Now Comes The Fiscal Year From Hell

Four things are not going to happen in the Imperial City before October 1. That is, there will be no bill to repeal and replace Obamacare, no sweeping tax cut stimulus, no debt ceiling increase and no appropriations bills for FY 2018, which happens to commence on that date.

What there will be, instead, is the opening days of the fiscal year from hell that will witness repeated funding and government shutdown crises. Three decades of kicking the can will come to roost on the front doorstep of a White House that will be hunkered down in a rear guard action to save its occupant from being carried away by the same warmed-up helicopter engines that took Nixon for his last ride 43 years ago this summer.

Shortly thereafter, in fact, we sat on the floor of the US House as Gerry Ford from our home state of Michigan told a traumatized nation that its "long nightmare" was over.

He tried, as did Ronald Reagan after him. But it turns out America's real nightmare was just starting.

Rather than demobilizing America's vast Warfare State when the Soviet Union disappeared at the end of the Gipper's watch, Washington declared itself the "indispensable nation" and consolidatedand extended its Empire and monopoly of power all around the planet.

Likewise, promising a balanced budget within three years during the 1980 campaign, Ronald Reagan did not produce one. Instead, he started Washington down the path of permanent massive deficits to fund a combined Warfare/Welfare State that even America with all its economic might and prosperity could not afford.

In the end he added $1.8 trillion to the national debt----two times more than his 39 predecessors had accumulated during the first 192 years of the Republic.

Ronald Reagan also promised an end to inflation and a sound dollar because he was old enough, and old-fashioned enough, to know that the gold standard had been the key to the nation's historic prosperity and dynamic capitalist growth. But he ended up appointing Alan Greenspan to head the Fed---a lapsed gold bug who turned out to be the monetary Benedict Arnold of modern times.

Needless to say, during the interim years the Imperial City has been hopelessly corrupted by war, debt and printing press prosperity. So now as its permanent ruling class of career politicians and Deep State apparatchiks prepare to eject another Oval Office occupant, the tables are reversed.

What is happening now is that a bad system is rejecting an electoral implant who is willful, unschooled, impetuous and unreliable. It desperately needed a caretaker and reliable communicant like Hillary Clinton to kick the can on empire abroad and phony state-fostered prosperity at home.

Instead, and against all odds, it got the Great Disrupter, and that turns out to be a fatal quirk of history. The system can't live with the Donald, but it can't survive much longer without a caretaker government and an Imperial City bailout brigade at the ready, either.

That is to say, whereas Nixon's departure offered the hope that a national nightmare was ending, Trump's impending removal will guarantee that an even greater one is starting. In a word, Washington will become ungovernable and Wall Street will be saddled with the greatest morning after collapse in world history.

So if there was ever a time to take advantage of the day traders and robo-machines which linger in the casino at its current hideous valuations, now would be the occasion to sell, sell, sell. That's because once the breakdown starts there will be no respite from the implosion.

At the same time, now would also be the point to recognize that Washington is lost and adrift, whistling bravely as it stumbles past the graveyard. Yesterday, for instance, Speaker Ryan announced the start of a concerted campaign in behalf of the "crown jewel" of the GOP agenda.

That is, a sweeping, once-in-a-generation tax reform plan to bolster economic growth and restore confidence to the nation's economically disabled households and businesses---despite growing skepticism about Washington's ability to reach consensus on the details of a plan.

Said the Speaker bravely,

"I am here to tell you: We are going to get this done in 2017," Ryan said. "You know why we're going to get this done in 2017? Because we have to get this done in 2017. ... Transformational tax reform can be done, and we are moving ahead. Full speed ahead."

We are here to tell you, of course, that greater humbug was never spoken. Ryan is lost in a fantasyland of Reaganite "morning in America" that never really happened back then, and is totally impossible now.

