Pairs In Focus - Sunday, April 20

Image Source: Unsplash

Silver

(Click on image to enlarge)

Silver moved back and forth during the course of the trading week, as it tested the $33 level. This level has previously been an area of significance, though it seems to be nothing more than a target at this point in time. If the gray metal can break above that point, the market could soar even higher, perhaps even to the $35.50 level.

Short-term pullbacks should continue to serve as potential buying opportunities in this market, as the space clearly has a lot of underlying upward pressure. I don’t think this will change anytime soon.

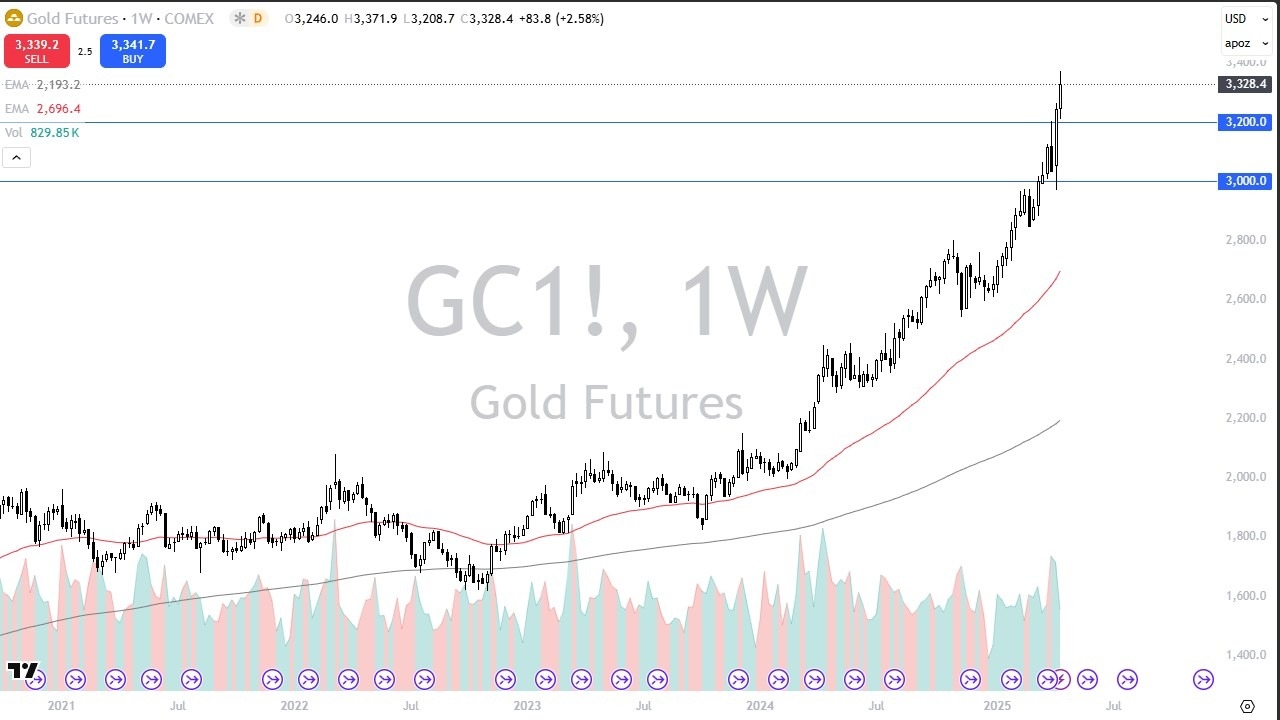

Gold

(Click on image to enlarge)

Gold markets continued to experience a lot of noise throughout the week, although it should be noted that a sell-off was seen on Thursday. This is not overly surprising, though, as I think pullbacks tend to attract traders looking for "cheap" gold.

I believe that the $3200 level underneath will serve as a significant support level, as it was a significant area previously. The large, round, and psychologically significant $3000 level could offer a bit of a short-term floor as well.

