NY Fed Survey Finds Surge In Household Delinquency Expectations, Worst Since April 2020 Covid Crash

After several months of declines in the 1-Year inflation expectation as tracked by the NY Fed's monthly consumer survey, September saw the second consecutive increase in this series which traditionally is also a proxy for the price of oil (which recently hit a 2023 high before tumbling, before spiking again on the latest war in Israel), however, this was offset by a small decline in 5 year inflation expectations, which traded places with the 3 year which in turn rose modestly. However, the most concerning observations was that despite a modest improvement in household income growth expectations, there was an unexpected spike in delinquency expectations as US household appear to have hit a brick wall on how much debt they can pay down in the immediate future

Here are the details: as shown in the chart below, inflation expectations at the one-year horizon were ever so slightly higher at 3.67% in Sept. from the previous month’s 3.63%; three-year-ahead inflation expectations also reversed higher and after falling from 2.91% in July to 2.79% in August, they then bounced all the way to 3.00% in September. Finally, 5-year-ahead inflation expectations declined from 3.00% to 2.84%, the lowest since May 2023.

(Click on image to enlarge)

The report also noted that median inflation uncertainty (the uncertainty expressed regarding future inflation outcomes) increased slightly across all three horizons

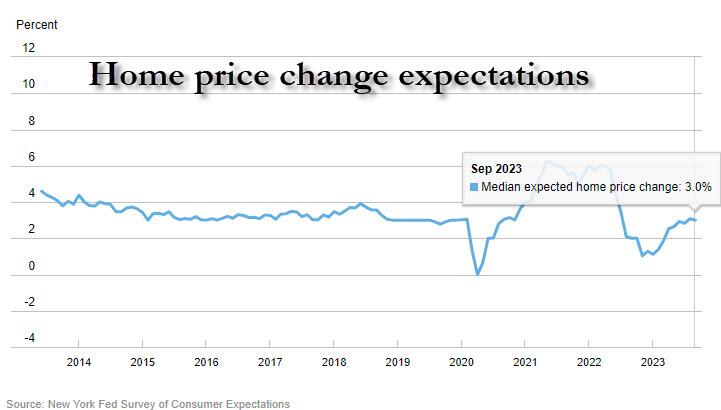

Turning to median home price growth expectations, the survey found that after a perplexing jump of 0.3% to 3.1% in August, September saw a modest drop to 3.0%... which of course is just what the Fed wants to achieve, and suggests that the Fed's tightening plans may finally be taking a toll on the single, most important asset class for the US middle class.The decrease was more pronounced among respondents below the age of 40 and those who live in the South Census regions.

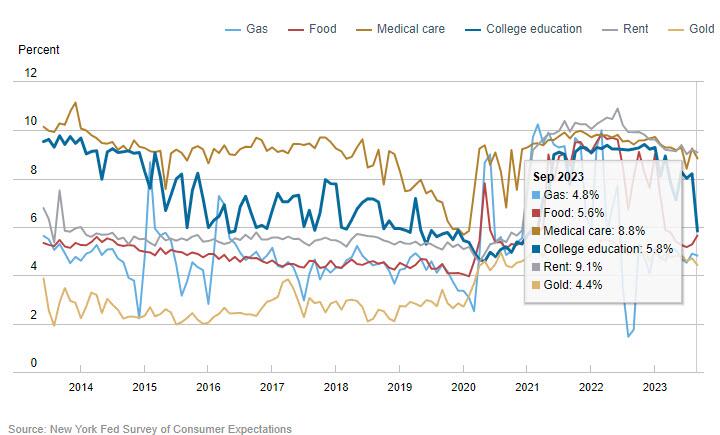

Next, turning to year-ahead commodity price expectations, there was a big drop in the cost of college education which decreased sharply to 5.8% from 8.2% , its largest one-month decrease since the onset of the survey in 2013 (good luck with that). Median year-ahead expected price changes declined by 0.1, 0.4 and 0.1 percentage point for the cost of gas (to 4.8%), medical care (to 8.8%) and rent (to 9.1%), respectively. In contrast, median year-ahead expected price changes for food increased by 0.3 percentage point (to 5.6%).

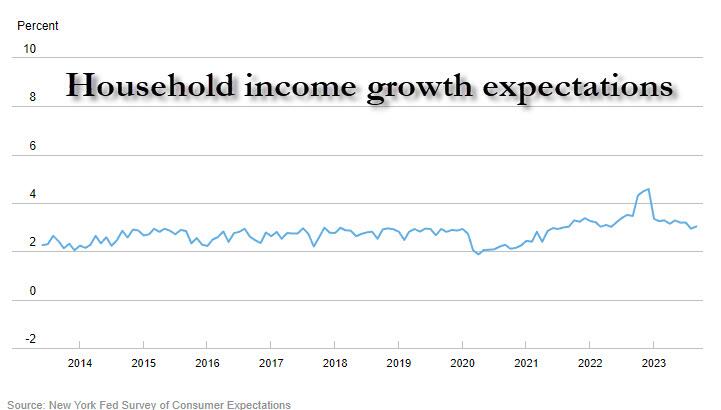

But while the latest reversal in the downward trend of inflation was troubling, this was offset in part by a similar reversal in the recent downward trend in household income growth expectations, which last month slumped to 2.9% - the lowest since July 2021 - and which in September rose modestly by 0.1% to 3.0%, remaining well below the series 12-month trailing average of 3.5% but at least halting the recent slide.

