Nvidia Stock Forecast: Still Worth Holding In The Long Term

Highlights

- Nvidia Q1 2023FY Earnings Beat Expectations Again.

- China Lockdown and Ukraine War Caused Negative Impact on Nvidia Next Quarter Guidance.

- Gaming and Data Center Segments Are Still Expected to Grow in the Future.

- Nvidia Automotive 6-Year Pipeline Represents $11 Billion Opportunity.

- Valuation Models Indicate NVDA is Currently Undervalued.

Company Overview

Founded in 1993 and headquartered in Santa Carla, CA, Nvidia Corp. (NVDA) is the global leader in accelerated computing, helping solve the most challenging computational problems. It designs, develops, and markets 3D graphics processors and related software in the United States, Taiwan, China, and internationally. GPU, the primary product of Nvidia, was invented in 1999, igniting the expansion of the PC gaming business and reshaping modern computer graphics, high-performance computing, and artificial intelligence. The company’s groundbreaking work in accelerated computing and artificial intelligence is transforming trillion-dollar industries including transportation, healthcare, and manufacturing, as well as propelling the growth of a slew of others.

Technology Development into the Unstable World

Nvidia is one of the most valuable stocks in the semiconductor industry. The semiconductor industry includes corporations that manufacture semiconductors and related devices and parts. Due to the COVID-19 pandemic, there was a rise in the use of communications technology, which raised the demand for this product area. However, shutting down factories to avoid the spread of the coronavirus caused a supply shortage. The higher than usual demand and paused production led to a chip shortage and increasing prices of the products globally.

Nvidia outperformed S&P 500 and Nasdaq indices since Jan 1st, 2020, when the pandemic started. Since then, Nvidia shares have risen by more than 200% as shown in Figure 1 below. Since the most recent earnings call on May 25, 2022, Nvidia shares have risen by 16%.

(Figure 1: Nvidia Historical Return Since 2020)

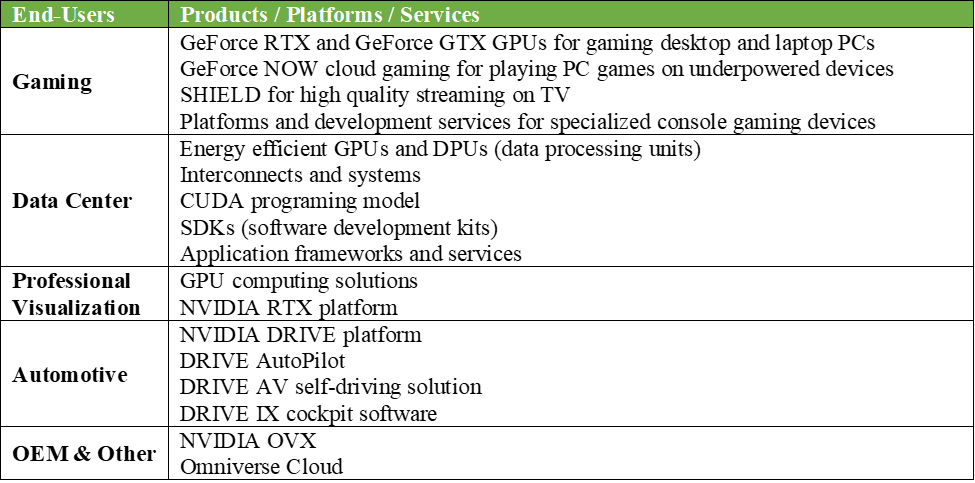

Nvidia operates in two segments: Graphics (59% of FY22 Total Revenue) and Compute & Networking (41% of FY 22 Total Revenue). As shown in the table below, Nvidia’s products are sold in five markets: Gaming, Data Center, Professional Visualization, Automotive, and OEM & Other.

(Figure 2: Nvidia Products by End-Users)

Is Nvidia a Good Business?