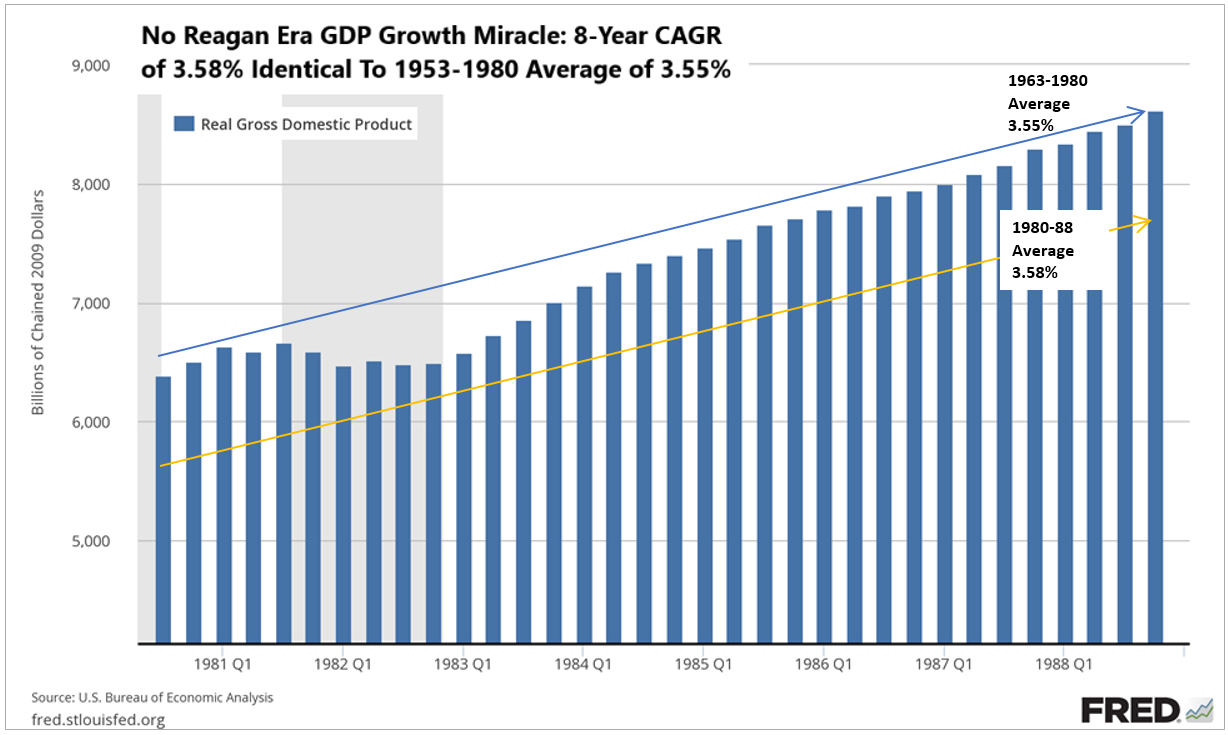

As to the historic mythology, here is the truth about the alleged GDP growth miracle during the 1980s. It didn't happen!

During the 27 year span between the end of the Korean War (1953) and 1980, real GDP growth averaged 3.55% per annum. By way of comparison, during the eight years of the Gipper's presidency, real GDP growth averaged 3.58%.

Needless to say, we are happy to send a microscope to any of today's born again supply-siders who profess to tell the difference.

And, no, you can't say the dip through early 1983 should be ignored. That happened because Volcker hit the monetary brakes hard in order to quell Jimmy Carter's rampant inflation, and it worked. The inflation rate dropped from just under 10% in 1981 to just over 3% by mid-1983.

This inflation purge, in turn, paved the way for a powerful snap-back of economic activity----and especially housing and consumer spending. But the temporary boom of 1983-1985 after this period of monetary restraint wasn't all that remarkable, either.

The six quarter GDP growth rate of 6.9% per annum during the mid-1980's boom was nearly identical to the temporary 6.7% annualized surge after the 1975 recession ended, and the 6.8% gain during a comparable snap-back boom during 1972-73 .

