November Monthly

Three main forces are shaping the business and investment climate: Surging energy prices, a dramatic backing up of short-term interest rates in Anglo-American countries, and the persistence of supply chain disruptions.

The US and Europe have likely passed peak growth. Fiscal policy will be less accommodative, and financial conditions have tightened. Japan appears to be getting a handle on Covid and after a slow start. Its vaccination rate has surpassed the US. The lifting of the formal state of emergency and a hefty dose of fiscal stimulus is expected to be delivered in the coming months. Many developing economies have already lifted rates, some like Brazil and Russia, aggressively so. They will likely finish earlier too.

US light sweet crude oil rose nearly 12% last month, even though US inventories rose last month for the first time since April. The price of WTI rose almost 10% in September. Statistically, the rise in oil prices is strongly correlated with the increase in inflation expectations.OPEC+ will boost supplies by another 400k barrels a day at the start of November and is committed to the same monthly increase well into 2022.

At the same time, new Covid infections in several Asia-Pacific countries, including China, Singapore, and Australia, warn of the risk of continued supply-chain disruptions. In Europe, Germany and the UK recently reported the most cases since the spring. Belgium is tightening curbs. Bulgaria is seeing a rise in infections, and Romania was at full capacity in its intensive care facilities. The fact that Latvia lags the EU in vaccination at about 50% leaves it vulnerable. The US may be lagging behind Europe, and the next four-six weeks will be critical. Roughly 40% of Americans are not fully vaccinated.

The rise in price pressures and the gradual acknowledgment by many central bankers that inflation may be more persistent have helped spur a significant backing up of short-term rates in the Anglo-American economies. The ultimately deflationary implications of the surge in energy prices through demand destruction and the implications for less monetary and fiscal support still seem under-appreciated. Yet, the market has priced in aggressive tightening of monetary policy over the next 12 months.

The focus of the foreign exchange market seems squarely on monetary policy. From a high level, the central banks perceived to be ahead in the monetary cycle have seen stronger currencies. The likely laggards, like the Bank of Japan, the Swiss National Bank, and the ECB, have currencies that underperformed. Norway and New Zealand have already raised rates and are expected to do so again in November.

Of course, as you drill down, discrepancies appear. In October, the Australian dollar was the top performer among the major currencies with a 4% gain. It edged out the New Zealand dollar and the Norwegian krone, whose central banks are ahead of the Reserve Bank of Australia. The RBA has pushed against market speculation that has 90 bp of tightening priced into 12-month swaps. The Australian dollar outperformed sterling by about 2.5% in October even though the Bank of England has been so hawkish with its comments that the market had little choice but to price in a high probability of a hike as early as November meeting.

In fact, the market has the UK's base rate above 50 bp by the end of Q1 22. This is important because in its forward guidance that BOE has identified that as the threshold for it to begin unwinding QE by stopping reinvesting maturing issues. Interestingly enough, when the BOE meets on March 17 next year, it will have a sizeable GBP28 bln maturity in its portfolio.

In an unusual quirk of the calendar, the Federal Reserve meets before the release of the October jobs report. All indications point to the start of the tapering process.It is currently buying $120 bln a month of Treasuries ($80 bln) and Agency Mortgage-Backed Securities. The pace of the reduction of purchases is a function of the duration, and the Fed has clearly indicated the tapering will be complete around mid-year. That suggests reducing the purchases by about $15 bln a month.

Chair Powell indicated that unlike the Bank of England, the Fed will stop its bond purchases before raising rates. A faster pace of tapering would be a hawkish signal as it would allow for an earlier rate hike. The gap between when the tapering ends and the first-rate hike does not appear predetermined. Powell has talked about the economic prerequisites, which emphasize a full and inclusive labor market in the current context. The Fed funds futures entirely discount a 25 hike in July, with the risk of a move in June. Comments by several officials hint that the Fed may drop its characterization of inflation as transitory, which would also be understood as a hawkish development.

Partly owing to the extended emergency in Japan, it is marching to the beat of a different drummer than the other high-income countries. Inflation is not a problem. In September, the headline rate rose to 0.2% year-over-year, the highest since August 2020. However, this is a function of fresh food and energy prices, without which the consumer inflation stuck below zero (-0.5%).In December 2019, it stood at 0.9%.In addition, while fiscal policy will be less accommodative in Europe and the US, a sizeable supplemental budget (~JPY30 trillion) is expected to be unveiled later this year.

