Only U.S. Bonds Were Spared From Last Week’s Widespread Losses

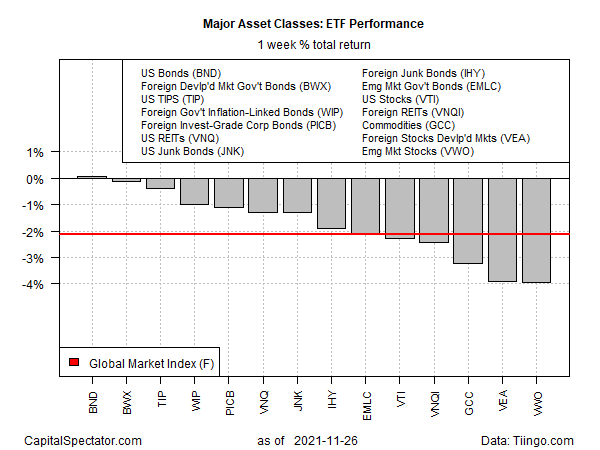

Was Friday’s selling wave overdone? Too early to tell, but the damage from last week’s sudden bout of risk-off left all the major asset classes in red – except US bonds, based on a set of ETFs as of Friday’s close (Nov. 26).

Vanguard Total US Bond Market (BND) bucked the trend and posted a fractional 0.05% weekly gain. The slight advance marks the second straight weekly increase for the fund, which holds a variety of investment-grade fixed-income securities.

(Click on image to enlarge)

Otherwise, it was losses across the board for the major asset classes, ranging from a mild -0.1% retreat in foreign government bonds in developed markets (BWX) to a hefty 4.0% tumble in emerging markets stocks (VWO).

Another week of widespread losses weighed on the Global Market Index (GMI.F) — an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI fell 2.1%, a third straight weekly loss.

There are signs in early trading today (Mon., Nov 29) that global markets are stabilizing after Friday’s rout. But some analysts are preparing for more volatility.

“Despite the irresistible pull of buying-the-dip on tenuous early information on omicron, we are just one negative omicron headline away from going back to where we started,” Jeffrey Halley, a senior market analyst at Oanda, advises in a research note. “Expect plenty of headline-driven whipsaw price action this week.”

But other strategists are inclined toward a contrarian approach. “We would be aggressive buyers of this pullback,” advises Fundstrat’s Tom Lee in a note to clients on Sunday night. “As with the case for Beta and Delta variants, the ‘bark’ has proven worse than the bite in each of those precedent instances. The market carnage, in our view, will be short-lived and transitory.”

Maybe, but the uncertainty about Omicron inspires caution, writes the co-chief investment officer and chief market strategist at Truist Advisory Services. “The pandemic and COVID variants remain one of the biggest risks to markets, and are likely to continue to inject volatility over the next year(s),” counsels Keith Lerner via a note on Friday. “It’s hard to say at this point how lasting or impactful this latest variant will be for markets.”

Meanwhile, reviewing the major asset classes through a one-year trend reflects a mixed bag of results. The top performer: US real estate investment trusts (REITs) via Vanguard US Real Estate (VNQ), which is up a strong 31.2% for the year through Friday’s close.

At the opposite extreme: bonds issued by governments in emerging markets (EMLC) – the loss in this corner is approaching -9% over the past year.

GMI.F’s one-year performance is a solid 15.3% at the moment.

Drawdowns are starting to deepen across the major asset classes after last week’s selling. The smallest peak-to-trough decline is currently found in US inflation-indexed Treasuries (TIP), which ended last week at -0.8% below its previous peak.

Otherwise, most drawdowns are in the -2% to -9% range. The big downside outliers: stocks and bonds in emerging markets (VWO and EMLC, respectively) and commodities (GCC).

GMI.F’s current drawdown: -3.0%.

Disclosures: None.