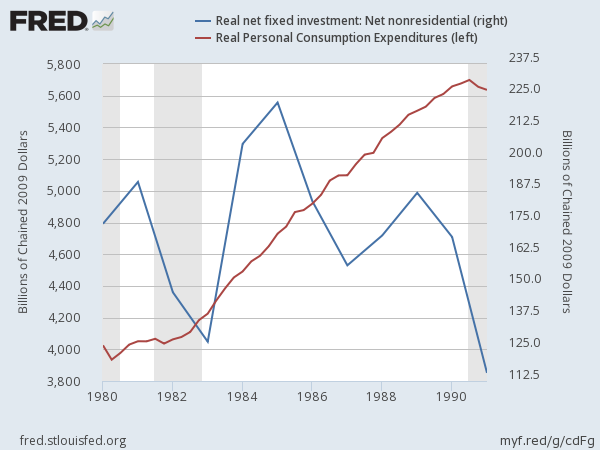

The fact is, the mid-1980s boom was an inadvertent case of Keynesian stimulus run amuck, not a supply side expansion in any sense of the word. The internal composition of GDP growth during the 1980s tells the real story.

To wit, household consumption spending (PCE) grew at a 3.4% rate over that 10 year period and government spending at a 3.3% rate. In fact, those two components of GDP accounted for nearly all of the expansion.

By contrast, gross business fixed investment grew at a lower rate than GDP in real terms. Moreover, as we have frequently pointed out, gross business CapEx spending is not a full measure of investment and the economy's capacity for future growth of productivity and output because it does not account for current period consumption of plant, equipment, technology and other fixed assets.

The chart below tells the true story. Real net business investment (after allowance for depreciation and amortization) actually declined by 0.3% per year during the decade compared to the 3.4% rise in PCE.

In short, shrinking real net investment is not the hallmark of a permanent supply-side expansion; it's the skunk in the woodpile that belies the whole Reaganite mythology.

So if Speaker Ryan were honest and insightful about today's debt, welfare and speculation barnacled economy, he would scrap the GOP's atavistic Reagan-era focus on cutting income taxes.

That's because another Reagan deficit-financed tax cut is not even remotely affordable; and one paid for with base-broadening and loophole-closings will never pass through the K-Street lobby gauntlet which owns the tax-writing committees of both houses and both parties.

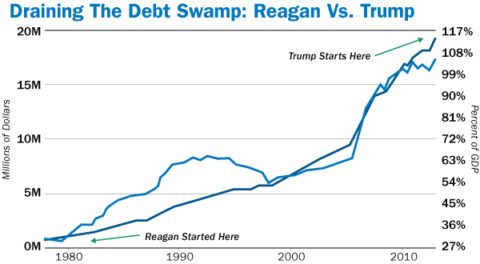

As to affordability, the chart below makes the story clear as a bell. Ronald Reagan started with a relatively clean Federal government balance sheet---- with $930 billion of debt, representing just 30% of GDP.

By contrast, today's $19.8 trillion of public debt amounts to 106% of GDP; and unlike the built-in surpluses in the outyears Reagan inherited owing to bracket creep and high inflation, today's fiscal baseline amounts to a permanent tidal wave of red ink.

Over the next decade, $10 trillion of cumulative deficits would be generated by current tax law and spending policies---even under CBO's Rosy Scenario economic assumptions. So plain and simply there is no fiscal headroom left for the kind of massive tax cut----which amounted to 6.2% of GDP when fully effective or $1.1 trillion per year in today's sized economy----that occurred by political accident in July 1981 during the Great Bidding War between the parties.

Moreover, notwithstanding the abstract economic merits of sharply reducing or even scrapping the income tax, recycled Reaganism no longer has political resonance with Flyover America, anyway. That's because the top 6% of US households now pay 60% of the tax; and the top 17% pay 80% of all income tax collections extracted by Uncle Sam.

At the same time, the real job killer in today's economy is the 15.3% payroll tax shared by employers and employees. That albatross, which is extracted on behalf of 160 million workers, will continue to drag down the American economy until it is slashed deeply or eliminated entirely.

Those figures compare to the vastly smaller cohort of 24 million households which pay 80% of the Federal income tax; and which would get virtually all of the benefits under the traditional supply side "rate" cuts. Worse still, this small cohort of wealthy income tax payers reside overwhelmingly in the "blue state" coastal strips of America, where the GOP could not win them over under any imaginable income tax cut.

