Pairs In Focus - Sunday, July 6

Image Source: Pexels

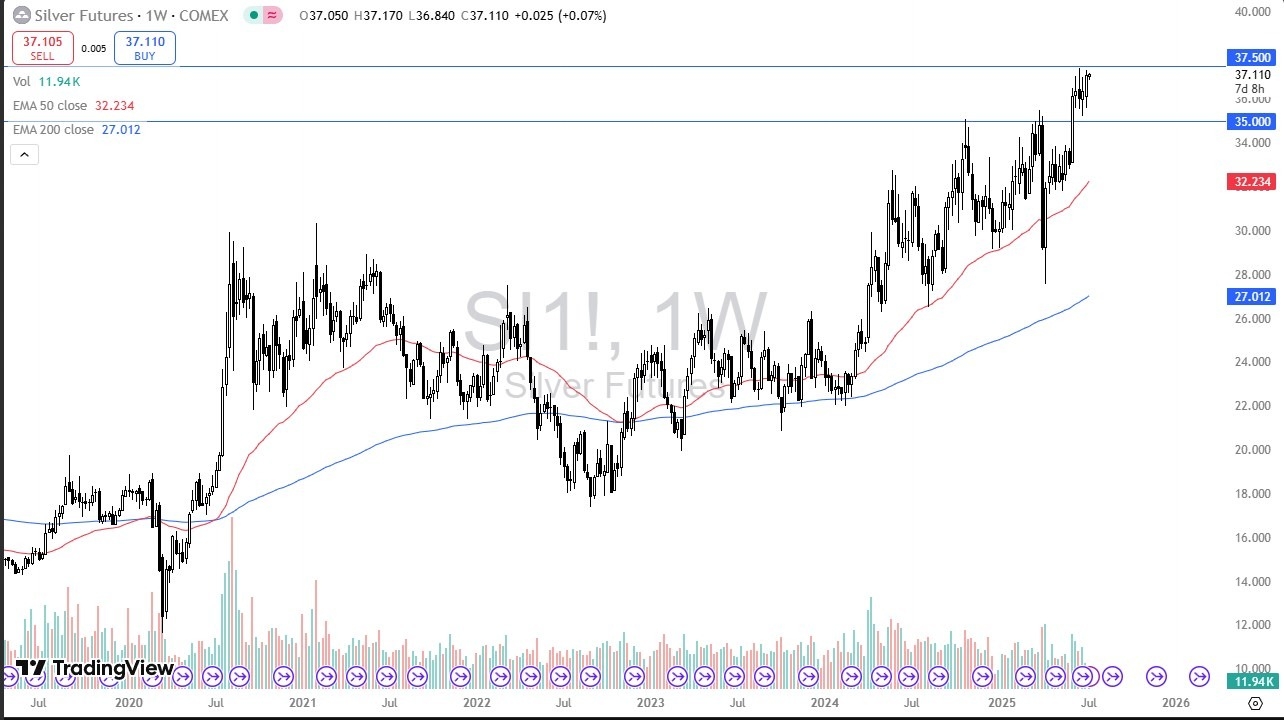

Silver

Silver's price action was very bullish over the past week, but as you can see from the weekly chart, the market continued to bounce between the $35 mark and the $37.50 level above. This market will likely continue to experience a lot of noise, and I think price action has been rather bullish overall.

Any short-term pullbacks that occur would likely attract attention, especially if the gray metal approaches the $35 level. A break above the $37.50 mark could open up a move to the $40 level.

Gold

(Click on image to enlarge)

The gold market was slightly bullish during the trading week, but, much like the silver market, it has been stuck in a fairly tight range of around $300. The $3200 level underneath has been holding onto a significant amount of support just waiting to act, and the $3500 level above has served as a significant barrier.

All things being equal, if gold manages to break above the $3500 level, then such a move could spark a rise to the $3800 level. Ultimately, gold has continued to see plenty of buyers on dips, and I fully anticipate that it will continue to go higher over the next several weeks.

