, June 1

Image Source: Unsplash

USD/JPY

(Click on image to enlarge)

The US dollar rallied against the Japanese yen during the course of the week, and it even managed to break above the JPY145 level. That being said, the market has since pulled back a bit. However, I still see plenty of support near the JPY142 level, and I think the currency pair may be in the middle of a bottoming pattern.

Furthermore, markets are starting to see the US dollar stiffen its resolve against the basket of major currencies that I typically follow. In other words, the pair may be in the process of turning things around.

GBP/USD

(Click on image to enlarge)

The British pound initially tried to rally during the trading week, but it eventually gave back those gains. Traders will likely be watching the crucial 1.35 level, as it is a major support level, and it has previously served as a major resistance barrier.

If traders were to see a break down below that level, however, then I think the British pound could find itself in quite a bit of trouble. On the other hand, if it can break above the 1.3650 level, then the British pound could really start to take off to the upside.

DAX

(Click on image to enlarge)

The German index rallied a bit during the week, before it started to show signs of hesitation around the EUR24,000 level. At this point, the market might be a little bit overbought. While it did manage to break above a major resistance barrier, I expect to see a bit of sideways price action from that point. I think the space may be starting to see a lack of confidence in chasing the 'FOMO' trade. Pullbacks seem likely at this point.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 took off to the upside during the course of the week, but it has since given back enough gains to show signs of hesitation. The 22,000 level is going to be difficult to get above, as it is a large, round, psychologically significant figure, and near enough to the all-time highs that traders will be watching it closely.

If we do see a pull back from here, then I think such a move would offer a buying opportunity if given enough time. However, there is some excess froth that needs to be worked out of the index, similar to what has been seen in other major indices.

EUR/USD

(Click on image to enlarge)

The euro initially fell during the course of the week to reach the 1.12 region, before it then turned around and bounced. All things being equal, this is a market that I think will continue to witness a large amount of noise. Thus, I believe the euro may be in a bit of a sideways consolidation range. With this being the case, the market will likely continue to see rather choppy price action.

However, a break down below the 1.12 level could see an even further drop to the downside.

Silver

(Click on image to enlarge)

Silver witnessed a rather negative trading week. Yet, it still appears to be stuck in the same trading range, and the $33 level looks like it will remain an important area to watch.

Furthermore, this trading range is defined between the $34 level above and the $32 level underneath. With this, I think the space will continue to see a lot of sideways action. However, short-term dips in the market could see continued buying as silver may build up enough momentum to rocket higher.

