Nomura Quant Sees "Brutal De-Allocation Flow" From Vol-Control Universe Today

US equity markets crashed through several technical levels, with S&P finding some support (for now) at its 100DMA...

As the spike in volatility (VIX is back up near 28)...

...prompted forced sellers in size, Nomura's Charlie McElligott - who correctly called this post-opex plunge - notes some remarkable flows going-through earlier this morning in response to the initial “vol squeeze” risk-off, as we witnessed brave vol sellers not waiting for the market purge- or Fed event risk- to clear, and instead, actively attempted to harvest “rich” index vol & skew / shorted it, while others monetized downside hedge gains (because the back-test on vol spikes tells you that you have under 1 day before the rally in spot, LOL)...

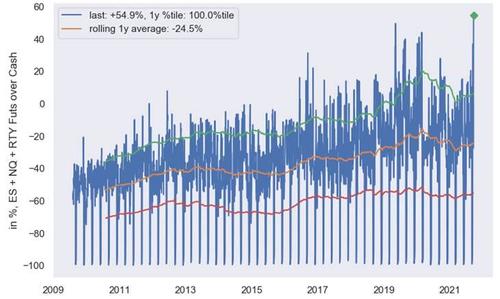

...in turn, this created a LOT of delta to buy over the opening hours and at least attempted to help offset what looks to be just a brutal & latent de-allocation flow originating from the systematic target vol/vol control universe, with a mechanical ‘offer’ all day in US Eq futures:

-

Cust here sold 10k SPY Dec 440 puts, $230mm to buy on that trade

-

Cust away sold 16k SPX Dec 3600 puts on futures, $350mm delta to buy (similar trade which reversed us near the lows of the prior month’s Op-Ex “vol expansion”)

-

SPY Oct 415/430 put spread sold 50k times, another $350mm in delta to buy

-

And the usual “strange seller” was back doing their thing: Spx 27sep 4225/ 4455 sgl paper sold @ 32.2 1147xput, 1091x call

Regardless, McElligott notes, sell pressure in futs has been relentless and those premature “short vol” / “vol harvesting” trades are hurting, with the VIX complex showing real stress - futs seeing some front-end inversion and Vol of Vol (VVIX +26 YIKES) squeezing to new highs, potentially exposing the magnitude of the Dealer “short vol / short skew” problem, which exacerbated the loss of their purportedly offsetting “long gamma” which has been absolutely wiped-out over the past few sessions into/around Op-Ex.

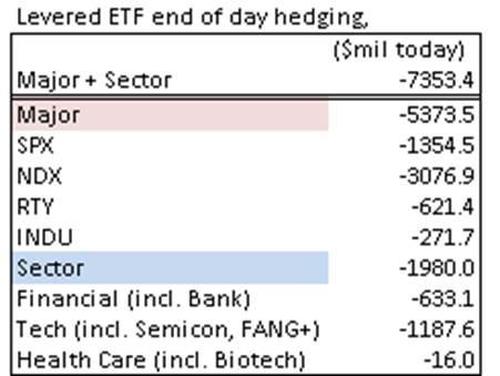

Projecting out into the close, flows from the leveraged ETF space will matter on their daily rebalancing requirements - we currently see ~$7.4B in aggregate across products, with NDX linked -$3.1B, Tech ETF linked -$1.2B, SPX -$1.4B, Russell -$621mm and cross-sector @ -$2B

Updating Vol Control, a -3.0% closing move implies a sale of -$62.9B de-allocation of US Eq futures; a -2.0% is -$40.0B; -1.5% is -$15.3B; -1.0% is -$5.0B

4328 / 4330 in SPX cash is a big level being noted as the 100dma support, but at this juncture with seeing so much ‘long’ options delta being ripped through by systematic deleveraging “sell” flows in index futs / ETF and single net-downs, it is going to be tough line to hold.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more