Pairs In Focus - Sunday, Jan. 12

Image Source: Unsplash

Gold

(Click on image to enlarge)

Gold markets experienced a very strong week, as gold tested the crucial $2700 level. It will be important to watch whether or not the yellow metal can break above that point. A daily close above the $2700 level could be a sign that the space may continue to go higher.

On the other hand, gold could also experience a pull back. However, that would likely offer a buying opportunity due to the consolidation seen in the space.

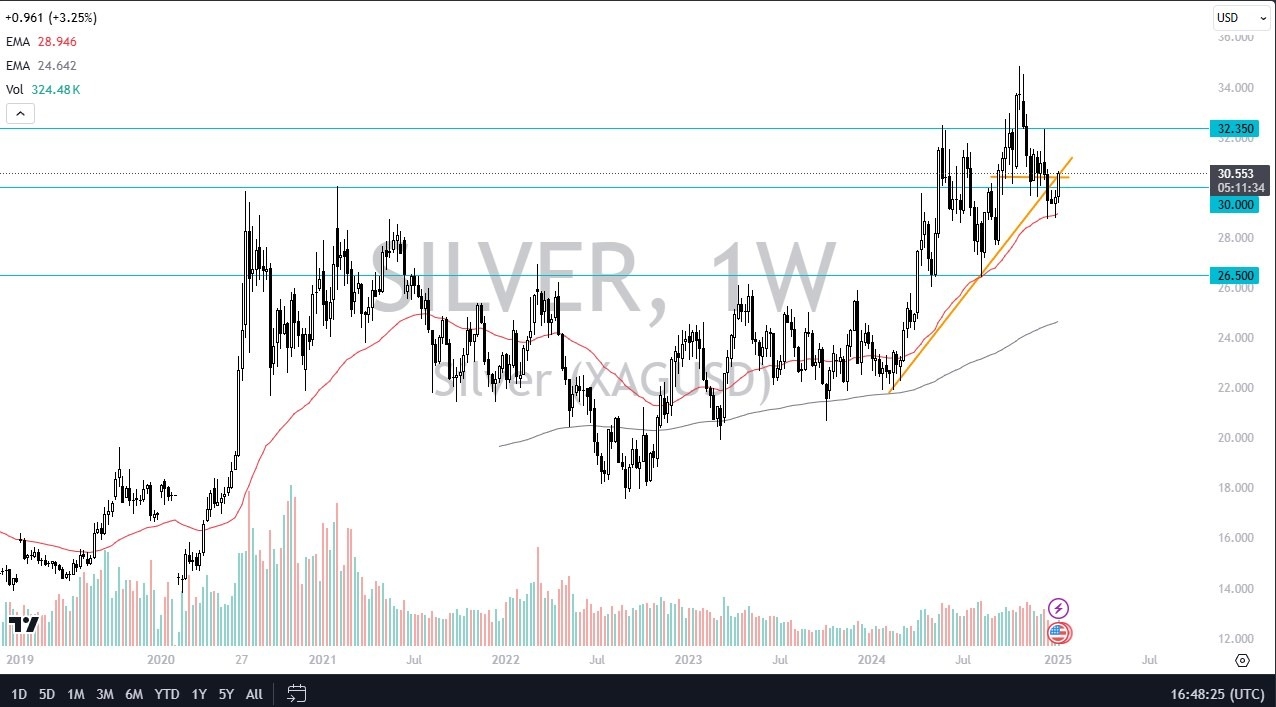

Silver

(Click on image to enlarge)

Silver rallied rather significantly during the course of the trading week, and it found itself near a major area of resistance. Silver has maintained a previous uptrend line on the charts, and the 50-day EMA can also be seen. With that being said, I think the market is at a major point of inflection.

At this point, if silver manages to break above the $31 level, then it could continue to go much higher. On the other hand, a move below the $30 level would signal that there’s trouble ahead.

