Oil Market Outlook Change – Too Low Demand Expectations

BP released their 2015 Energy Outlook. As noted by their Chief Economist this is not to address prices or near term events. However, price, in the end, is the meat of a discussion for an energy outlook as price and outlook for supply and demand are intertwined.

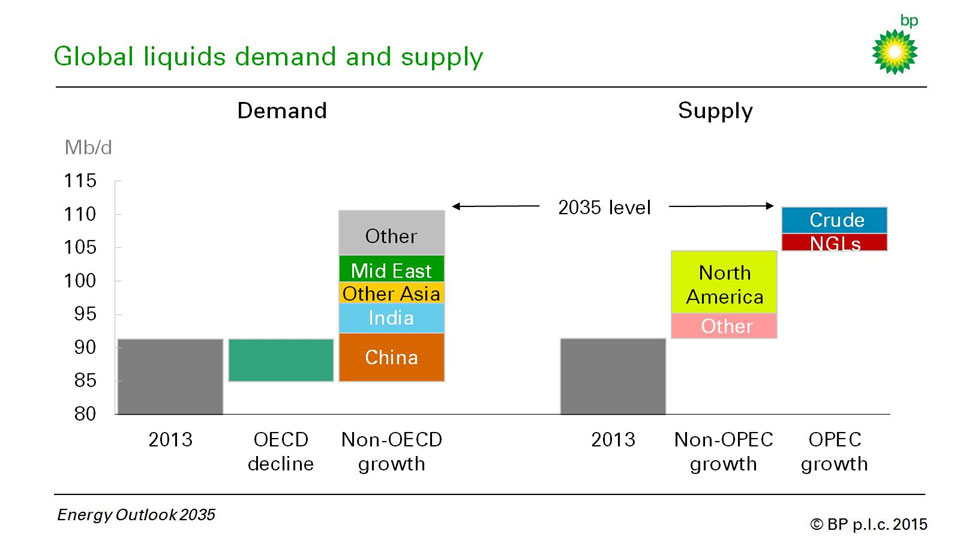

The outlook by itself is useful to gather facts and trends. The real value for someone like me comes from the change in the outlook. In theory, the process of formulating these outlooks should not change. Therefore a change in outlooks signifies a change in market place expectations. The best slide in reviewing the change to show the dramatic shift in expectations is slide 13 in the presentation. The latest forecast for 2035 shows a very small call in OPEC <5 million barrels/day see figure below.

