Pairs In Focus - Sunday, Jan. 5

Image Source: Pixabay

USD/MXN

(Click on image to enlarge)

The US dollar rallied rather significantly against the Mexican peso during the previous week, but it has since given back some of the gains. I will continue to focus on the MXN21 level. A break above this level could open up the possibility for a huge move higher.

I believe the space will continue to see some back-and-forth movement, as many traders have seemingly adopted a “buy on the dip” type of attitude. If a break down below the MXN20 level were to occur, then such a move could spark more of a deeper correction.

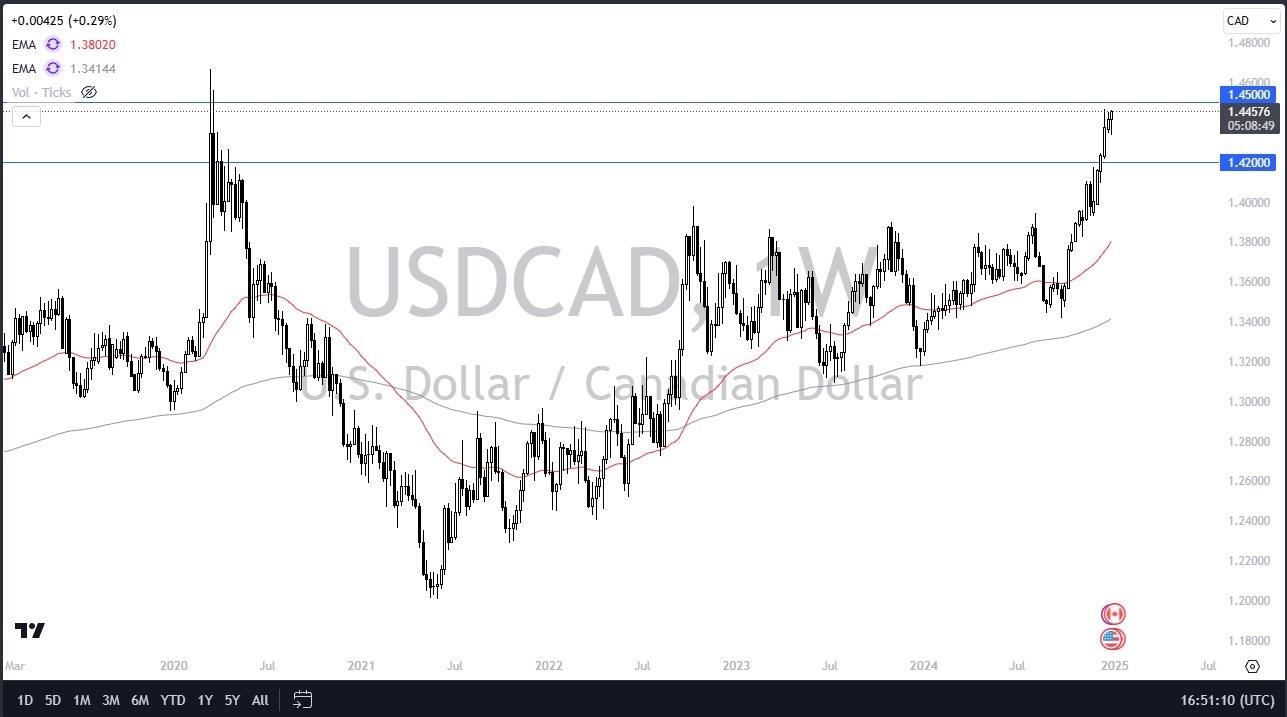

USD/CAD

(Click on image to enlarge)

The US dollar initially fell against the Canadian dollar during the week, but it then turned around to show signs of significant strength. The market may continue to see more of a “buy on the dip” attitude, as market participants have been paying close attention to the 1.45 level.

A move above that level could see the market continue going higher, perhaps with a break out through massive resistance. Between now and that move, I anticipate that traders will see the occasional pullback in order to take profit. I also believe that there are plenty of buyers out there that are willing to get involved.