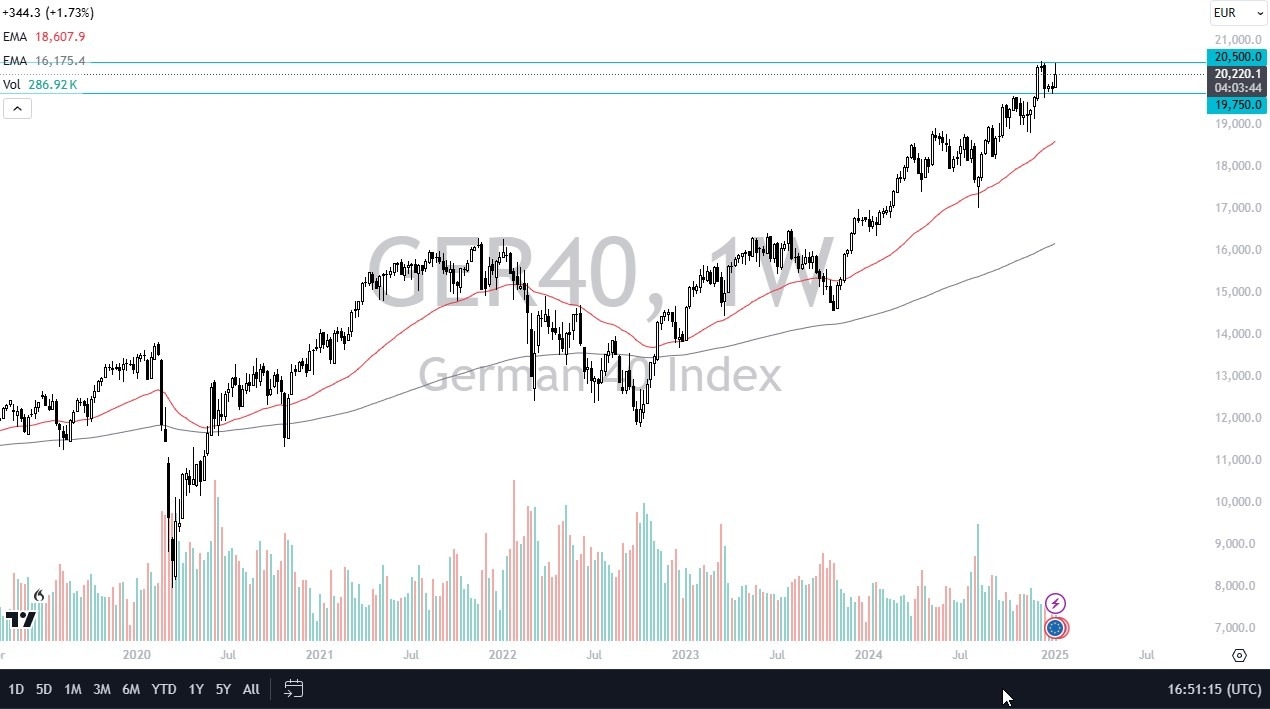

DAX

(Click on image to enlarge)

The German index saw a positive week, but it continued to see a lot of noise near the EUR20,500 level. It should be noted that this level has previously offered a bit of resistance.

Short-term pullbacks in the index could end up providing nice buying opportunities. As things stand right now, I don’t have any interest in trying to short this market.