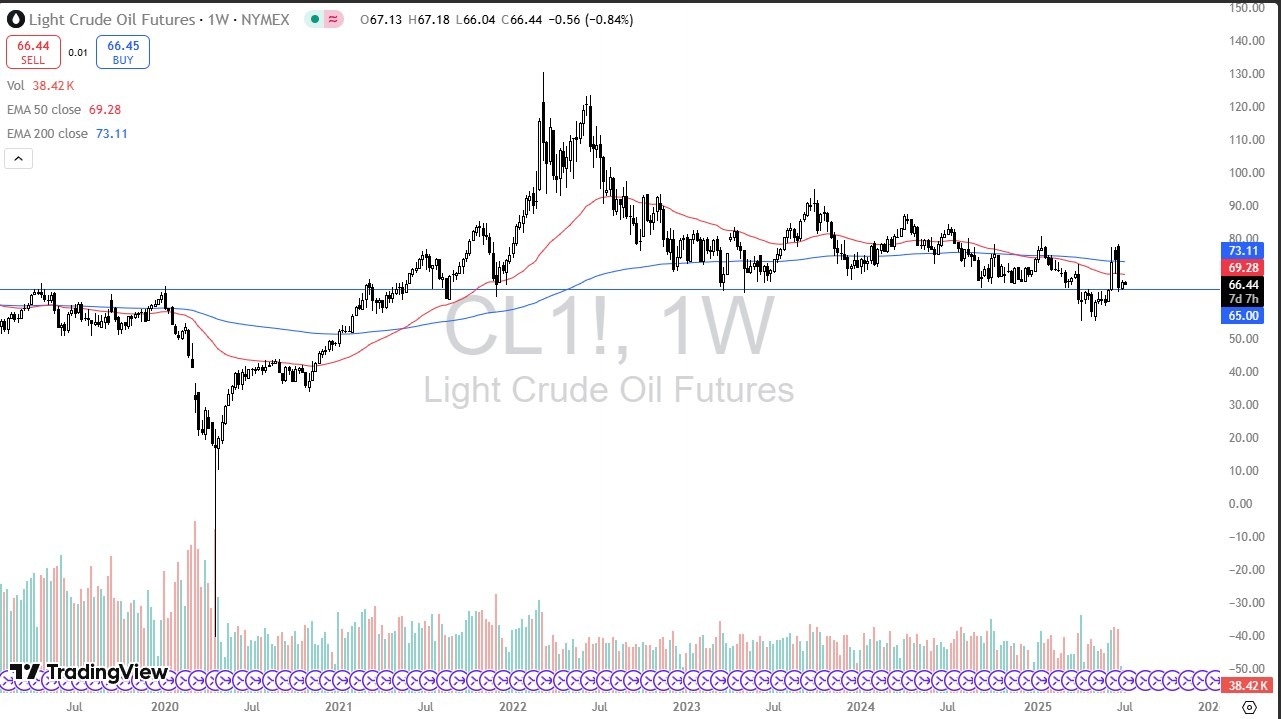

Crude Oil

(Click on image to enlarge)

The crude oil space bounced just a bit during the course of the week, as it continued to hang around the $65 level. This is a market that I think will continue to see a lot of volatility, yet I also anticipate it rallying from here to reach the $80 level as we head into the busiest time for demand in crude oil. Short-term pullbacks at this point in time could likely serve as buying opportunities.

Bitcoin

(Click on image to enlarge)

Bitcoin moved back and forth during the week as it continued to experience a certain amount of upward pressure, with the $110,000 level serving as a major barrier. If it can break above that level, then it could go looking to the $120,000 level.

Short-term pullbacks will likely continue to attract value hunters underneath, especially near the $100,000 level, as this is an area that has previously held some significance.

