Next Year's Housing Crash, In Charts And Anecdotes

Image Source: Unsplash

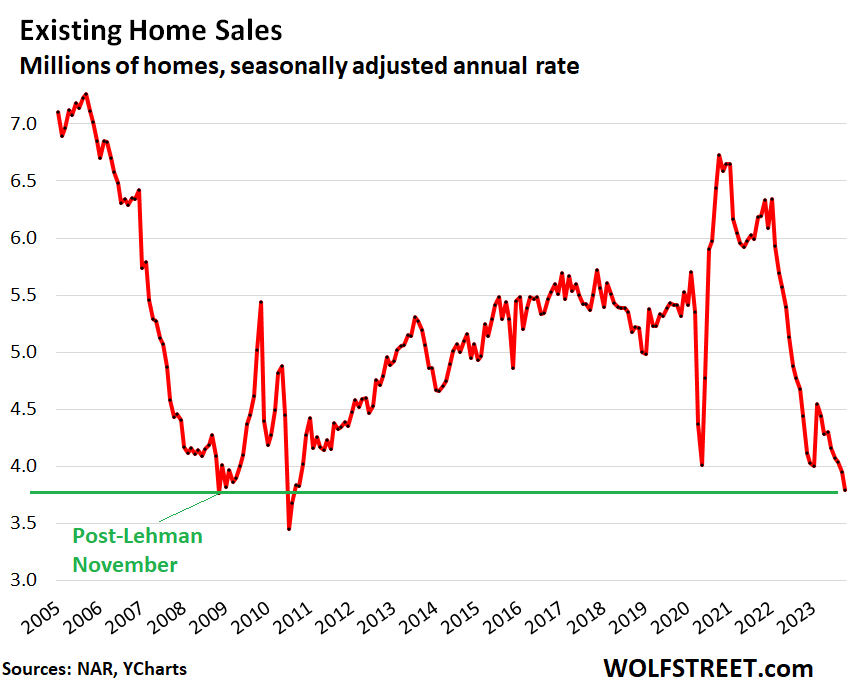

Signs are multiplying that the US housing bubble is about to pop. To start with the headline number, home sales are back at Great Recession levels.

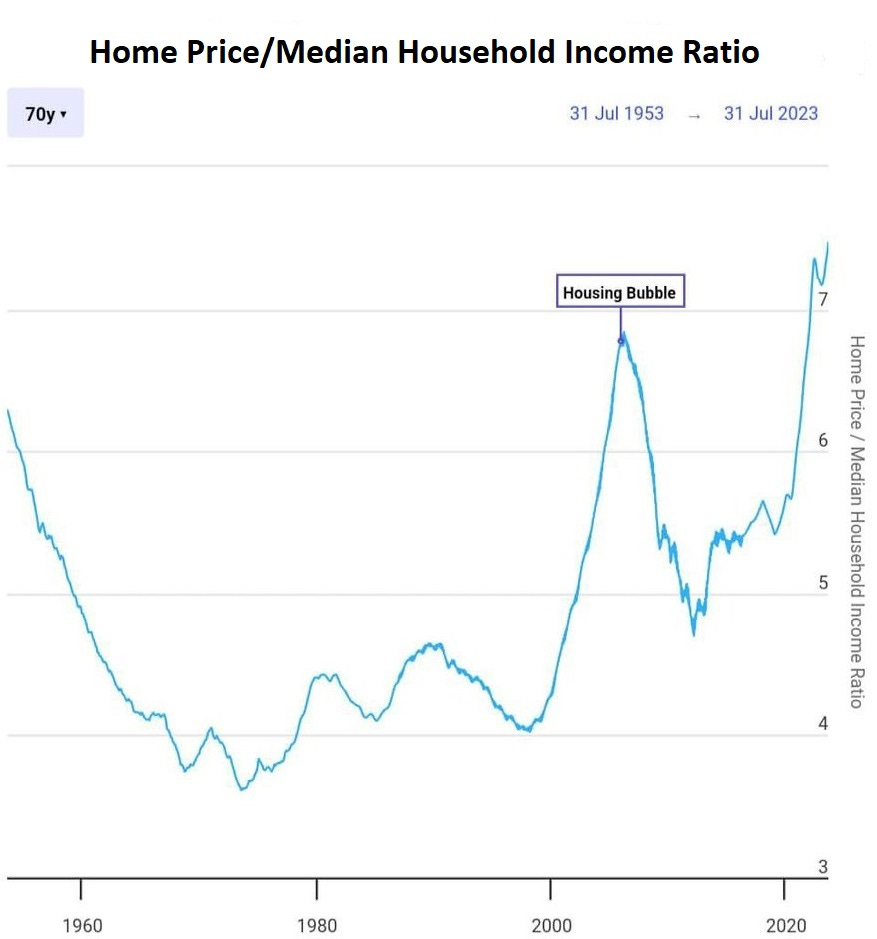

Declining sales are no surprise when viewed against a backdrop of the worst affordability in American housing history. The following chart explains why Boomers are such a cocky generation: We grew up in a time when pretty much everyone could afford a decent house. Now, the average person can’t come close to affording the average house:

Normal topping behavior

Sales falling while prices are reasonably stable is actually normal for housing market tops. Sellers demand the prices they saw a year ago, and buyers can’t afford to pay that much, so the number of completed sales shrinks. Observers start referring to a “sellers’ strike”.