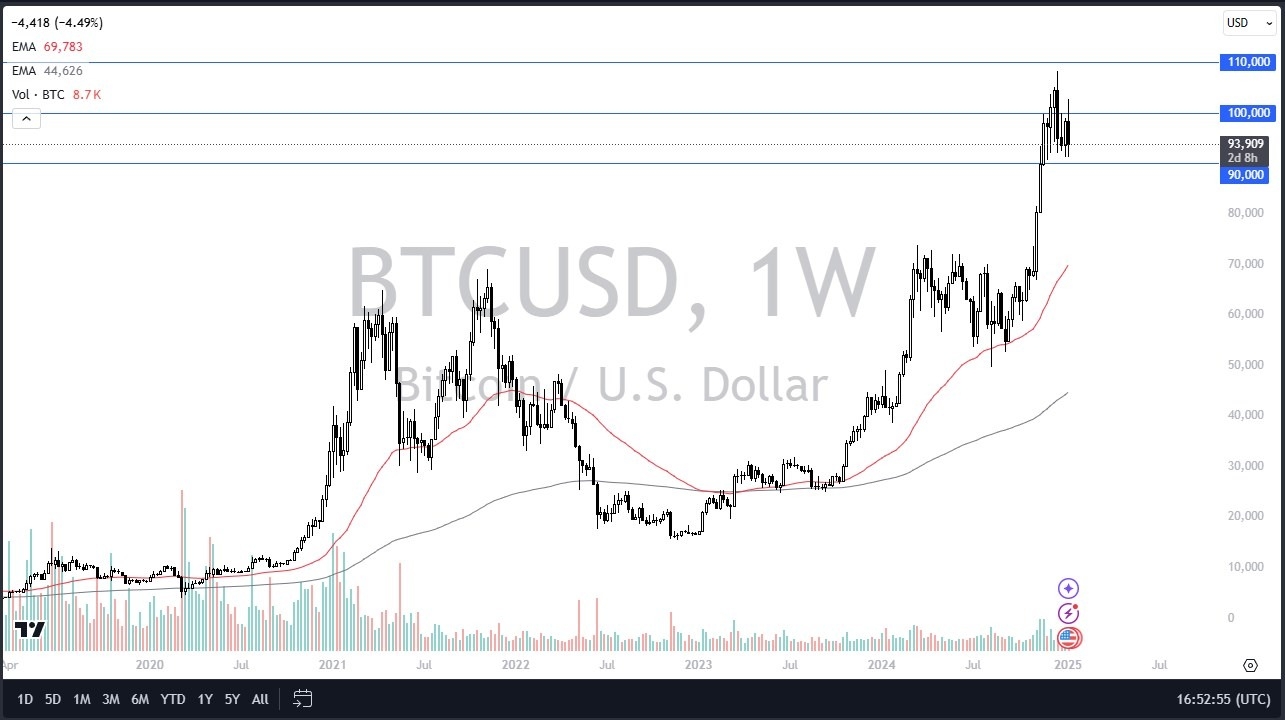

Bitcoin

(Click on image to enlarge)

Bitcoin moved back and forth during the week, as it tried to break out and climb above the $100,000 level. It failed, however, and Bitcoin ended up plummeting toward the $93,000 level yet again. This is an area that has witnessed significant support, and I think that will only continue to be the case.

A move below the $88,000 level would see this market sell off quite drastically, perhaps even down to the $74,000 level. On the other hand, if Bitcoin were to break above the top of the candlestick for the week, it would signal the potential for a shift back to the $109,000 level.

USD/CAD

(Click on image to enlarge)

The US dollar initially fell against the Canadian dollar during the course of the trading week, before it then turned around to form a massive hammer. This seemingly demonstrated just how much upward pressure has been seen in the currency pair.

With the Canadian Parliament on pause, it’s difficult to imagine that people would want to throw money at the Canadian dollar. Given enough time, I think the psychologically and structurally important 1.45 level could be broken through. Short-term pullbacks should continue to provide buying opportunities.