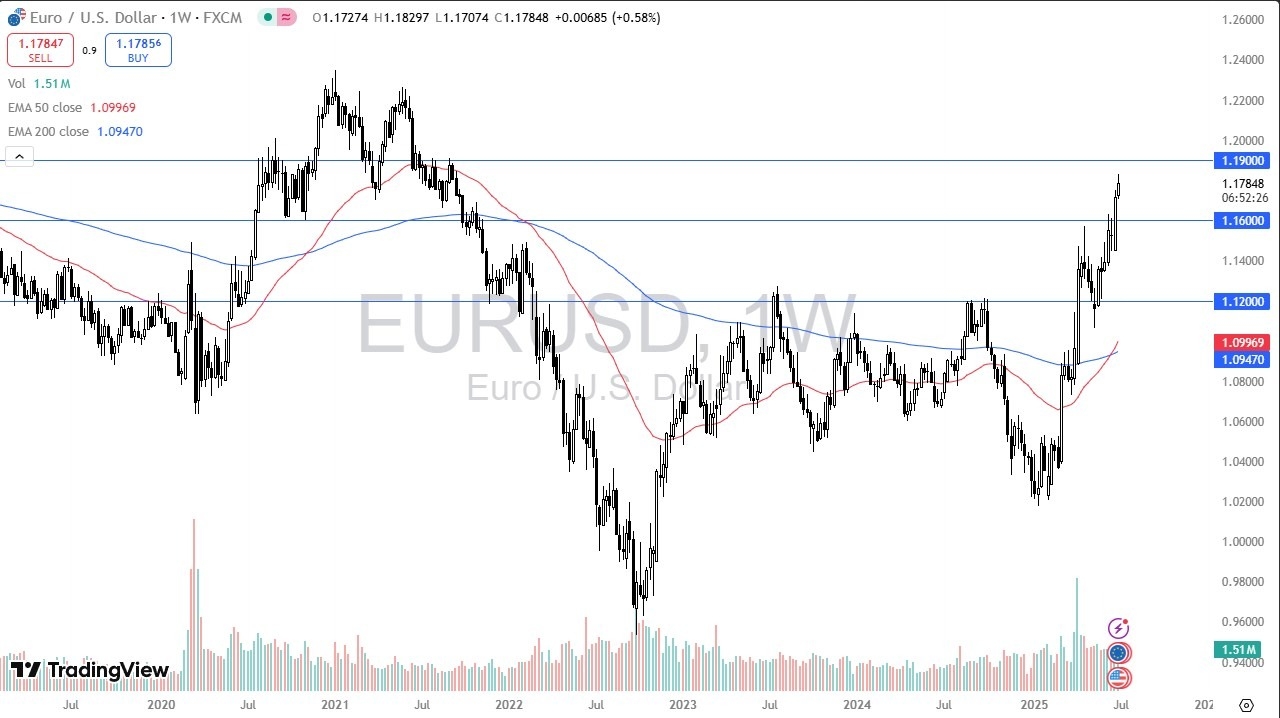

EUR/USD

(Click on image to enlarge)

The euro rallied during the trading week as it continued to see a lot of bullish pressure. I think it could go looking to the 1.19 level, but a short-term pullback could also occur. I’d be interested in going back into this market if the euro dropped down to the 1.16 level and bounced from there.

This is a market that looks very bullish, but it also appears to be a little overstretched at this point in time. I have no interest in shorting this pair anytime soon, but I will be watching the Federal Reserve right along with the rest of the trading world.

USD/JPY

(Click on image to enlarge)

The US dollar initially fell against the Japanese yen during the course of the trading week, but it has since bounced back quite significantly. The JPY142 level is an area that has been support multiple times, and now the 200-week EMA has entered the region.

The weekly candlestick looks like a hammer. If the pair can break above the top of it, then the market could target the 50-week EMA near the JPY148.23 level. Interest rate differentials have continued to favor the US dollar, so I think that there will be plenty of traders willing to enter the space.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 rallied a bit during the trading week, but it gave back some of its gains as the space continued to experience a large amount of noise. Ultimately, this market has been rather bullish in recent trading, and I think a short-term pullback is likely to occur. The 22,250 level is an area that I will be looking at very closely.

S&P 500

(Click on image to enlarge)

The S&P 500 rallied during the week to break above the 6200 level. If a pullback was to occur in this space, it would likely attract a lot of attention from traders. The 6150 level is an area that previously has been resistance, so it could now end up being a support level.

Ultimately, this is a market that I think will continue to go much higher if given enough time, especially due to recent market momentum.

More By This Author:

GBP/USD Forex Signal: Pound Holds 1.3550 SupportAUD/USD Forecast: Rebounds After NFP-Driven Drop

BTC/USD Forecast: BTC Gains On Dips Ahead Of Key U.S. Jobs Data

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more