Nvidia Stock Takes A Hit Amid China Restriction News - Time To Buy The Dip?

Image Source: Pexels

This year’s leading stock, Nvidia (NVDA) took a hit Tuesday in trading after the Biden administration announced plans to halt semiconductor shipments to China. Is this sell-off an opportunity to pick up shares at a discount?

Even after a nearly four-month consolidation, Nvidia is still the top-performing stock in the S&P 500. And after breaking out from a descending wedge two weeks ago, looks to be staging a buyable pullback. Furthermore, Nvidia enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions, and boosting near-term stock performance expectations.

With a critical level of support at $400, this looks like a good buying opportunity given the risk-reward setup.

Image Source: TradingView

Biden Cuts Off China

The Biden administration announced its decision to stop shipments of advanced artificial intelligence chips, specifically those designed by Nvidia and other companies, to China. This move is part of a broader effort to prevent Beijing from accessing state-of-the-art U.S. technology that could enhance its military capabilities. These new regulations will further limit the export of advanced chips and tools associated with chipmaking to countries including Iran and Russia.

Nvidia, a leading AI chip designer, reported its compliance with the new regulations and does not foresee an immediate significant financial impact. However, its shares dropped by -5%, and other chipmakers like Advanced Micro Devices (AMD) and Intel (INTC) also experienced stock declines.

Industry Leader

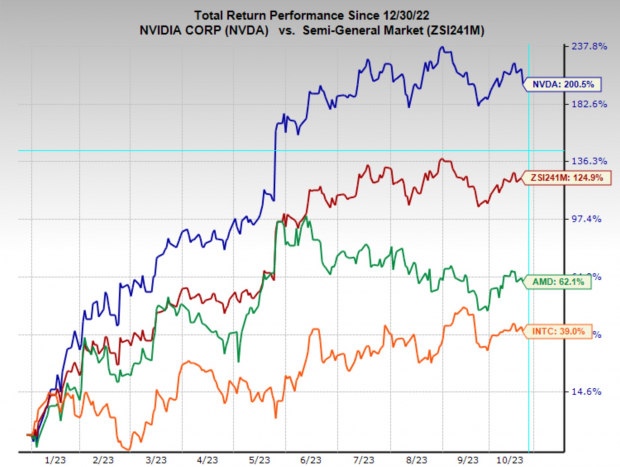

After releasing its Artificial Intelligence infrastructure products earlier this year, Nvidia has set itself apart from the industry. Now years ahead of the competition regarding its AI hardware and software, Nvidia stock has far outperformed competitors Intel and Advanced Micro Devices, as well as the industry.

Although Intel has struggled in recent years, it has been receiving some earnings estimates upgrades, boosting the stock to a Zacks Rank #2 (Buy) rating. However, AMD has not convinced analysts to revise its earnings higher as it currently has a Zacks Rank #3 (Hold) rating, indicating mixed earnings revisions.

Image Source: Zacks Investment Research

Bottom Line

While many traders have been shaken out of their positions on this surprising news, Nvidia still looks appealing at these levels. Furthermore, with the final quarter of the year often showing a strong bullish tendency, I would expect the market’s leading name to finish the year with a bang.

More By This Author:

Bull Of The Day: Nu Holdings Ltd.

Three Small-Cap Growth Mutual Funds For Fantastic Returns

Bear Of The Day: Tyson Foods

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more