Not If, But When: This Is Why Cryptocurrency Will Replace Traditional Payment Methods

With Facebook's (FB) Libra (LIBRA) Project shining a spotlight on cryptocurrency -- and drawing the ire of American lawmakers and regulators -- the debate has been rekindled as to whether Bitcoin and other cryptos will have staying power beyond 2019. There's even speculation that cryptocurrency could pose a serious challenge to traditional payment and money-transfer services.

Some of the larger companies entrenched in the traditional payment system seem to agree with this sentiment, as Visa (V), Mastercard (MA), and PayPal (PYPL) have joined Coinbase, Uber (UBER), eBay (EBAY) and Spotify (SPOT) in each contributing $10 million or more into the Libra Project. Evidently, they're subscribing to the "If you can't beat 'em, join 'em" strategy -- as is JP Morgan Chase (JPM), an erstwhile harsh crypto critic that's currently in the process of launching their own stablecoin, JPM Coin.

Heck, we're even hearing of die-hard gold bug Peter Schiff -- who has lambasted Bitcoin (BITCOMP) investors in the past -- admitting that he owns Bitcoin; meanwhile, inveterate gold investor Mark Mobius turned more than a few heads when he recently conceded that if Bitcoin continues to grow, he’ll probably buy some himself.

But that's no reason to believe that Bitcoin, Libra, or some other digital currency could replace old-school payment avenues someday... though it certainly could lead us to believe that (to misquote Bob Dylan) "the times, they are a-changin'." Rather, I'm leaning massively bullish on cryptocurrency as the preferred payment of tomorrow because it's cheaper and more efficient than traditional payment methods.

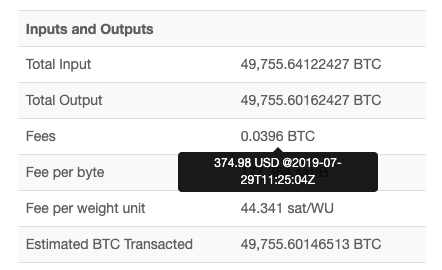

Consider, if you will, what it would take to move $468.5 million in a single transaction via traditional payment mechanisms. On the blockchain, it's no big deal: 49,755.64 BTC was moved quickly and easily, and the Bitcoin network charged just $374.98 (a very small portion of $468.5 million worth of BTC) to facilitate the transfer.

Courtesy: TheNextWeb.com

As a point of reference, we can contrast this with a more traditional payment platform like TransferWise, which would reportedly have charged $1,684,800 to send $468 million from the U.S. to the Eurozone; much of the fee inflation would have been due to the costs involved with converting between currencies (more of a fiat-money issue than something you'd encounter with cryptocurrency).

This, I believe, is emblematic of why Visa, Mastercard, and PayPal are jumping on board the crypto train: they see the writing on the wall, and they'd rather join the movement than get lost in the shuffle. Can you really blame them?

Disclosure: David Moadel is not a licensed or registered investment advisor, and has no position in any securities listed herein.

I've always thought of cryptocurrency as something only criminals would really need or benefit from. But you make an excellent point regarding transaction fees.

Thank you for the comment Michele