After expanding by 1.3% quarter-over-quarter in Q2, the Chinese economy slowed to a crawl of 0.2% in Q3, which was half the pace expected by economists. Some of the decline in economic activity resulted from the virus and natural disasters (floods). Still, some of it stemmed from an effort to cut emissions in steel and other sectors. The problems in China's property development space, accounting for a large part of its high-yield bond market, unsettled global markets briefly. Talk of a Lehman-like event seems a gross exaggeration. Still, given the sector's importance to China's economy (30% broadly measured) and the use of real estate as an investment vehicle, it may precipitate a structural shift in the economy.

The Communist Party and the state are reasserting control over the economy's private sector and the internet and social network. It has also weighed in on family decisions, like the number of children one has, how long a minor should play video games, the length of men's hair, what kind of attributes entertainers should have, and appropriate songs to be played with karaoke. It seems to be reminiscent of part of the Cultural Revolution and a broader economic reform agenda like Deng Xiaoping did in the late 1970s and Zhu Rongji in the 1990s.

At the same time, Beijing is wrestling with reducing emissions and soaring energy prices, which also dampen growth. Even though consumer inflation is not a problem in China (0.7% year-over-year in September), Chinese officials still seem reluctant to launch new stimulative fiscal or monetary initiatives. Moreover, new outbreaks of the virus could exacerbate the supply chain disruptions and delays fuel inflation in many countries.

The aggressiveness in which investors are pricing G10 tightening weighed on emerging market currencies in October. The JP Morgan Emerging Market Currency Index fell by almost 0.8% last month after falling 2.9% in September, the largest decline since March 2020. The continued politicization of Turkey's monetary policy and the aggressive easing saw the lira tumble nearly 7.5% last month, which brings the year-to-date depreciation to 22.5%.

On the other hand, Brazil's central bank has aggressively hiked rates, and the 150 bp increase in late October brought this year's tightening to 575 bp and lifting the Selic to 7.75%. Yet, it is still below the inflation rate (10.34% October), and the government has lost the confidence of domestic and international business. The Brazilian real fell nearly 3.5% last month to bring the year-to-date loss to almost 7.8%.

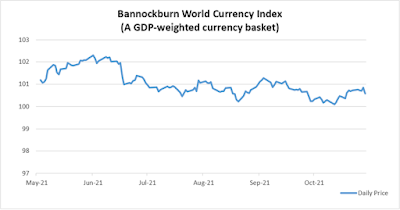

Our GDP-weighted currency basket, the Bannockburn World Currency Index, snapped a two-month decline and rose by 0.35%.The rise in the index reflects the outperformance of the currencies against the dollar.The currencies from the G10 countries, including the dollar, account for about two-thirds of the index, and emerging markets, including China, the other third.The yen was the weakest of the majors, falling 2.3%.It has a weighting of 7.5% in the BWCI.

Among the emerging market currencies in our GDP-weighted currency index, the Brazilian real's 3.4% decline was the largest, but its 2.1% weighting minimizes the drag.It was nearly offset by the Russian rouble's 2.5% advance.It has a 2.2% weighting in our basket.The Chinese yuan, which has a 21.8% share, rose by 0.6%.

Dollar: The market is pricing in very aggressive tightening by the Federal Reserve. As recently as late September, only half of the Fed officials anticipated a hike in 2022. The December 2022 Fed funds futures are pricing in a little more than two hikes next year. More than that, the market is discounting the first hike in June next year, implying a transition from completing the bond-buying to raising rates with no time gap. The disappointing 2% Q3 GDP exaggerated the slowing of the world's largest economy. We note that the supply-side challenges in vehicle production halved the growth rate. Growth is likely to re-accelerate in Q4, but we continue to believe that the peak has passed. While inflation is elevated, the pace of increase slowed in Q3. Consider that the PCE deflator that the Fed targets rose at an annualized rate of 4.0% in Q3 after a 5.6% pace in Q2. The core rate slowed to an annualized pace of 3.3% last quarter, half of the speed in the previous three months. The infrastructure spending plans have been reduced, and some of the proposed tax hikes, including on corporations, appear to be dropped as part of the compromise among the Democratic Party.