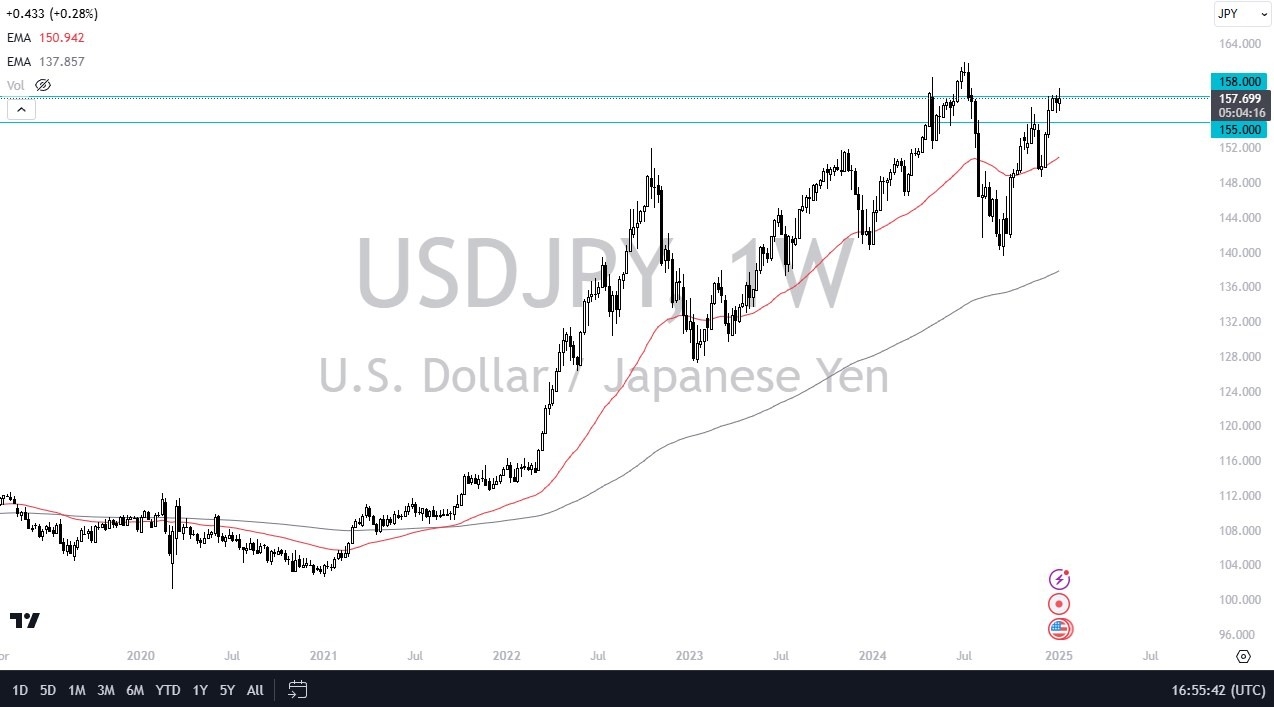

USD/JPY

(Click on image to enlarge)

The US dollar pierced the crucial JPY158 level during the course of the trading week, but it then fell pretty significantly following the jobs report. This shift occurred just after the US dollar shot straight up in the air, so it goes to show just how much volatility there is in the market.

A break above the top of the candlestick could send the market higher, if given enough time. However, I think the space would still see quite a lot of "buy on the dips" price action.

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 initially tried to rally at the start of the week, but it then turned around and broke down below the lows of the last couple of weeks, as it began to show signs of extreme weakness.

Furthermore, Wall Street has been whining about the idea that the US economy is fairly strong, and they won't see cheap money from the Federal Reserve anytime soon. That being said, I do think eventually people will start to think that a strong economy could actually be a good thing. As things stand right now, though, it seems unlikely that markets could be entering a strong downtrend.

S&P 500

(Click on image to enlarge)

The S&P 500 initially tried to break above the 6000 level, but it was then slammed near the 5800 level. This is an area that should see significant support. It should be noted that the market has been reacting to a strong US economy and a strong US dollar. I think the index will see a bounce that traders can start buying into, if given enough time.

More By This Author:

USD/CAD Forecast: Is The Dam About To Break In The Canadian Dollar?USD/CAD Forecast: Friday's Critical Moves

USD/JPY Forecast: Finds Buyers On Dips

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more