Based on the “Good Business” framework, Nvidia meets all the criteria. Nvidia is the largest GPU provider as well as the market leader. The GPU market is expected to grow at a CAGR of 33% from 2021 to 2028 according to Statista. The growth rate is far above the ideal market growth rate in the Good Business Framework. According to Statista, Nvidia GPU shipment share worldwide grew from 15% to 20% from Q1 2021 to Q3 2021, while AMD gained only 2% shares during the same period. Nvidia has average cyclical risk and strong positive cash flow that can be used for strategic acquisition. Nvidia’s five-year ROC is 29% based on Morningstar calculations, which is much higher than the ideal criterion. Due to the pandemic and metaverse, the importance of cloud and AI is increasing dramatically. As a result, the market stability is shifting in favor of Nvidia.

Nvidia Q1 2023FY Earnings Beat Expectations Again

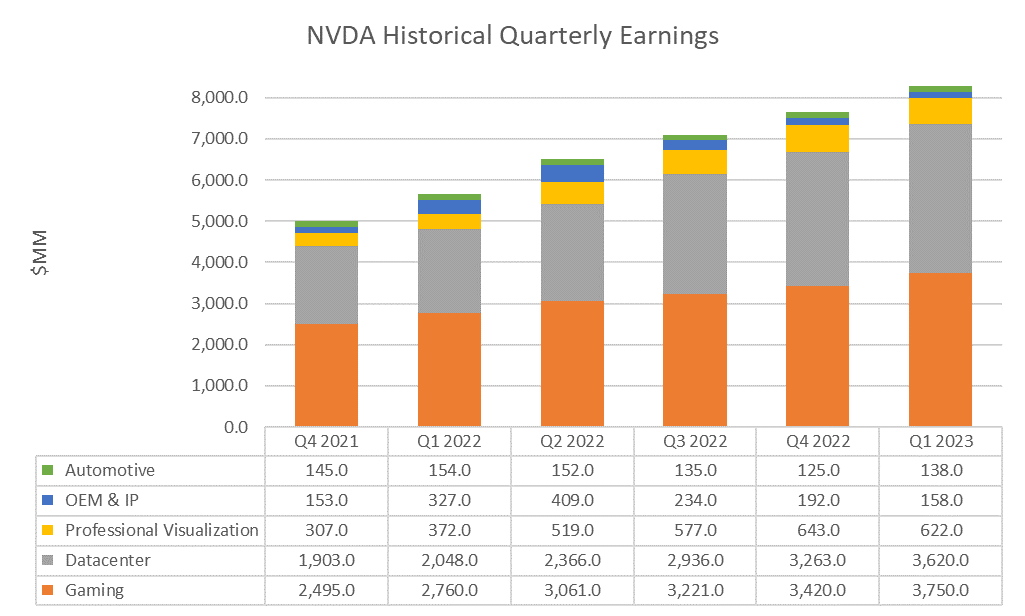

(Figure 4: NVDA Historical Quarterly Earnings)

On May 25, 2022, Nvidia reported record revenue for the first quarter ended May 1, 2022 (Q1 2023FY). Revenue for Q1 2023FY was $8.29 billion, which was 2.40% higher than the expected revenue. Q1 2023FY revenue grew 46% year-over-year and 8% quarter-over-quarter.

(Figure 5: Nvidia Quarterly Earnings History)

(Figure 6: Nvidia Quarterly Financials)

Reported non-GAAP earnings per diluted share (non-GAAP EPS) of $1.36 for the quarter also beats analysts’ expectations, representing a 5.4% surprise. Non-GAAP EPS was up 49% year-over-year and 3% quarter-over-quarter. However, the termination of Arm Limited acquisition from SBG due to significant regulatory challenges caused a $1.35 billion charge, negatively impacted Nvidia’s GAAP earnings per diluted share (GAAP EPS) for the quarter. The GAAP EPS was $0.64, down 16% year-over-year and 46% quarter-over-quarter.