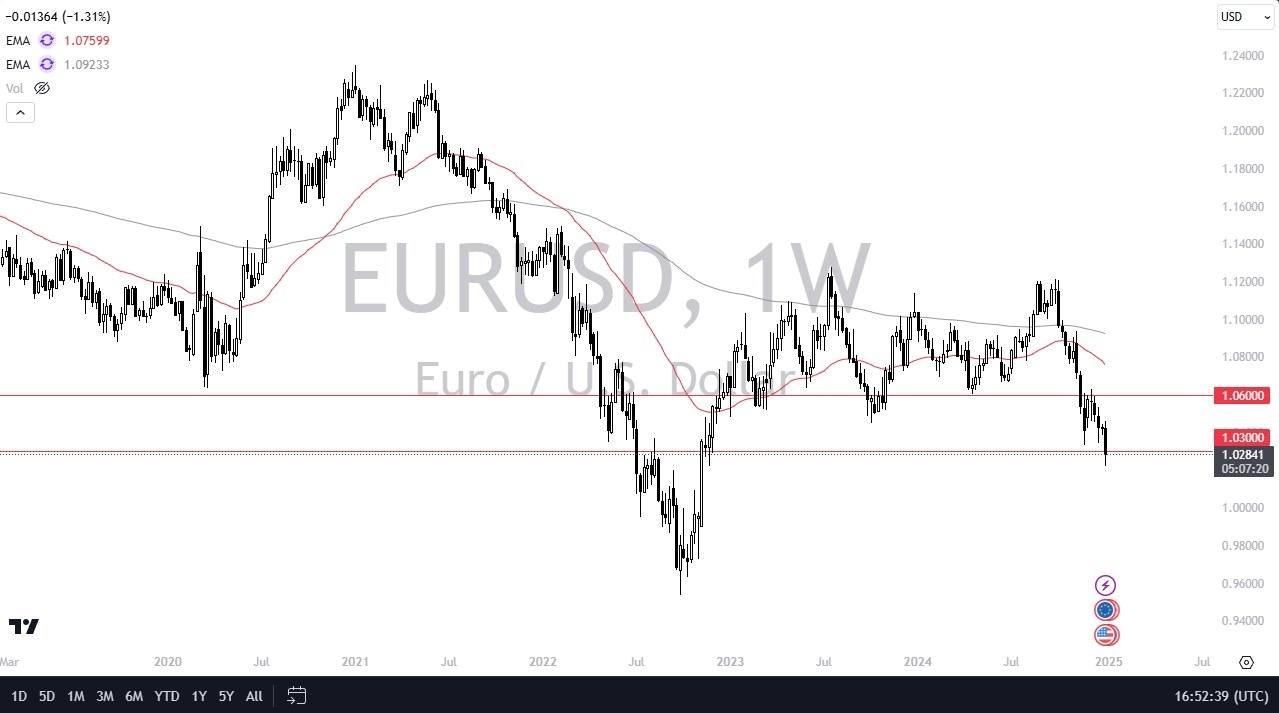

EUR/USD

(Click on image to enlarge)

The euro initially tried to rally during the trading week, but it then fell apart as it broke below the 1.03 level. This level is a large, round, psychologically significant figure, and an area that previously had served as massive support.

The fact that price action pierced that level suggests to me that the euro will likely continue to go lower. All things being equal, I like the idea of feeding short-term rallies that show signs of exhaustion, and I think the euro is eventually going to approach the parity level.

GBP/USD

(Click on image to enlarge)

The British pound broke down during the course of the week, as it finally broke below the 1.25 level. Now that the pound has reached below that point, there’s a chance that the market could run to the downside.

That being said, I think short-term rallies could potentially serve as selling opportunities. However, I should also point out that the British pound has outperformed many of its peers against the US dollar, so I think the downside is going to be a little less drastic here than it is in other major currency pairs denominated in the US dollar.

USD/JPY

(Click on image to enlarge)

The US dollar triumphed a bit against the Japanese yen during the previous week. Quite frankly, traders seem ready to step in and pick up any offered “value” in the greenback that they can get.

The JPY155 level underneath has served as a major support level, while the JPY158 level above has been a massive barrier. If the market can break above the JPY158 level, then the US dollar could spike and approach the recent swing high near the JPY161.50 level.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 has experience a bit of noise throughout the week. The 21,000 level is an area that could serve as potential support. If the index witnessed a break down below the lows of the week, the 21,000 level could trigger a bit more selling. At that point, I would anticipate that the Nasdaq 100 would go looking to the 20,000 level for a significant amount of support based on the large, round, psychologically significant figure.

All things being equal, I expect that this market will see more back-and-forth movement during most of the week, as we have the Non-Farm Payroll numbers coming out on Friday. Either way, I’m bullish longer-term.

Gold

(Click on image to enlarge)

Gold markets moved back and forth during the trading week, as the space appeared to be sorting out a direction for the longer-term. Gold seems to be entering a rather large consolidation area, as the yellow metal had originally shot straight up in the air. I am very neutral on the gold market right now, but I recognize that a pullback could form potential "value" at the $2500 level.

DAX

(Click on image to enlarge)

The German DAX was rather quiet during the trading week. Price action was mostly similar to what was seen in the previous week, but I do find it interesting that the EUR19,750 level has offered a significant floor in the market over the last three weeks. Even if there index could break higher, perhaps clearing through the EUR20,000 level, I don’t see any potential for it to reach the highs at the EUR20,500 level.

More By This Author:

USD/CAD Forecast: Will The Dam Break For CAD?Gold Forecast: Gold Eyes Breakout

AUD/USD Forecast: Breaks Below Crucial Support

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more