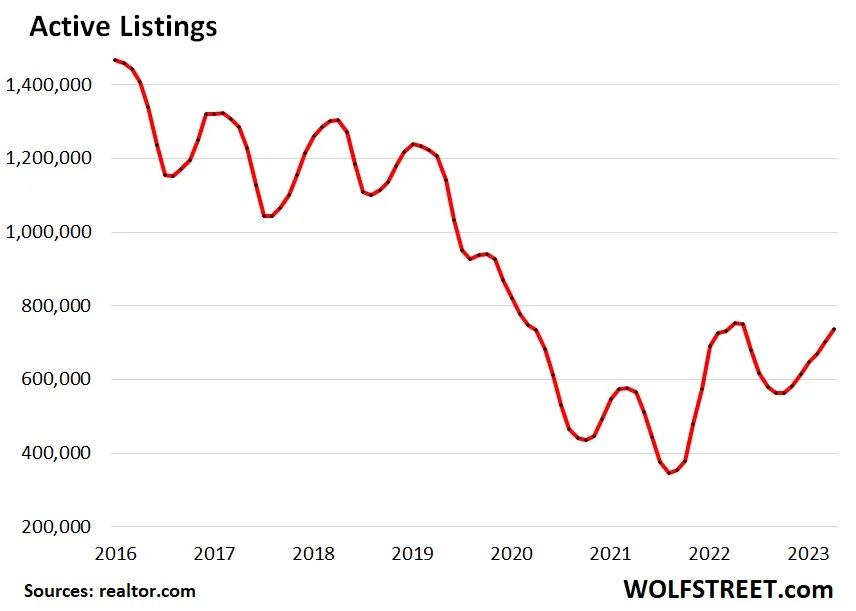

But gradually the number of people who have to sell for whatever reason starts to rise, and the inventory of for-sale houses expands. The resulting oversupply causes prices to plunge and the bubble pops.

The next few charts are from Wolf Richter, who’s doing a great job on both commercial and residential real estate. Definitely read his most recent housing article and if possible subscribe to his work.

