Pairs In Focus - Sunday, Jan. 28

Image Source: Pixabay

Crude oil surpassed the $75 figure before targeting the $85 mark. The USD/JPY currency pair appears to be volatile, while the USD/CAD pair has followed the price of oil. Bitcoin rebounded throughout the week, while gold remained steady. The S&P 500 appears to be bullish.

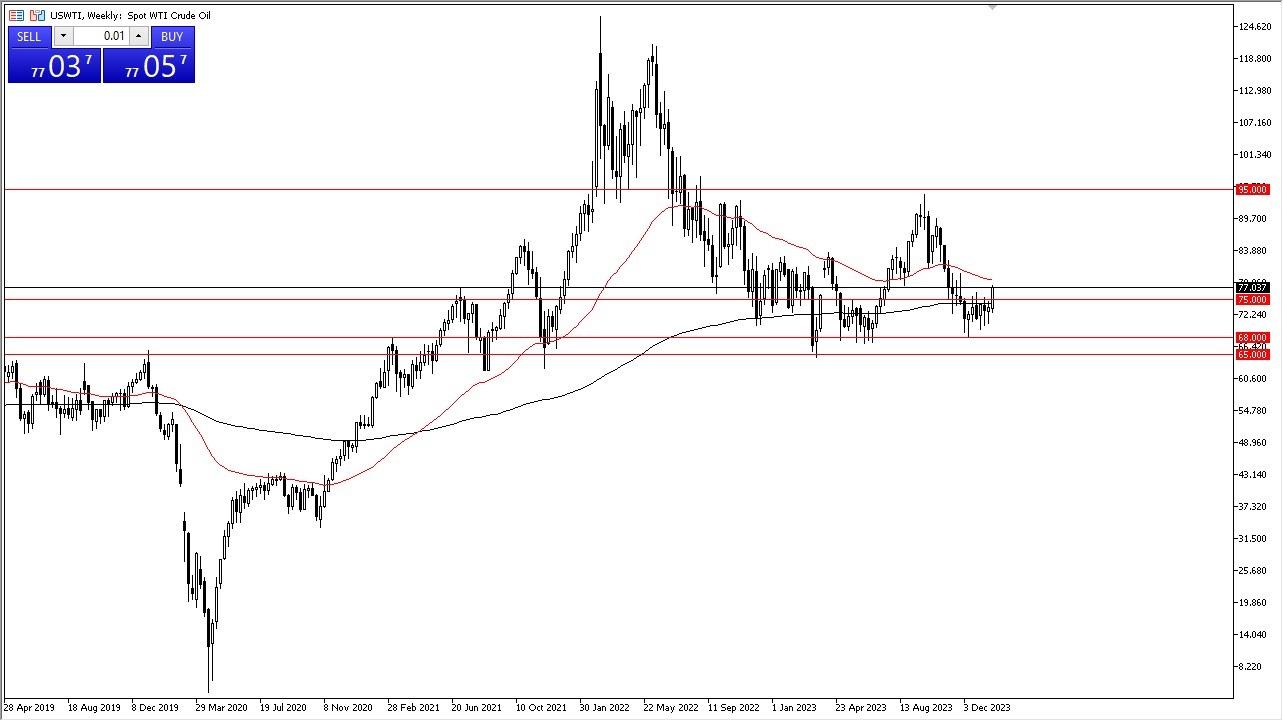

WTI Crude Oil

(Click on image to enlarge)

The crude oil market saw quite a bit of upward pressure during the course of the week, as oil finally broke above the crucial $75 level. By doing so, the market looks ready to attack the 50-week EMA, which is an area that has proven to be important more than once.

With this, a break above that point would open up the possibility of a move to the $85 level. Short-term pullbacks should continue to be buying opportunities in this market, as crude oil has behaved favorably over the last several weeks.