The company’s outstanding performance in the core gaming and data center markets is the main reason for exceeding expectations. In the face of a tough macro environment, Nvidia generated record results in Data Center and Gaming. Even as Gaming had a great quarter, Data Center has become the company’s largest platform. The success of the effectiveness of deep learning in automating intelligence is driving corporations across industries to use Nvidia for AI computing.

With new GPU, CPU, DPU, and robotics processors ramping up in the second half, Nvidia is preparing for the largest wave of new products in its history. Its new processors and systems will have a significant impact on AI, graphics, the Omniverse, self-driving cars, and robots, as well as the other sectors that these technologies affect.

China Lockdown and Ukraine War Caused Negative Impact on Nvidia Next Quarter Guidance

While Nvidia delivered outperformed Q1 2023FY results, the guidance for the next quarter is not as expected. Nvidia expects revenue of approximately $8.1 billion, plus or minus 2%, in the second quarter.

The company explained that its forecast was much lower than Wall Street’s target of $8.54 billion due to “Russia and the COVID lockdowns in China,” which are expected to result in a $500 million sales shortfall. In the recent earnings call, Nvidia Chief Financial Officer Colette Kress stated that the company expects “the impact of lower sell-through in Russia and China to affect our Q2 gaming sell-in by $400 million. Furthermore, we estimate that the lack of sales to Russia will have a $100 million impact on Q2 data center revenue.”

With the recent reopening of Shanghai, the concern about lockdowns in China should be alleviated.

Gaming and Data Center Segments Are Still Expected to Grow in the Future

Gaming sales increased 31% to a record $3.62 billion in the first quarter, up from $2.76 billion. However, revenue is expected to fall in the current quarter, further lowering Nvidia’s outlook. According to Nvidia CFO Colette Kress, as they anticipate ongoing impact and prepare for a new architectural transition later this year, they expect gaming revenue to decline sequentially in Q2. Channel inventory has nearly normalized, and they anticipate that it will remain around these levels in Q2. The good news is that Nvidia now has a better equilibrium between its available supply and prices, which is not perfect but close to a normal level. The CFO also stated that the demand for the gaming segment is expected to remain very strong, growing on a year-over-year basis in the next quarter.

The Data Center segment grew more rapidly than the gaming segment due to global demand for AI and cloud computing. Data Center Segment revenue in the first quarter was a record $3.75 billion, up 83% year-over-year and 15% from the previous quarter. Nvidia’s Data Center platform focuses on accelerating the most compute-intensive workloads, for example, AI, graphics and scientific computing, cloud, and edge data centers. The foundation of the Data Center platform is Nvidia’s energy-efficient GPU products, which are the gold standards in accelerating workloads for AI. Nvidia also expanded its data center processor portfolio to include DPUs last fiscal year and will be shipping CPUs in early FY2024. The hardware is supported by foundational software, such as DOCA (data-center-infrastructure-on-a-chip). The software can be delivered to customers as part of the data center platform or separately with a subscription or perpetual license, which is a new source of revenue. According to Ark Invest, Nvidia controls 90% of the data center accelerator market share in 2021. Nvidia has the first-mover advantage to capture the market shares related to chips and AI computing. By launching the new CPU by 2023, Nvidia is able to build its complete computing platform, joining its own GPU and DPU.

Automotive 6-Year Pipeline Represents $11 Billion Opportunity

Nvidia’s automotive plan covers traditional OEMs, electric vehicles, autonomous trucks, and Robo-taxis. The company also partnered and built ecosystems with strong businesses. It plans to achieve an $11 billion design win pipeline in the next 6 years as shown in Figure 7 below. Nvidia has established the foundation to lead the autonomous vehicle, which is the future of the automotive industry.

