NFP Preview: Jobs Data May Determine How Much More The Fed Cuts This Month

Background

Every month, we remind traders that the Non-farm Payrolls report is significant because of how it impacts monetary policy. In other words, the Federal Reserve is the “transmission mechanism” between U.S. economic reports and market prices, so any discussion about NFP should start with a look at the state of the U.S. central bank.

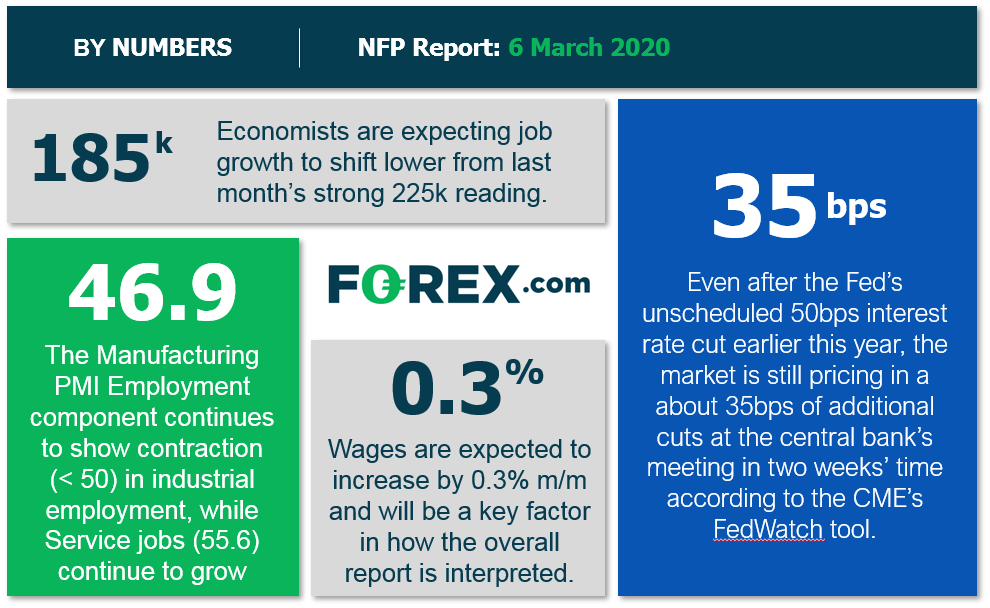

As the spread of coronavirus disrupts large swathes of the global economy, the Federal Reserve took the unusual step of delivering an unscheduled 0.50% cut to interest rates earlier this week. Despite this aggressive move, traders are still speculating that the central bank will cut interest rates again at its next scheduled meeting in less than two weeks’ time, with traders currently pricing in a 60% chance of a 0.25% reduction and 40% odds of another 0.50% “double” cut, according to the CME’s FedWatch tool. Accordingly, this month’s jobs report will help shape by how much the Fed is likely to cut interest rates later this month and should, therefore, lead to a more significant market reaction than recent releases.

NFP Forecast

From our perspective, there are four historically reliable leading indicators for the NFP report:

- The ISM Manufacturing PMI Employment component ticked up to 46.9, a slight improvement over last month’s 46.6 reading (though still in the contractionary territory).

- The ISM Non-Manufacturing PMI Employment component improved to 55.6 from 53.1 last month.

- The ADP Employment report printed at 183k, a slight decline from last month’s downwardly-revised 209k reading.

- The 4-week moving average of initial unemployment claims fell to 213,000, down from 214,500 last month

In other words, the leading indicators are generally positive this month, with three improving and just one deteriorating slightly. Of course, the early impact of coronavirus may start to feed into this jobs report, especially when it comes to manufacturing jobs, but the full brunt of the disease’s spread beyond China likely won’t be felt until next month and beyond. Weighing these factors and our internal models, the data points to a potentially stronger-than-expected jobs report, with headline job growth in the 180k-220k range, albeit with a bigger band of uncertainty given the possible early impact from coronavirus on manufacturing employment.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). Most importantly, readers should note that the unemployment rate and (especially) the wages component of the report will also influence how traders interpret the strength of the reading.

Source: GAIN Capital

Potential Market Reaction

See wage and job growth scenarios, along with the potential bias for the U.S. dollar below:

|

Earnings < 0.3% m/m |

Earnings = 0.3% m/m |

Earnings > 0.3% m/m |

|

|

< 150k jobs |

Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

150-210k jobs |

Slightly Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

> 210k jobs |

Neutral USD |

Neutral USD |

Bullish USD |

In the event the jobs and the wage data beat expectations, then we would favor looking for short-term bearish trades in EUR/USD, which surged more than 400 pips in the last couple of weeks and is currently testing resistance near 1.1200. But if the jobs data misses expectations, then readers may want to consider bullish opportunities in NZD/USD, which is bouncing from support in the 0.6200 area and could benefit from continued monetary stimulus from the US and elsewhere.