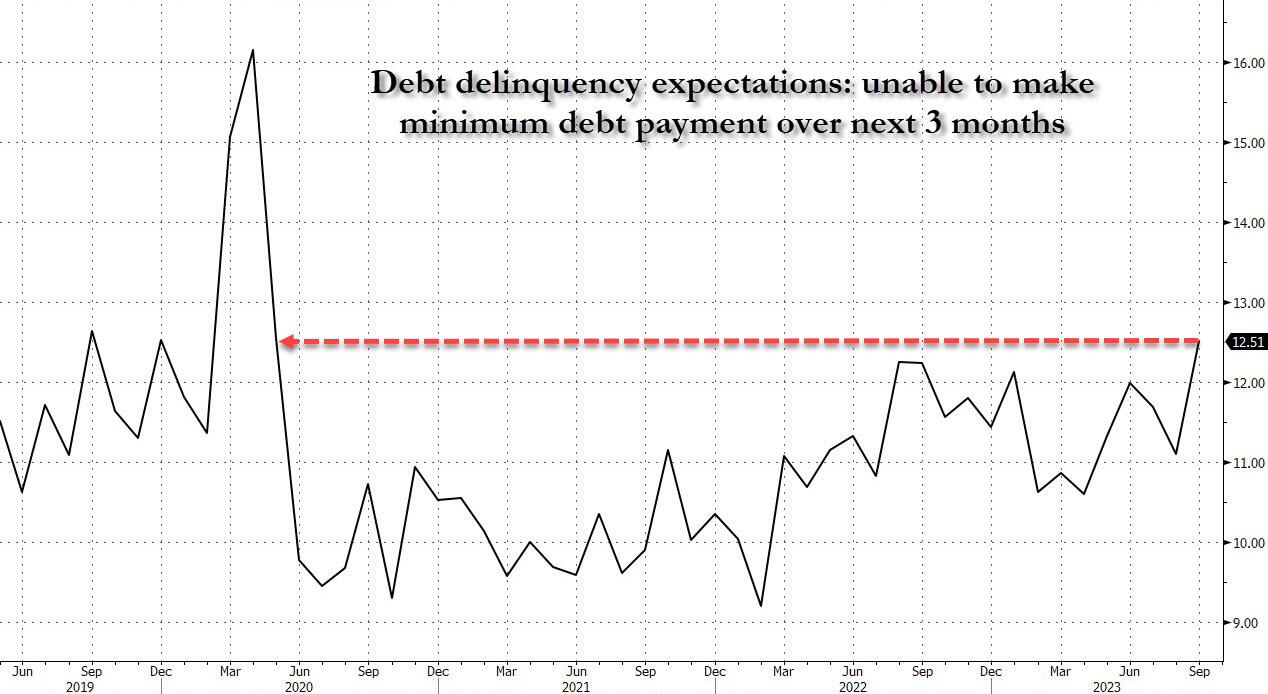

But while the latest uptick in income growth expectations was welcome, what was more troubling was the response to the question whether a respondent won't be able to make minimum debt payments over the next three months. As shown below, expectations for debt delinquencies surged to 12.5%, the highest since the covid lockdown in April 2020. The increase was largest for respondents below the age of 40, with some college education, and those with an annual household income below $50k.

(Click on image to enlarge)

In other words, with delinquency and charge-off rates already surging, the near-term is about to go from very bad to much worse.

Here are some other observations from the latest Ny Fed survey, first those dealing with household finance

- Perceptions of credit access compared to a year ago deteriorated slightly. The share of households reporting that it is more difficult to obtain credit now than a year ago increased, while the share reporting that it is easier declined. Similarly, respondents’ views about future credit availability deteriorated slightly. The share of respondents expecting tighter credit conditions a year from now increased, while the share expecting looser credit conditions declined.

- Median household spending growth expectations remained unchanged at 5.3% in September, remaining well above pre-pandemic levels.

- The median expectation regarding a year-ahead change in taxes (at current income level) decreased to 4.0% from 4.1%, its lowest reading since October 2020. Good luck with that.

- Median year-ahead expected growth in government debt increased by 0.6 percentage point to 9.5%, remaining below the series 12-month trailing average of 9.9%. The real number will be much, much higher.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.7 percentage point to 30.8%.

- Perceptions about households’ current financial situations deteriorated slightly in September with more respondents reporting being worse off than a year ago and fewer respondents reporting being better off. In contrast, year-ahead expectations improved with more respondents expecting to be better off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.5 percentage point to 36.7%.

And the labor market:

- Median one-year-ahead expected earnings growth increased by 0.1 percentage to 3.0% in September. The series has been moving within a narrow range of 2.8% to 3.0% since September 2021. The increase was most pronounced among respondents with some college education.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.6 percentage points to 40.1%, equal to its 12-month trailing average.

- The mean perceived probability of losing one’s job in the next 12 months decreased by 1.4 percentage points to 12.4%, remaining slightly above its 12-month trailing average of 12.1%. The mean probability of leaving one’s job voluntarily in the next 12 months decreased as well, by 0.7 percentage point, to 18.2%.

- The mean perceived probability of finding a job (if one’s current job was lost) increased to 56.5% from 55.7%, just below its 12-month trailing average of 56.9%. The increase was driven by respondents above the age of 60.

Putting it all together, while inflation expectations rose (tracking the price of oil in September) and household perceptions about their current financial situations and expectations for the future improved modestly, what was a flashing red alert was the sudden spike in delinquency expectations as US households can no longer afford to pay down their (record) debt and instead prepare to simply default.

More in the full report here.

More By This Author:

Strikes Hit General Motors Plants In Canada As Contract Talks Fail In Last HourStocks, Bonds, Gold And Oil Soar As Dovish Fed Comments Trample Israel War Fears

Israel Orders Chevron To Close Tamar Gas Field As War Rages

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more