Not So Fast On Banking De-Regulation

...It's my view that at least one of following Trump's "bucket list" financial deregulation items will not materialize as planned:

- the repeal of Sarbanes-Oxley, passed in 2002 to protect investors from fraudulent accounting activities by corporations,

- and the 2010 Dodd-Frank Act (the Wall Street Reform and Consumer Protection Act) [that] places regulation of the financial industry in the hands of government.

[Here's why.]

Written by Bryan Perry

Donald Trump has vowed to either eliminate Dodd-Frank or defang it greatly, including a major overhaul of its many components, saying it crimps business as usual and has been a large drag on economic growth. Unchecked, the banks and Wall Street sorely lack the Boy Scout character traits to operate freely, much less in a self-policing manner that can be trusted - or taken seriously at all.

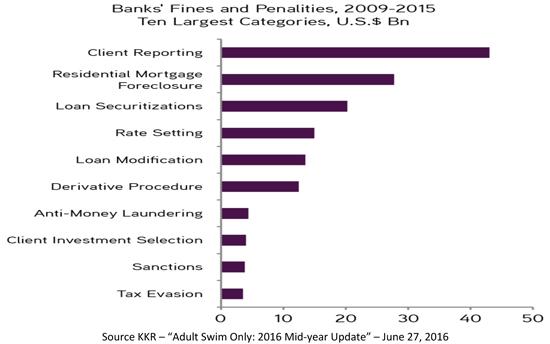

In 2016, we saw leading Wall Street firms pay out $5 billion in a mortgage settlement, and $2.6 billion in connection with misleading investors regarding mortgage securities. We also saw two of Europe's leading banks agree to pay $7.2 billion and $5.3 billion to settle similar charges in recent high-profile cases. The numbers related to banking corruption are simply staggering.

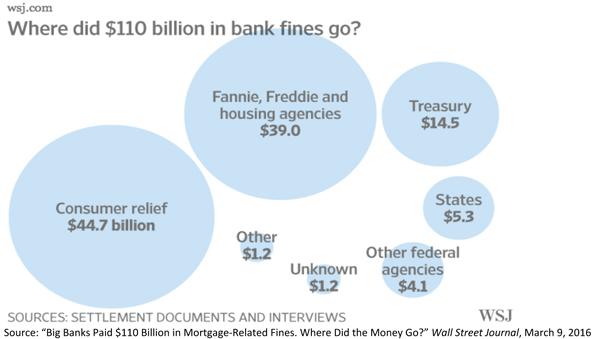

According to an in-depth report from The Wall Street Journal, bankers were fined roughly $110 billion for their misdeeds in the mortgage market during the run-up to the financial crisis. About $50 billion of those $110 billion in fines from 30 settlements ended up with the entity that levied it: the U.S. government. About $49 billion of fines ended up at the Treasury Department. Treasury, which manages the country's budget and taxes, usually puts fines in its general fund (where federal taxes usually land as well), which can be used for any item in the budget, including employee salaries, Medicare and military costs. It's not exactly clear, though, what Treasury is doing with its portion of the bank's mortgage fines. A spokesman for the Treasury told The Wall Street Journal that it is being spent "as Congress authorizes." ("Big Banks Paid $110 Billion in Mortgage-Related Fines. Where Did the Money Go?" Wall Street Journal, March 9, 2016)

Here's the full breakdown of where the $110+ billion went, according to the Wall Street Journal study:

- The Treasury initially received $14.5 billion, although funds from other government agencies - including $34 billion from Fannie Mae and Freddie Mac - later went to the Treasury.

- $44.7 billion was put aside for consumer relief.

- $10 billion was set aside to be used for housing-related federal agencies and to whistleblowers who called banks out. Some of these funds were also went back to the Treasury.

- $5.3 billion went to states, which appeared to use the money as they saw fit, including directing the money to pension plans which were hit hard by the fallout from mortgage-backed securities.

- $447 million was given to the Justice Department, which had a role negotiating with the banks.

- Some $1.2 billion could not be tracked down or was unaccounted for.

CNBC reported that banking fines and settlements amounted to much more ($204 billion), most of it related to mortgage fraud prior to the passing of Dodd-Frank in 2010. In September 2016, one of America's biggest banks and a major holding of Warren Buffett was fined $185 million for falsely creating two million fee-generating accounts without customer knowledge or approval, with most of this activity condoned by upper management up until the allegations were made public a few months ago. (Source: "Misbehaving Banks Have Now Paid out $204 Billion in Fines" CNBC, October 15, 2015)

It's a culture of misconduct. Whistleblower defense firm Labaton Sucharow, conducted a survey within the banking community and published quite a revelation: Almost half of the senior-level bankers they polled refused to say they wouldn't break the law. One in four said they "had observed or had firsthand knowledge of wrongdoing in the workplace." Only 41% of them said that colleagues in their own firm had "definitely not" committed crimes to get ahead - and nearly one-fourth "believed that financial services professionals may need to engage in unethical or illegal conduct in order to be successful" ("The Street, The Bull and The Crisis." University of Notre Dame and Labonton Sucharow LLP, May 2015).

These numbers are probably low. Admitting one's criminal inclinations to a total stranger isn't easy but, even if taken at face value, the poll is an eye-opener: One in six bankers said they were "fairly likely" to commit a banking crime if they could get away with it and 45% refused to rule it out if the payoff were big enough - and it's not just a matter of personal morality: "Nearly one-third of all financial services professionals reported feeling pressured by bonus or compensation plans to violate the law or engage in unethical conduct." In other words, the system is vulnerable to law breaking in many banking functions.

Looking back on this highly-visible pattern of fraud and deceit within the banking industry, it seems that as long as a big bank can write a big check, nobody goes to jail. I wonder about the nature of Mr. Trump's eagerness to abandon what may be the only guardrail against letting the fox reign inside the hen house. Sure, elements of Dodd-Frank can be modified to advance business at the community bank level, but history is not on the side of allowing big banks to operate freely. Our banking system has a design flaw, because its incentives are broken. The systemic threat posed by our biggest banks can endanger our economy, but the nature of their crimes has made them immune from real (personal) punishment.

William Dudley, President of the Federal Reserve Bank of New York, spoke before the Global Economic Policy Forum ("Ending Too Big to Fail," November 7, 2013), citing "deep-seated cultural and ethical failures" and "the apparent lack of respect for law, regulation and the public trust" in the culture of our biggest banks. The Labaton Sucharow study suggests that banker ethics have gotten worse since 2013.

The old saying of 'be careful what you wish for' might be appropriate in the case of a drastic reduction in big bank regulation. If Mr. Trump expects to win the trust of the very people that voted him into office, I think it would serve him well to keep a strong and well-funded pack of watch dogs eyeing America's big banks.

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more

This is a sobering article, Lorimer.