Pairs In Focus - Sunday, April 6

Image Source: Pixabay

Gold

(Click on image to enlarge)

Gold markets sold off rather viciously during the trading week. However, I believe that the yellow metal may eventually find buyers, especially if it manages to approach the $3000 level. That level is a large, round, psychologically significant figure that traders will likely be paying close attention to.

Ultimately, gold remains very bullish, and I do think that it is only a matter of time before the buyers come back in and pick this market up. Remember, the precious metal space formed a bullish flag that could suggest a move to the $3300 level.

S&P 500

(Click on image to enlarge)

Basically, the S&P 500 continued to get slapped around by the idea of tariffs, just as most indices did. However, on Friday, the index saw some buyers step in to pick up the market.

If buyers continue to enter the space, then the worst of the selling may be behind us. This isn’t to say that you should be a buyer of this market, however, I am just commenting that the selling appears to be a little bit overdone at this point. The 5000 area underneath should continue to be a significant support level as well, so it may be prudent to pay close attention to it.

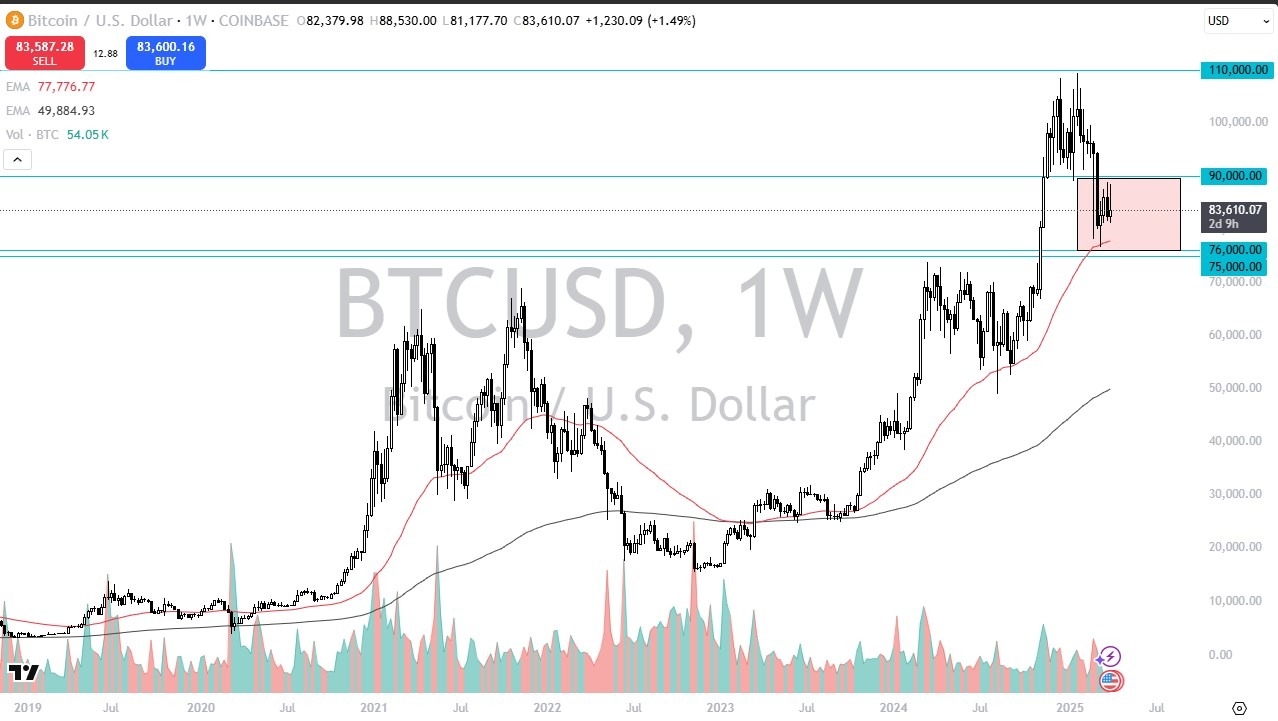

Bitcoin

(Click on image to enlarge)

Bitcoin performed relatively well in comparison to the rest of the markets. The cryptocurrency has been stuck in a consolidation area for a while. Although it gave up quite a bit of its gains, Bitcoin returned to where it started for the week, which is something that you cannot say for most assets.

Granted, Bitcoin sold off previously, so perhaps all of the “weak hands” have been flushed out? Regardless, I think the $75,000 level will continue to be the “floor in the market.”