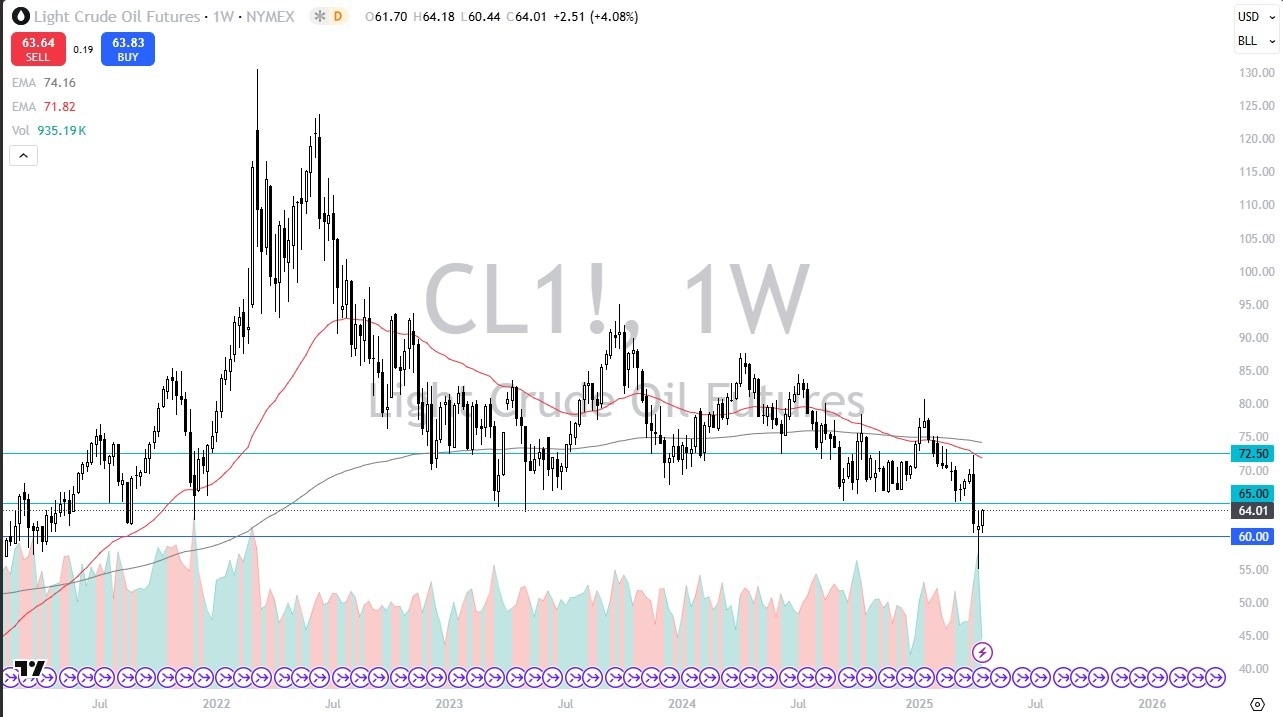

Crude Oil

(Click on image to enlarge)

The crude oil space seemed to maintain an air of positivity, as the $60 level offered support. It seems that the market could even bounce towards the $65 level above. Such a move could spark an even further rise, perhaps even toward the $70 level.

That being said, I think this space will likely remain rather noisy.

