One Step Back, Two Steps Forward

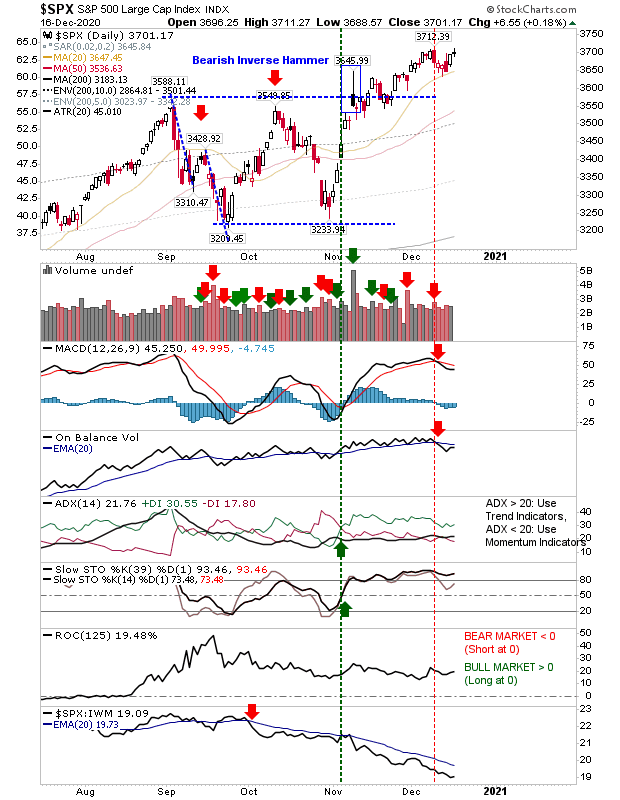

After Monday's disappointing selling, Tuesday and Wednesday saw the return of sufficient buying to negate the bearish taint leftover from Monday. The S&P now looks primed to push past last week's swing high peak of 3,712, following the Nasdaq which has already managed to achieve this.

The buying in the S&P was less, volume-wise, than recent selling, so we are not looking at a significant increase in the amount of buying, probably more the case there is a reluctance from sellers - or at least - longs holding big gains and looking for more, than selling. Technicals remain the same, with 'sell' triggers for the MACD and On-Balance-Volume.

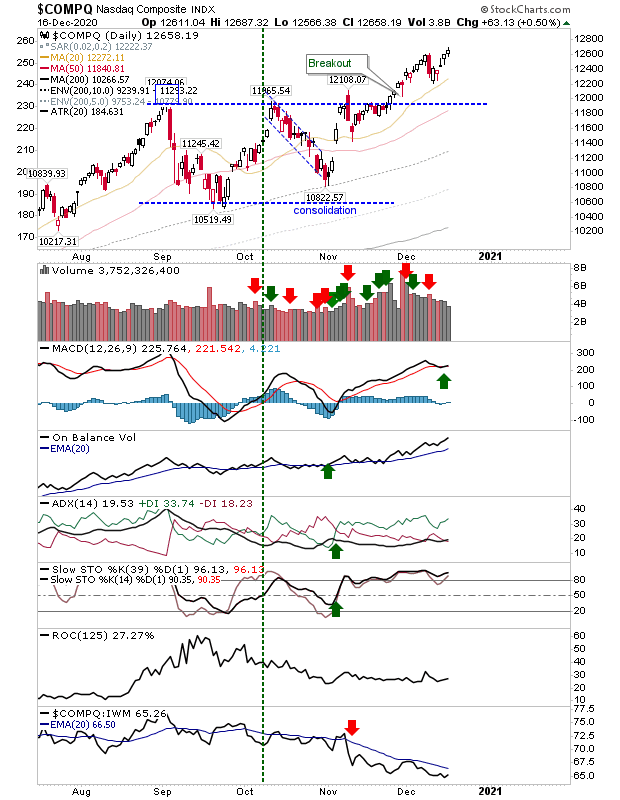

The Nasdaq is already at a new swing high and nicely positioned to keep going. Technicals have all improved and are net bullish. If last week's swing lows are an anchor for a measured move, then the projected target is around 14,000, but this could be the summer of next year before it gets there.

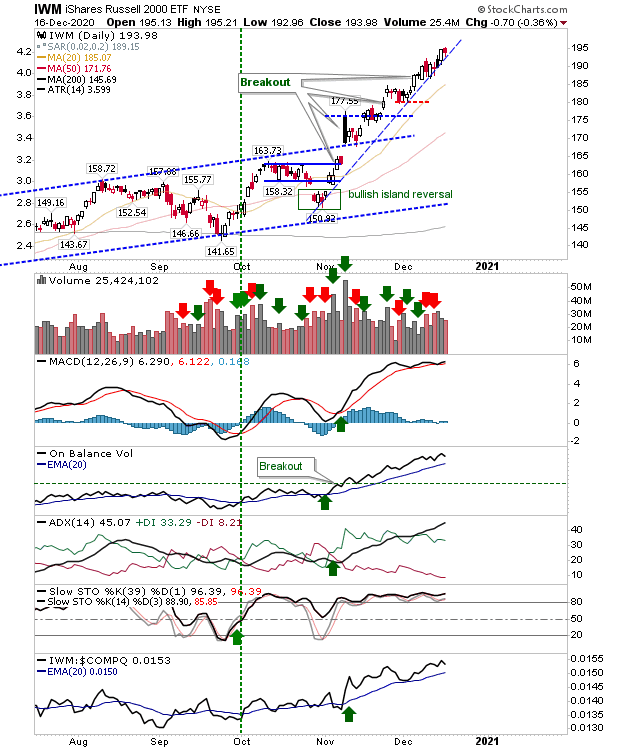

The Russell 2000 ($IWM) was a loser on the day, but it didn't break the rising trendline. However, it's looking vulnerable and it wouldn't take more than a couple of days of selling to send long holders into a frenzy of profit-taking. The last area of consolidation was back in October in the 150-160 zone; to play a Fib retracement would see support around the 170 zone - also the area with that dominant black candlestick in early November.

We have just over a week to Christmas. There tends to be a consensus for many to take an early Christmas holiday, so maybe we will have a little flourish into Friday before things cool down next week.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more