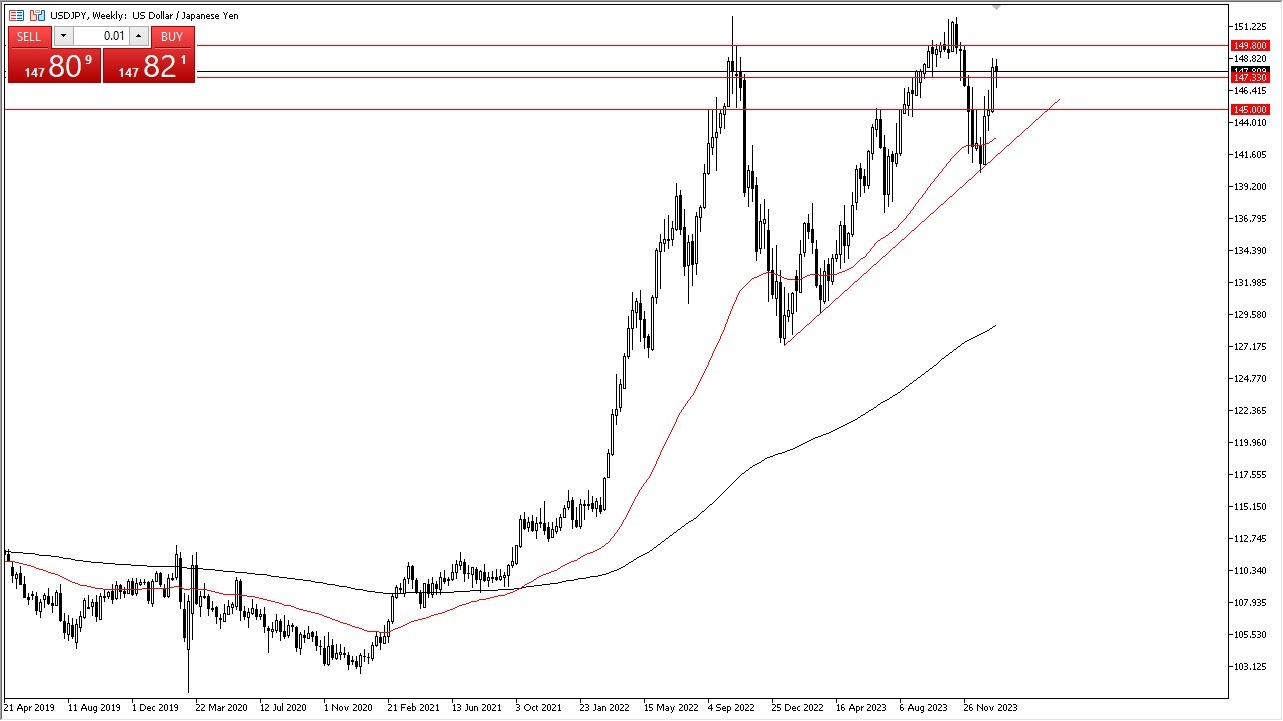

USD/JPY

(Click on image to enlarge)

The US dollar initially fell during the course of the trading week against the Japanese yen, only for it to turn around and show signs of life again. By doing so, it looks as if the market is going to continue to be very volatile, but I do think that this area will retain more of a “buy on the dip” attitude going forward.

Underneath, I see the JPY 145 level as a major support level that a lot of people will be paying close attention to. However, a move to that level doesn't appear likely.

USD/CAD

(Click on image to enlarge)

The US dollar initially tried to rally against the Canadian dollar during the week, and it even broke above the 1.35 level. However, just like the previous week, the US dollar sold off against the Loonie.

We witnessed a Bank of Canada interest rate decision this past week, where it was stated that interest rate hikes aren’t necessarily an impossibility going forward. Quite frankly, I think what we are seeing here is a return to the old correlations of the Canadian dollar following the oil market, which looks very bullish.

USD/CHF

(Click on image to enlarge)

The US dollar tried to break above the 0.87 level against the Swiss franc over the past week, but it gave up those gains rather quickly. At this point, it looks like it could continue to drive down, perhaps even to the 0.85 level.

However, if it can break above the candlestick high from the past week, then we could see this market really start to take off and reach toward the 0.8850 level. Keep in mind that both of these are considered to be safety currencies, so you would have to assume that there is going to be a lot of noise regardless of what happens in the market.