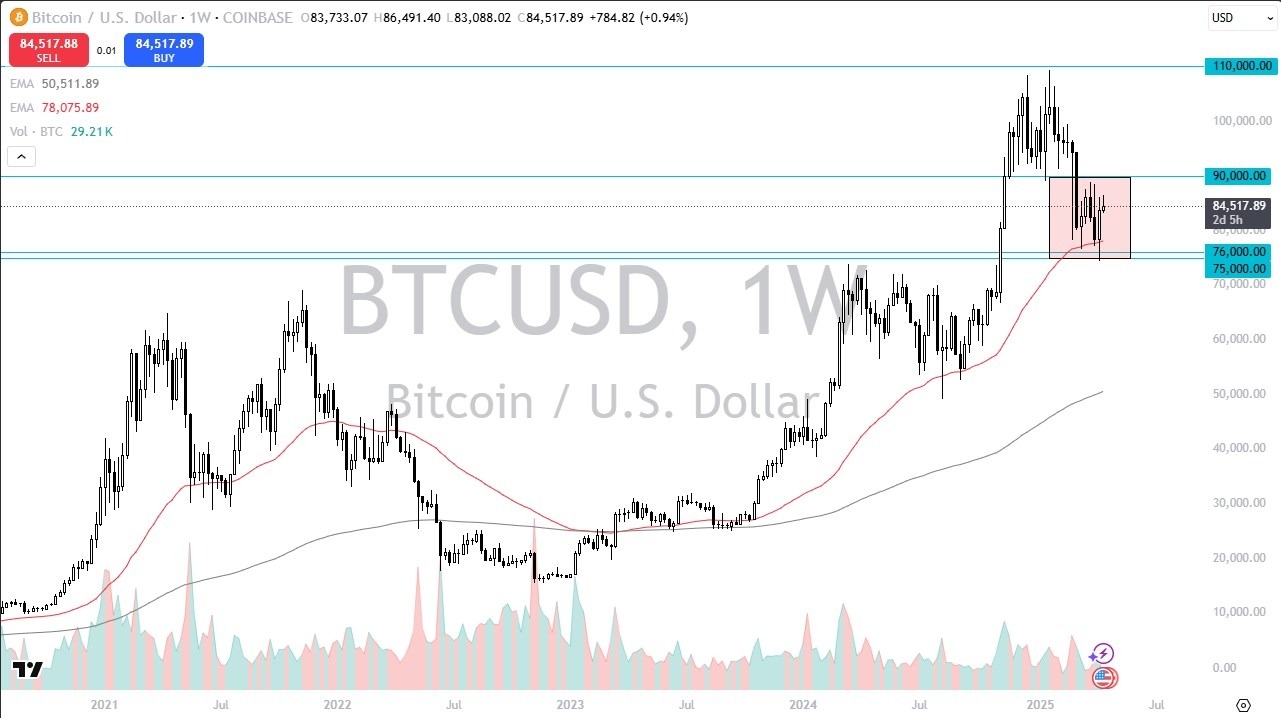

Bitcoin

(Click on image to enlarge)

Bitcoin initially tried to rally during the course of the trading week, but it eventually gave back those gains. The cryptocurrency has been stuck in a range between the $75,000 mark and the $90,000 level above.

I think Bitcoin will continue to experience a lot of noise, although it should be noted that it seems to be in a bit of an accumulation phase at the moment. The biggest thing that Bitcoin needs is for some type of risk appetite to return to the market, as it is such a risky asset for most investors.

DAX

(Click on image to enlarge)

The German index tried to rally to the EUR22,200 level, before it ended up pulling back a bit. This could be due to the Good Friday holiday.

The bounce at the EUR20,000 level has likely caught traders' eyes, especially with the 50-week EMA being seen in that area. I don’t have any interest in shorting this index, but I do expect that any pullback in the index could see traders enter the space, looking to take advantage of “cheap contracts.”