(Figure 7: Nvidia Automotive Pipeline)

Nvidia DRIVE Hyperion and DRIVE Orin are gaining traction in the industry. BYD, the world’s second-largest electric vehicle manufacturer, announced at the Nvidia GTC conference that it will build its next-generation fleets on the DRIVE Hyperion architecture. This DRIVE Orin-based platform is now in production, powering a diverse ecosystem of 25 EV makers building software-defined vehicles on high-performance, energy-efficient AI compute. The first BYD vehicles based on Nvidia’s Drive technology will be available in early 2023.

Furthermore, Lucid, as well as Chinese EV startups Nio (NIO), Xpeng Motors (XPEV), and Li Auto (LI), use Nvidia systems-on-a-chip (SoCs) in their new and upcoming vehicles. They are all powered by Nvidia’s Orin, which functions as the central computer for intelligent vehicles.

Innovative startups, such as DeepRoute, Pegasus, UPower, and WeRide, have recently joined the DRIVE Hyperion ecosystem, and luxury EV maker Lucid Motors has announced that its automated driving system is built on Nvidia DRIVE.

Nvidia DRIVE Hyperion is a Level 2+ and Level 3 highway autonomous solution development platform and reference architecture. It includes a fully tuned, optimized, and safety-certified sensor suite, as well as a high-performance AI computing platform, Nvidia DRIVE AGX.

Nvidia DRIVE Orin SoC (system-on-a-chip) is the central computer for intelligent vehicles, delivering 254 TOPS (trillion operations per second). It’s the perfect solution for powering autonomous driving, confidence views, digital clusters, and AI cockpits. The scalable DRIVE Orin product family enables developers to build, scale, and leverage a single development investment across an entire fleet, from Level 2+ systems to fully autonomous vehicles at Level 5.

Valuation Models Indicate NVDA is Currently Undervalued

Based on a five-year DCF model shown in Figure 8, the one-year target price of NVDA stock is $214.53, inferring a 13% upside from the current price of $189.26 as of June 8, 2022. The main assumptions made are revenue growth rates for the five segments to achieve a 5-year CAGR of 29% as Nvidia did from FY2018 to FY2022.

Gaming and Data Center segments are the two primary sources of revenue for Nvidia. The Data Center segment is expected to generate more revenue than the gaming segment in two years according to the forecasted revenue schedule as AI industry demand rises. The gaming segment will still experience high growth as the metaverse develops. The revenue growth rates for the other three segments are relatively conservative. Nevertheless, the two-year target price of $234.52, indicating a 24% upside, suggests that Nvidia is worth investing in for the long run as well.

Nvidia sets the standards in its industry and is the second to none as a leading GPU supplier. The most comparable company is AMD, operating in the same market. However, Nvidia’s market cap is $402 billion, about two times more than AMD’s $146 billion. As the market leader, Nvidia has higher multiple ratios than its peers, making its stock seem overvalued as shown in Figure 9 above. But Nvidia is growing more rapidly than its peers and returns higher ROA and ROE than average. In addition, there is always a premium for the market leader.

Bloomberg also supports my bullish NVDA stock forecast. As of June 12th, 40 out of 50 analysts give overweight or buy recommendations, 9 give neutral or hold recommendations, and only 1 gives underweight or sell recommendations.

Conclusion

Based on all the analysis above and a 1-year target price of $214.53, around 13% upside from the current price, I give a BUY recommendation. Nvidia is expanding into all possible markets needing GPU and launching innovative software and CPU products to support its hardware and ambitious expansion. The company is expected to boost its revenue in all segments in the future.

Past Success with NVDA Stock Forecast

I Know First has been bullish on Nvidia’s shares in past forecasts. On our April 13, 2021 premium article, the I Know First algorithm issued a bullish NVDA stock forecast (should be noted that Nvidia split the stock 4:1 on July 20, 2021). The algorithm successfully forecasted the movement of Nvidia’s shares on the 1-year time horizon. NVDA’s shares rose by 45.99% in line with the I Know First algorithm’s forecast.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more