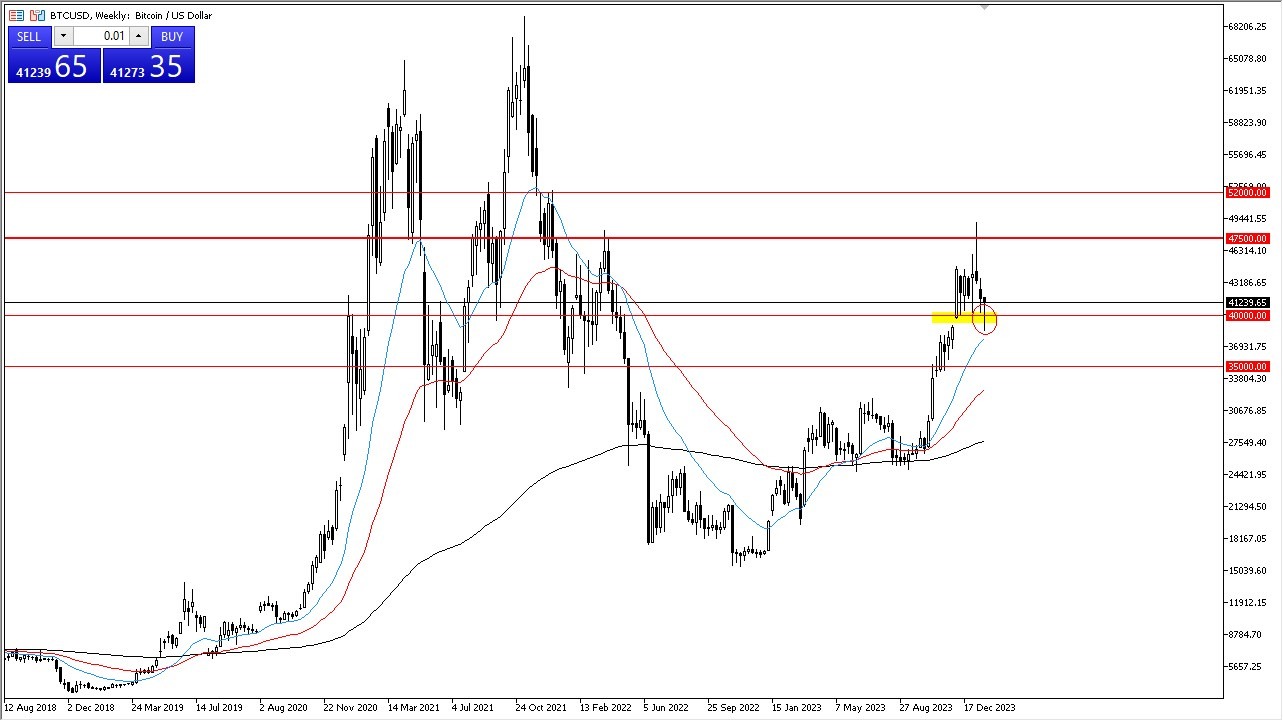

Bitcoin

(Click on image to enlarge)

Bitcoin plunged to kick off the week, dropping down below the $40,000 level only to turn around and save itself. By doing so, it appears ready to continue the overall uptrend, and it’s worth mentioning that the market has seemingly reaffirmed the $40,000 level as being an area of interest. Now, the question is going to be whether or not the cryptocurrency is going to try to get back to the top of the overall range, which I see at the $47,500 level.

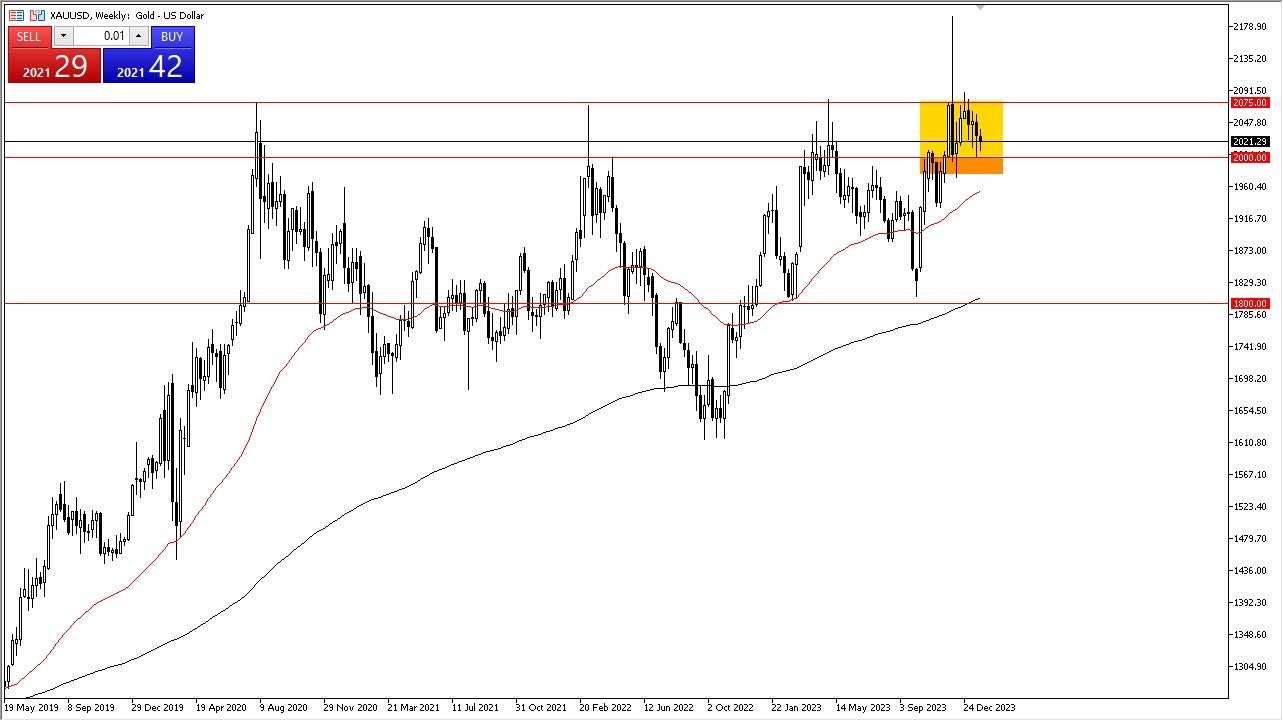

Gold

(Click on image to enlarge)