That's the real reason we say that Speaker Ryan is lost in fantasyland. The income tax has been slashed so many times since 1981 that it's no longer a broad based societal tax; it's a kind of luxury tax on upper income salary earners and the small share of households which garner most of the capital income from dividends, interest payments and capital gains.

Thus, during the most recent year (2014), there were 91 million filers with adjusted gross income (AGI) under $50,000. They represented 61% of the 148 million personal income tax filers in the nation, but paid only $77 billion in taxes or 5.6% of the total.

That's right. Three-fifths of income tax filers accounted for only one-twentieth of the income taxes paid.

In addition to the fact that the top brackets have most of the income and pay higher marginal rates under our so-called "progressive" tax system, there is another reason for that startling skew. Namely, more than 52 million or 35% of tax filers----mostly at the bottom and middle of the income ladder--- didn't owe a single dime of taxes after deductions, exemptions and credits.

In a word, the Fed's Bubble Finance policies over the last three decades have artificially and unjustly driven income and wealth toward the top of the ladder. Call it Keynesian Trickle-Up policy.

At the same time, these wrong-headed policies have pushed more and more of the available employment into a bulge of marginal and part-time "jobs" at the bottom of the ladder, which Washington than attempted to redress by relieving ever greater numbers of workers from most or all income tax payments.

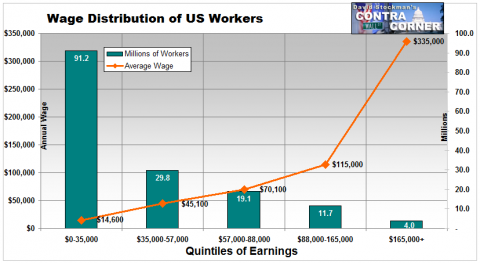

The chart below is based on total income reported by employers for withholding tax purposes and is a slightly different measure than the AGI statistics referenced above. But still, there were 91 million payroll jobs in 2014 that paid $35,000 or less in total wages that year.

Needless to say, the first bar in the chart represents the overwhelming share of the US work force and presumably the American electorate. Yet of the 65 million IRS returns filed by this category of workers, only 22 million or one-third owed any Federal income tax at all----even as the average workers in this cohort had upwards of $2,300 extracted from his pay envelope and his employer's costs ledgers for the OASDHI payroll tax.

Indeed, even if you take the threshold up to $100,000 AGI, the story is not much different. There were 122.8 million filers in that category or 83% of all American's who checked in with the IRS. Yet they only paid $278 billion in Federal income taxes or 20% of the total.

In short, owing to the interaction of Bubble Finance policies at the Fed and "progressive" tax policies on Capitol Hill, the core Federal taxation system embodied in the personal income tax has devolved into an inverse case of the 80/20 rule.

But it's not only bad tax policy to put 80% of the income tax burden on a small slice of the population. It's also worse politics to pretend that income tax reduction still has any serious political appeal.

In fact, the Ryan-GOP's ritualistic fixation on marginal rate cuts causes it to completely ignore the real destructive elephant in the room. That's the $1.2 trillion per year Federal payroll tax levy.

The fact is, the payroll tax wedge on labor costs is the heart of the current economic stagnation. After 30 years of the Fed's feckless pursuit of 2% inflation, nominal wages in the US economy have risen from $8 per hour on average to $24 per hour.

They are now among the highest in the world, and clearly not competitive with China or most of the Asian export economies, which are based on mercantilist trade policies and pegging of exchange rates well below market clearing levels.

At the end of the day, therefore, the only real way to make the American economy great again is to clean house at the Fed and fire its entire posse of Keynesian monetary central planners. What the US economy actually needs to become competitive again is market clearing interest rates (e.g. much higher) and the systematic deflation of domestic costs, prices and wages that would result.