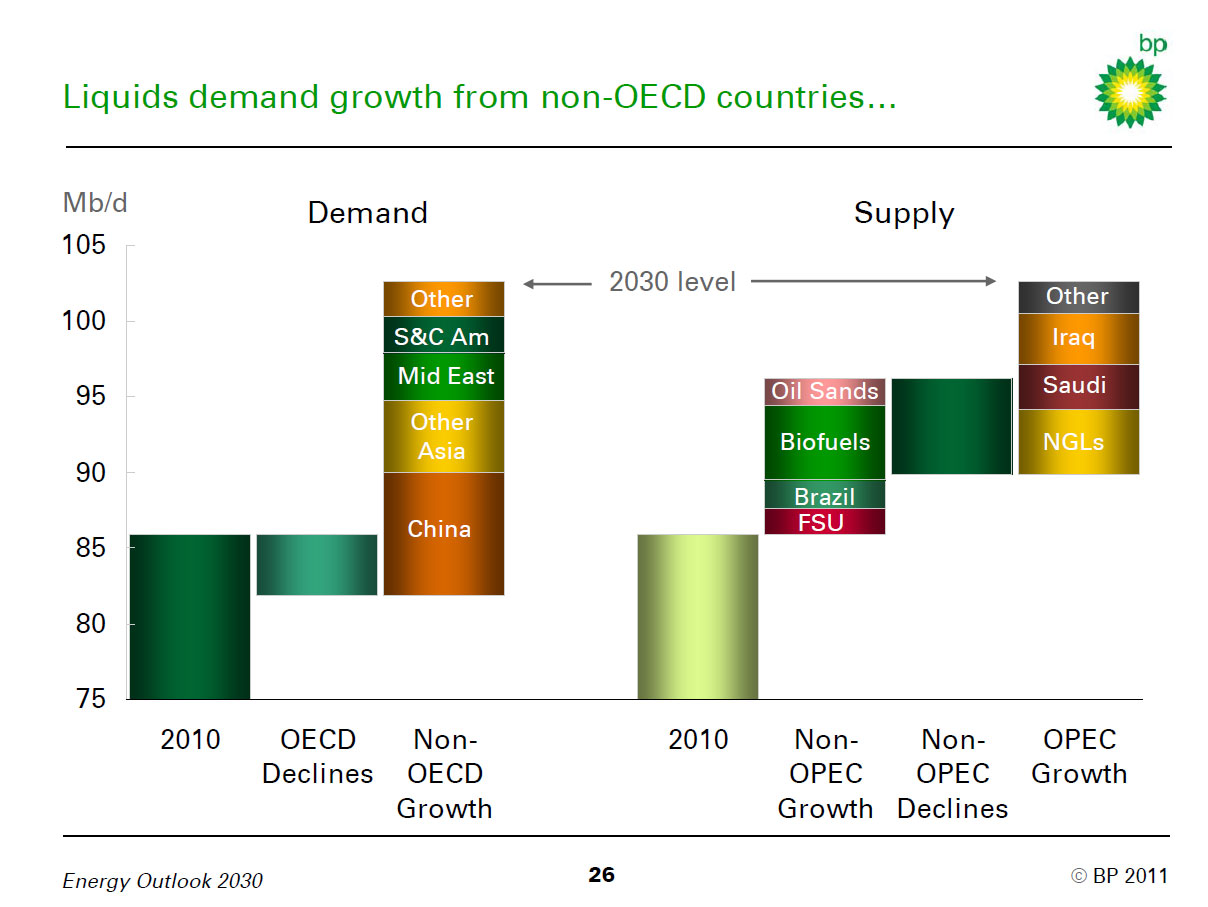

If we go back into time and look at the very same slide in 2011, we see the call for OPEC in 2030 (even less demand requirement given 20 year gap vs. 22 year gap in current forecast) amounts to over 10 million b/d. This is a dramatic swing see figure below for 2011 BP Energy Outlook.

IF one believed in the process and the forecast output, the shift between the two forecasts would dramatically drop the expectations of crude oil price. As a longtime forecaster of the crude oil markets, the call on OPEC is key component on price forecast. This piece of the puzzle represented the additional swing from OPEC who, in theory, purposely holds spare capacity to sustain a reasonable market level. With the need of OPEC being diminished, the overall pressure for oil prices to move upwards is limited.

Obviously, BP cannot state or present a price view given its role in the market place, but if their trade floor was made well aware of this trend and believed it, they would have made a good call over the last year. However, the long-term aspect of this trend does not bode well for BP as a company. In fact, the overall energy sector would not benefit from this including renewable energy and refining industry – will be discussed in later article.

The demand side also shows some major shift in expectations. In 2011, the expectation for China oil growth was nearly 10 million b/d more than the base year (2010). Now expectations have fallen to around 5 million b/d from the base year (2013). The interesting outcome of this is whether BP flowed back the price response from the expectations of lower prices per the lower call in OPEC to the response of China demand. To lose 5 million b/d would require a much lower expectations of GDP outlook for China, in addition a very inelastic response to the price of oil is needed to maintain such a drop in demand.

From my experience, the demand piece is typically the flawed portion of the forecast after coming off a major supply shift. Supply can be well understood in terms of cost of development and potential technology improvement curves. It is my belief that the demand outlook presented is too low. The expectations of this come from both the price feedback of consumers and the fact that the demand side has included a significant portion of efficiency improvements over the past few years.

Efficiency improvements do not lead to reduce consumption of a commodity without a continued price increase. This is supported by the Khazam Brookes postulate and Jevons Paradox. My caveat to the theory is to add the price component. Improving efficiency of a commodity leads to more use of that product without a corresponding price increase. I also expect this with electricity as we make up for the large efficiency improvement by having more devices and more appliance than we had a decade ago, even though, a single appliance may be 50% more efficient.

I do not expect our human desires to have a car that is faster and bigger to be different by region or time. Corporate Average Fleet Efficiency (CAFE) improvements have and will result in near-term gasoline demand improvement in the US, but eventually with the falling prices and the improved efficiency improvement the auto manufacturer can produce an SUV with mass appeal and size that can go 0 to 60 in few seconds yet offer 25-40 mpg. Auto manufacturers who ignore this trend will be left in the dust as was seen last time SUV sales outsold compact vehicles. This move to this larger and faster car will swallow the small vehicles leading to overall growth in oil demand while maintaining the CAFE standards.

This mass appeal will also eventually migrate to other areas of the world. The ability to stop this rebound is the corresponding price. In the oil markets that seems to be muted as expectations of price is likely between $50 to $100/bbl and not rising over $100/bbl for the next decade or so. Power markets may thwart the rebound given the trend in transmission and distribution cost, but this will be highly dependent on the region. Obviously adding a carbon tax would increase the cost curtailing the demand.

Your Fundamental Supply / Demand Energy Analyst,

David

At All Energy Consulting we understand supplying you with forecasts is only one step of the process and may even be the smallest value of the process. The real value comes from the interaction with ...

more