Gold markets appeared to be somewhat choppy during the course of the week, but the idea of the $2000 level being support was reaffirmed. I think this is an area where buyers will continue to come in and pick up the dip every time it shows up, as there are a lot of central banks out there that could be loosening monetary policy. Furthermore, gold has a geopolitical aspect tied to it that can have a major influence as well.

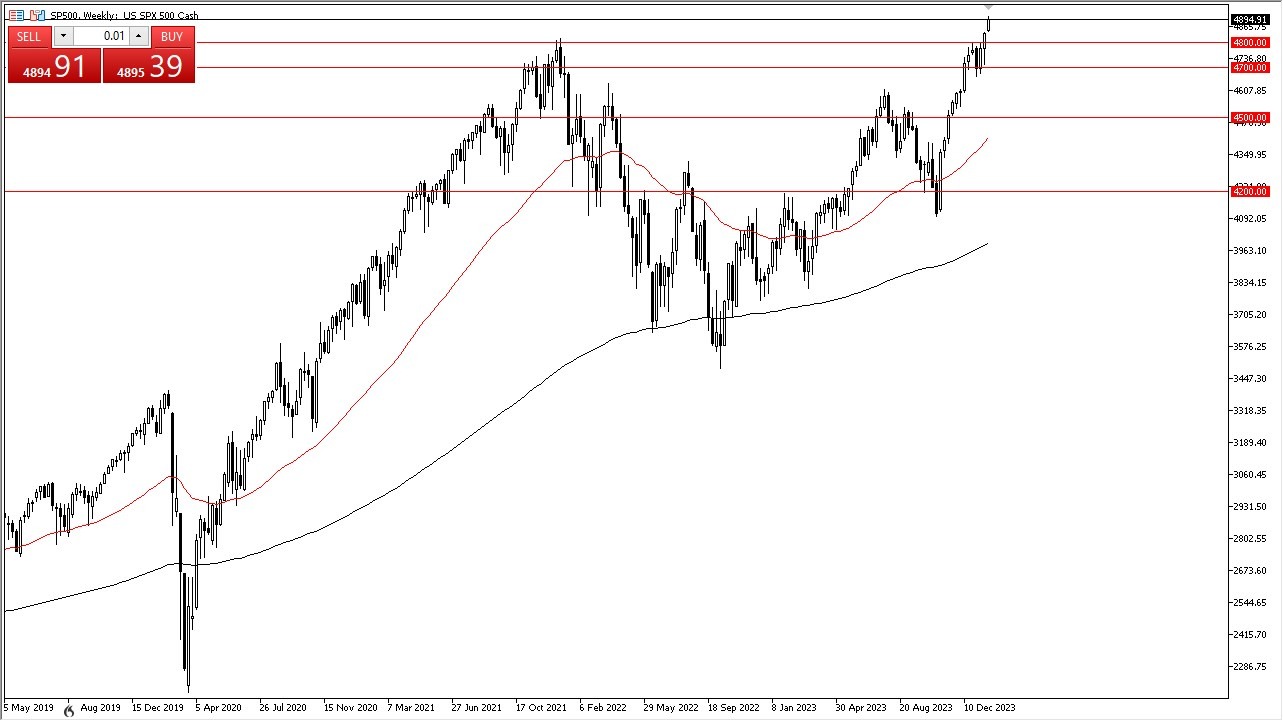

S&P 500

(Click on image to enlarge)

The S&P 500 had been bullish all week, as traders continued to assume that the Federal Reserve is there to back them up. With loose monetary policy coming, that obviously will attract a lot of inflows into risk assets, because that’s the way things have worked since the Great Financial Crisis.

At this point, the economy doesn’t seem to matter, and “bad news is good news” going forward. Each dip in the index will almost certainly attract a certain amount of value hunting by those looking to play the trend.

GBP/USD

(Click on image to enlarge)

The British pound continued to bang up against the 1.2750 level, an area that I think eventually could give way. However, it’s probably worth noting that it is also the 61.8% Fibonacci level from the selloff. I think the pound will remain range-bound with an upward tilt until we finally see it break out of what has been a very solid level.

More By This Author:

Nasdaq 100 Forecast: Nasdaq 100 Continues To Rocket HigherNatural Gas Forecast: Natural Gas Continues To Recover

Bitcoin Forecast: Bitcoin Continues To Wrestle With $40,000

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more