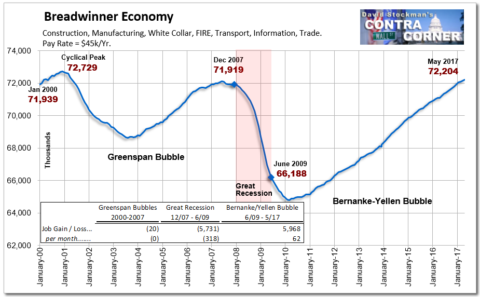

Needless to say, neither the Congressional Republicans nor the Donald and his Wall Street economics team of Goldman alumni (e.g. Gary Cohn and Steve Mnuchin) have a clue. That is, that the Fed's massive financial repression and falsification of financial asset prices is the overwhelming cause of America's sputtering economy and dearth of "breadwinner" jobs-----a reality that was reconfirmed once again in May's jobs report

Indeed, they are so out of it that they have not yet bothered to fill the Fed's existing vacancies or announced who will replace Janet Yellen and Stanley Fischer when their terms as chair and vice-chair mercifully expire next January.

At the same time, the economic nationalists in the White House---led by Steve Bannon, Peter Navarro and Wilbur Ross (Commerce Secy) are mainly huffing and puffing about the wrong culprit in the form of allegedly "bad" trade deals. The Fed's massive warping of the US economy's price levels and capital and trade flows is more destructive than 100 NAFTA deals.

As free traders correctly point out, free trade doesn't have much to do with "deals" negotiated on a government-to-government basis, anyway. Mainly those become smokescreens for hidden crony capitalist privileges, subsidies and protections.

The best way to promote free trade in a world of honest money, in fact, is to unilaterally reduce domestic tariffs and other state-imposed non-tariff obstacles to trade, and let the entrepreneurs and businessmen on the free market do the rest. But under the current regime of monetary central planning that approach is neither politically possible nor perhaps economically desirable.

So the second best alternative is to shift tax policy to lifting the heavy burden on hiring and take-home pay for the bottom 90 million workers who depend upon part-time, low-pay and other marginal employment.

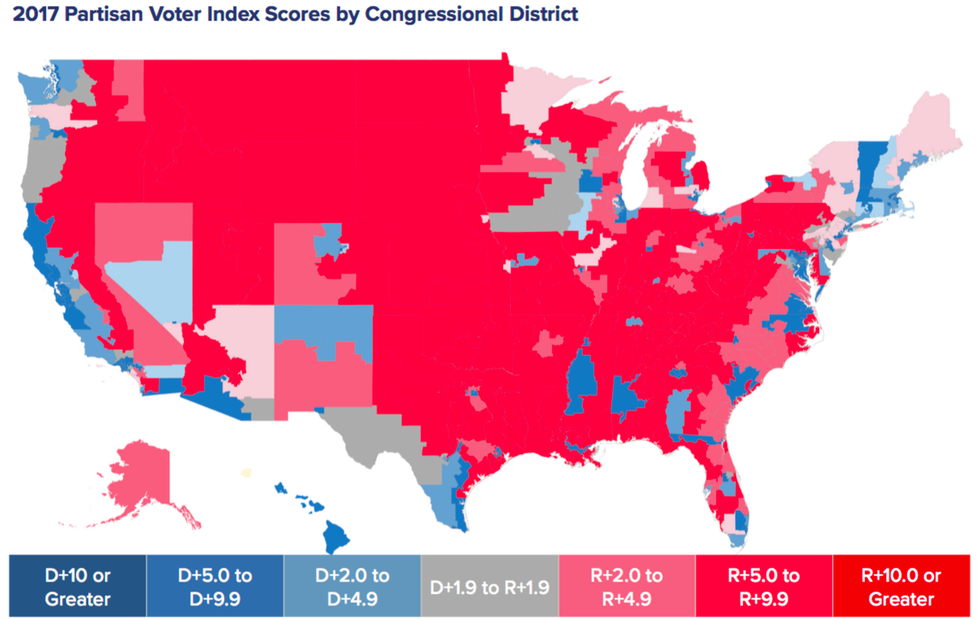

That is,the citizens who live right there in the red zones of the map below.

Awhile back we posted this electoral map of the 2016 election. Needless to say, a high share of the 24 million households which pay 80% of the Federal income tax are domiciled in the blue sliversalong the coasts. Why does Ryan and the GOP congressional mainstream insist on wasting its political mandate on them?