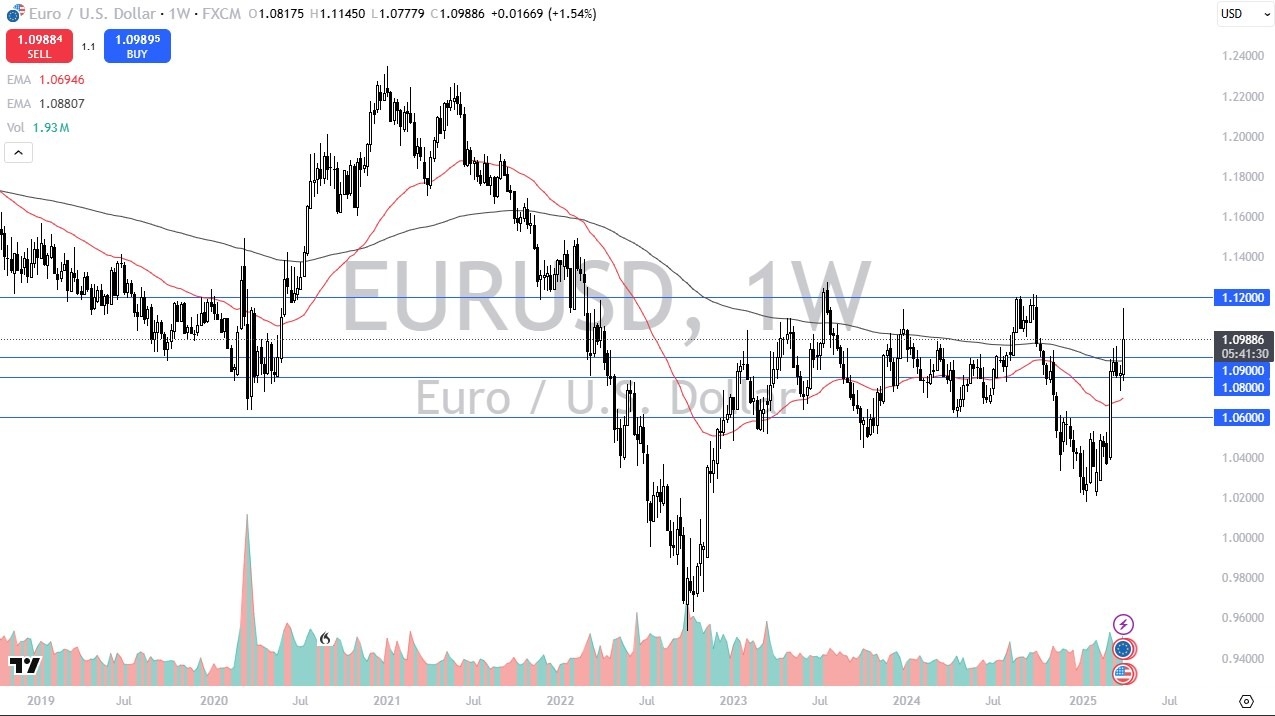

EUR/USD

(Click on image to enlarge)

I believe this coming week could be crucial for the euro, as the market has exploded to the upside, mainly in reaction to the new tariffs in the United States. However, sooner or later people will run back to the dollar for safety, and this flight to safety may have already started.

As things stand at the moment, I believe the currency pair could remain stuck in a 300 pip range between the 1.09 level and the 1.12 level, which has acted as a ceiling more than once. Choppy, sideways, and erratic behavior will likely continue to be the norm in this space for quite a while.

DAX

(Click on image to enlarge)

The German index was absolutely crushed during the week. While it was previously one of my favorite indices, I think a drop down to the EUR20,000 level could be in sight.

While it has outperformed the lot of the New York indices, it looks like it could be getting ready to play “catch up” with those same indices. After all, the tariff war will likely hurt European markets in an outsized way, as Europe blocks or places tariffs most US products already. Simply put, the American markets just don’t sell much to the European markets on a day-to-day basis.

USD/MXN

(Click on image to enlarge)

To begin the week, the US dollar fell against the Mexican peso, but it now looks like the area around the MXN19.90 level may continue to offer massive support. At the close of the week, the pair was seen right in the middle of the previous consolidation area, between the MXN20 level at the bottom and the MXN21 level at the top.

It’s very likely to stay in this range, as long as economic uncertainty persists. The US dollar would likely be used as a safety currency in this scenario, and if global economic conditions start to deteriorate, a major exporter like Mexico would potentially suffer. For what it is worth, no new tariffs were placed on Mexico, as the Mexican and the American markets have been working together quite well over the last month or so.

USD/CAD

(Click on image to enlarge)

This pair will likely be interesting to watch due to its status at the “epicenter of the trade war nonsense” going forward. At this point, the American markets seemingly hold all the cards, but the Canadian markets are still fighting on every front. Good on them, but sooner or later the Canadian dollar will pay the price, just as it has done so for several months.

While I do expect to see a lot of volatility, the fact that the US dollar bounced so hard this past week suggests that there is still more upward bias in the space. Furthermore, the Canadian economy showed a loss in employment numbers on Friday, while the American economy still saw plenty of new hires. You should also keep in mind that there is a major election in Canada in a couple of weeks, so a lot of the recent rhetoric may die down after April 28.

Crude Oil

(Click on image to enlarge)

Crude oil initially tried to rally a bit during the trading week, but it was slammed at the $72.50 level. It broke significantly below the $65 level, as it showed quite a bit of negativity. This could be due to a mixture of concerns about the global growth situation going forward, as well as the fact that OPEC+ has stated that they are going to increase production by 400.000 barrels per day, despite global growth potentially slowing.

More By This Author:

BTC/USD Forecast - Looking For BuyersSilver Forecast: Looking For Buyers On Dips

BTC/USD Forex Signal: Rebounds, Faces 200-Day EMA Test

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more