Euro: For most of Q3, the euro has been in a $1.17-$1.19 trading range.It broke down in late September and was unable to recapture it in October. Instead, it recorded a new low for the year near $1.1525.A convincing break of the $1.1500 area could signal a move toward $1.1300. The single currency drew little support because growth differentials swung in its favor in Q3:the Eurozone expanded by 2.2% quarter-over-quarter while the US grew 2% at an annualized pace. The ECB is sticking to its analysis that the rise in inflation is due to transitory factors while recognizing that energy prices may prove more sticky. That said, news that Gazprom may boost gas sales to Europe after it finishes replenishing Russian inventories after the first week in November, natural gas prices fall at the end of October. After the Pandemic Emergency Purchase Program ends next March, decisions about the asset purchases next year will be announced at the December ECB meeting along with updated forecasts.

(October indicative closing prices, previous in parentheses)

Spot: $1.1560 ($1.1580)

Median Bloomberg One-month Forecast $1.1579 ($1.1660)

One-month forward$1.1568 ($1.1585) One-month implied vol5.1% (5.1%)

Japanese Yen: The dollar rose 2.3% against the yen in October to bring the year-to-date gain to nearly 9.5%.The Bank of Japan will lag behind most high-income countries in the tightening cycle, and the higher US yields are a crucial driver of the greenback's gains against the yen. Japan's headline inflation and core measure, which only excludes fresh food, may be rising, but they are barely above zero and, in any event, are due to the surge in energy prices. In response to the weakening yen, Japanese investors appear to have boosted their investment in foreign bonds, while foreign investors increased their holdings of Japanese stocks.The LDP and Komeito maintained a majority in the lower chamber of the Diet. A sizeable stimulus supplemental budget is expected to help strengthen the economic recovery now that the formal emergencies have been lifted.In Q3, the dollar traded mainly between JPY109 and JPY111.It traded higher in the second half of September rising to nearly JPY112.00.The dollar-yen exchange rate often seems to be rangebound, and when it looks like it is trending, it is frequently moving to a new range.We have suggested the upper end of the new range may initially be the JPY114.50-JPY115.00.The four-year high set last month was about JPY114.70.A move above JPY115.60 could target the JPY118.50 area.

Spot: JPY113.95 (JPY111.30)

Median Bloomberg One-month Forecast JPY112.98 (JPY111.00)

One-month forward JPY113.90 (JPY111.25) One-month implied vol6.4% (5.6%)

British Pound: Sterling rallied around 4 1/3 cents from the late September low near $1.34.The momentum stalled in front of the 200-day moving average (~$1.3850).After several attempts, the market appeared to give up.We anticipate a move into the $1.3575-$1.3625 initially, and possibly a return toward the September low. The implied yield of the December 2021 short-sterling interest rate futures rose from 22 bp at the end of September to 47 bp at the end of October as the market. It was encouraged by Bank of England officials to prepare for a hike at the meeting on November 4, ostensibly while it is still providing support via Gilt purchases. If there is a surprise here, it could be that, given the unexpected softening of September CPI and the fifth consecutive monthly decline in retail sales, rising Covid cases, that the BOE chooses to take the more orthodox route. This would entail ending its bond purchases, as two MPC members argued (dissented) at the previous meeting and holding off lifting rates a little longer.

Spot: $1.3682 ($1.3475)

Median Bloomberg One-month Forecast $1.3691 ($1.3630)

One-month forward $1.3680 ($1.3480) One-month implied vol 6.8% (7.1%)

Canadian Dollar: The three drivers for the exchange rate moved in the Canadian dollar's favor in October and helped it snap a four-month slide against the US dollar.First, the general appetite for risk was strong, as illustrated by the strength of global stocks and the record highs in the US.Second, the premium Canada pays on two-year money more than doubled last month to almost 60 bp from 25 bp at the end of September.Third, commodity prices in general and oil, in particular, extended their recent gains.The CRB Index rose 3.8% last month, the 11th monthly increase in the past 12, to reach seven-year highs.The Bank of Canada unexpectedly stopped its new bond purchases and appeared to signal it would likely raise rates earlier than it had previously indicated.The swaps market is pricing 125 bp of rate hikes over the next 12 months, with the first move next March or April.Still, the US dollar's downside momentum stalled near CAD1.2300.There is scope for a corrective phase that could carry the greenback into the CAD1.2475-CAD1.2500 area.

