One Comment Changes The Odds (Bigly!)

Image Source: Pexels

Here we were, meandering along ahead of the Martin Luther King Day holiday, when comments from President Trump completely changed the market’s calculus about the next Federal Reserve Chair. Suddenly, Kevin Hassett, currently the director of the National Economic Council, no longer appeared to be the favorite for the role.

According to a report in Bloomberg,

“I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event. “If I move him, these Fed guys — certainly the one we have now — they don’t talk much. I would lose you. It’s a serious concern to me.”

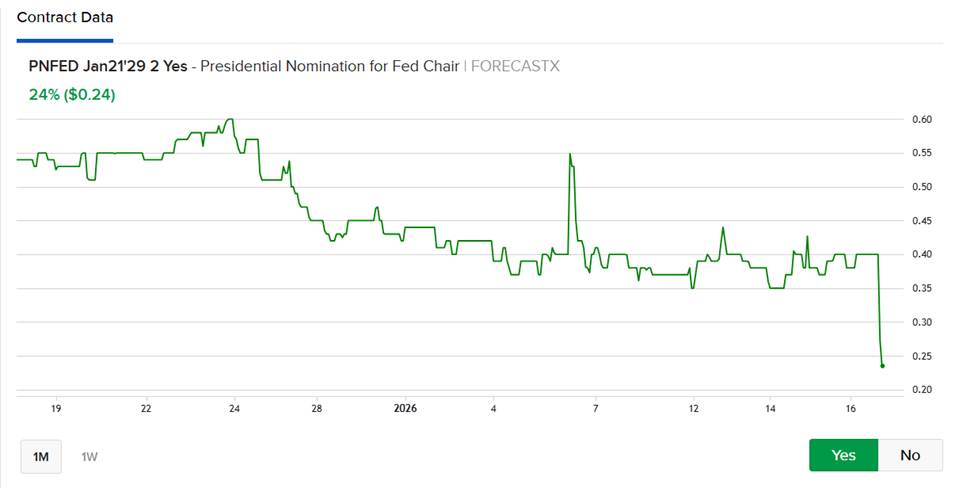

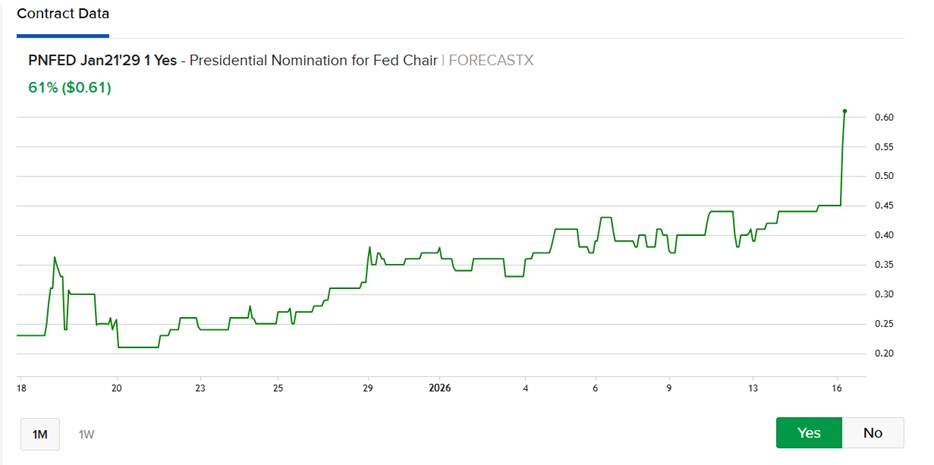

Pricing on ForecastEx moved swiftly after the news broke.The “Yes” for “Will President Trump nominate Kevin Hassett as Fed Chair?” fell to 24% after hovering around 40% for the past few days.Conversely, the “Yes” for Kevin Warsh, which had been steadily edging higher from the low 20s to about 45%, jumped to 61%.The relative odds for the two candidates had been converging as the days dragged on without an announcement; today’s comments caused them to diverge dramatically.