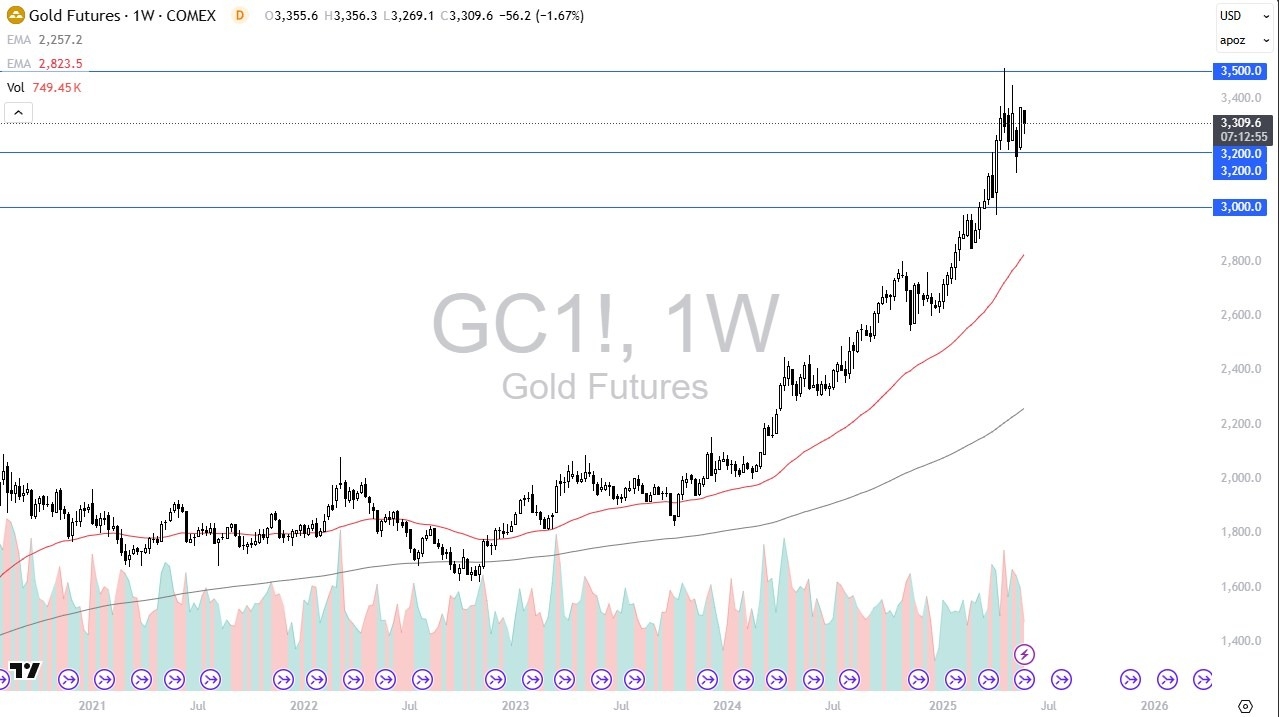

Gold

(Click on image to enlarge)

Gold markets witnessed a somewhat negative week. However, I would not worry too much about the overall uptrend at this point, as the market seems like it needs to work off a fair amount of excess momentum, and this means that gold will likely approach a trading range.

Ultimately, the $3200 level will likely continue to be supported. If gold markets break to the upside, then the $3500 level could be the next target, as well as a major resistance barrier. A break above that point could see the yellow metal really start to take off.

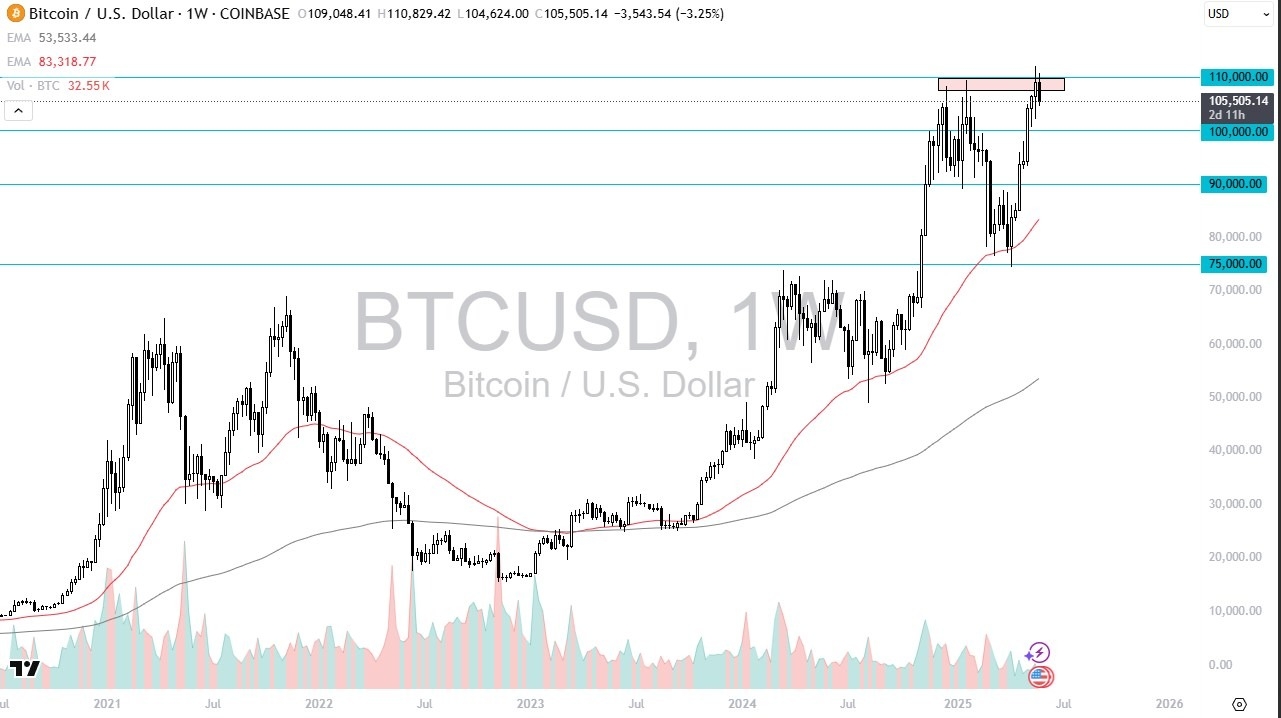

Bitcoin

(Click on image to enlarge)

Bitcoin initially tried to rally during the trading week, but it seemingly found the area above the $110,000 level to be a bit too much for the market. I think that the cryptocurrency will likely continue spending time in this general area.

It may attract enough inflows to finally break out to the upside and pull back to the $100,000 level. Such a move could potentially serve as a buying opportunity in what has been an extraordinarily bullish market.

More By This Author:

BTC/USD Forecast: Continues To ConsolidateUSD/CAD Forecast: CAD Under Pressure

AUD/USD Forecast: Drops To Previous Range

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more