Newton’s Third Law Of Markets?

Image Source: Unsplash

One could assert that Friday’s market could have been even worse, considering everything that was thrown its way.We had already written about the implementation of tariffs and the jobs report that featured a stunning revision which led to a reassessment of the economic situation and the likelihood for imminent rate cuts.Then in the afternoon, we learned of the President’s intention to fire the head of the Bureau of Labor Statistics (BLS), the resignation of a Fed Governor, and the $200+ million verdict against Tesla (TSLA).Put that all together, and a big decline seemed more than understandable.

Then, as if on cue, the dip buyers emerged in force this morning. We have frequently referred to momentum-driven markets as obeying Newton’s First Law of Motion:

A body remains at rest, or in motion at a constant speed in a straight line, unless it is acted upon by a force.

Friday’s market was emblematic of that effect. Stocks had been following very solid uptrends, with external factors seemingly providing insufficient forces to disrupt the upward motion. Sure, some stocks were battered recently by unpleasant reactions to their earnings reports, but even those downdrafts were not enough to darken the market’s mood entirely.Only after a confluence of factors was that path disrupted.

But today, like so many others, seems to be obeying a modified version of Newton’s Third Law of Motion:

To every action, there is always opposed an equal reaction; or, the mutual actions of two bodies upon each other are always equal, and directed to contrary parts

While the now-routine attempts to buy dips and then chase the bounces are not exactly equal and opposite reactions, they seem to come awfully close.As I type this around noon EDT, theS&P 500 (SPX) has recouped most of, but not quite all, Friday’s decline:

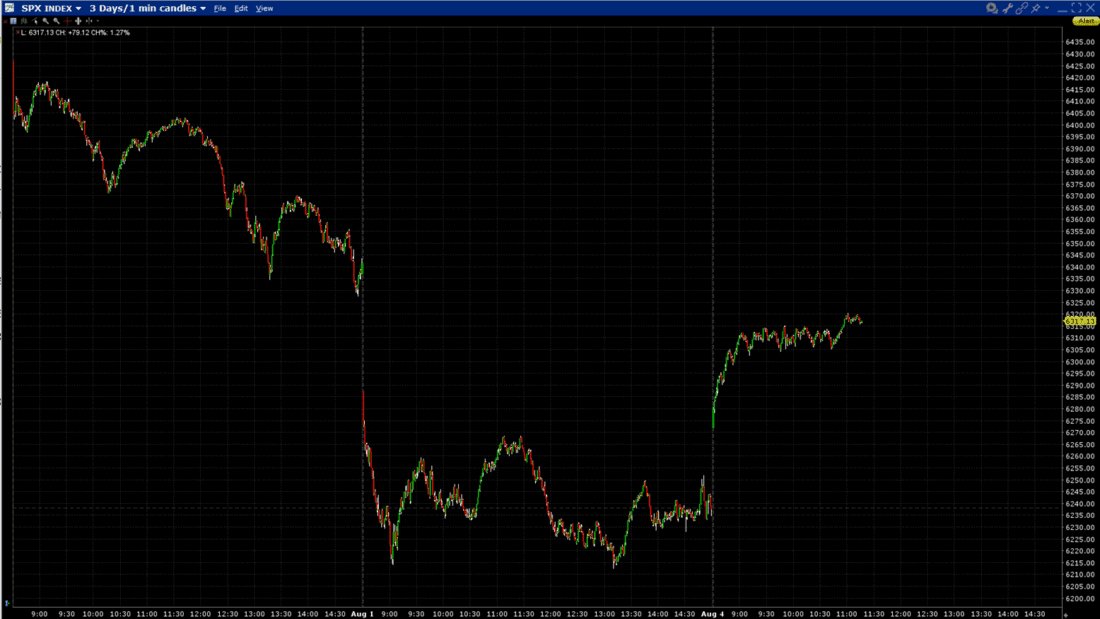

SPX, 3 Days, 1-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

The gap from Thursday has so far been nearly filled, but not completely.Thursday’s low was 6327.64 (with a 6362.90 close), and today’s high as of now is 6320.35.A push to close the gap seems kind of inevitable, no?

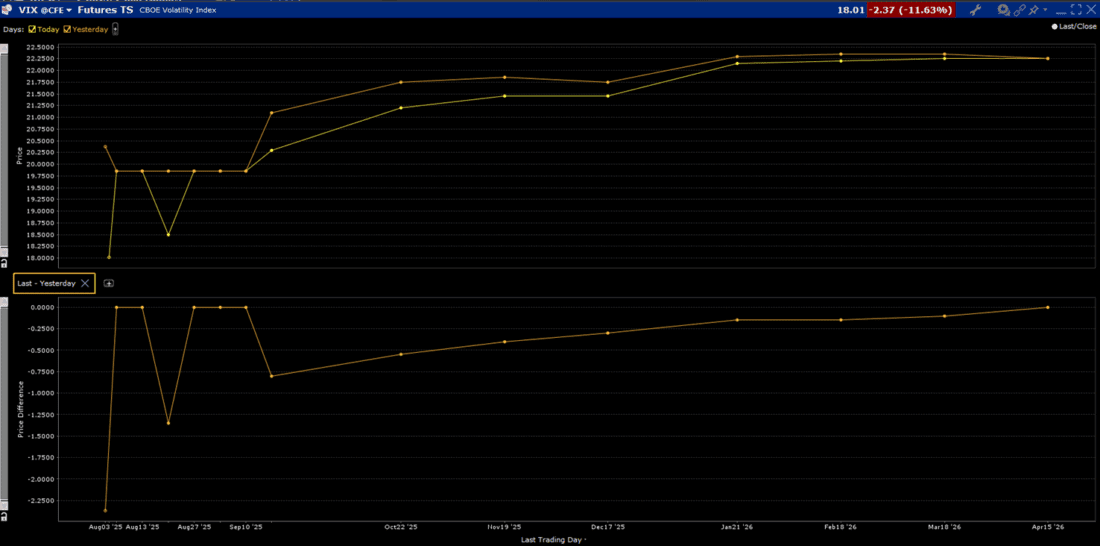

Unlike Friday’s decline, which was quite easily explained, the cause for today’s rally is a bit murkier. It could be that rate cut expectations have solidified, but the odds for a cut haven’t improved markedly since Friday, nor have we seen a significant move in 2-year rates today to reaffirm that.It could be a reaffirmation of the “Fed Put”, the thought that impending rate cuts will bolster stocks no matter what.That is basically a reiteration of the prior point, with the caveat that the “Fed Put” is not really about the stock market at all – it is the Federal Reserve stepping in to protect the broader economy or money market liquidity. Besides, if that was the case we would expect to see longer-term VIX futures decline – why buy protection if the Fed will give it to you for free?Despite the plunge in spot VIX and short-term futures, the long end is relatively firm:

VIX Futures Term Structure, Today (yellow, top), Yesterday (orange, top), with 1-Day Change (bottom)

(Click on image to enlarge)

Source: Interactive Brokers

In this case, I think the simplest explanation is the best.Buying dips has worked so spectacularly well for active traders recently that they are loath to abandon that strategy.Who can blame them when it has worked so spectacularly well?It’s not a question of whether traders will attempt to buy dips, but how aggressively will they step in during the decline and how aggressively will they chase the seemingly inevitable bounce.For today at least, it is very nearly an equal and opposite reaction, with very little news and positive sentiment almost balancing out a highly consequential flow from the prior session.

More By This Author:

Markets And Jobs Hit An Air PocketYes, They Do Care

Earnings Season Thus Far

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more