The vast swaths of red scattered across Flyover America are where the nation's payroll taxpayers live. It is in the farms, small towns, rust belt cities and faltering economies of the nation's industrial interior that tax relief is most urgently needed.

And it is where a massive $1.2 trillion cut in the combined payroll tax would deliver real economic punch and powerful political dividends, too-----even if it was paid for by a $1.2 trillion per year VAT (value added tax on consumption).

In the case of the $35,000 dollar job category shown in the chart above, the payroll tax wedge would be reduced by $5,40o per year at that level; and by $2,300 in the case of the average job in that cohort which generates just $14,600 per year in covered wages.

We have consistently advocated exactly this strategy. That is, elimination of the payroll tax in favor of a consumption tax or VAT as the heart of a maneuver to revive the GOP's century-ago "McKinley full dinner-pail coalition".

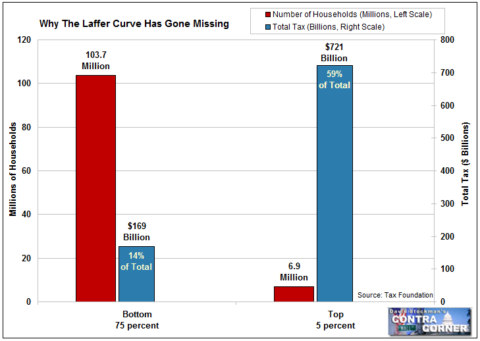

Owing to the drastic evolution of the Federal income tax toward a luxury tax on the elites as described above, the so-called Laffer Curve has gone missing. When you have 80-90 million tax filers who pay essentially nothing in Federal income taxes, you self evidently don't get any supply side "response" from them when you cut rates.

At the same time, the distributional math of rate cuts is insuperable. Under the Reagan-style across-the-board rate cut and collapse to three brackets that Ryan proposed still again in yesterday's speech, the top 1% of tax filers (1.4 million) would get a $152 billion annual tax cut or about half of the $300 billion per year total. By contrast, the bottom 60% (84 million) would save just $25 billion.

In round terms, the bottom 80 million tax filers would save the grand sum of $5.75 per week. That's not going to ignite the debt-burdened US economy into a paroxysm of supply side growth.

This point bears repeating. Most workers are not really on the Laffer Curve nowadays because they don't pay enough income taxes to shake a stick at. Thus, in the most recent year (2014), of the 148 million citizens who filed Federal income tax returns as documented above, about 122 million or 83% either owed no taxes at all or relatively modest amounts relative to their earnings.

In fact, the $278 billion of total income taxes paid by all 122 million taxpayers with an AGI under $100,000 per year amounted to just 6.5% of their AGI (adjusted gross income). It also accounted, as indicated above, to just one-fifth of total income tax collections.

Even more strikingly, within that group the bottom half (75 million) of tax filers paid just $45 billion in taxes or a minuscule 3.3% of the total. In round terms it averaged out to about $8 per week per tax filer.

In the scheme of things, these 75 million income tax filers are irrelevant to both economics and the nation's fisc. Their payments accounted for less than 4 days worth of Federal outlays.

By contrast, the top 4% or 6.2 million filers paid $802 billion in Federal income taxes. That accounted to nearly 58% of total payments, and resulted in a average tax rate of 24% on the group's AGI.

(Chart data is slightly different because it's for 2013, while the above data is more current for 2014. But the extreme skew to the top is still the same).

Do we think there is a snowball's chance that either the Ryan supply-side tax cut or the "fresh look"payroll tax swap suggested above will get any traction in the months ahead?

No, we do not. The ballyhooed Trump Tax Stimulus is positively stillborn and the Ryan can-do-cut is but a pipe dream.

What lies ahead, instead, is the fiscal year from hell. The battle will not be about cutting taxes, stimulating growth or indulging Wall Street with the fantasy of sweeping corporate rate cuts and another $20 per share of S&P 500 earnings.

What happens now is an endless struggle to keep the lights on in the Washington Monument and to pay the bills of a Federal leviathan that will be no longer governable after the Deep State attempts one more coup with the Presidential helicopter.

Disclosure: None.