ForecastEx Prices for “Yes” to “Will President Trump nominate Kevin Hassett as Fed Chair?”, 1-Month Data

(Click on image to enlarge)

Source: IBKR ForecastTrader

ForecastEx Prices for “Yes” to “Will President Trump nominate Kevin Warsh as Fed Chair?”, 1-Month Data

(Click on image to enlarge)

Source: IBKR ForecastTrader

It’s not clear that the potential change in the Fed leadership horse race is leading to a meaningful set of reactions in stocks and bonds.Futures on the S&P 500 (SPX) were already giving back a portion of their overnight gains in early trading, though we did get a bout of additional selling when the story hit.The drop, of course, was eventually deemed to be another in a series of dip-buying opportunities, and broad indices largely recovered.We also saw bond futures tick lower, causing yields to rise.

1-Day, March Futures on ES (1-minute red/green candles), ZN (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

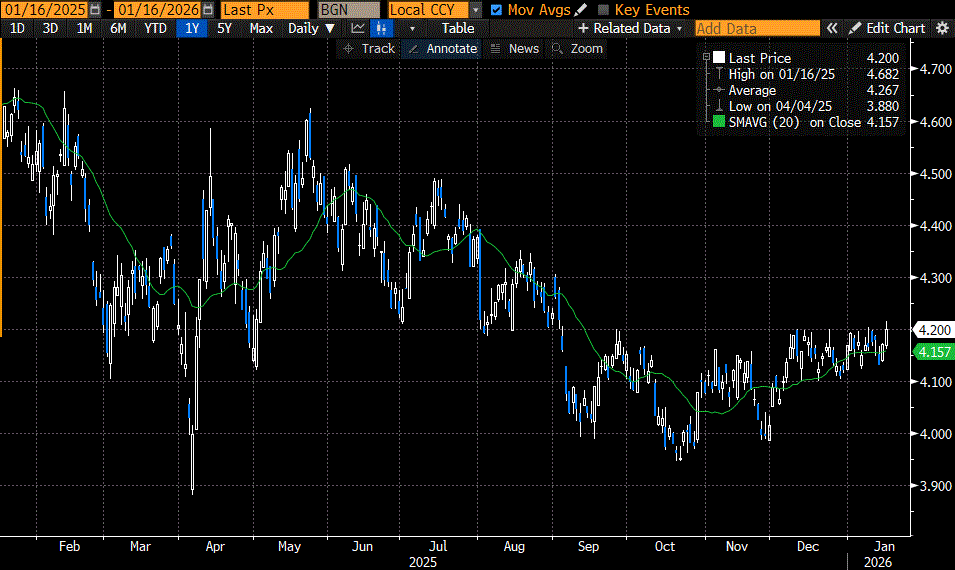

The rise in 10-year yields would be concerning if today wasn’t the Friday before a three-day weekend.The 4.20% yield level has acted as resistance since September.Before that, it was support.(Note: the resistance is from a yield viewpoint, but it’s support from a price viewpoint – we’ll be talking in terms of yields here.)Although it could be quite meaningful if 10-year yields broke through the 4.20% level, it is difficult to imagine that a significant change in bond market sentiment will take root on a Friday afternoon ahead of a three-day weekend.We will more likely need to wait until Tuesday to see if that occurs.

1-Year Chart: 10-Year US Treasury Yields (daily candles), with 20-day Moving Average

(Click on image to enlarge)

Source: Bloomberg

In general, this is the sort of day that one might normally expect ahead of a holiday.Indeed, this is a monthly options expiration, which might present the opportunity for an extra bout of late volatility – especially on an otherwise low-volume day.In the meantime, we are looking at mixed activity, with about half the SPX sectors higher and breadth is slightly negative.It seems unlikely that too much will change this afternoon, but stranger things have happened, no?

More By This Author:

Add Some Good Tech News, And Up We Go

Not As Bad As It Looks

Earnings Are Back

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ...

more