Orange And Black

I rarely do posts about being “done” with a trade, but I did so yesterday early in the morning, with respect to gold and miners. The 50% gain on DUST in three weeks was a great winner, and the Fibonacci retracement on GDX looked like support.

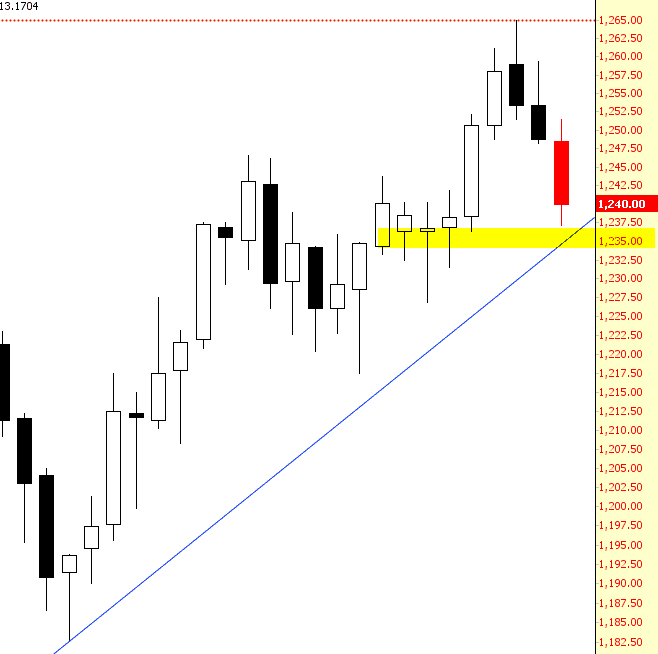

As I looked at the charts later in the day, I did feel that miners might be largely complete with their down-move, but I was having second thoughts about gold. It still seemed like it had a decent prospect of falling. This morning, that thought seems to be borne out, as we’re down nearly $12. The key to watch, however, is the $1235 (approximately) level. That would be a fairly important trendline break.

Of far more interest to me is crude oil. I was mightily irked yesterday (a day in which being irked was easy) that oil was weak but energy stocks roared higher. (You can hear my plaintive “it’s not fair” wails). Oil is getting slammed even harder this morning, down a full 2% as I am typing this. C’mon, energy stocks, let’s see some weakness!

Disclosure: None.

Thanks for sharing

Thanks for sharing