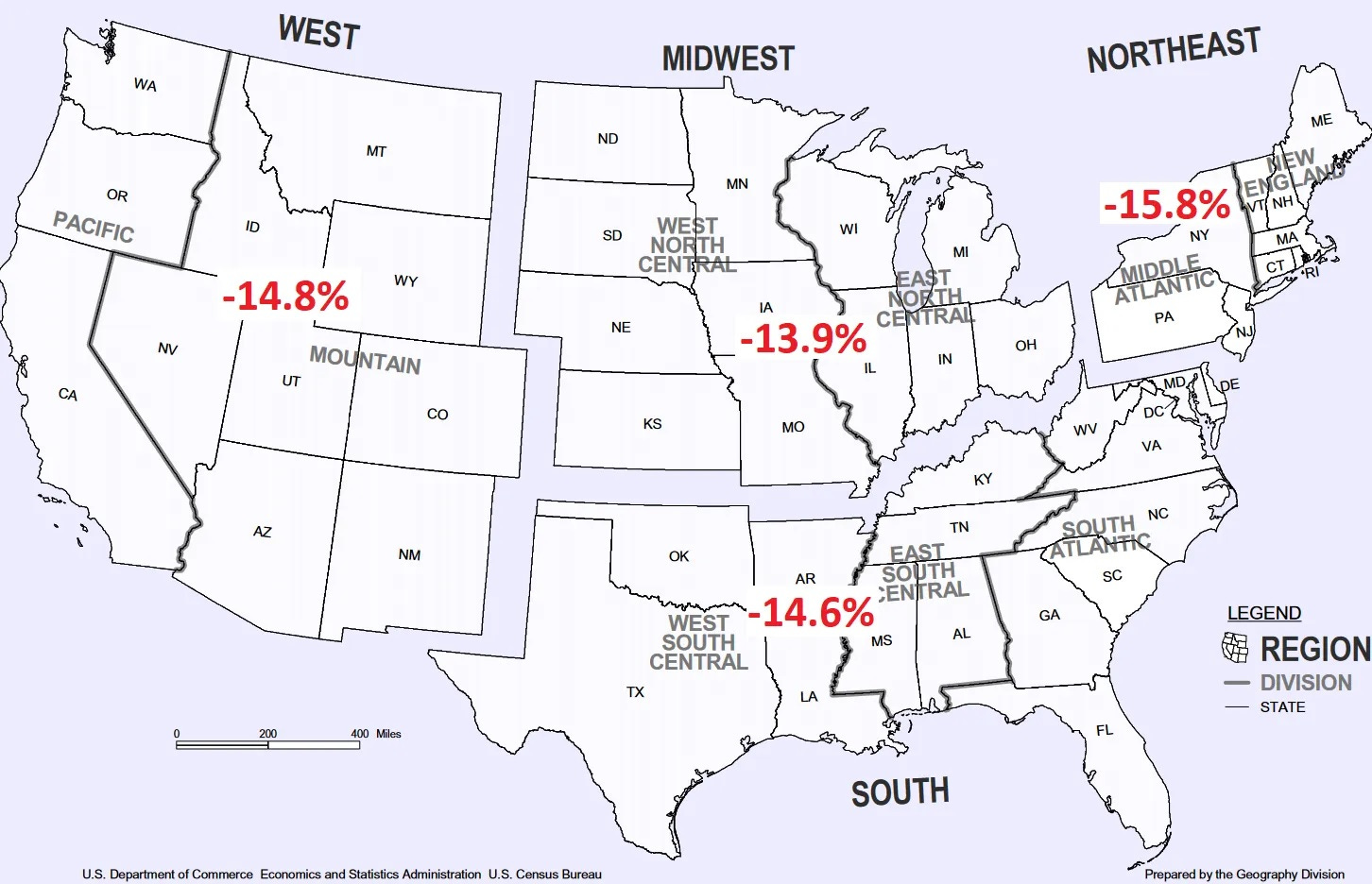

Falling sales aren’t a regional issue. They’re down pretty much everywhere:

Meanwhile, the number of homes listed for sale is rising…

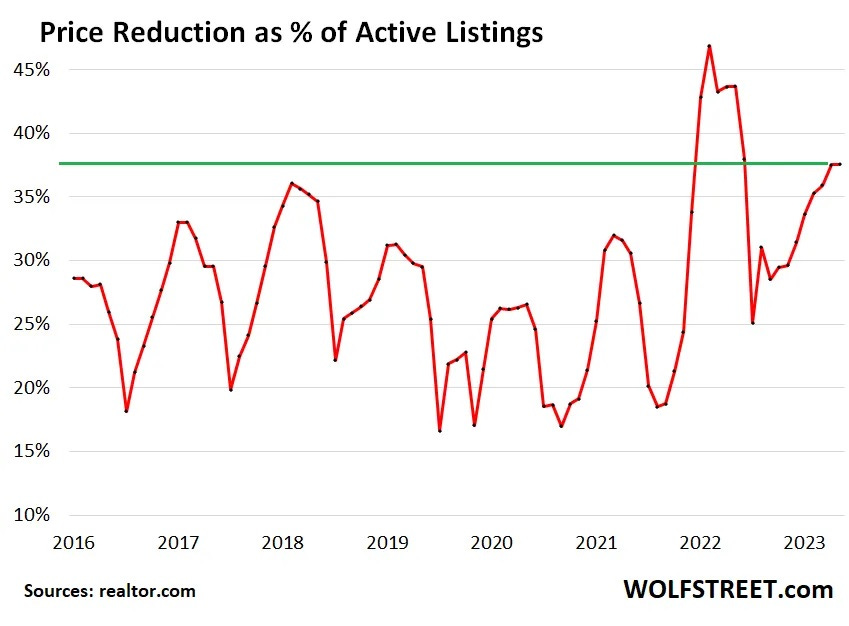

…while the prices of current listings are being cut:

Real-time data

The above trends are translating into a lot of videos in which local realtors and other analysts wander their territories pointing out signs of a nascent housing apocalypse:

Inventory tsunami

To summarize: Home prices have gotten waaayyy ahead of themselves and multiple groups — aging boomers, Airbnb entrepreneurs, Wall Street landlords speculators — are starting to panic-dump inventory while slashing prices.

This might sound hyperbolic after a decade of rising home prices. But it’s what always happens to Wall Street’s bubble assets, including the Nifty 50 in the 1970s, junk bonds in the 80s, tech stocks in the 90s, and subprime mortgages in the 2000s. The idea takes hold that these assets will always go up — right before they crash.

And Airbnb might be the catalyst for the 2024 bust:

More By This Author:

Is Gold A Manipulated Market?Gratitude Check: Gold Price Resistance Proves Sound Money Works

Precious Metal Predators: Short Sellers Look to TSX:V Miners