Spot: CAD1.2388 (CAD 1.2680)

Median Bloomberg One-month Forecast CAD1.2395 (CAD1.2580)

One-month forward CAD1.2389 (CAD1.2685) One-month implied vol 6.2% (6.9%)

Australian Dollar: The Aussie's 4% gain last month snapped a four-month, roughly 6.5% downdraft.Despite RBA Governor Lowe's guidance that the central bank does not anticipate that the condition to hike rates will exist before 2024 is being challenged by the market.Underlying inflation rose above 2% in Q3. The central bank's failure to continue defending the 10 bp target of the April 2024 bond spurred speculation that it would be formally abandoned at the November 2 policy meeting.The RBA's inaction unsettled the debt market.The two-year yield soared almost 70 bp last month, and the 10-year yield rose nearly 60 bp.Although the RBA could have handled the situation better, New Zealand rates jumped even more.Its two-year yield jumped 80 bp while the 10-year yield surged by 58 bp.Last month, the Australian dollar's rally took it from around $0.7200 to slightly more than $0.7550, where it seemed to stall, just in front of the 200-day moving average.We suspect the October rally has run its course and see the Aussie vulnerable to a corrective phase that could push it back toward $0.7370-$0.7400.The New Zealand dollar has also stalled ($0.7220), and we see potential toward $0.7050.

Spot:$0.7518 ($0.7230)

Median Bloomberg One-Month Forecast $0.7409 ($0.7290)

One-month forward$0.7525 ($0.7235) One-month implied vol 9.1 (9.0%)

Mexican Peso: The peso eked out a minor gain against the dollar last month.However, the nearly 0.4% gain understated the swings in the exchange rate last month.The dollar's recovery seen in the second half of September from almost MXN19.85 to nearly MXN20.40 at the end of the month was extended to a seven-month high around MXN20.90 on October 12.It then proceeded to fall to almost MXN20.12 before the greenback was bought again.A move above the MXN20.60 area now would likely signal a test on last month's high and possibly higher. Recall that the dollar peaked this year's peak set in March was near MXN21.6350. The economy unexpectedly contracted in Q3by 0.2% (quarter-over-quarter).Nevertheless, with the year-over-year CPI at 6% in September, Banxico will see little choice but to hike rates at the November 11 meeting. The market expects a 25 bp increase.A 50 bp hike is more likely than standing pat.

Spot: MXN20.56 (MXN20.64)

Median Bloomberg One-Month ForecastMXN20.42 (MXN20.41)

One-month forwardMXN20.65 (MXN20.74) One-month implied vol 9.6% (11.0%)

Chinese Yuan: Our starting point is the yuan's exchange rate is closely managed.The fact that the yuan rose to four-month highs against the dollar and a five-year high against the currency basket (CFETS) that the PBOC tracks imply a tacit acceptance. While it is tempting for observers to link the appreciation to securing an advantage as it secures energy supplies and other commodities, we note that the yuan's gains are too small (0.6% last month and less than 2% year-to-date) to be impactful. We suspect that the dollar's recent weakness against the yuan will be unwound shortly. The US government continues to press its concerns about the risk for investors in Chinese companies listed in the US and American companies operating in China. At the same time, the FTSE Russell flagship benchmark began including mainland bonds for the first time. China's 10-year government bond is the only one among the large bond markets where the yield has declined so far this year (~16 bp).On the other hand, Chinese stocks have underperformed. That said, some investors see this underperformance as a new buying opportunity. The Nasdaq Golden Dragon Index that tracks Chinese companies listed in the US fell by 30% in Q3 and gained 5% in October, its best month since February. Lastly, the Central Committee of the Chinese Communist Party meets November 8-11 this year, a prelude to the important National Party Congress in 2022 that is expected to formally signal the third term for President Xi.

Spot: CNY6.4055 (CNY6.4450)

Median Bloomberg One-month ForecastCNY6.4430 (CNY6.4470)

One-month forward CNY6.4230 (CNY6.4725) One-month implied vol3.5% (3.4%)

Read more by Marc on his site Marc to Market.

Disclaimer: Opinions expressed are solely of the author’s, based on current ...

more