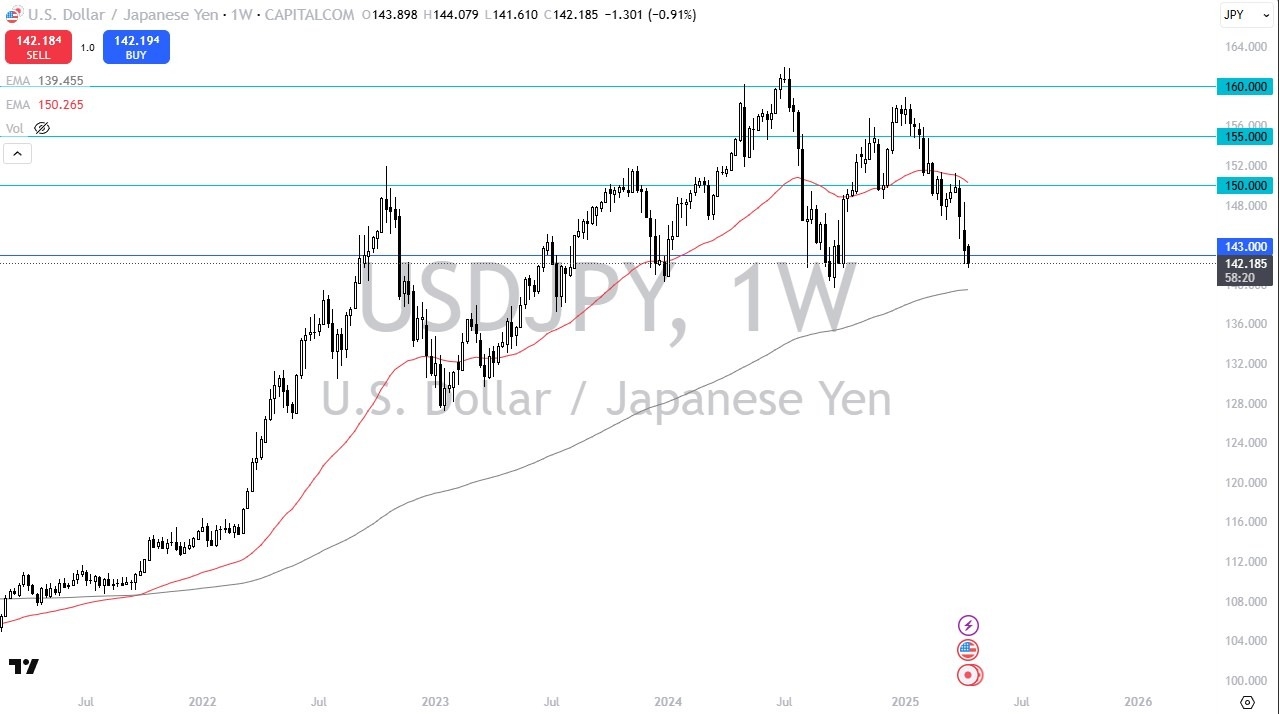

USD/JPY

(Click on image to enlarge)

The US dollar fell during most of the trading week, as it broke down towards the JPY142 level. Some minor support may be found in this area, but I think the currency pair could continue to decline, perhaps even down to the JPY140 level. This market will likely continue to see a lot of volatility. It's worth noting that the 200-week EMA can be seen near the JPY148 level.

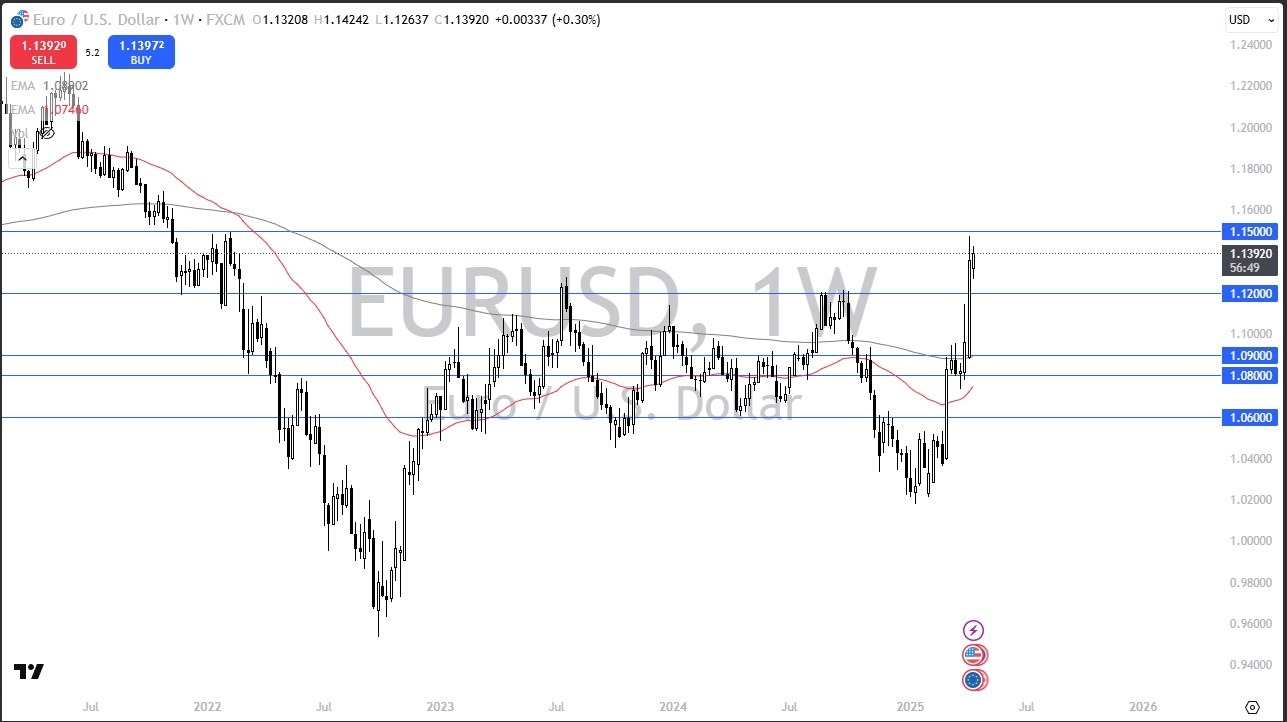

EUR/USD

(Click on image to enlarge)

The euro initially pulled back during the course of the trading week, only for it to then turn around and show signs of life again. At this point in time, I think the 1.15 level is going to continue to be a major resistance barrier, so traders may want to pay close attention to that area.

