Overvalued Equities Are Ignoring These Seven Recession Indicators

Image Source: Pixabay

August is usually a quiet market month. But the creaking and popping sounds coming from the economy are suddenly quite difficult to ignore. What happens when stock that are priced for perfection slam into a long-overdue recession? They fall.

We’re at a very weird moment in time, with stocks acting like Wily E Coyote strapped to a rocket even as numerous economic indicators are flashing bright red recession warnings.

It’s a familiar, but strange, place for a couple of market pros like myself and Paul Kiker to find ourselves. We’ve been here before, back in 2000 and 2008.

It’s where market euphoria blithely overlooks economic facts. Let me be blunt; with stocks now the most expensive they’ve ever been in all of history, the chance of portfolio losses here is approaching certainty.The alternative is that this time has to be different, and it never is.

Stocks are priced to perfection, which means absolutely nothing can go wrong, or else.

Measured against total market capitalization, the Nasdaq shares are by far the most expensive they’ve ever been.

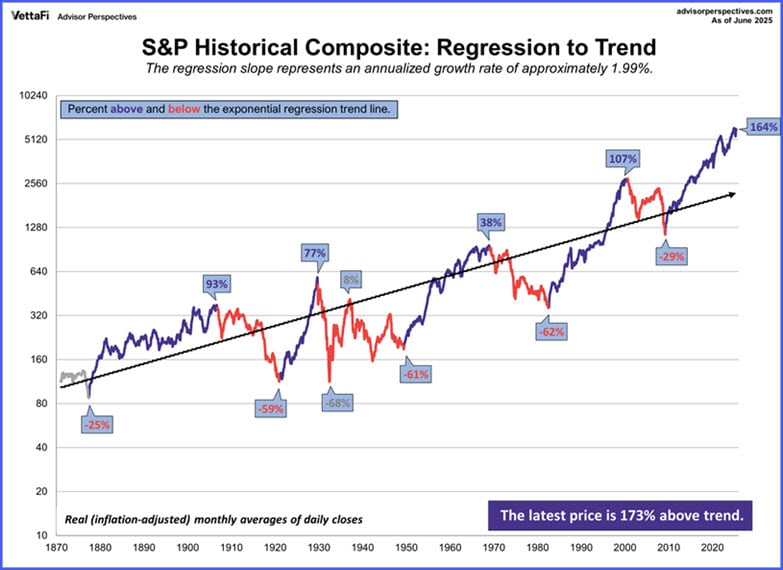

If measured against 150 years of trendline history, the S&P 500 has never been as extended into nosebleed territory:

(Click on image to enlarge)

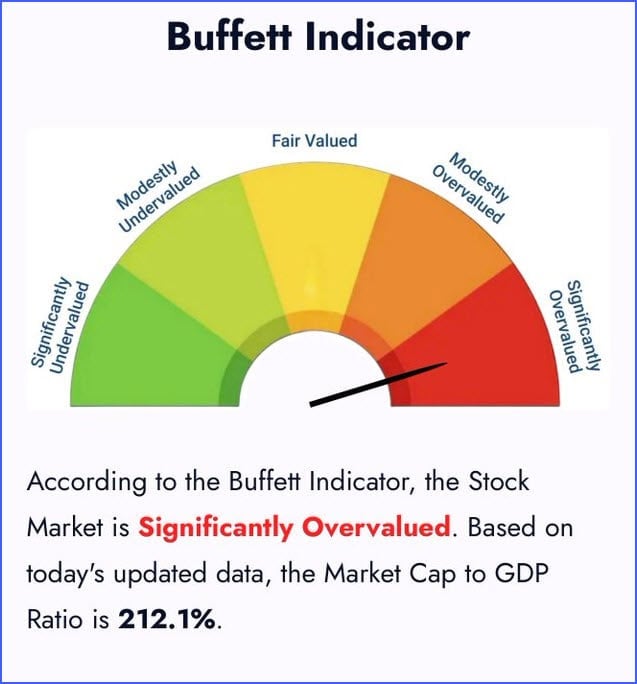

If measured against the total value of the GDP – the so-called Warren Buffett indicator – the grand total of all stocks is now apparently ‘worth’ 2.12 times the entirety of US economic output.

When looked at in terms of ‘price-to-sales’, the S&P 500 tech sector is now sporting a 10x(!!) value.

(Source)

These are just somewhat elevated stock prices, but all-time historical record breaking stock valuations.

Flashing Red: Recession Indicators and What Comes Next

Making those stock valuations especially difficult to defend are these 7 recession warning signs that are flashing bright red:

- UPS stock price is tumbling. This is the “package indicator” – fewer packages mean fewer purchases, which means less economic activity.

- Young adult joblessness is climbing, which it only does during recessions.

- Travel services (hotels, airfare, and restaurants) are down three months in a row, a condition last seen in 2008, right before the GFC.

- Fast food earnings are down, again a sign that an economically-sensitive portion of the population is struggling.

- The Conference Board’s Leading Economic Indicator Index (LEI) is now deeply red, and we again have to go back to 2008 to see a similarly poor reading.

- Construction spending is down sharply

- Most important of all, the Stripper Indicator is down sharply.

The ticker symbol RICK is for the “Hospitality” company RCI Holdings, which operates a wide network of strip clubs and sports bars.In all seriousness, the RICK indicator is a pretty good leading indicator of recessions.When men cannot afford to indulge their escapist pleasures, you know things are getting serious.

We also discussed the fact that foot traffic in Las Vegas is down sharply, but I think there’s a chance that we’ll have to file that under “self-inflicted wound” caused by typical greedy behavior:

This is why Vegas tourism is down

— Wall Street Apes (@WallStreetApes) August 14, 2025

American shows prices for food and drinks by a Vegas pool

- Bucket of 24 Coors Light $290.99

- 24 High Noon Seltzers $309.99

- Basic cocktails like a Bloody Mary $39.99

- 12 shots $190

Just look at this good and drink menu, the prices are… pic.twitter.com/ZAh3XKRCzb

So what comes next?Well, stocks are not priced for a recession.At all.If these 7 recession indicators are accurate, and a recession is (in all likelihood) already underway, then a big fat stock market correction is what happens next.

More By This Author:

Get Ready: High Inflation Is ComingInvesting When Stocks Are the Most Expensive They’ve Ever Been

Decoding The Japanese Carry Trade Tsunami

Disclosures: None.