However, a break above the 1.15 level could see the market surge much higher, perhaps even to the 1.23 level. Underneath, the 1.12 level looks set to serve as a massive support barrier. Thus, the currency pair may be entering into a consolidation phase.

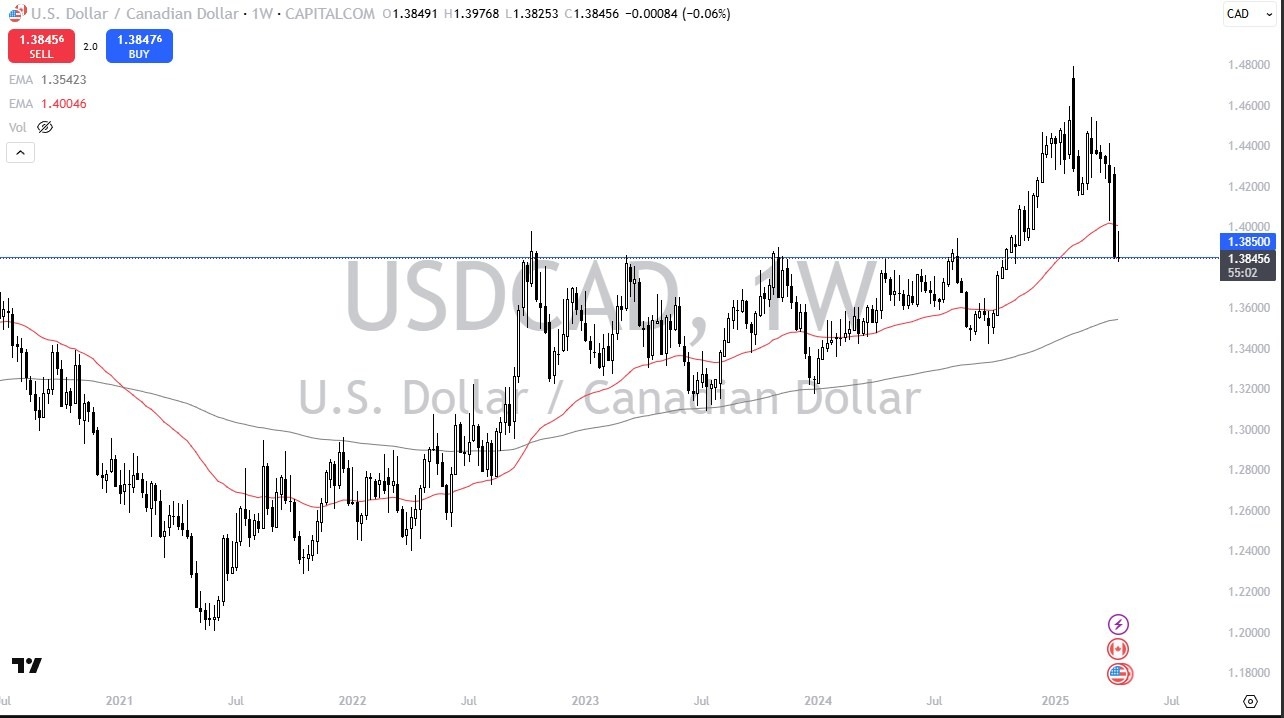

USD/CAD

(Click on image to enlarge)

The US dollar initially rallied against the Canadian dollar during the week. However, it found quite a bit of resistance before it turned around to show signs of weakness. At this point in time, the currency pair has been hanging around the 1.350 level, which is an area that has previously held some significance.

With that being said, I think the market may continue to see a significant amount of resistance above. A break below this point could see the market declining down to the 1.36 level, where the 200-week EMA could be found. However, a break above the 1.40 level could spark a run higher, perhaps even to the 1.42 level.

More By This Author:

USD/CAD Forecast: Consolidates Near Crucial SupportGold Forecast: Pulls Back as Traders Lock in Profits Before Holiday

GBP/USD Forecast: Rally Stalls: Is A Pullback Coming?

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more